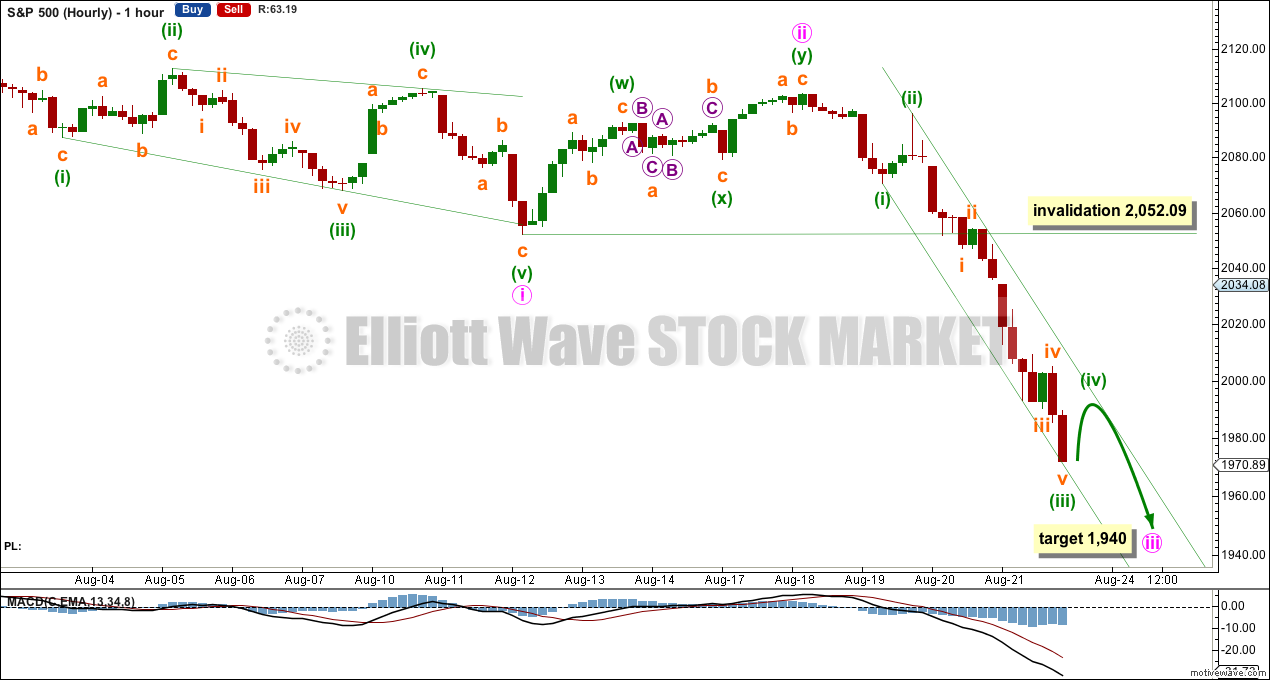

Yesterday’s analysis expected more downwards movement to a target at 2,002.

The direction was right, but the target was inadequate.

Summary: This third wave is not yet done. A target for it to end is now recalculated at 1,940. When this third wave is done the channel on the hourly chart should be breached, and the following fourth wave correction should begin to unfold which may last a Fibonacci five or eight days. The fourth wave correction may be a “dead cat bounce” and may not move above 2,052.09.

To view the last weekly chart click here.

Changes to last analysis are bold.

ELLIOTT WAVE COUNT

The S&P has seen a primary degree (or for the bear count below a Super Cycle degree) trend change.

Primary wave 2 was a relatively shallow 0.41 zigzag lasting 12 weeks. Primary wave 4 may be more shallow, most likely to be a flat, combination or triangle, and may be longer lasting than primary wave 2 as these types of sideways corrective structures tend to be more time consuming than zigzags. Primary wave 4 is likely to end in the price territory of the fourth wave of one lesser degree between 1,730 – 1,647. It may last about 21 or maybe now even 34 weeks.

Within primary wave 4, it may be that intermediate waves (A) and (B) are both complete as three wave structures indicating a flat may be unfolding. Intermediate wave (C) down must be a five wave structure; it looks like it is unfolding as an impulse. For now I will leave this degree as is, but depending on where intermediate wave (C) ends I may move it back down one degree. It is equally as likely that only minor wave A may be unfolding as a flat correction.

If this impulse does not bring price down to the target range or the lower edge of the big channel on the weekly chart, then it may only be intermediate wave (A) of a bigger flat for primary wave 4. If it does bring price lower to the target range, then it may be primary wave 4 in its entirety.

Within minor wave 3, minute wave iv may not move into minute wave i price territory above 2,052.09.

At 1,940 minute wave iii would reach 2.618 the length of minute wave i. Again, if this target is wrong, then it may not be low enough. This warning about my targets during a bear market will remain. If any are wrong, then they won’t be low enough.

This wave count now has some confirmation at the daily chart level with a close more than 3% of market value below the long held bull market trend line.

Full and final confirmation would come with:

1. A clear five down on the daily chart.

2. A new low below 1,820.66.

As each condition is met the probability of a substantial trend change increases.

Minor wave 3 should show its subdivisions clearly on the daily chart. Minor wave 3 still has to show a further increase in downwards momentum beyond that seen for minor wave 1 for it to have a typical third wave look.

Primary wave 4 may not move into primary wave 1 price territory below 1,370.58. Invalidation of this bull wave count (still bullish at cycle degree) would be confirmation of the bear wave count.

Minute wave iii must unfold as an impulse. Within minute wave iii, minuette wave (iv) has not yet arrived, which should be relatively shallow and quick, and should not show up on the daily chart because minuette wave (ii) does not.

Although I am labelling minuette wave (iii) as over, it may not be complete there. I would not expect that it is over until a green candlestick is seen on the hourly chart. Only then would I expect that minuette wave (iv) has arrived.

Minuette wave (iv) should be shallow and brief.

Keep redrawing the acceleration channel about minute wave iii. Draw the first trend line from the low of minuette wave (i) to the last low then place a parallel copy on the high of minuette wave (ii). Minuette wave (iv) should have a few green candlesticks when it arrives, and should find resistance at the upper edge of the channel.

When minute wave iii is a completed five wave impulse, then a correction for minute wave iv should be expected to show up on the daily chart, to last maybe a Fibonacci five or eight days in total. Minute wave iv may not move back up into minute wave i price territory above 2,052.90.

A breach of the green channel may be earliest indication that minute wave iii is over and minute wave iv is underway.

BEAR ELLIOTT WAVE COUNT

The subdivisions within cycle waves a-b-c are seen in absolutely exactly the same way as primary waves 1-2-3 for the main wave count.

In line with recent Grand Super Cycle wave analysis, I have moved the degree of labelling for the bear wave count all up one degree.

This bear wave count expects a Super Cycle wave (c) to unfold downwards for a few years, and if it is a C wave it may be devastating. It may end well below 666.79.

However, if this wave down is a Super Cycle wave (y), then it may be a time consuming repeat of the last big flat correction with two market crashes within it, equivalent to the DotCom crash and the recent Global Financial Crisis, and it may take another 8-9 years to unfold sideways.

For this bear wave count a big impulse down must begin, so a series of overlapping first and second waves should now be complete. The new idea for the first wave count does not work for this bear wave count.

A new low below 1,370.58 would invalidate the first wave count confirming a huge market crash. Before that price point is passed though, structure should be a strong indication that this bear wave count would be correct. It is supported by regular technical analysis at the monthly chart level.

TECHNICAL ANALYSIS

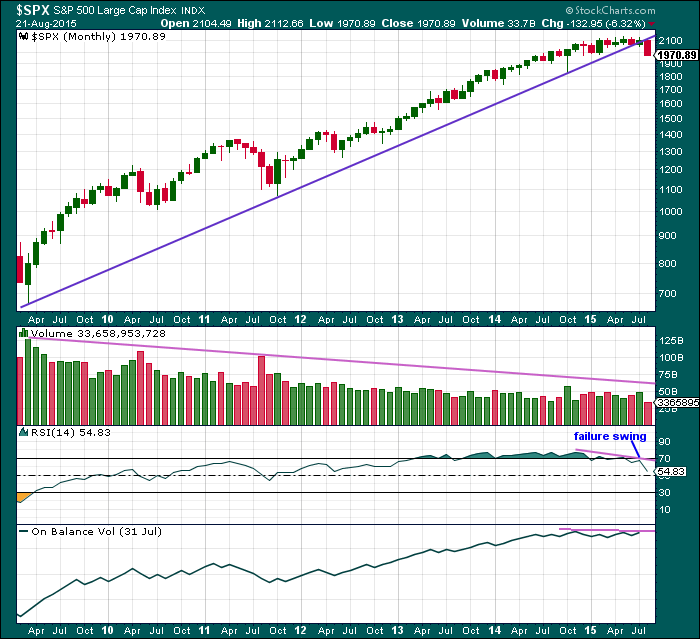

Click chart to enlarge. Chart courtesy of StockCharts.com.

Monthly Chart: A long held trend line from the end of the big low at 666.79 in March 2009, to the next big swing low at 1,074.77 in October 2011, has been breached and now provides resistance.

Volume has been falling during this bull market spanning six years and five months. This rise in price is not supported by volume, so is suspicious at the monthly chart level.

Back to November 2014, there is now double negative divergence between price and RSI at the end of this movement. This pattern was last seen just prior to the DotCom crash and the GFC. In both of those instances there was also a failure swing by RSI, which appears here too.

On Balance Volume shows slight negative divergence with price.

At the monthly chart level, this regular technical analysis favours the bear wave count

The last two bear markets for the S&P, that of the Dotcom crash from September 2000, to October 2002, and the Global Financial Crisis from October 2007, to March 2009, were reliably indicated as complete by RSI on the weekly and monthly chart. I will use this indicator this time to see when this bear market could be complete.

As each of those last two bear markets ended, RSI showed oversold on the monthly chart level plus had one divergence with the final month: as price moved lower RSI turned up. That was the end.

So far RSI is nowhere near oversold. There is plenty of room for price to fall.

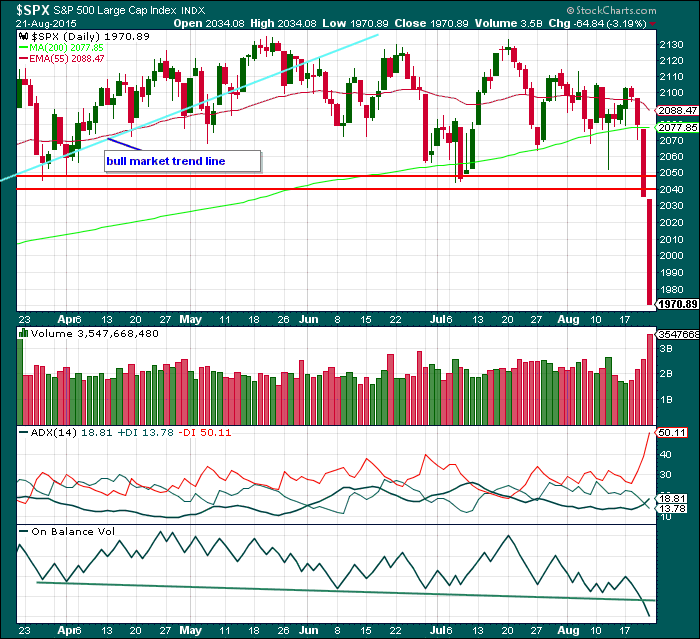

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily Chart: Another strong downwards day on further increased volume supports the Elliott wave count nicely. Price has broken out of the sideways range the S&P was in since April last year. The breakout is confirmed with a huge movement below the lower support line on increased volume.

ADX is clear. The black ADX line is above 15 and turning up indicating the market is in the early stages of a new trend. The -DX line is above the +DX line indicating the new trend is down.

On Balance Volume is also breaking clearly below its trend line, further bearish confirmation.

A note on Dow Theory: for the bear wave count I would wait for Dow Theory to confirm a huge market crash. For that to be confirmed the following new lows are needed:

S&P500: 1,820.66

Nasdaq: 4,116.60

DJT: 7,700.49

DJIA: 15,855.12

At this time DJT is closest, but none of these indices have made new major swing lows yet.

This analysis is published about 11:40 p.m. EST.

We`should see a red VIX candle for minor 4, followed by a final spike to complete impulse at five down. A doji or hammer with the final spike up would be a welcome confirmation. I like to buy calls on the VIX at the end of the trading day showing the red candle, with an order to sell at the open the next day. The high is usually made shortly after the open. I occasionally hold calls two days but never hold calls past the opening the second day. The second day generally sports a lower high with a red candle close.

That’s the time to take an early Xmas present in the form of VIX puts.

Huge kudos to Lara for incredibly sharp analysis and great insight!

Thanks Vernecarty! It was a pretty spectacular week from the markets, finally making that big move we’ve been patiently expecting.

Bear markets move so fast, the whipsaws can be deep and quick. Personally I’m not going to try any trades here, I’ll be waiting patiently for the bottom when I can pick up some cheap stocks to hold for a very long term investment.

Magee’s “Technical Analysis of Stock Trends” has some great insight into how to pick those. When the time comes and I troll through the charts and make my decision I’ll be sharing that with members so you may all profit too. If I’m right that is. Always, that caveat. Sometimes I’m wrong.

Looking forward to your recommendations!