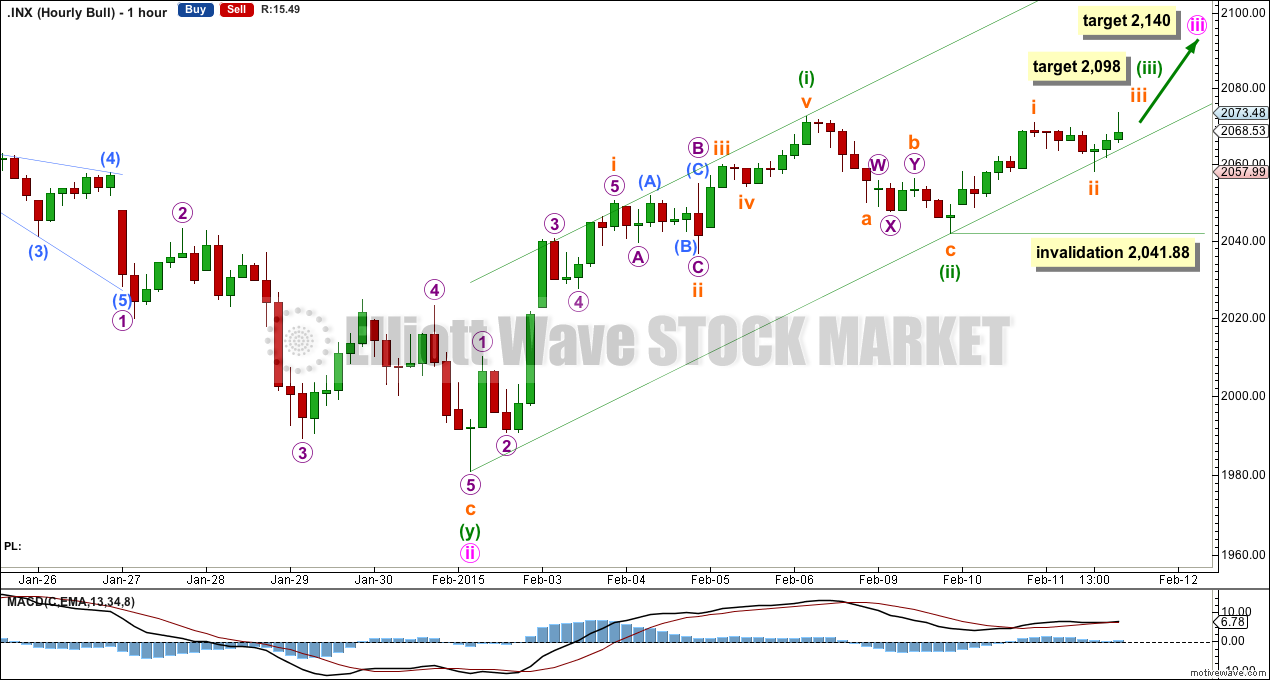

Upwards movement was expected for Wednesday for both Elliott wave counts.

Summary: The upwards trend should continue tomorrow. The short term target is either 2,098 (main wave count) or 2,133 (alternate wave count). I expect to see an increase in upwards momentum over the next few days.

Click charts to enlarge.

All monthly, weekly and daily charts are on a semi-log scale.

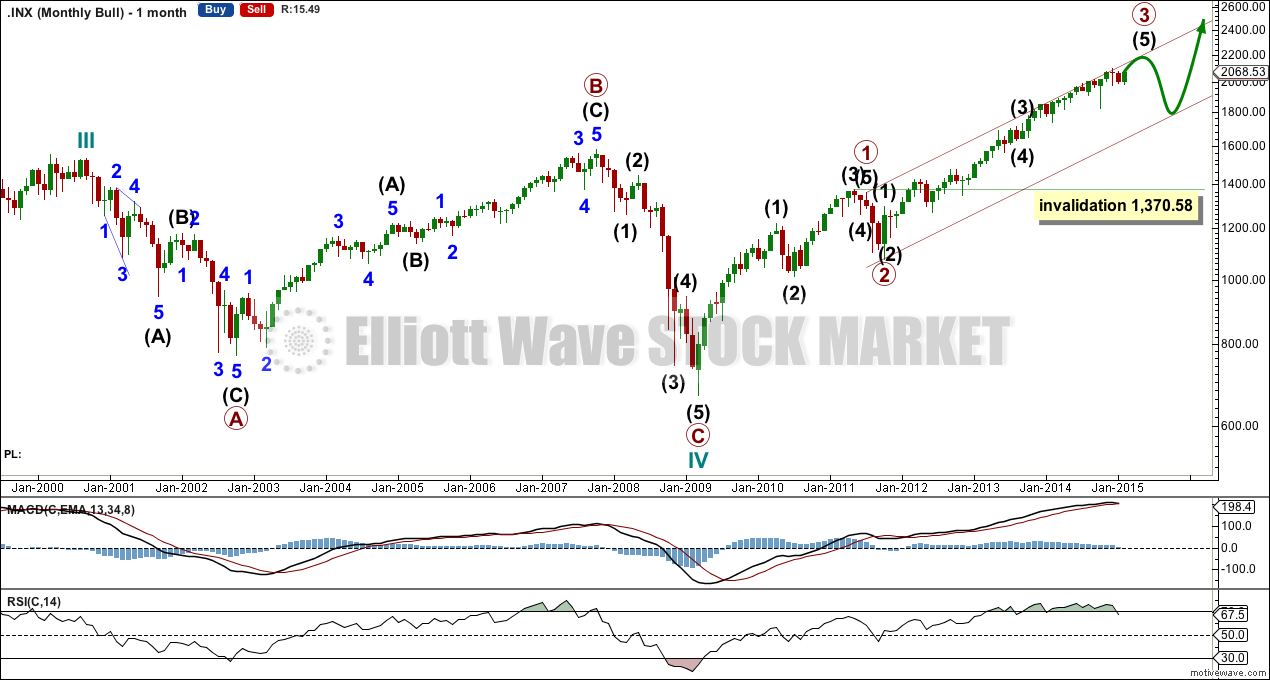

Bullish Wave Count

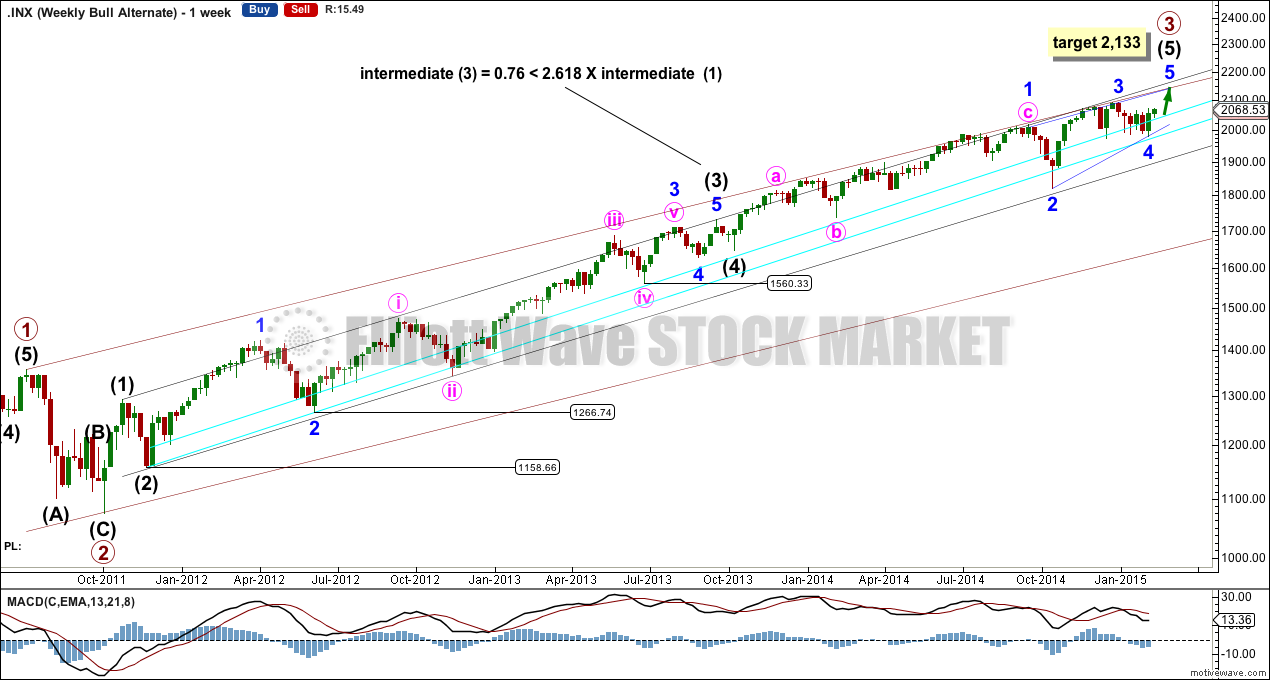

This monthly wave count expects that super cycle wave (I) is not over and the huge correction ending with the credit crunch was the end of cycle wave IV. Cycle wave V upwards is incomplete.

The maroon channel is here an Elliott channel about the upwards impulse of cycle wave V. The first trend line is drawn from the end of primary waves 1 to the current high within primary wave 3, then a parallel copy is placed on the end of primary wave 2. Keep redrawing the channel as primary wave 3 continues higher. Primary wave 4 may find support at the lower edge of this channel.

A base channel about primary waves 1 and 2 has not been breached to the upside by primary wave 3 as it should. However, looking back to 1974 a prior cycle degree wave there had a primary wave 3 which behaved in the same way. Base channels often work, but not always.

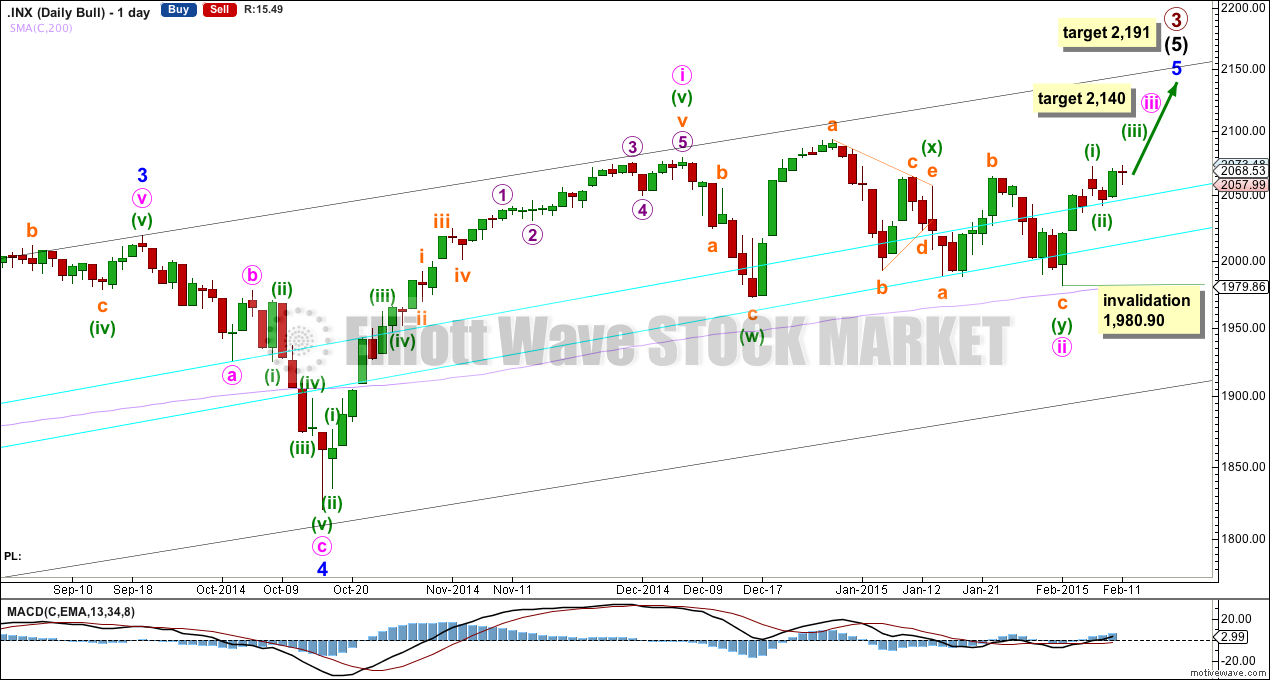

Main Bullish Wave Count

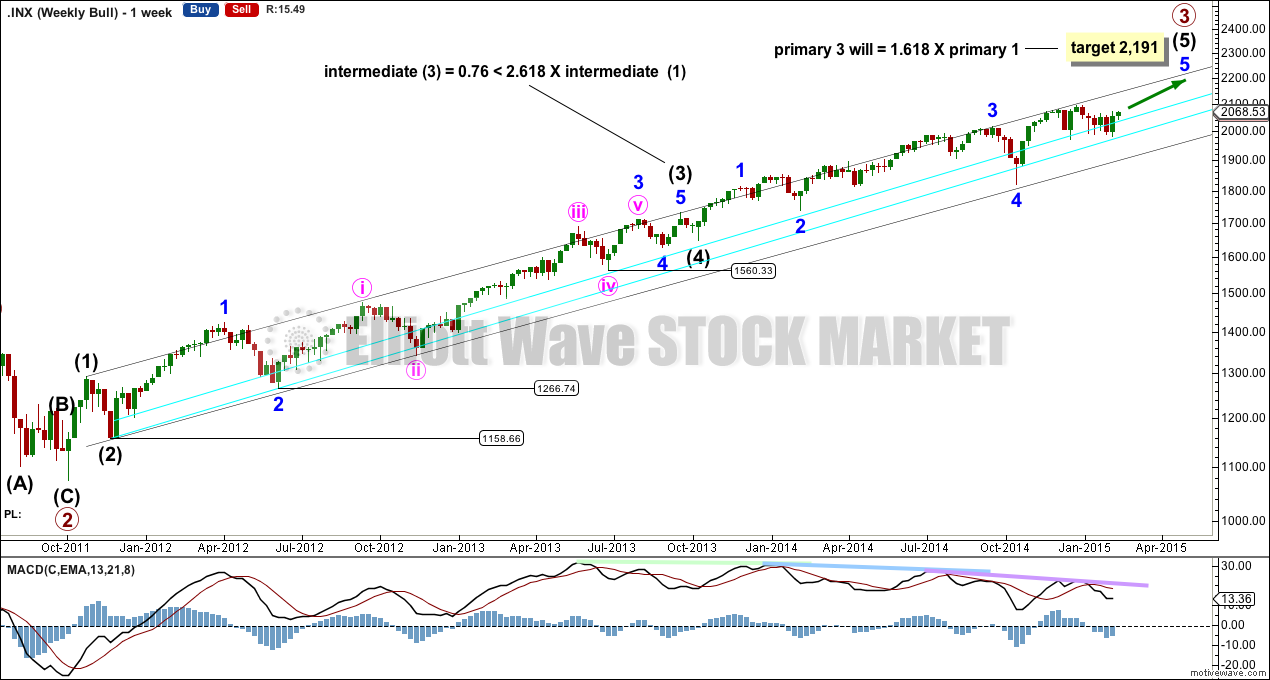

There is still triple technical divergence between price and MACD at the weekly chart level. This supports the idea that primary wave 3 is close to an end.

Intermediate wave (3) is just 0.76 short of 2.618 the length of intermediate wave (1), and it includes the strongest upwards momentum within primary wave 3. Intermediate wave (3) subdivides perfectly as a complete impulse, with all subdivisions very clear. I am very confident this part of the wave count is correct.

There are two possible structures for intermediate wave (5). This main bullish wave counts looks at intermediate wave (5) as the more common impulse. At the weekly chart level minor wave 3 has stronger momentum than minor wave 5, and so this wave count is acceptable.

Within intermediate wave (5) minor wave 3 is 11 points longer than 1.618 the length of minor wave 1. Minor wave 2 is a flat correction and minor wave 4 is a zigzag, exhibiting alternation.

Draw a channel about primary wave 3 using Elliott’s first technique: draw the first trend line from the highs labeled intermediate waves (1) to (3), then place a parallel copy on the low labeled intermediate wave (2). Look for intermediate wave (5) to end at the upper edge of this channel. When this channel is breached by subsequent movement to the downside that shall provide trend channel confirmation that primary wave 3 is over and primary wave 4 is underway.

Upwards movement from the low at 666.79 subdivides as an incomplete 5-3-5. For the bull wave count this is seen as primary waves 1-2-3.

The aqua blue trend lines are traditional technical analysis trend lines. These lines are long held (the lower one has its first anchor in November, 2011), repeatedly tested, and shallow enough to be highly technically significant. When the lower of these double trend lines is breached by a close of 3% or more of market value that should indicate a trend change. It does not indicate what degree the trend change should be though. It looks like the last four corrections may have ended about the lower aqua blue trend line, which gives the wave count a typical look.

I have pulled the upper trend line down a little to touch the low of minute wave a within minor wave 4. This may be a better position for recent movement.

At 2,191 primary wave 3 would reach 1.618 the length of primary wave 1. This would expect that within minor wave 5 minute wave iii will be shorter than minute wave i, and minute wave v will be shorter still, which would be a repeat of the pattern seen within minor wave 1. Or the target is wrong.

At 2,140 minute wave iii would reach 0.618 the length of minute wave i.

Looking at momentum within intermediate wave (5) it is concerning that minor wave 3 exhibits weakest momentum at the daily chart level, although at the weekly chart level it does have strongest momentum. It is for this reason I am seriously considering the alternate bullish wave count.

I expect that minuette wave (iii) has begun. At 2,098 minuette wave (iii) would reach 0.618 the length of minuette wave (i). This fits with the higher target of minute wave iii at 2,140.

Within minuette wave (iii) no second wave correction may move beyond the start of its first wave below 2,041.88. However, along the way up downwards corrections should find support at the lower edge of the green base channel drawn about minuette waves (i) and (ii). If this lower green trend line is breached by downwards movement that would be the earliest indication that at the hourly chart level the wave count is wrong.

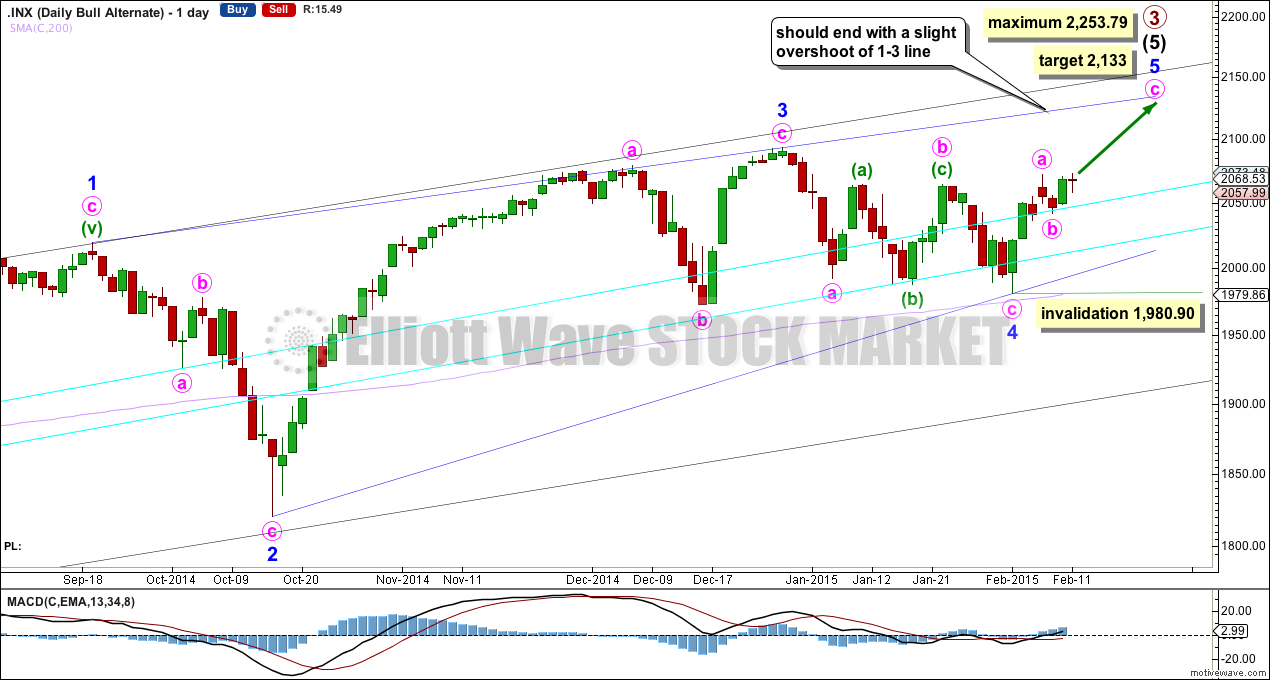

Alternate Bull Wave Count

The alternate bullish wave count looks at the other less common structural possibility for intermediate wave (5) as an ending diagonal.

Ending diagonals require all sub waves to be zigzags. So far this is a perfect fit.

The diagonal is contracting. The only problem with this possibility is that minor waves 2 and 4 are more shallow than second and fourth waves within diagonals. In this case they may have been forced to be more shallow by support offered from the double aqua blue trend lines.

At the daily chart level this wave count has a better fit with momentum. At the daily chart level the strongest upwards momentum within intermediate wave (5) is within the high labeled minute wave a within minor wave 3. This wave count sees strongest momentum as within the third wave.

Within minor wave 5 minute wave b may not move beyond the start of minute wave a below 1,980.90.

At 2,133 minute wave c would reach equality in length with minute wave a.

Contracting diagonals normally have fifth waves which end with a slight overshoot of the 1-3 trend line.

Within minute wave c no second wave correction may move beyond the start of minute wave a at 2,041.88.

Minute wave c does not have to show an increase in upwards momentum beyond that seen for minute wave a. Sometimes C waves are weaker than A waves, and sometimes they are stronger. Weaker upwards momentum would favour this alternate wave count over the main wave count at this stage.

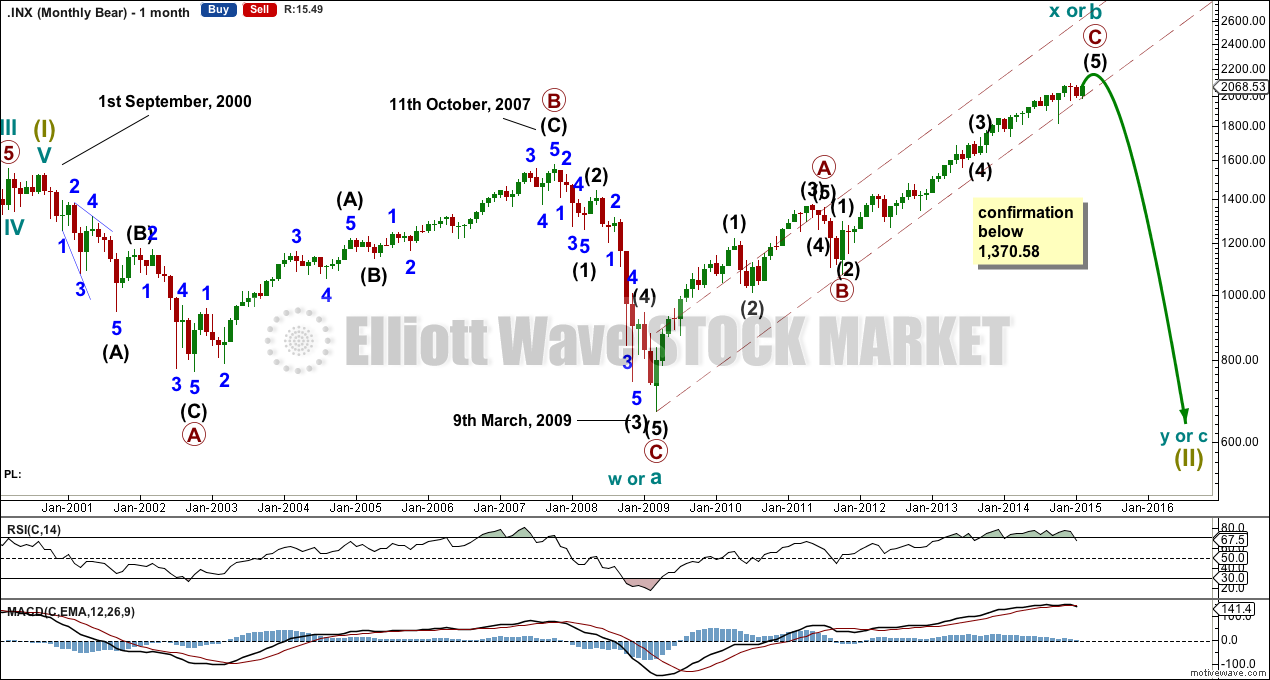

Bear Wave Count

This bearish wave count expects that the huge correction which began in 2000 is not over. The flat correction which ended at 666.79 was only cycle wave a (or w) of a larger super cycle second wave correction.

The structure and subdivisions within primary wave C for the bear wave count are the same as for intermediate wave (1) for the bull wave count because A-B-C and 1-2-3 subdivide in exactly the same way. Both the main and alternate ideas at the weekly chart level for intermediate wave (5) also work for the bear wave count exactly the same.

Cycle wave b (or x) is now longer than the maximum common length of 138% the length of cycle wave a for a B wave of a flat correction. It is 165% of cycle wave a. It is within the maximum length of 200% beyond which the wave count should be discarded.

The maroon – – – channel is now drawn differently for the bear and bull wave counts. For this bear wave count the maroon channel is a corrective channel about the upwards zigzag. Primary wave C remains within the corrective channel and sits in the lower half. This fits nicely for this bearish wave count. When this channel is breached by downwards movement that should provide trend channel confirmation that cycle wave b (or x) is over and cycle wave c (or y) has begun.

RSI has some divergence, continuing a pattern seen before the 2000 crash and 2007 crash. If it now turns up to make either one final push over 70 with stronger divergence, or if it makes a failure swing, the pattern would be complete.

The subdivisions within primary waves A-B-C are seen in absolutely exactly the same way as primary waves 1-2-3 for the bull wave count. The alternate bull wave count idea also works perfectly for this bear wave count.

At cycle degree wave b is over the maximum common length of 138% the length of cycle wave a, at 165% the length of cycle wave a. At 2,393 cycle wave b would be twice the length of cycle wave a and at that point this bear wave count should be discarded.

While we have no confirmation of this wave count we should assume the trend remains the same, upwards. This wave count requires confirmation before I have confidence in it.

This analysis is published about 07:32 p.m. EST.

Hi Lara. Thanks for the timely update and a reminder of the long term historical count.

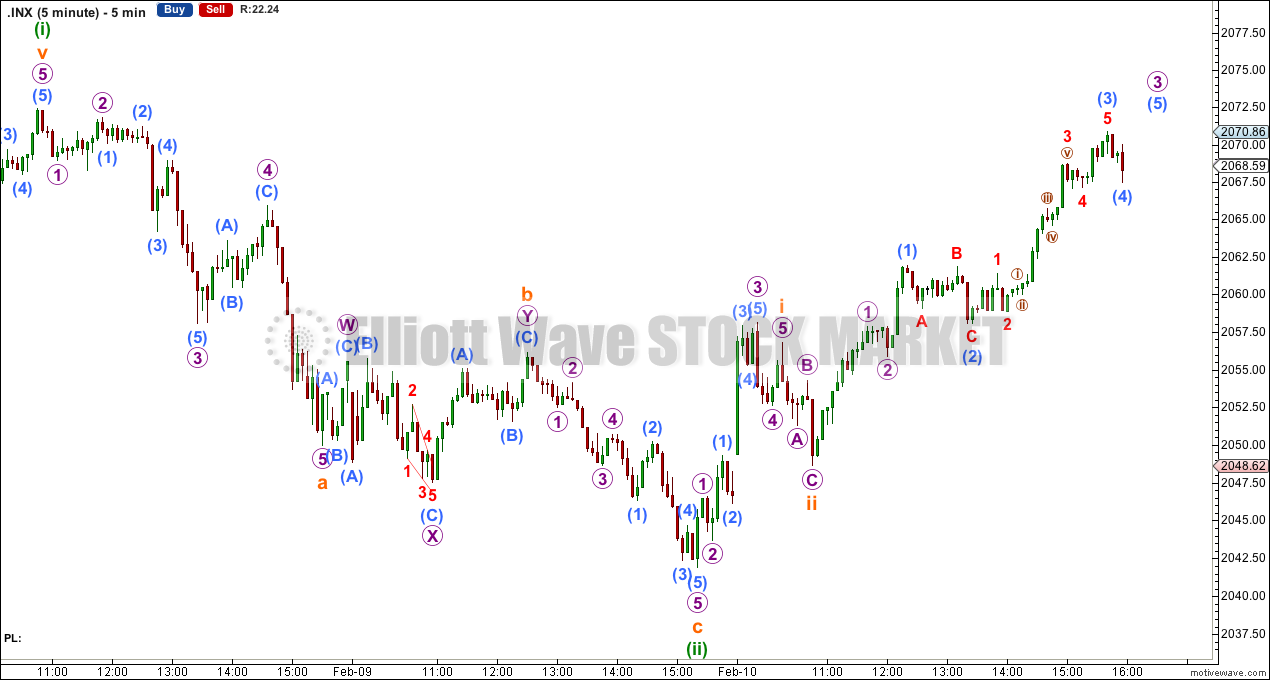

I just have one small query as I can’t seem to reconcile graph 4 (the hourly bull count) with graph 5 (the 5 minute count). In graph 4, subminuette 1 is around 2071 and subminuette 2 is 2057.99, whereas in graph 5, subminuette 1 is around 2057 and subminuette 2 is given as 2048.62.

Appreciate your clarification. Thank you.

I have on my hourly bull wave count subminuette wave i ending at 2,070.86.

On the five minute chart I have it ending at 2,070.86.

Its the same point. So I’m sorry, I just can’t see what you’re seeing.

How I prepare the charts is like this: I prepare the bigger time frame first, then I create a new wave count based upon that and then reduce the time frame.

I redo the five minute chart about once a week or so in this way, when my hourly chart changes. So the price points are actually exactly the same.

Oh no, I’m so sorry. I’ve found the problem.

I prepared the five minute chart as usual and uploaded it yesterday, but forgot to change the code for the chart to the next date. So you’re looking at the prior days five minute chart.

I’ve fixed it now. You’ll see the correct five minute chart in todays analysis and it will make sense.