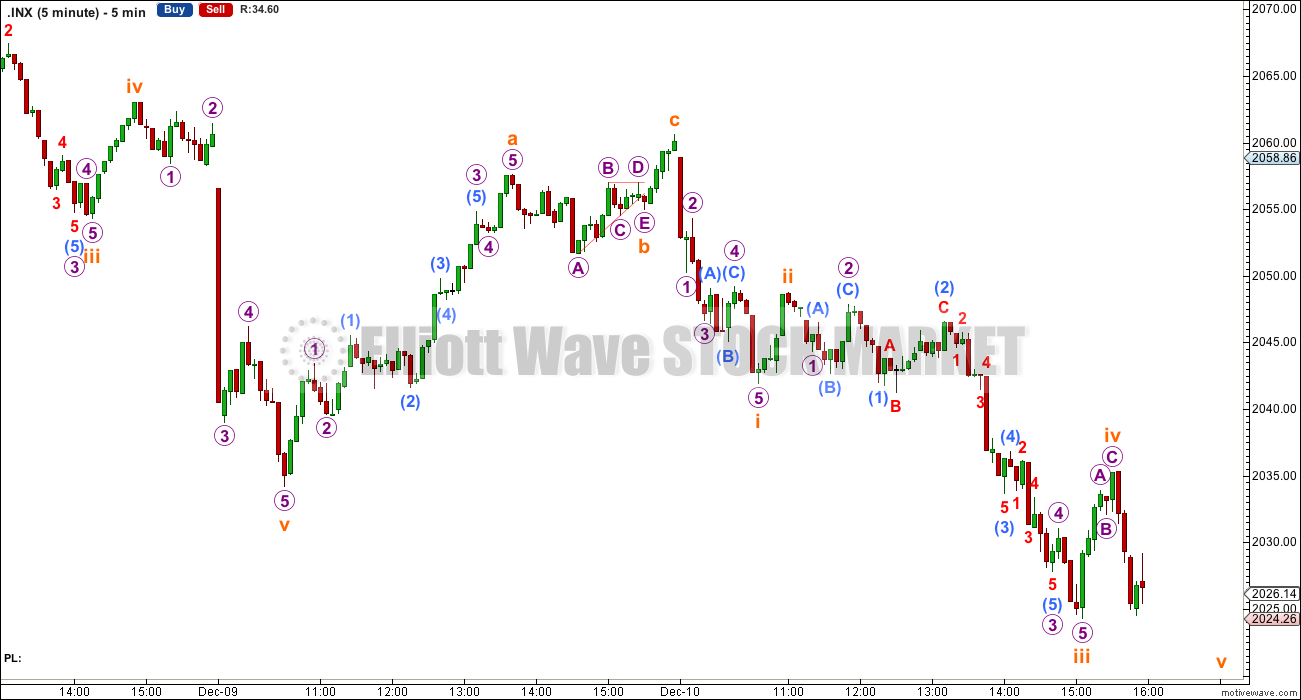

Downwards movement was expected for Wednesday’s session.

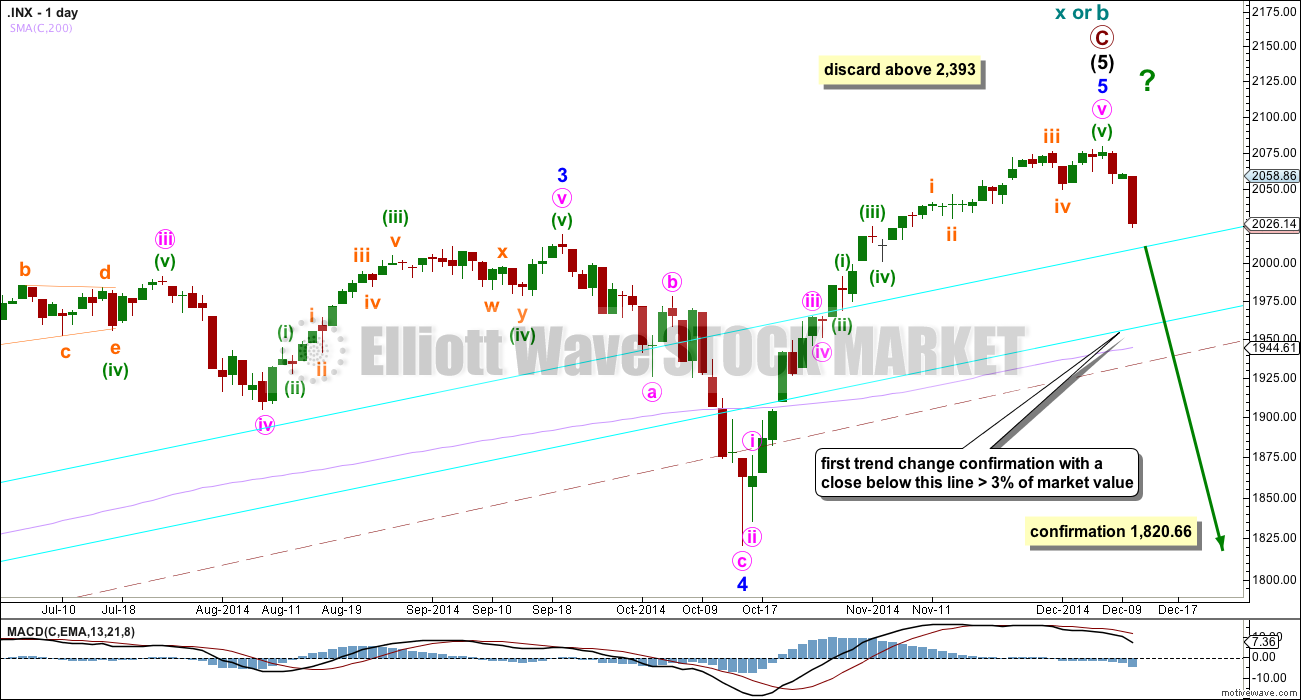

Summary: We should always assume the trend remains the same, until proven otherwise. The trend is your friend. At this stage I will assume that a small second wave correction is unfolding, and the target for it to end is at 2,017 – 2,015. Only if the lower aqua blue trend line is breached by a close of more than 3% of market value will I expect the trend change may have been at either primary degree (bull count) or cycle degree (bear count). A new low below 1,820.66 would provide price confirmation that the trend change is either at primary or cycle degree. If we see a new high above 2,060.60 in the next one to few days then the upwards trend will be confirmed as still in place.

Click on charts to enlarge.

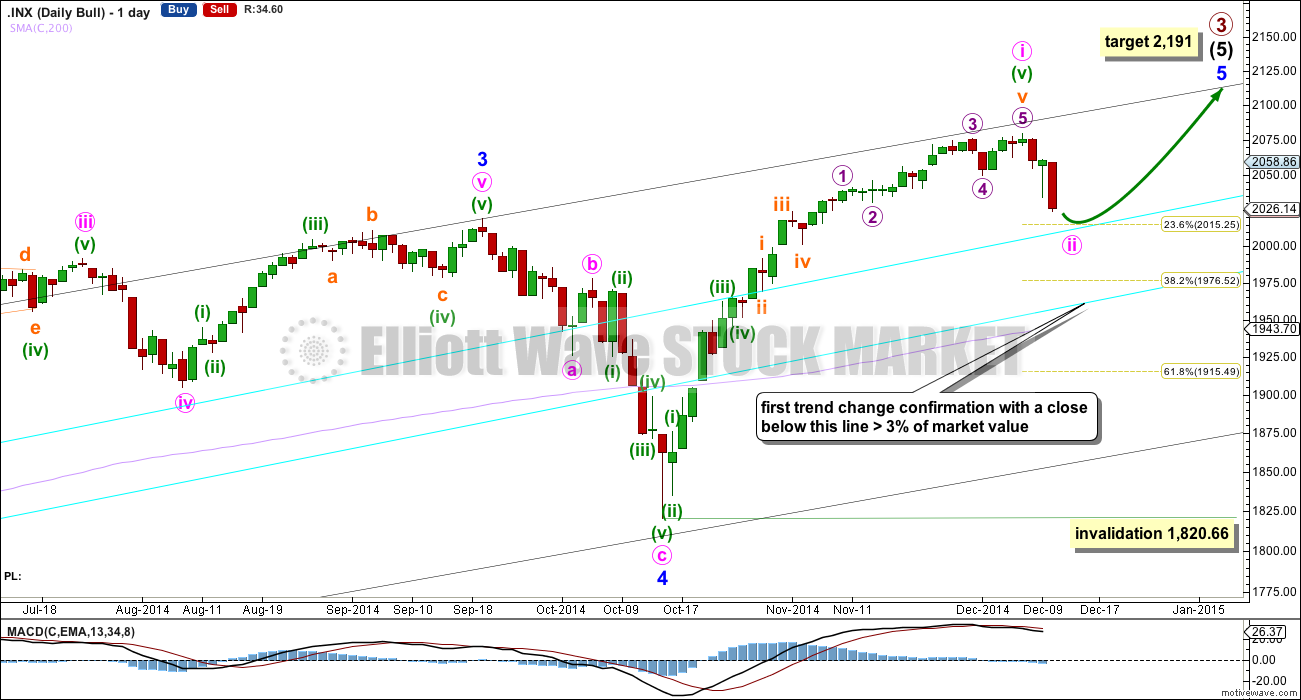

Bull Wave Count

I will favour neither the bull or bear wave count. Both are viable and both expect this current upwards impulse may again be complete.

To see a weekly chart with subdivisions and how to draw trend lines and channels click here.

Upwards movement from the low at 666.79 subdivides as a complete 5-3-5. For the bull wave count this is seen as primary waves 1-2-3.

Within intermediate wave (5) minor wave 2 is an expanded flat and minor wave 4 is a zigzag. Minor wave 3 is 14.29 points longer than 1.618 the length of minor wave 1.

At intermediate degree there is also a very close relationship between intermediate waves (3) and (1): intermediate wave (3) is just 0.76 points less than 2.618 the length of intermediate wave (1).

The aqua blue trend lines are traditional technical analysis trend lines. These lines are long held, repeatedly tested, and shallow enough to be highly technically significant. When the lower of these double trend lines is breached by a close of 3% or more of market value that should indicate a trend change. It does not indicate what degree the trend change should be though.

There is still triple technical divergence between MACD and price at the weekly chart level.

I would expect the final top to form a slow curving structure, like a double head and shoulders or a rounding top. At the high volume should be low. Once the high is in place the new downwards trend may begin with slow movement, and deep second wave corrections. These would form two right hand shoulders, or the right hand side of a rounding top. When the neckline is formed, and eventually broken I would not expect to see an increase in volume, but I would expect to see an increase in momentum.

Because we should assume the trend remains the same until proven otherwise, while price remains above both aqua blue trend lines I will assume this downwards movement is a smaller correction within the upwards trend. I have moved the degree of labelling within minor wave 5 all down one degree. This downwards movement may be a small second wave correction. Minute wave ii may find strong support at the upper aqua blue trend line, or maybe the lower trend line. These trend lines may force this second wave correction to be more shallow than otherwise. Minute wave ii may not move beyond the start of minute wave i below 1,820.66.

At 2,191 primary wave 3 would reach 1.618 the length of primary wave 1. This would expect that minor wave 5 is either an ending contracting diagonal (minute wave i would be seen as a zigzag, which is possible) or within minor wave 5 minute wave iii will be shorter than minute wave i, and minute wave v will be shorter still. Both these scenarios are possible. Or the target is wrong.

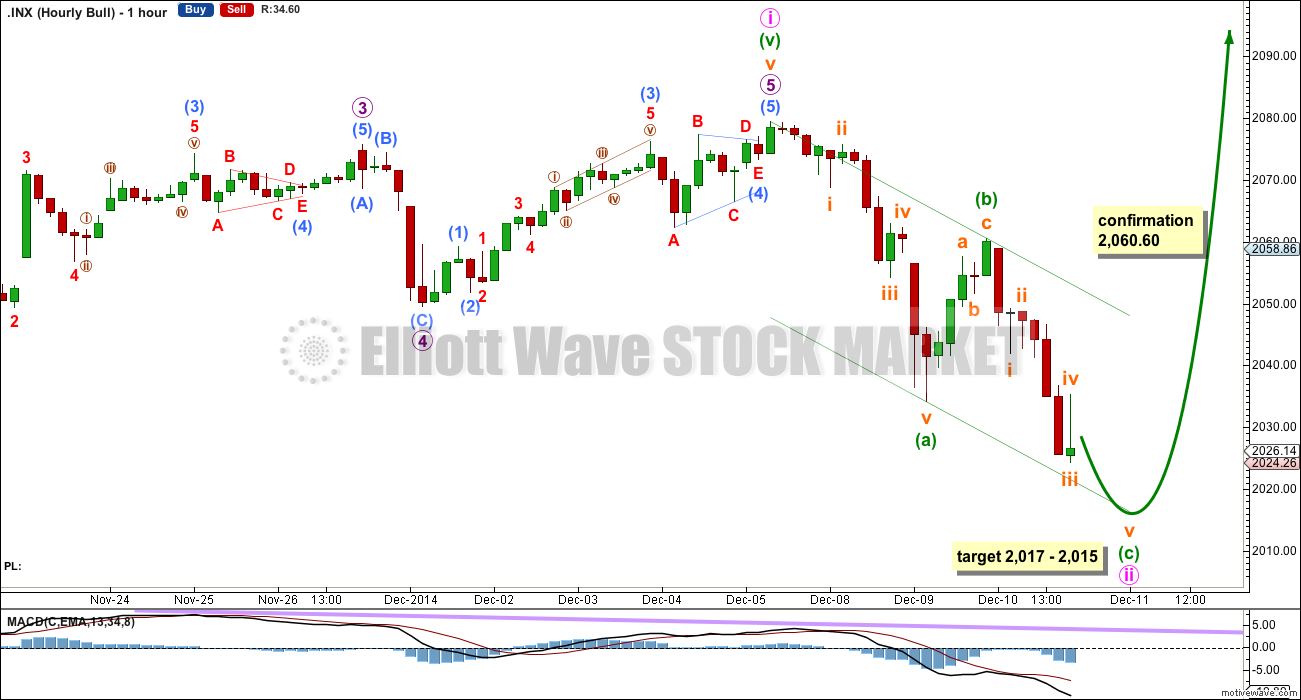

Main Hourly Wave Count

Minute wave ii may be close to completion as a 5-3-5 zigzag, or this may be only minuette wave (a) of a larger flat correction or minuette wave (w) of a double zigzag or double combination. When the first 5-3-5 zigzag down is complete I will have to use alternate wave counts to look at these possibilities. This current labelling may see minute wave ii as too quick.

So far within the second five wave structure the fifth wave is incomplete. At 2,017 subminuette wave v would reach equality in length with subminuette wave i. This is just 2 points above 2,015 where minuette wave (c) would reach equality in length with minuette wave (a).

When this 5-3-5 zigzag downwards is a complete structure (probably early tomorrow) then subsequent movement above 2,060.60 would confirm this main wave count. At that stage downwards movement would be a three wave structure and its completion would be confirmed. At that stage I would have confident that it would be very likely that the upwards trend remains intact.

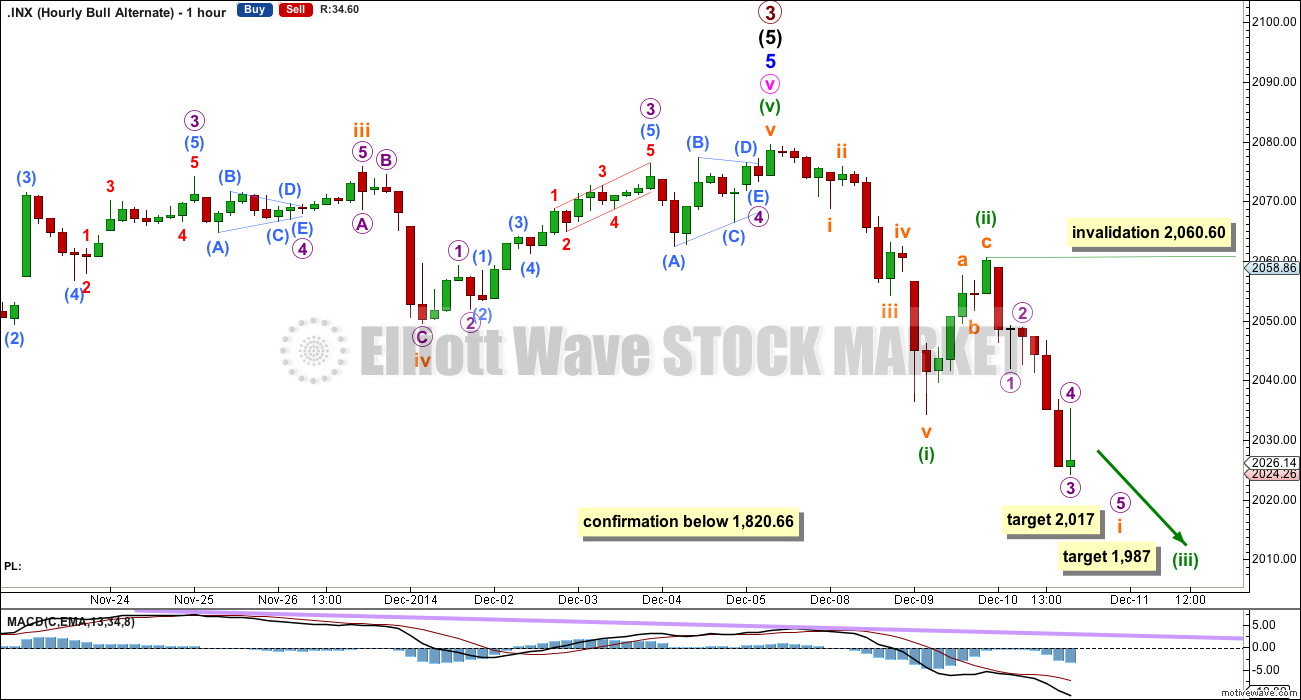

Alternate Hourly Wave Count

To have confidence in a trend change at primary degree (or for the bear count at cycle degree) I now want to see the following things (probably in this order):

1. A clear five down on the daily chart.

2. A breach of the lower aqua blue trend line by a close of more than 3% of market value.

3. A new low below 1,820.66.

Following that it should be the structure which shows which wave count is correct: bull or bear.

So far to the downside only a first and second wave are complete. For this alternate the degree of labelling within the third wave is lower, only its first wave is close to completion. The short term target remains the same: at 2,017 micro wave 5 would reach equality in length with micro wave 1. This wave count would then expect a small upwards correction for subminuette wave ii which may not move beyond the start of subminuette wave i above 2,060.60. This is the price point which differentiates the wave counts at this stage.

At 1,987 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Any movement below 1,820.66 would confirm the end of primary wave 3 (for the bull count) or cycle wave b (for the bear wave count).

Bear Wave Count

This bear wave count differs from the bull wave count at the monthly chart level and at super cycle wave degree. To see the historic picture go here.

The subdivisions within primary waves A-B-C are seen in absolutely exactly the same way as primary waves 1-2-3 for the bull wave count.

At cycle degree wave b is over the maximum common length of 138% the length of cycle wave a, at 164% the length of cycle wave a. At 2,393 cycle wave b would be twice the length of cycle wave a and at that point this bear wave count should be discarded.

At this point in time it is again possible that the market has just turned and is beginning a big crash. This wave count would be confirmed if we see a clear breach of the lower maroon – – – channel on the weekly chart. If we see a full weekly candlestick below this trend line and not touching it then this bear wave count would be my main wave count. A new low below 1,370.58 would provide price confirmation of a market crash, but we should have confidence in this wave count well before that point by looking carefully at structure.

While we have no confirmation of this wave count we should assume the trend remains the same, upwards. This wave count requires confirmation before I have confidence in it.

This analysis is published about 07:33 p.m. EST.