Upwards movement was expected. The Elliott wave count remains the same.

Summary: One final small fifth wave is now all that is required to complete this structure at primary (bull count) or cycle degree (bear count). The target is now at 2,087 – 2,089.

Click on charts to enlarge.

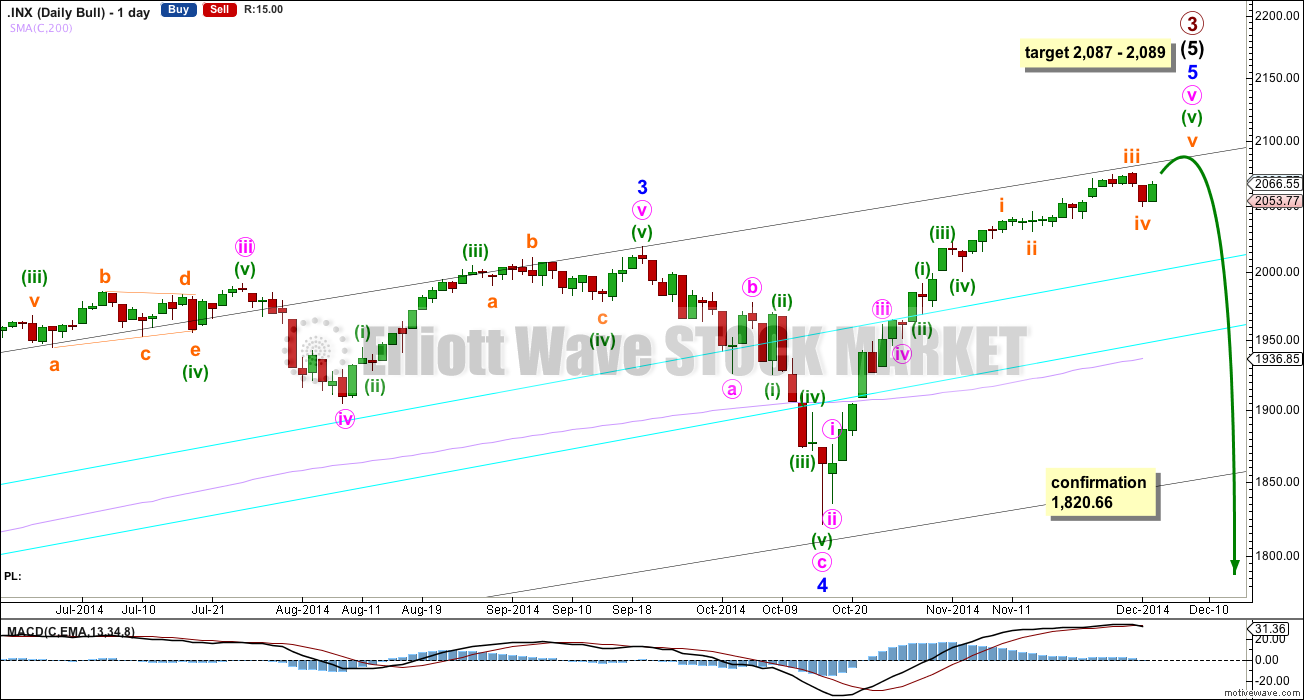

Bull Wave Count

I will favour neither the bull or bear wave count. Both are viable and both expect this current upwards impulse may again be close to completion.

To see a weekly chart with subdivisions and how to draw trend lines and channels click here.

Upwards movement from the low at 666.79 subdivides as an almost complete 5-3-5. For the bull wave count this is seen as primary waves 1-2-3.

Within intermediate wave (5) minor wave 2 is an expanded flat and minor wave 4 is a zigzag. Minor wave 3 is 14.29 points longer than 1.618 the length of minor wave 1.

At intermediate degree there is also a very close relationship between intermediate waves (3) and (1): intermediate wave (3) is just 0.76 points less than 2.618 the length of intermediate wave (1).

The aqua blue trend lines are traditional technical analysis trend lines. These lines are long held, repeatedly tested, and shallow enough to be highly technically significant. When the lower of these double trend lines is breached by a close of 3% or more of market value that should indicate a trend change. It does not indicate what degree the trend change should be though.

There is still triple technical divergence between MACD and price at the weekly chart level.

I would expect the final top to form a slow curving structure, like a double head and shoulders or a rounding top. At the high volume should be low. Once the high is in place the new downwards trend may begin with slow movement, and deep second wave corrections. These would form two right hand shoulders, or the right hand side of a rounding top. When the neckline is formed, and eventually broken I would not expect to see an increase in volume, but I would expect to see an increase in momentum.

Movement below 1,820.66 could not be a second wave correction within minor wave 5, and so at that stage the final fifth wave would have to be over. A trend change at primary (bull count) or cycle degree (bear count) would be confirmed.

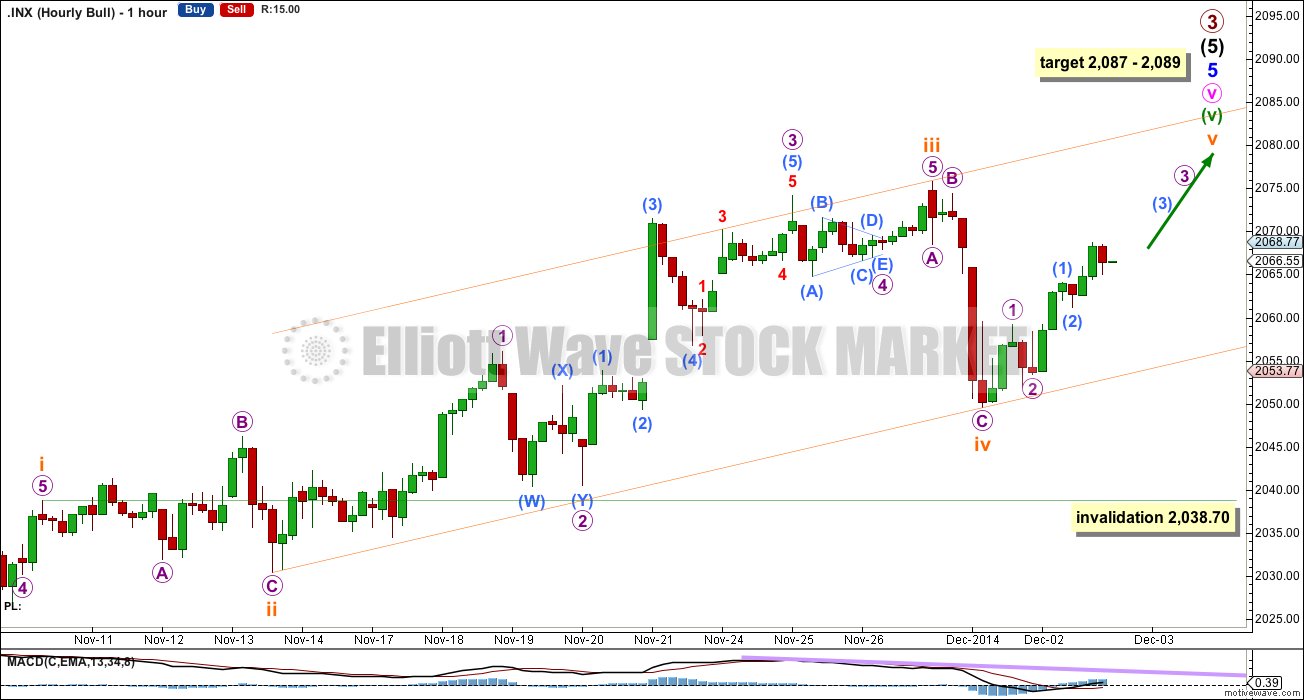

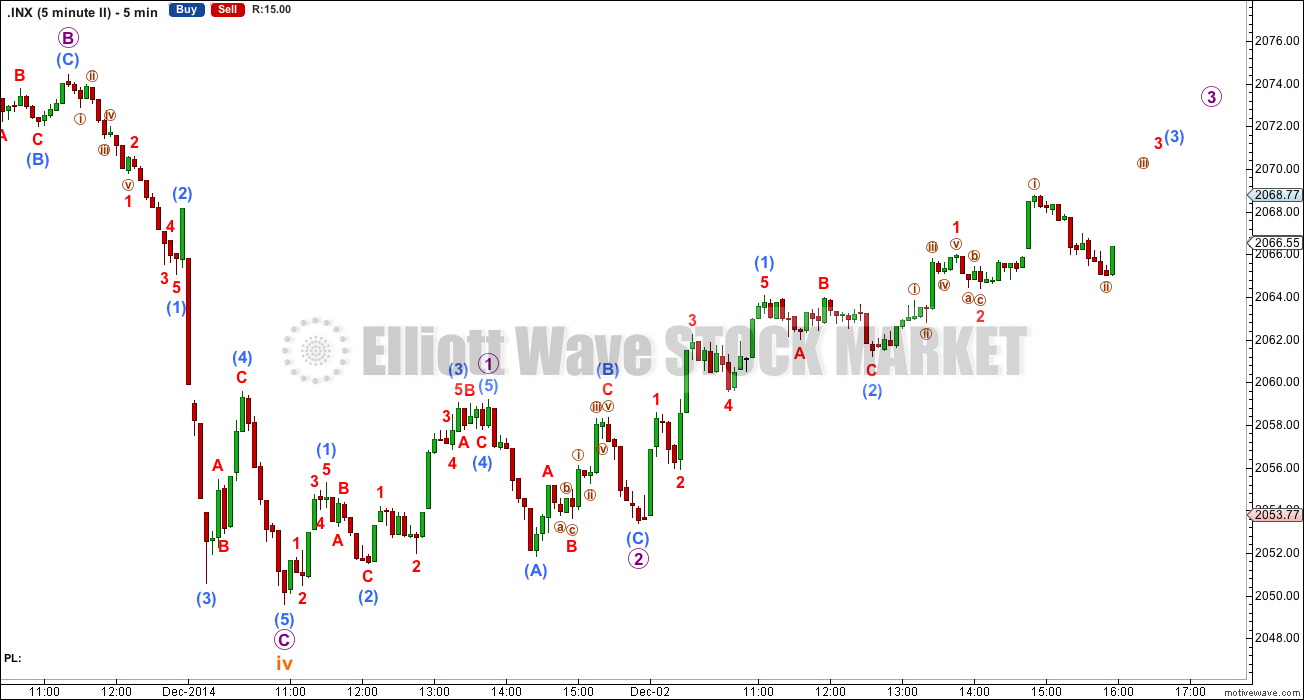

Minute wave v is extending. Within that fifth wave extension, minuette wave (v) is also extending. This hourly chart focusses on minuette wave (v).

Within minute wave v there is no Fibonacci ratio between minuette waves (i) and (iii). At 2,089 minuette wave (v) would reach 2.618 the length of minuette wave (i).

Within minuette wave (v) there is no Fibonacci ratio between subminuette waves i and iii. At 2,087 subminuette wave v would reach equality with subminuette wave i. If subminuette wave iv moves lower then the lower end of the target zone must also move correspondingly lower.

At this stage it is very likely that subminuette wave iv is over, and here it has perfect alternation with subminuette wave ii. However, subminuette wave iv lasted only 5 hours compared to the 23 hours for subminuette wave ii, so I will allow for the possibility that subminuette wave iv could continue further as a double zigzag, which would mean it may also move lower. A double zigzag would still provide perfect alternation with the expanded flat of subminuette wave ii.

If subminuette wave iv moves further then it may not move into subminuette wave i price territory below 2,038.70.

What is most likely is that subminuette wave iv is over and subminuette wave v has begun. I am expecting more upwards movement for a few days to the final target. If it continues for the rest of this week and into next week, then minor wave 5 may total a Fibonacci 8 weeks.

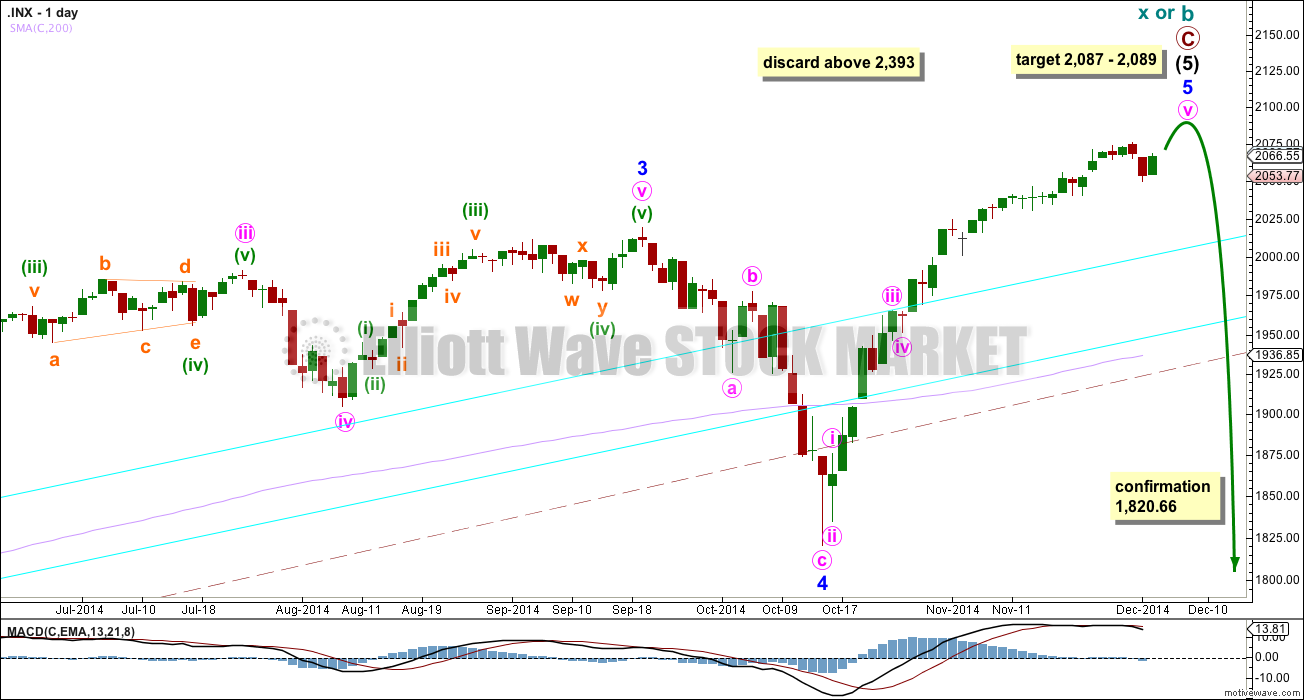

Bear Wave Count

This bear wave count differs from the bull wave count at the monthly chart level and at super cycle wave degree. To see the historic picture go here.

The subdivisions within primary waves A-B-C are seen in absolutely exactly the same way as primary waves 1-2-3 for the bull wave count.

For both wave counts when minor wave 5 may be a complete structure on the hourly and five minute charts, I have an alternate wave count which moves the degree of labelling within it all down one degree. A completion of a five wave impulse up within minor wave 5 may be either minor wave 5 in its entirety, or it may only be minute wave i within minor wave 5.

At cycle degree wave b is over the maximum common length of 138% the length of cycle wave a, at 161% the length of cycle wave a. At 2,393 cycle wave b would be twice the length of cycle wave a and at that point this bear wave count should be discarded.

This analysis is published about 05:22 p.m. EST.

Hi Lara,

Do you use the FXCM SPX 500 charts because sometimes my chart looks completely different to yours i.e. Different highs and lows.

And if it is not FXCM’s how do you trade it or do you just use it for analysis?