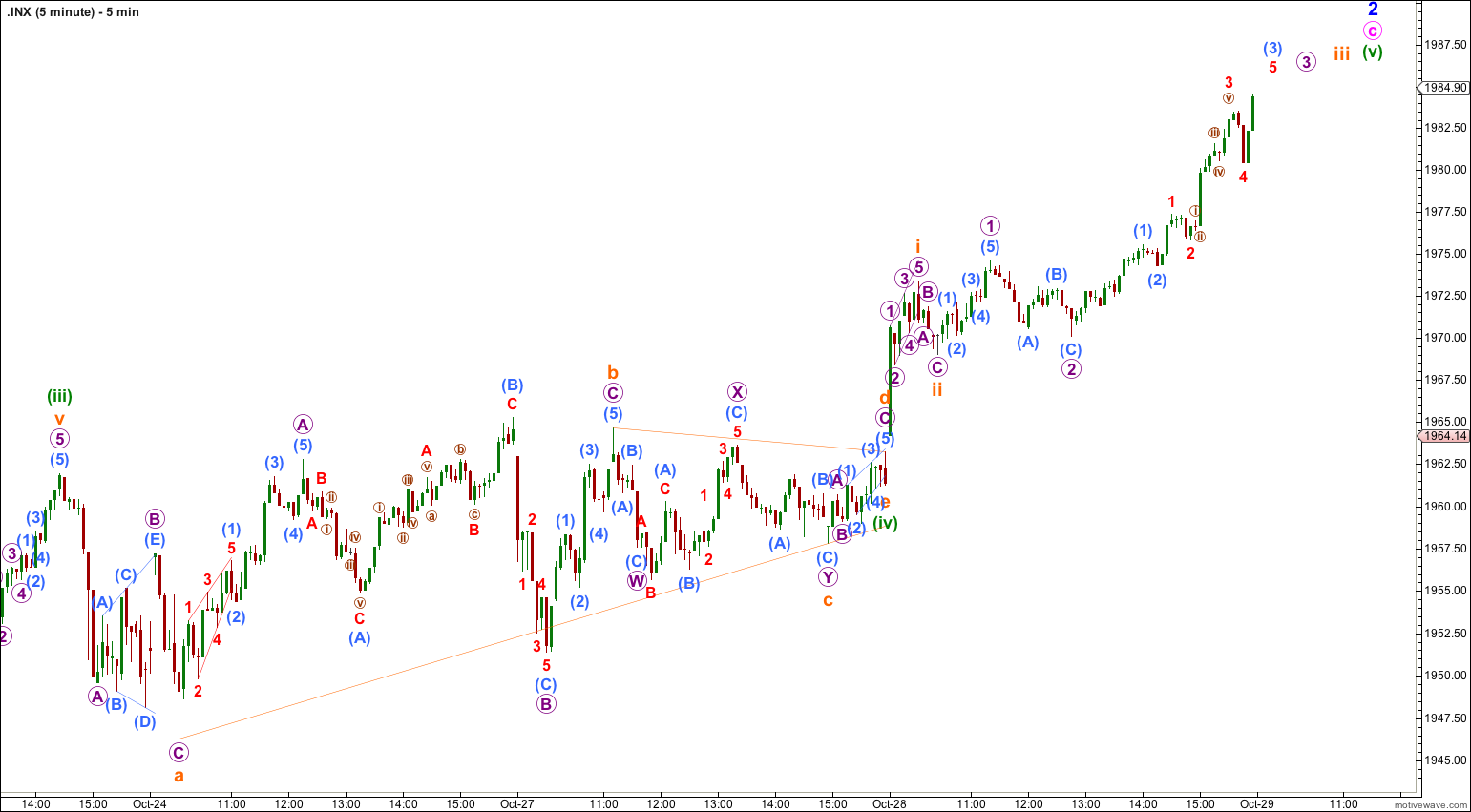

Yesterday’s Elliott wave analysis expected more upwards movement which is what has happened.

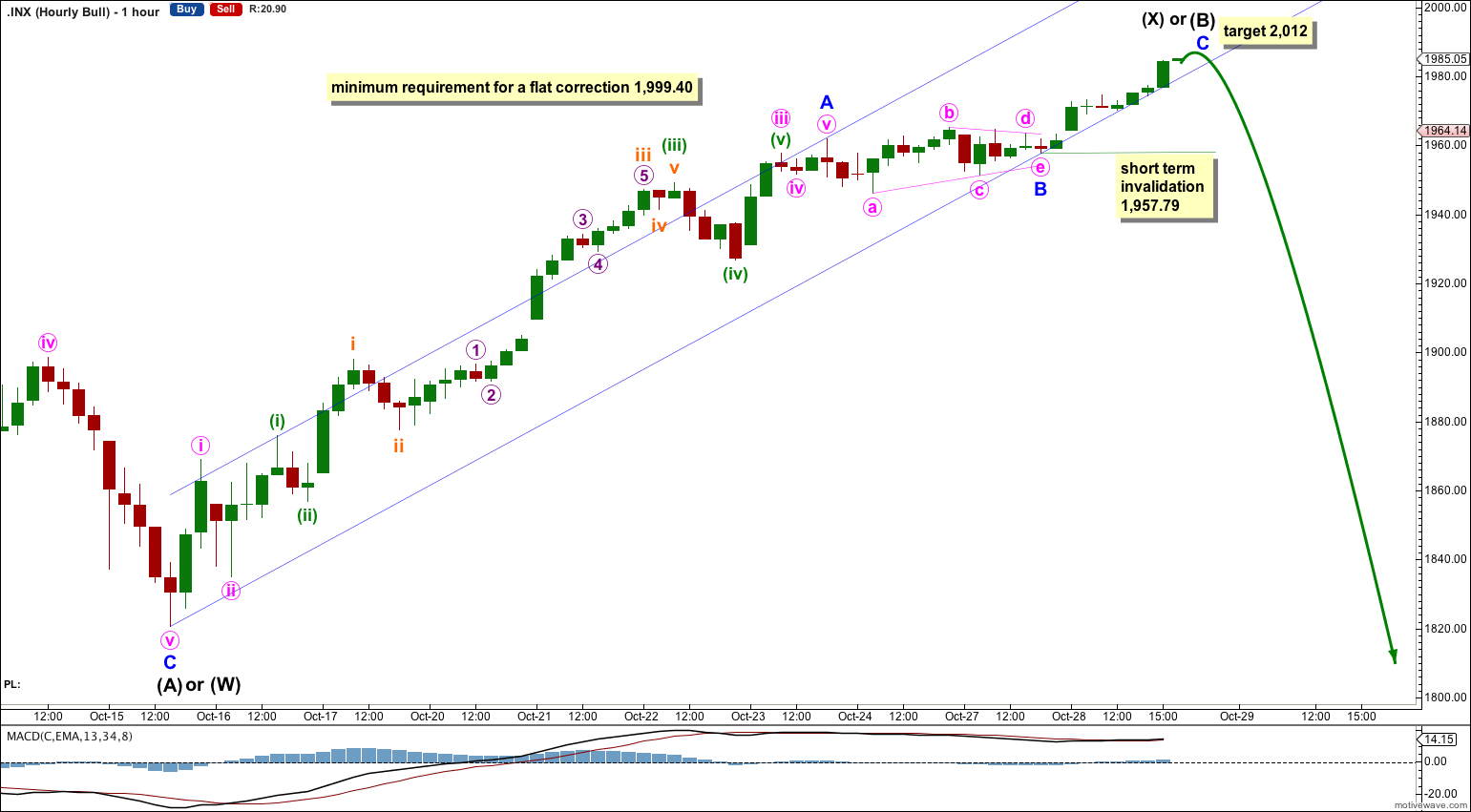

Summary: The structure is incomplete. The target is at either 1,999 or 2,012. Upwards movement should continue tomorrow.

Click on charts to enlarge.

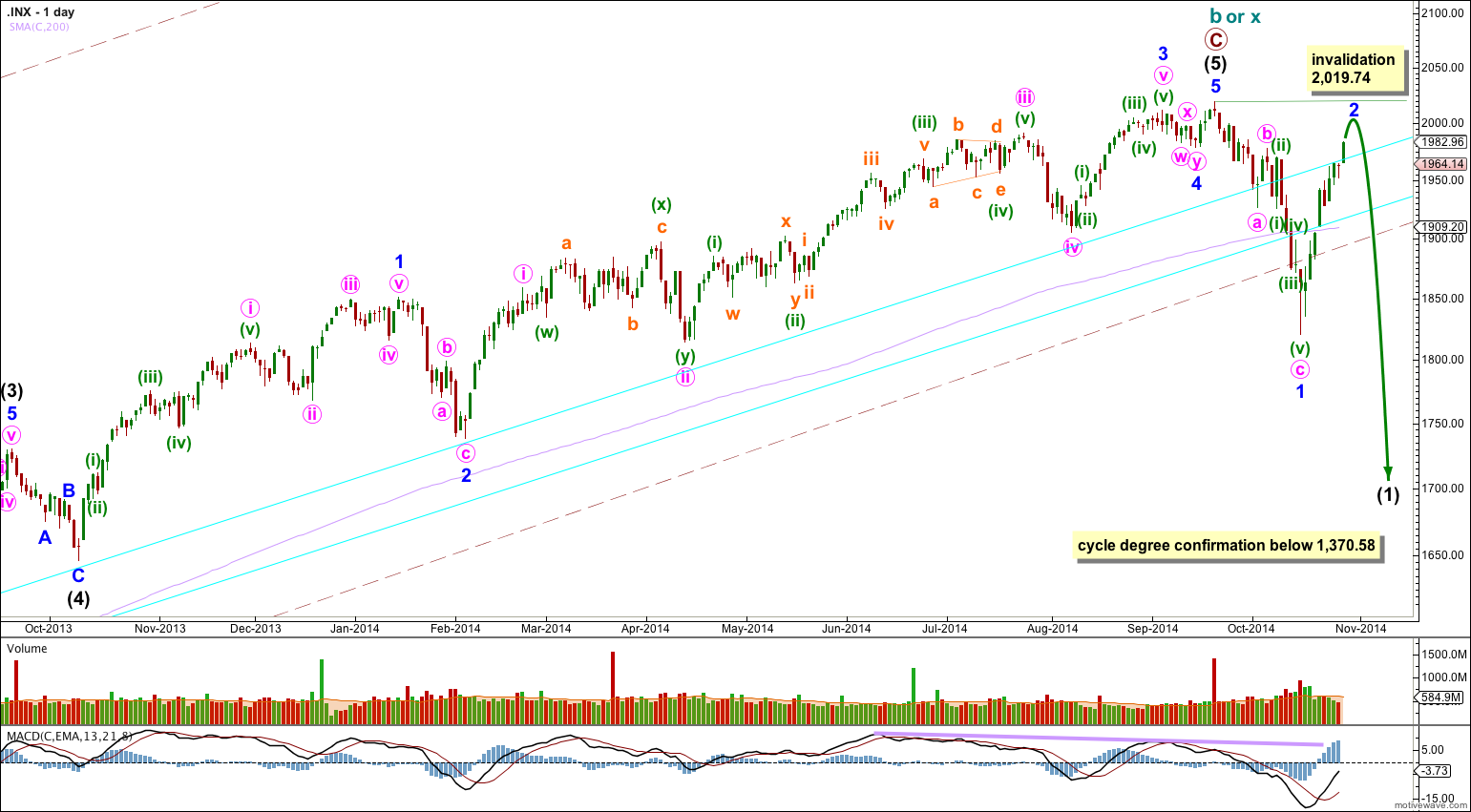

Bearish Wave Count

The weekly charts show how to draw the double aqua blue trend lines. The lower trend line began back in 2011 has repeatedly been tested and is reasonably shallow which is highly technically significant. It has now been breached by more than 3% of market value indicating a trend change.

Because there is such a close Fibonacci ratio between intermediate waves (3) and (1) and intermediate wave (3) lasted 455 days, I am confident this labeling is correct. Also, intermediate wave (3) has the strongest upwards momentum within primary wave C. Therefore, the only piece of this wave count of which I am not confident is the structure within intermediate wave (5). Is it complete or not? This is why I have an alternate bearish wave count for you.

There is technical divergence between price and MACD at the weekly and daily chart levels. This indicates a trend change, but it does not indicate what degree the trend change should be.

For the first time in five years the lower edge of the maroon – – – channel about cycle wave b (or x) was breached. This is significant.

The bear wave count sees a huge super cycle wave (II) incomplete as either an expanded flat correction, a combination, or a double flat.

If cycle wave b or x is now over then the first downwards wave for intermediate wave (1) is now most likely unfolding as a leading diagonal.

To have full confidence in this bearish wave count, and to discard the bullish wave count, I want to see three things happen:

1. A clear five down on the daily chart, with completion of intermediate wave (1).

2. Confirmation from NASDAQ with a new swing low for that market below 3,414,11.

3. A new low below 1,370.58 (although using structure as a guide the bull wave count would probably be discarded before this point).

When we have those three things I will have full confidence in this wave count.

This wave count differs from the alternate bear count below in the labeling of the subdivisions within intermediate wave (5). Here, there is no Fibonacci ratio between minor waves 3 and 1, and minor wave 5 is 0.89 points longer than 0.146 the length of minor wave 3. Minor wave 2 is a single zigzag lasting 14 days, and minor wave 4 is a double combination lasting 7 days.

There is still more than one way to see this upwards movement as a zigzag. This bear wave count has slightly better Fibonacci ratios, although minute wave c is very long in comparison to minute wave a.

At 1,999 minuette wave (v) would reach equality in length with minuette wave (i). While minuette wave (v) is unfolding no second wave correction within it may move beyond the start of its first wave below 1,957.79.

Draw a channel about this upwards movement using Elliott’s second technique: draw the first trend line from the ends of minuette waves (ii) to (iv), then place a parallel copy on the end of minuette wave (iii). I would expect minuette wave (v) to remain in the lower half of this channel. When this channel is clearly breached by downwards movement I would take that as trend channel confirmation that minor wave 2 is over.

Minor wave 2 may not move beyond the start of minor wave 1 above 2,019.26. If this invalidation point is passed I would use the alternate bear wave count below.

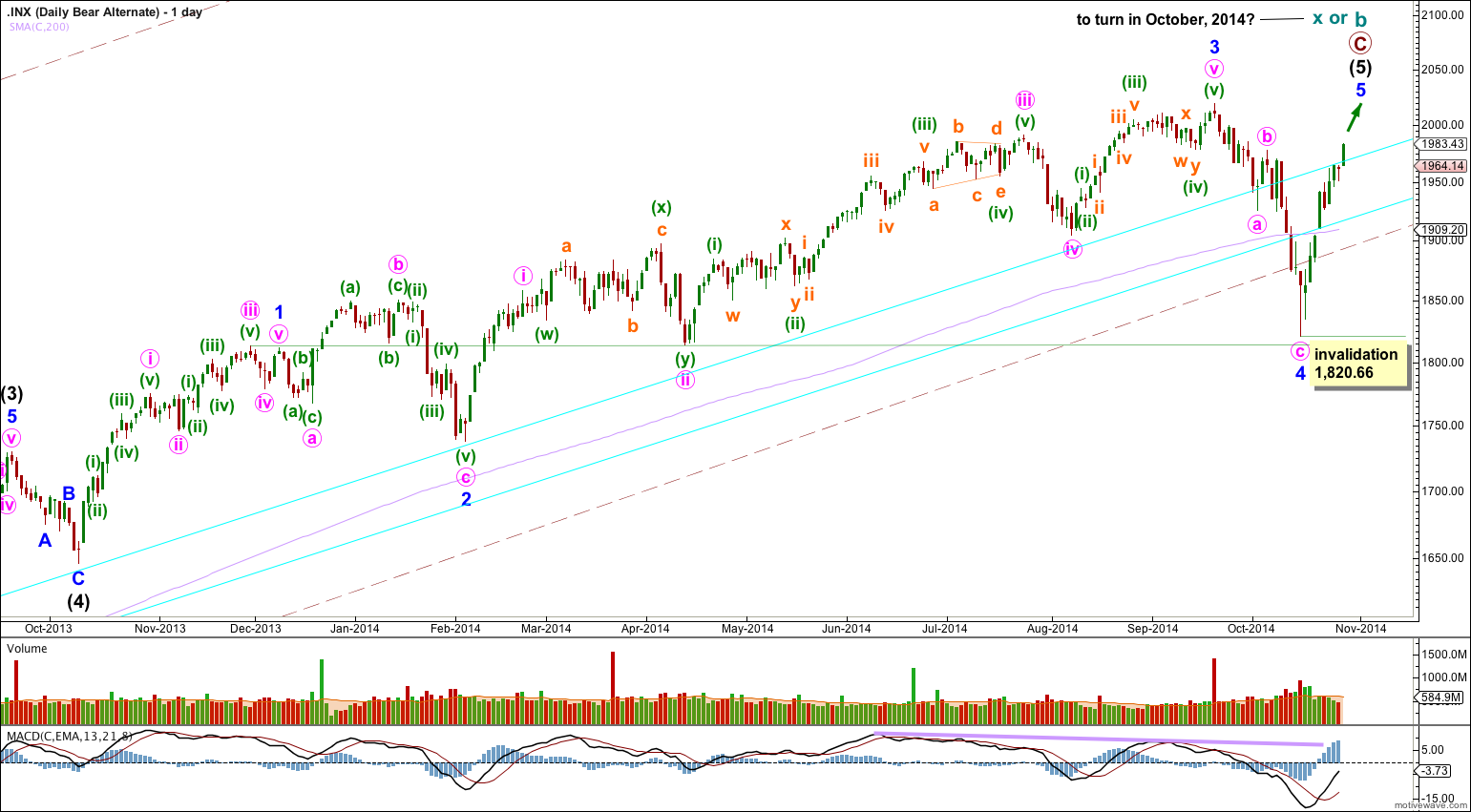

Alternate Bearish Wave Count

This idea works for both bull and bear wave counts.

I am confident that I have the labeling of intermediate waves (3) and (4) correct. Intermediate wave (3) lasted 455 days and is just 0.76 short of 2.618 the length of intermediate wave (1). Intermediate wave (3) has the strongest upwards momentum within primary wave C.

With this wave count minor wave 3 is 14.29 points longer than 1.618 the length of minor wave 1. Minor wave 2 is an expanded flat lasting 39 days and minor wave 4 is a zigzag lasting 18 days, and the proportions between minor waves 2 and 4 are better.

The problem within this wave count is at the end of minor wave 3: within it minute wave v looks like a three wave structure and not a five because minuette waves (ii) and (iv) are grossly disproportionate. There is another problem with this wave count: a clear breach of the lower edge of the maroon channel is most likely an indication that there has been a trend change prior, not that there is a trend change to come.

Because there is a Fibonacci ratio between minor waves 3 and 1 I would not expect to see a Fibonacci ratio for minor wave 5 to either of 3 or 1. If minor wave 5 only reached equality with minor wave 1 it would be truncated. Minor wave 5 is most likely to make a new high above minor wave 3 at 2,019.26, but it does not have to. It only needs to subdivide as a five wave structure.

It is at this point that this alternate wave count now diverges from the main bearish wave count. This alternate would expect to see maybe three more days of upwards movement to a slight new high.

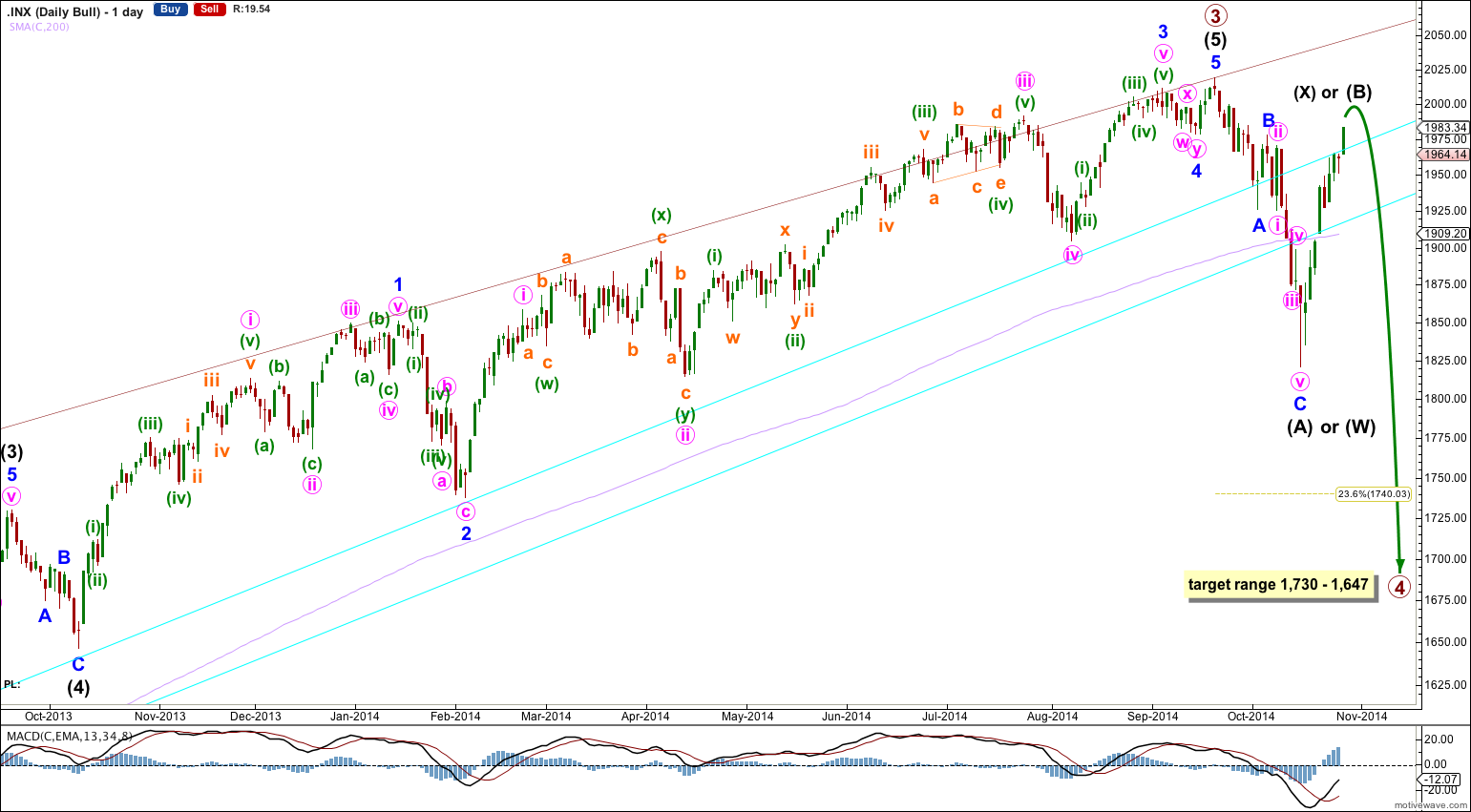

Bullish Wave Count

This bullish wave count differs from the bearish wave count at the monthly chart level and at super cycle wave degree. To see the historic picture go here.

Primary wave 4 may end within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) price territory is from 1,730 to 1,647.

Primary wave 2 was a 41% zigzag correction. I would expect primary wave 4 to show alternation in structure so most likely it will be a flat, combination or triangle. All of these structures may include a new price extreme beyond the start of intermediate wave (A), so they could see a new high.

Primary wave 2 lasted a Fibonacci 13 weeks. Zigzags tend to be more brief structures. I would expect primary wave 4 to last at least 13 weeks, and it may last up to a Fibonacci 21 weeks if it is a more time consuming structure like a combination or triangle. This would give it a 1.618 duration to primary wave 2. So far primary wave 4 is only in its sixth week, so this wave count would reasonably expect it to continue for at least another seven weeks.

It is too early to label primary wave 4 as over because it has lasted only 4 weeks and would be a zigzag so have no structural alternation with the zigzag of primary wave 2.

However, my degree of labeling for this downwards movement may be one degree too high. If we see a five down complete then I would move the degree of labeling for this bull wave count down one degree within primary wave 4, which could be only minor wave A of a zigzag for intermediate wave (A).

Because primary wave 4 is most likely to be a flat, triangle or combination, the first movement down is most likely to subdivide as a three wave structure labeled either intermediate waves (A) – (B) – (C) or (W) – (X) – (Y).

This is another way to see upwards movement as a zigzag. The recent triangle may have been minor wave B rather than a fourth wave.

At 2,012 minor wave C would reach 0.382 the length of minor wave A.

The channel drawn here is a corrective channel: draw the first trend line from the start of minor wave A to the end of minor wave B, then place a parallel copy on the end of minor wave A. Expect price to remain in the lower half of this channel. A clear breach of the channel by downwards movement would indicate a trend change.

If primary wave 4 is a flat correction then within it intermediate wave (B) must reach a minimum 90% length of intermediate wave (A) at 1,999.40 or above. Intermediate wave (B) may make a new high beyond the start of intermediate wave (A) for an expanded flat.

If primary wave 4 is a double combination then there is no minimum requirement for intermediate wave (X).

If primary was 4 is a triangle there is no minimum requirement for intermediate wave (B). Intermediate wave (B) may make a new high beyond the start of intermediate wave (A) for a running triangle.

This analysis is published about 04:55 p.m. EST.