Price moved lower as expected, but the short term target was not reached and downwards momentum did not increase.

The wave count remains the same.

Summary: The trend remains down at minor degree. The short term target for Monday / Tuesday is at 1,817 to 1,812.

This analysis is published about 8:15 p.m. EST. Click on charts to enlarge.

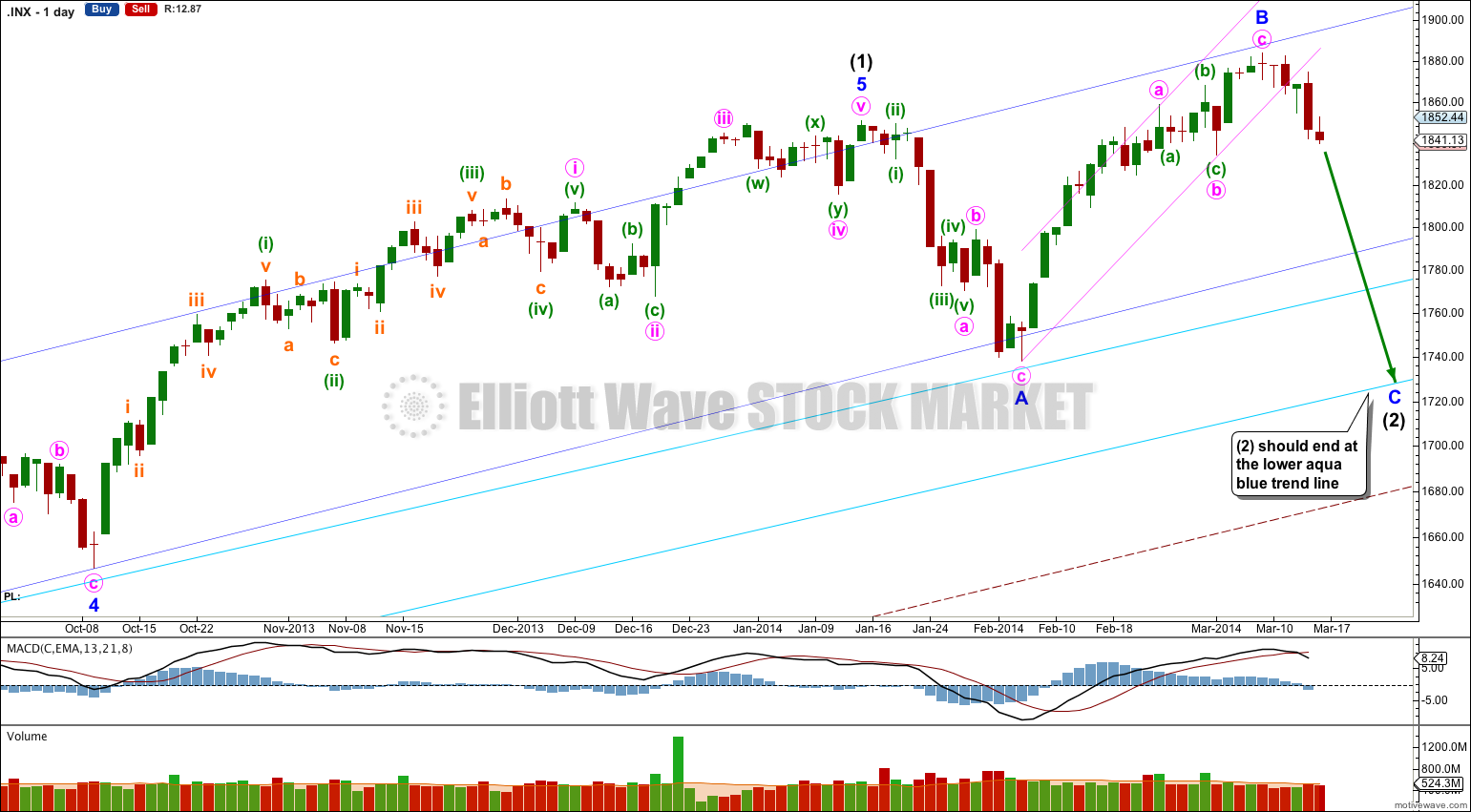

Bullish Wave Count.

The aqua blue trend lines are critical for all wave counts. Draw the first trend line from the low of 1,158.66 on 25th November, 2011 to the next swing low at 1,266.74 on 4th June, 2012. Create a parallel copy and place it on the low at 1,560.33 on 24th June, 2013. While price remains above the lower of these two aqua blue trend lines we must assume the trend remains upwards. This is the main reason for the bullish wave count being my main wave count.

This bullish wave count expects a new bull market began at 666.79 for a cycle wave V. Within cycle wave V primary waves 1 and 2 are complete. Within primary wave 3 intermediate wave (1) is complete at 1,850.84. Intermediate wave (2) is continuing as an expanded flat correction.

Intermediate wave (2) should find strong support at the lower of the two aqua blue trend lines. Minor wave A lasted 14 days and minor wave B lasted a Fibonacci 21 days. I would expect minor wave C to be of a similar duration and to last about three to four weeks in total.

For this bullish wave count when intermediate wave (2) is complete then very strong sustained upwards movement would be expected as an intermediate degree third wave within a primary degree third wave upwards unfolds.

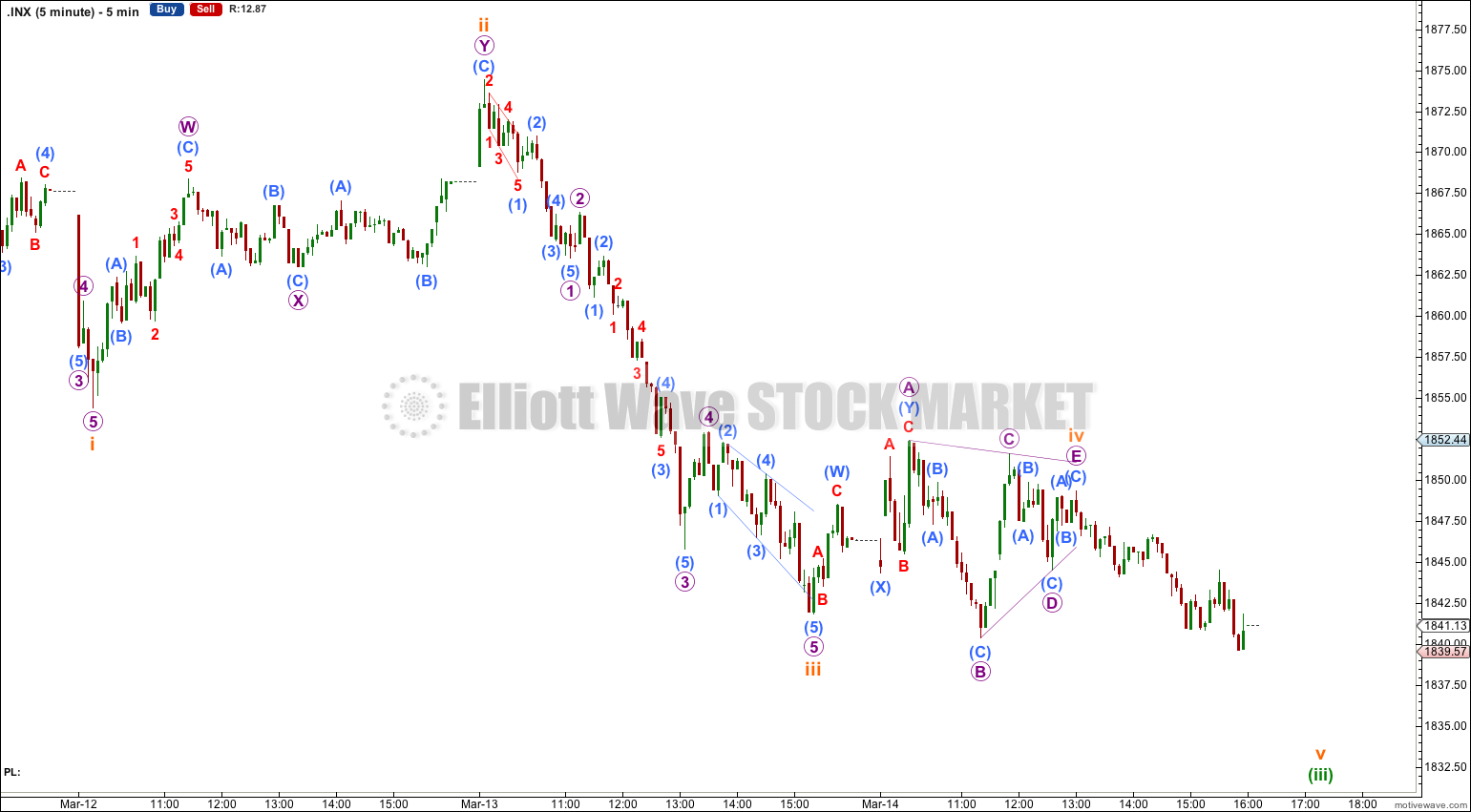

My last analysis of the five minute chart was wrong because subminuette wave iii was already over.

Sideways movement for much of Friday’s session fits nicely as a triangle. Subminuette waves ii and iv have perfect alternation.

There is no Fibonacci ratio between subminuette waves iii and i. At 1,817 subminuette wave v would reach equality in length with subminuette wave iii.

At 1,812 minuette wave (iii) would reach 4.236 the length of minuette wave (i). This gives us a 5 point target zone calculated at two wave degrees.

We may now use Elliott’s first technique to draw a parallel channel about this downwards movement. Draw the first trend line from the ends of subminuette waves i to iii, then place a parallel copy upon the end of submineutte wave ii. I would expect subminuette wave v to end either mid way within this channel or about the lower edge where it should find support. Along the way down upwards corrections should find resistance at the upper edge, if they even get that high.

When this channel is breached by subsequent upwards movement we shall have indication that minuette wave (iii) is over and minuettte wave (iv) should be underway. Minuette wave (iv) may not move into minuette wave (i) price territory. This wave count is invalidated with movement above 1,867.04.

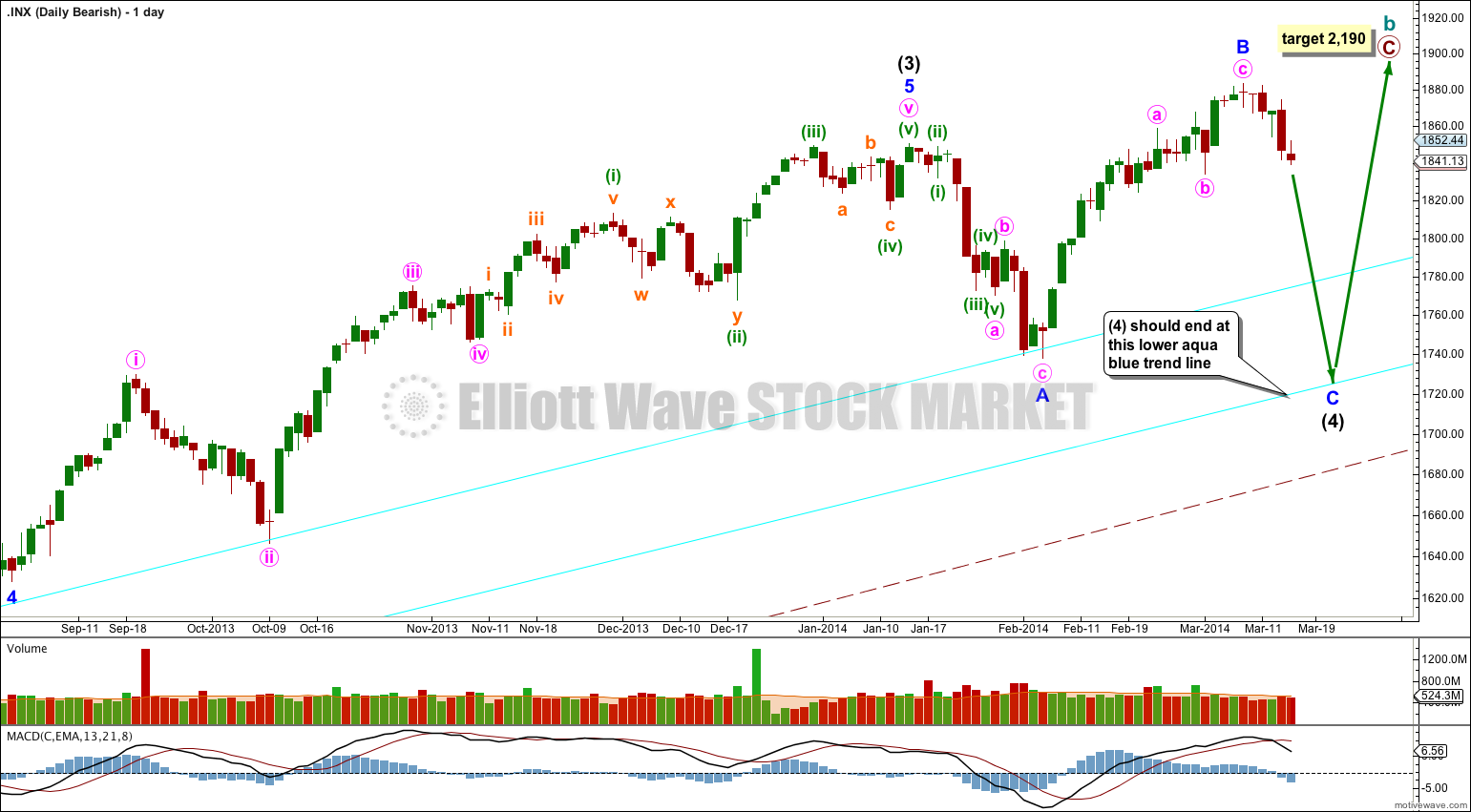

Bearish Alternate Wave Count.

This bearish wave count expects that the correction was not over at 666.79, and that may have been just cycle wave a of a huge expanded flat for a super cycle wave II. Cycle wave b upwards is a close to complete zigzag.

Within flat corrections the maximum common length of B waves in relation to A waves is 138%. So far cycle wave b is a 141% correction of cycle wave a. For this reason only this wave count is an alternate.

Within primary wave C of the zigzag intermediate wave (4) would be incomplete.

The subdivisions for intermediate wave (4) would be the same as the main wave count for intermediate wave (2). I would expect it to end at the lower aqua blue trend line.

At 2,190 primary wave C would reach 1.618 the length of primary wave A. When intermediate wave (4) is complete I would recalculate this target at intermediate degree. I have found Fibonacci ratios between actionary waves (1, 3 and 5) of impulses are more reliable than between A and C waves within zigzags for the S&P500.

If intermediate wave (5) lasts about five to six months it may end about October this year.

I think it was b wave too and mat last few more hours

As i said it was not impulsive down. New highs coming.

could it be a (b) wave up to 1860 and now entering a (c) wave down to about 1810 area?

I think after enetring 1864 zone we should see big, huge reversal under 1854, if not new highs coming.

You keep saying that… and you’re not producing any analysis to back it up.

Although so far you’re right, price has moved higher, without any reason for your prediction it is no better than the toss of a coin.

I’m very curious to see how you would see the upwards wave labeled minor wave B as an impulse. If we are about to see new highs then that upwards wave cannot be corrective, it must be an impulse. How would that subdivide? Because.. I just can’t get that to work.

If you want to fit your predictions into an Elliott wave framework (and considering this is an Elliott wave site and membership that would be a reasonable expectation) then you have to resolve that problem.