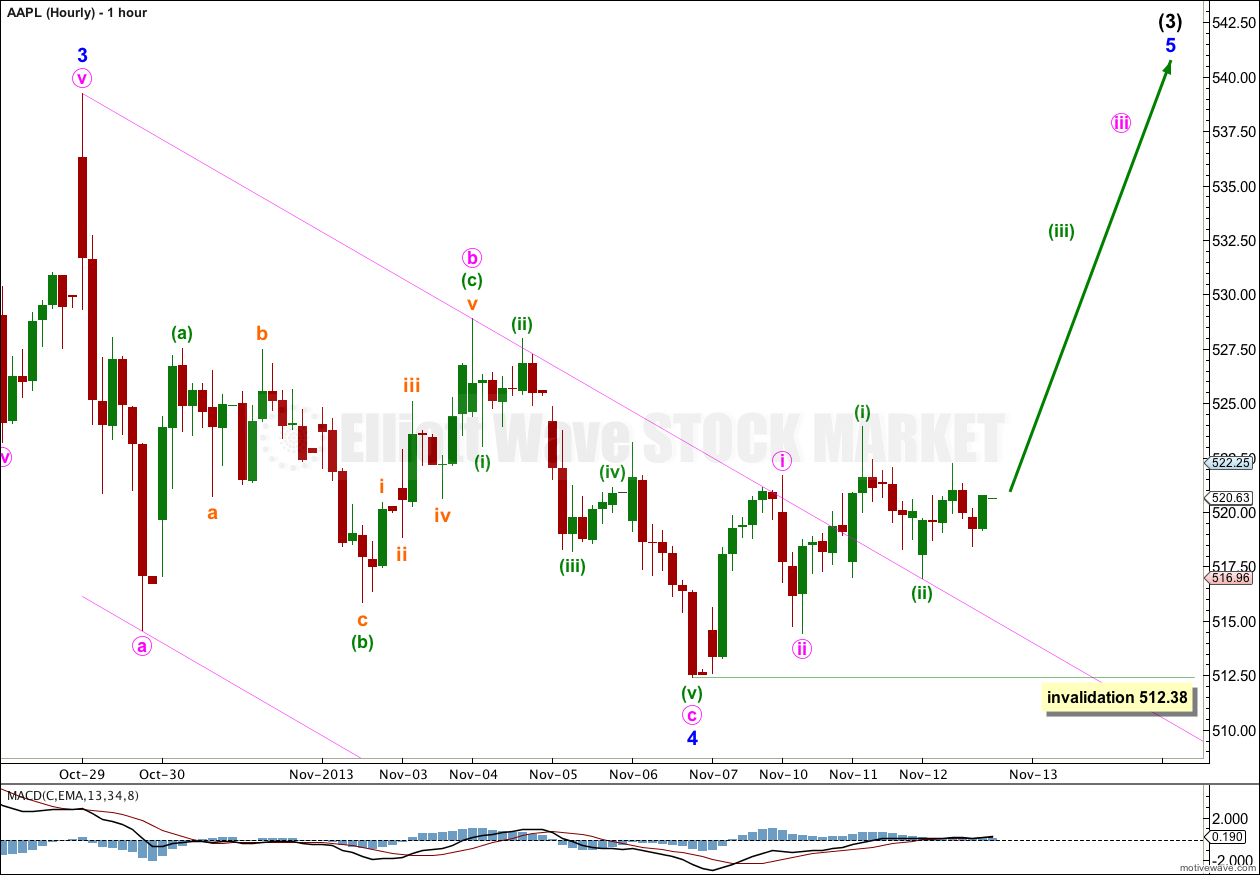

Last analysis expected some more downwards movement towards a short term target calculated at 515 to 513.61. Downwards movement ended at 512.38, $1.23 below the lower end of the target zone.

Thereafter, price has turned higher and breached the parallel channel on the hourly chart.

Click on the charts below to enlarge.

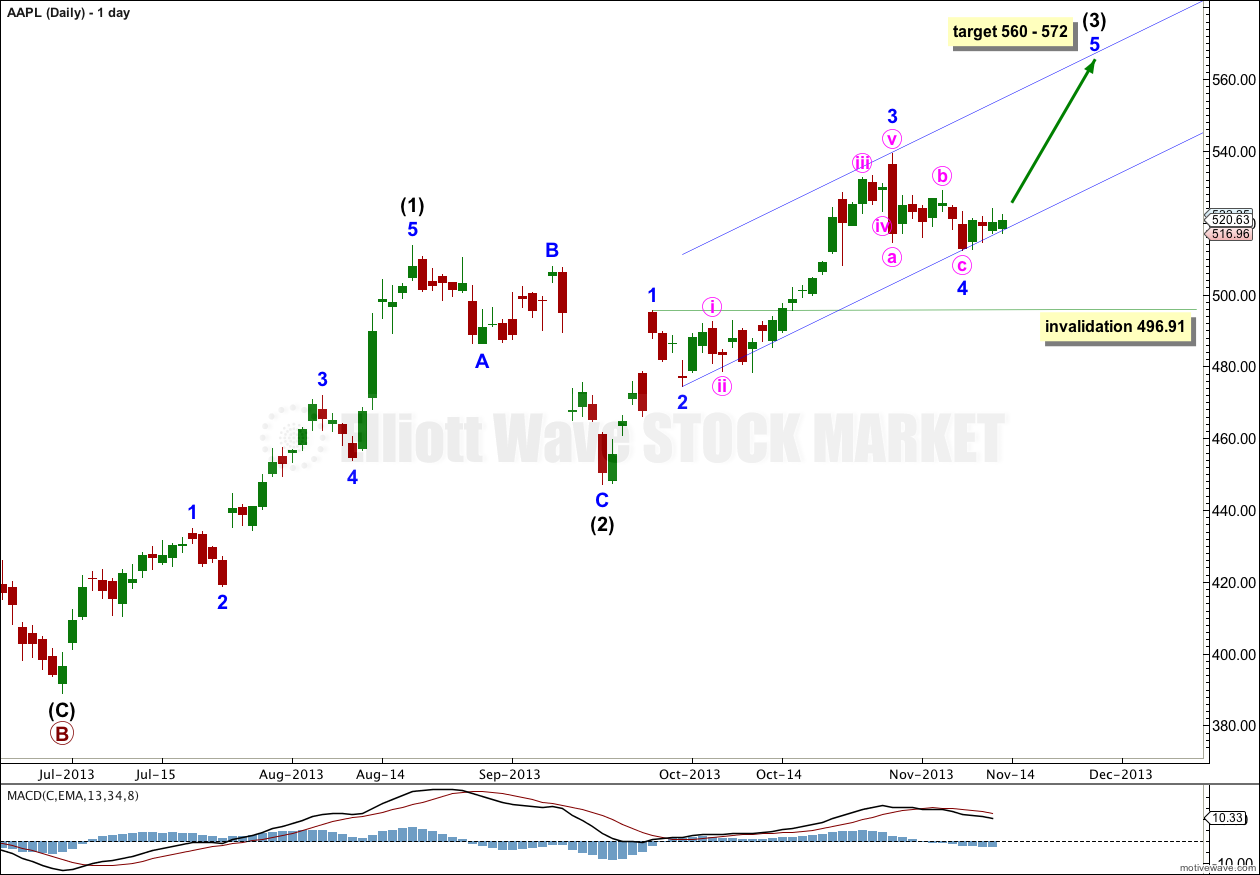

The daily chart shows the structure of primary wave C upwards within a larger upwards correction for a cycle wave b zigzag.

Within primary wave C so far intermediate waves (1) and (2) are complete. Intermediate wave (3) is an incomplete impulse.

Within intermediate wave (3) minor wave 3 has no Fibonacci ratio to minor wave 1.

I have redrawn the channel about intermediate wave (3) this week using Elliott’s second channeling technique. Draw the first trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the high of minor wave 3. I will expect minor wave 5 to most likely end midway within this channel, and if it gets higher to find resistance at the upper edge.

At this stage it is most likely that minor wave 4 is complete. In the unlikely situation that it continued further as a double combination, flat or double zigzag, then it may not move into minor wave 1 price territory. This wave count is invalidated with movement below 496.91.

At 572 intermediate wave (3) would reach equality in length with intermediate wave (1). At 560 minor wave 5 would reach equality in length with minor wave 1. I am aware that this target zone is rather large, and so as we get closer to the end I will try to narrow it down when I can add to it at a third wave degree.

Minor wave 4 is most likely complete now as a zigzag. Within it minute wave c is 1.24 longer than 1.618 the length of minute wave a.

The parallel channel about minor wave 4 zigzag is now clearly breached by upwards movement. This provides confidence that minor wave 4 should be over and minor wave 5 should be underway.

Minor wave 2 was a relatively shallow 44% zigzag correction of minor wave 1. If minor wave 4 is over now then it too was a relatively shallow 41% zigzag correction of minor wave 3. Within minor wave 2 minute waves a and c are very close to equality; within minor wave 4 minute waves a and c have a 0.618 Fibonacci relationship. There is no alternation in depth of correction or structure, but there is alternation within the structures.

If this wave count is correct this week at the hourly chart level then I would expect to see an increase in upwards momentum from AAPL over the next few days.

Within minor wave 5 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 512.38.