Last analysis expected more downwards movement for AAPL which is what has happened.

The wave count remains the same.

Click on the charts below to enlarge.

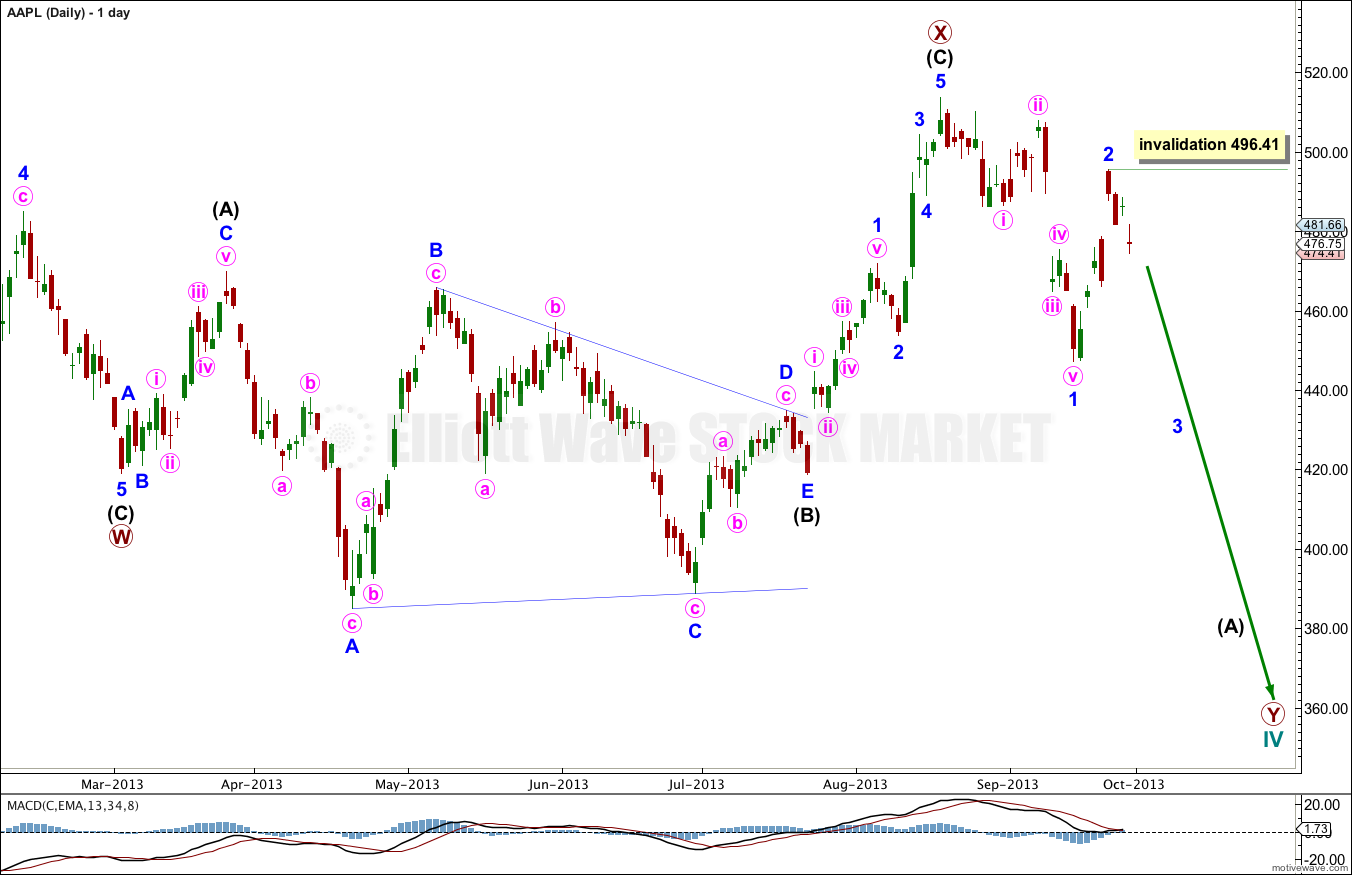

Primary wave X within the double zigzag of cycle wave IV is now complete.

At the low labeled primary wave W this downwards wave subdivides perfectly as a three wave zigzag. Because a new low was made after this zigzag was completed cycle wave IV cannot be over there, it must be continuing.

At cycle degree the structure unfolding is most likely a double zigzag. It may also be a double combination, but that would normally have a deeper retracement for the X wave; this upwards correction for primary wave X is relatively shallow and fits better the normal form for an X wave within double zigzag.

At this stage primary wave X is a complete flat correction because intermediate wave (A) within it subdivides as a three wave zigzag, and intermediate wave (B) is a corrective structure that is just over 100% the length of intermediate wave (A). Intermediate wave (C) subdivides nicely as a five wave impulse and has no Fibonacci ratio with intermediate wave (A).

Primary wave Y has begun and is most likely to be a large zigzag trending downwards. It should last months and take price to new lows. When the intermediate degree waves (A) and (B) within it are completed I can calculate a target for it to end. I cannot do that yet for you.

Within minor wave 3 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 496.41.

The channel about minor wave 2 is very clearly breached by downwards movement. This provides trend channel confirmation that minor wave 2 should be over and minor wave 3 downwards has recently begun.

At 389.28 minor wave 3 would reach 1.618 the length of minor wave 1.

Minor wave 1 lasted 19 days, minor wave 2 lasted 5 days. I would expect minor wave 3 to last about two to three weeks.

Within the current wave down if micro wave 2 continues higher it may not move beyond the start of micro wave 1. This wave count is invalidated with movement above 488.56.

Lara, would you have an alternate count for AAPL at the moment, in case price moves above 496.41?