Last analysis expected more upwards movement which is what we have seen. The wave counts remain the same.

Click on the charts below to enlarge.

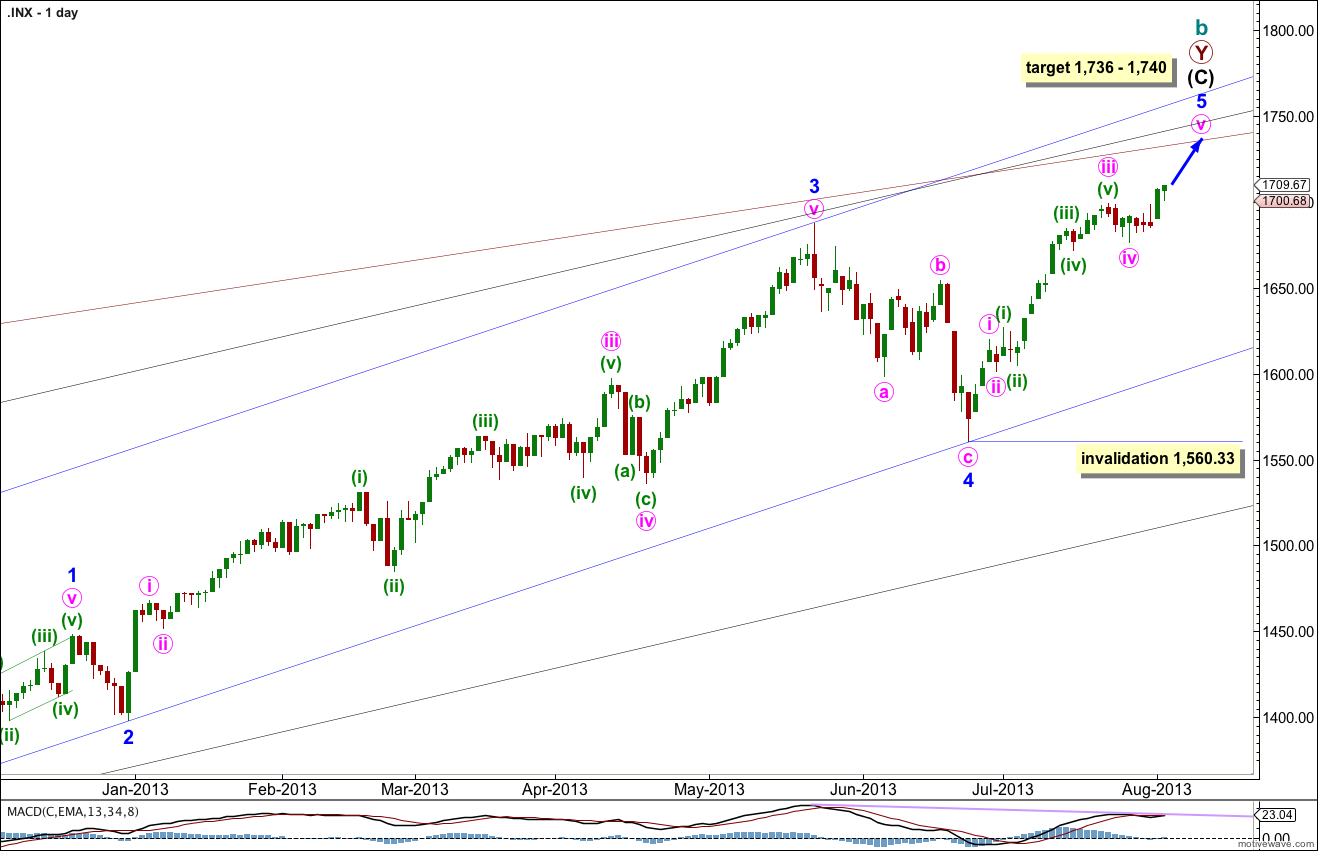

This wave count agrees with MACD and has some nice Fibonacci ratios in price and Fibonacci relationships in time.

Minor wave 3 is 15.1 points longer than 2.618 the length of minor wave 1.

Ratios within minor wave 3 are: there is no Fibonacci ratio between minute waves iii and i, and minute wave v is 5.44 points longer than equality with minute wave iii.

At 1,740 intermediate wave (C) would reach equality with intermediate wave (A). At 1,739 minor wave 5 would reach 0.618 the length of minor wave 3. At 1,736 minute wave v would reach 0.618 the length of minute wave iii.

Within minor wave 5 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,560.33.

Minor wave 1 lasted a Fibonacci 21 days, minor wave 2 lasted a Fibonacci 8 days, minor wave 3 has no Fibonacci duration at 98 days, and minor wave 4 lasted 22 days, just one day longer than a Fibonacci 21.

At this stage minor wave 5 has lasted 28 sessions. A further six sessions would see it ending in a Fibonacci 34 (give or take one session either side of this would be an acceptable variation). At that time I will look to see if the structure could be considered complete. If it can we shall have an alternate wave count to consider the possibility again of a trend change at cycle degree.

Keep drawing the wider parallel channels from the monthly chart and copy them over to the daily chart.

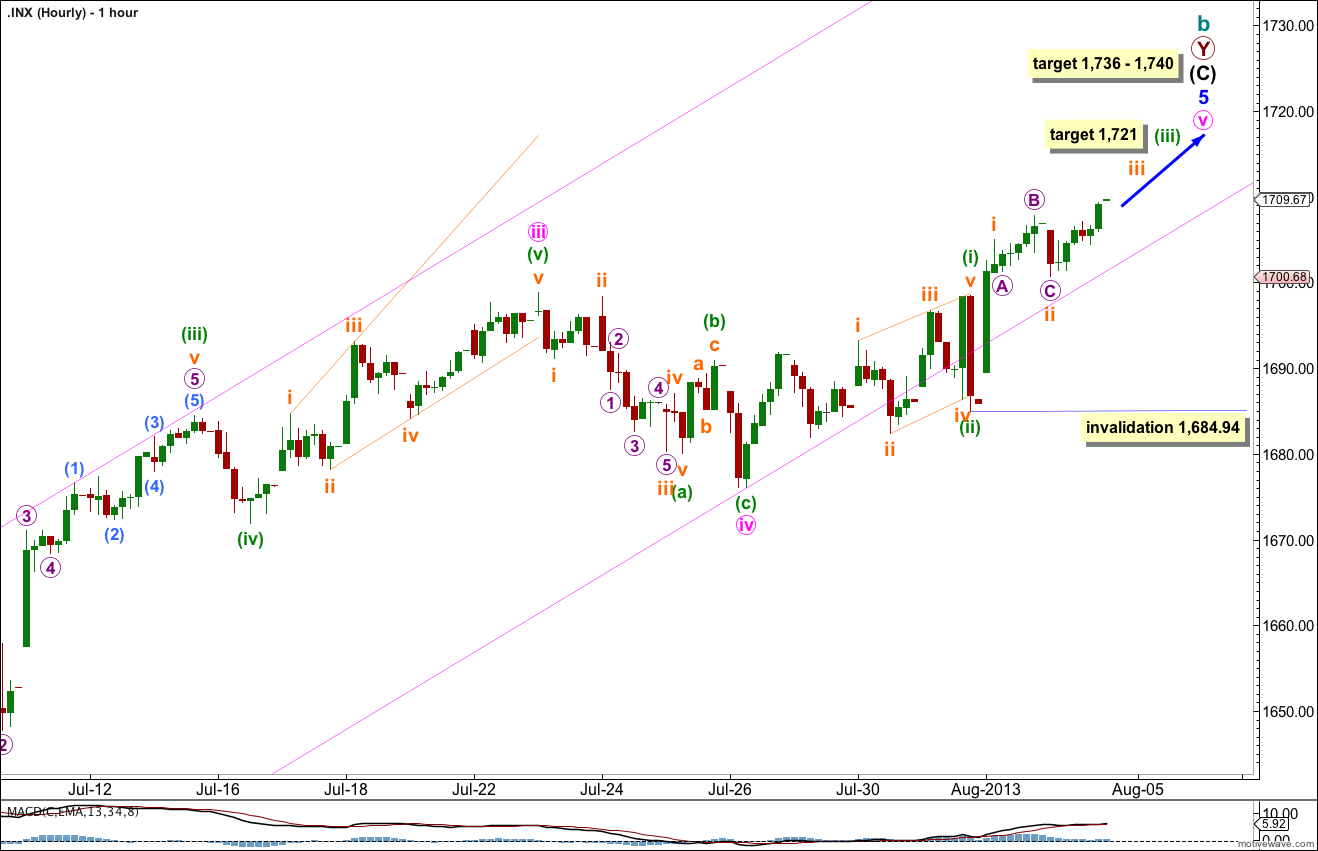

Further upwards movement to end the week is most likely the beginning of subminuette wave iii within minuette wave (iii). If this analysis is correct then Monday and maybe Tuesday also should see an increase in upwards momentum as the middle of a small third wave unfolds.

The short term target remains the same. At 1,721 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Within minuette wave (iii) subminuette wave ii may not move beyond the start of subminuette wave i, if it were to continue further, although it does look most likely to be over here.

There is a very slim possibility that minuette wave (iii) could be over at the high labeled subminuette wave i, but this has a low probability though because it would see minuette wave (iii) as slightly shorter than minuette wave (i), which is unusual. This would limit the fifth wave to no longer than equality with the third, because the third wave may never be the shortest. This idea would be invalidated with any movement above 1,720.71.

It is most likely that minuette wave (iii) would be extended.

Hi Lara-

If the slim possibility is playing out, are you labeling Friday’s low as minuette iv and we are currently in minuette v?

Yes.

Thanks for keeping is on target Lara.