Choppy overlapping downwards movement continued the correction for this small fourth wave and invalidated the alternate hourly wave count which saw it possibly complete.

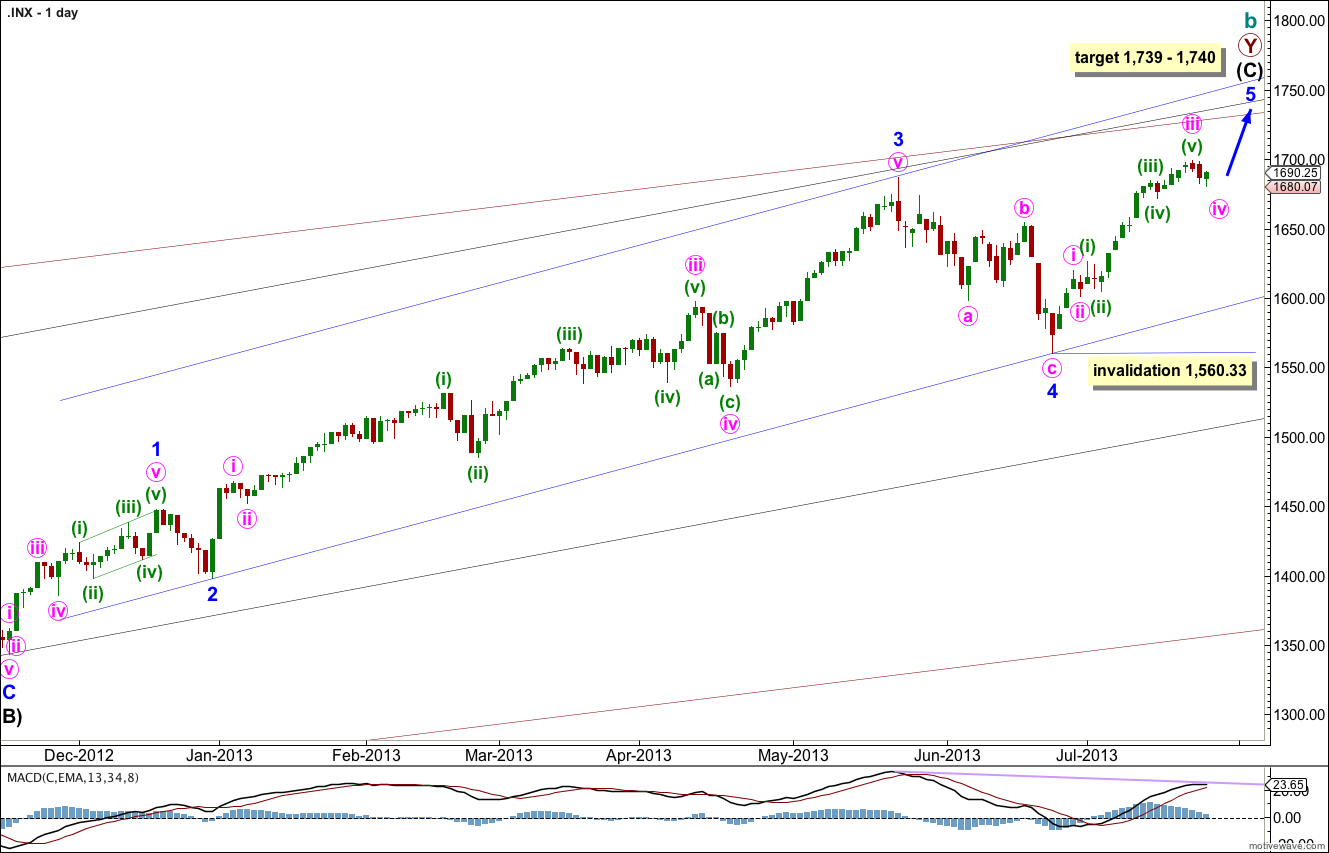

The wave count remains the same. I have again the same daily chart, and two hourly charts for you today.

Click on the charts below to enlarge.

This wave count agrees with MACD and has some nice Fibonacci ratios in price and Fibonacci relationships in time.

Minor wave 3 is 15.1 points longer than 2.618 the length of minor wave 1.

Ratios within minor wave 3 are: there is no Fibonacci ratio between minute waves iii and i, and minute wave v is 5.44 points longer than equality with minute wave iii.

At 1,740 intermediate wave (C) would reach equality with intermediate wave (A). At 1,739 minor wave 5 would reach 0.618 the length of minor wave 3.

Within minor wave 5 no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,560.33.

Minor wave 1 lasted a Fibonacci 21 days, minor wave 2 lasted a Fibonacci 8 days, minor wave 3 has no Fibonacci duration at 98 days, and minor wave 4 lasted 22 days, just one day longer than a Fibonacci 21.

At this stage minor wave 5 has lasted 22 sessions. A further 12 sessions would see it ending in a Fibonacci 34. At that time I will look to see if the structure could be considered complete. If it can we shall have an alternate wave count to consider the possibility again of a trend change at cycle degree.

Keep drawing the wider parallel channels from the monthly chart and copy them over to the daily chart.

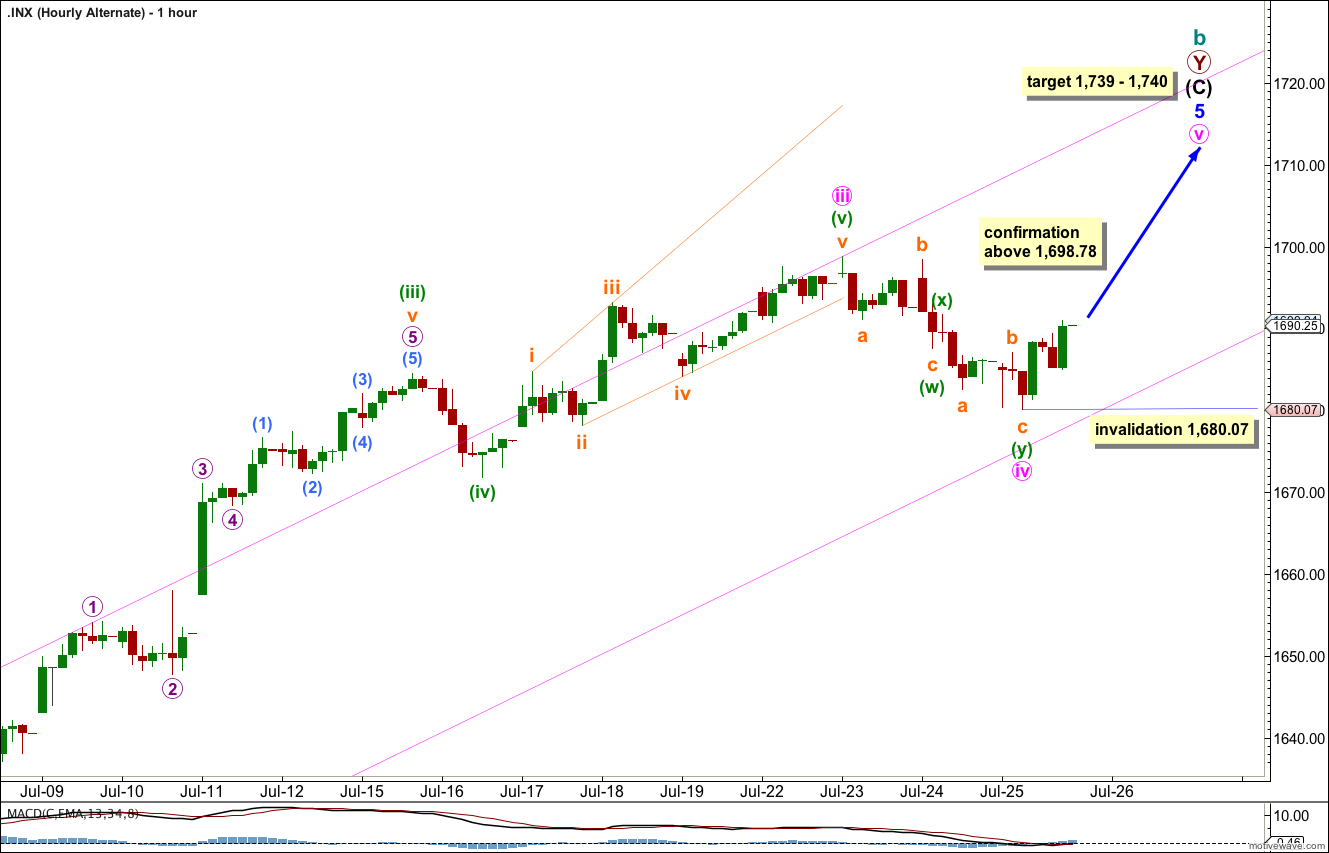

Further downwards movement ended a five wave impulse to the downside. This cannot be minute wave iv because a correction cannot subdivide as a five wave structure. This must be only minuette wave (a) within minute wave iv.

Minute wave iv may be unfolding as a zigzag or a double zigzag or double combination with the first structure a zigzag. Either way, a zigzag is unfolding.

Within the zigzag minuette wave (b) may be complete or very close to it. If it moves higher it may not move above the start of minuette wave (a) at 1,698.78. This wave count is invalidated in the short term with movement above this point.

As soon as minuette wave (c) downwards may be seen as complete then the short term invalidation point no longer applies.

At 1,679 minuette wave (c) would reach 0.618 the length of minuette wave (a), price would slightly overshoot the parallel channel, and the correction would end just short of the 0.236 Fibonacci ratio at 1,675.72.

It is very likely that minuette wave (c) will at least move below 1,680.07 to avoid a truncation.

Minuette wave (c) may be over during tomorrow’s session, or it may take all of tomorrow.

When it is complete then it is most likely that minute wave iv will be over. If minute wave iv were to continue further it would be out of proportion to minute wave ii.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,620.07.

If price moves above 1,698.78 tomorrow or the day after (prior to a new low and minuette wave (c) downwards completing) then we shall use the alternate wave count below.

Alternate Hourly Wave Count.

It is possible on the five minute chart to see a completed double zigzag structure. This wave count would see nice alternation between minute waves ii and iv: minute wave ii was a brief shallow 32% zigzag, and minute wave iv a longer lasting more shallow 19% double zigzag. There is some alternation in depth and nice alternation in structure.

If minute wave iv has ended here then at 1,740 minute wave v would reach 0.618 the length of minute wave iii. This leaves the target zone at just one point and calculated at three wave degrees: minute, minor and intermediate. It has a very good probability.

If price moves above 1,698.78 tomorrow or the day after and does not breach the invalidation point then this wave count should be correct.

Within minute wave v no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement below 1,680.07.

Nice Job Lara!