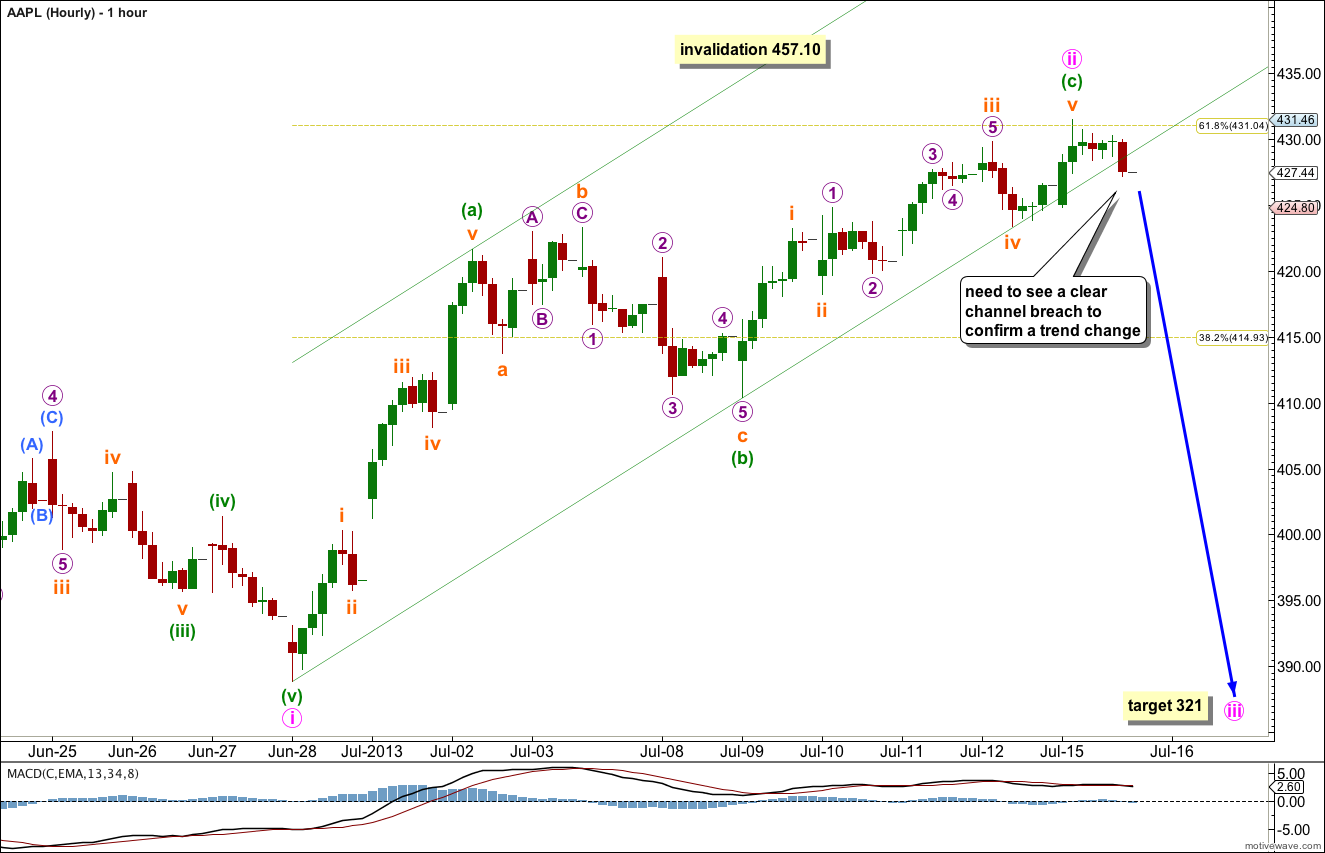

Last analysis of AAPL expected more upwards movement towards a short term target at 431. Price has reached up to 431.46 but we do not yet have a trend channel breach on the hourly chart to confirm that the trend has changed back to the downside.

Click on the charts below to enlarge.

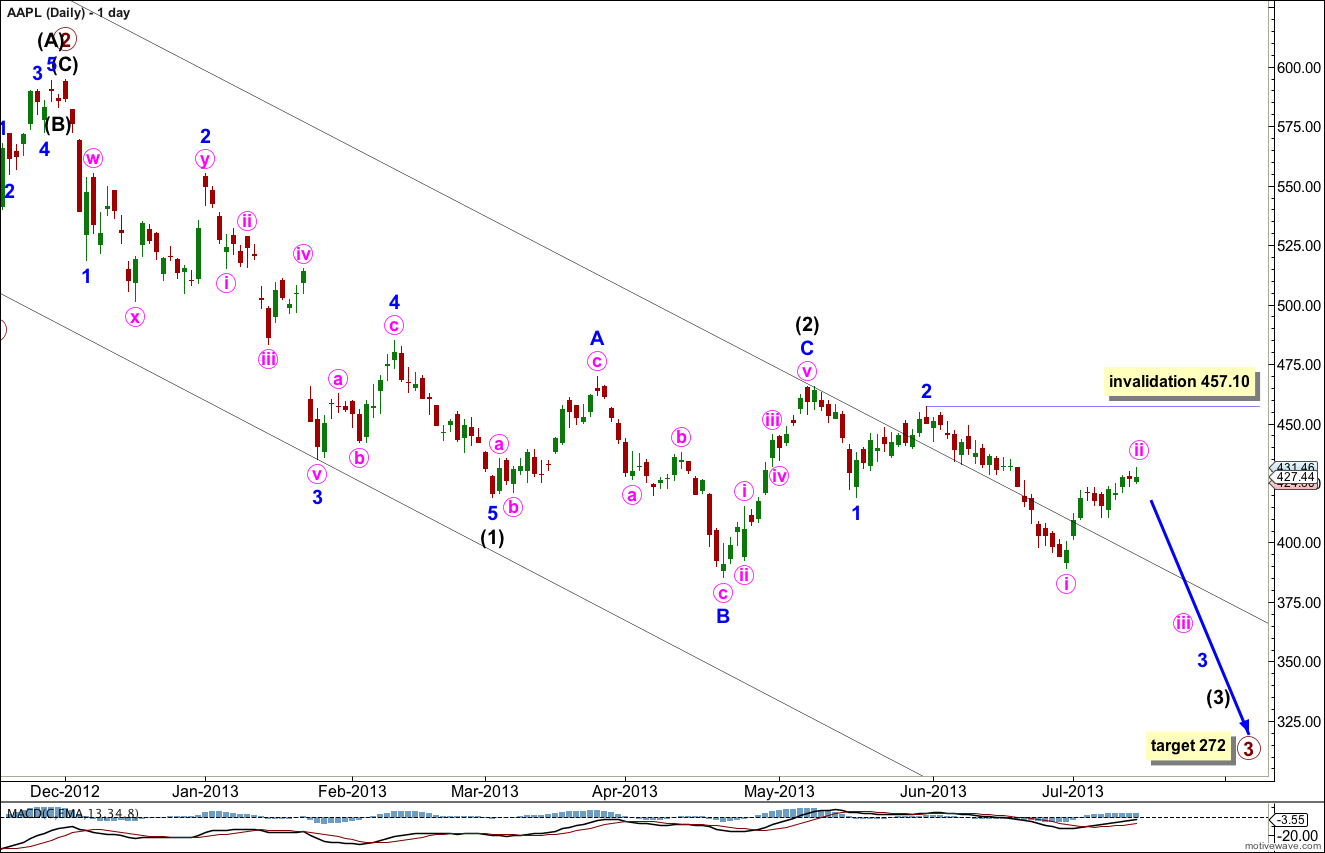

This wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Primary wave 3 is extending. Within primary wave 3 intermediate waves (1) and (2) are complete.

I have removed targets for minor wave 3 and intermediate wave (3). Because we have not seen a strong increase in downwards momentum yet I expect the middle of this third wave has not yet passed. I expect momentum to increase. Targets calculated may have been too high. As these waves get closer to completion I will use multiple wave degrees to calculate targets.

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. This long term target is still months away.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement above 457.10.

I have considered various possibilities for this downwards movement from the high labeled primary wave 2. What is most clear is that the middle of primary wave 3 has not yet passed because we have not seen momentum increase beyond that seen for primary wave 1. Primary wave 3 cannot be complete.

When this next five wave impulse labeled primary wave 3 is complete we shall have to consider that may be the end of cycle wave a as a three wave zigzag if super cycle wave II is unfolding as a big flat correction. I will consider that alternative at the appropriate time if it remains viable.

Minute wave ii may be over. We shall have confirmation when the channel drawn about it is clearly breached by at least one hourly candlestick fully below the channel and not touching the lower trend line. If downwards movement continues from here it is likely to be the start of a very strong third wave.

At 321 minute wave iii would reach 1.618 the length of minute wave i.

Ratios within minute wave ii are: minuette wave (c) is just 0.83 longer than 0.618 the length of minuette wave (a).

Ratios within minuette wave (c) are: subminuette wave iii is 1.28 short of equality with subminuette wave i, and subminuette wave v 0.13 longer than 0.618 the length of subminuette wave i.

Ratios within subminuette wave iii are: micro wave 3 has no Fibonacci ratio to micro wave 1, and micro wave 5 is 0.29 longer than 0.382 the length of micro wave 3.

At this stage because there is not a clear channel breach (the last hourly candle is outside the channel, but it is completely unconvincing) we must allow for the possibility that minute wave ii may move higher.

When the channel has a clearer breach then the invalidation point may move down to the start of minute wave iii at 431.46.