Last analysis of AAPL expected some downwards movement followed by new highs, in choppy overlapping corrective movement.

Price did not start with downwards movement as expected, it just moved higher.

Click on the charts below to enlarge.

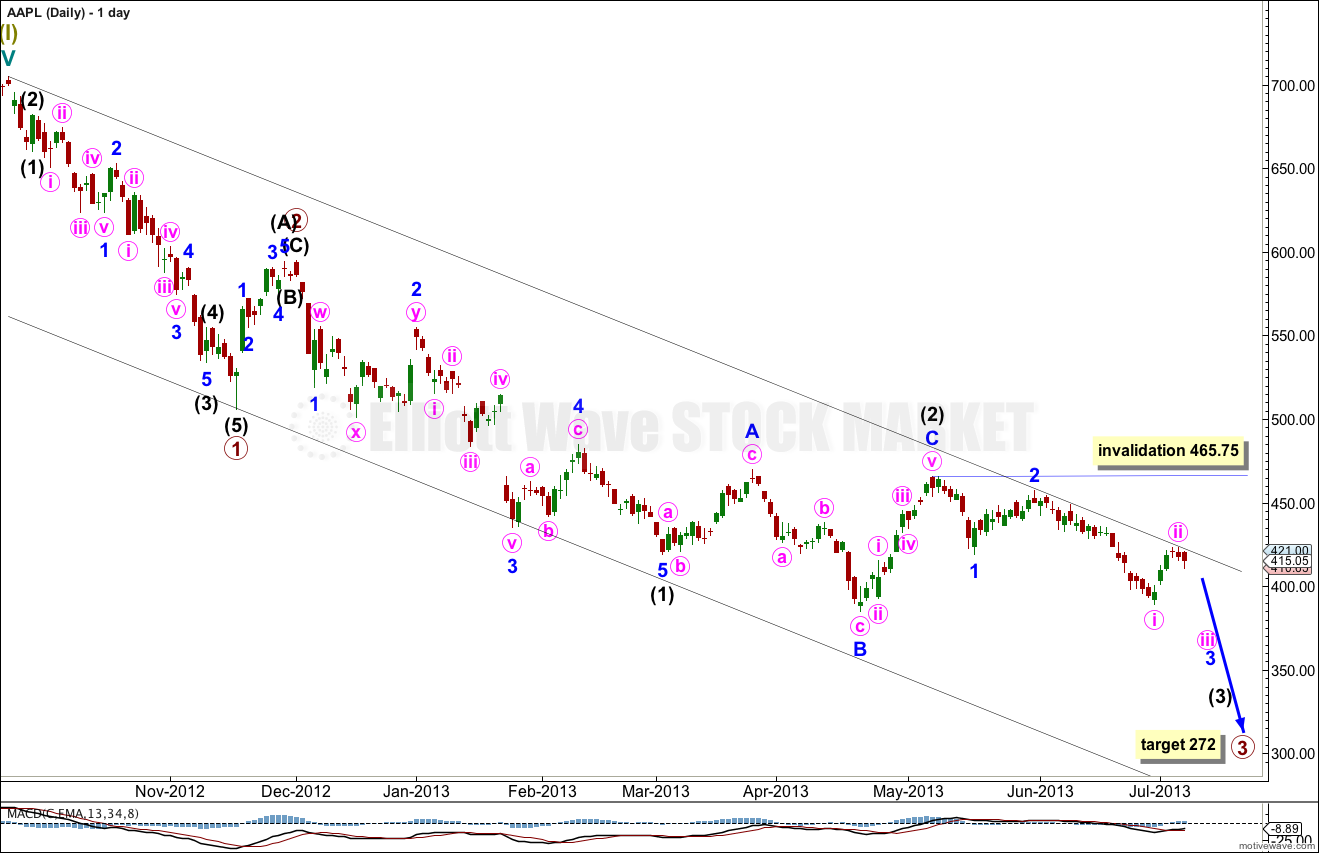

This wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Primary wave 3 is extending. Within primary wave 3 intermediate waves (1) and (2) are complete.

I have removed targets for minor wave 3 and intermediate wave (3). Because we have not seen a strong increase in downwards momentum yet I expect the middle of this third wave has not yet passed. I expect momentum to increase. Targets calculated may have been too high. As these waves get closer to completion I will use multiple wave degrees to calculate targets.

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. This long term target is still months away.

Within intermediate wave (3) no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 465.75.

I have considered various possibilities for this downwards movement from the high labeled primary wave 2. What is most clear is that the middle of primary wave 3 has not yet passed because we have not seen momentum increase beyond that seen for primary wave 1. Primary wave 3 cannot be complete.

When this next five wave impulse labeled primary wave 3 is complete we shall have to consider that may be the end of cycle wave a as a three wave zigzag if super cycle wave II is unfolding as a big flat correction. I will consider that alternative at the appropriate time if it remains viable.

As stated last week the upwards correction may have been at higher degree. This week I have moved the degree of labeling within this movement all up one degree. This correction may be only minute wave ii. This wave count now expects that the middle of intermediate wave (3) is incomplete and we should see a strong increase in downwards momentum this week or next.

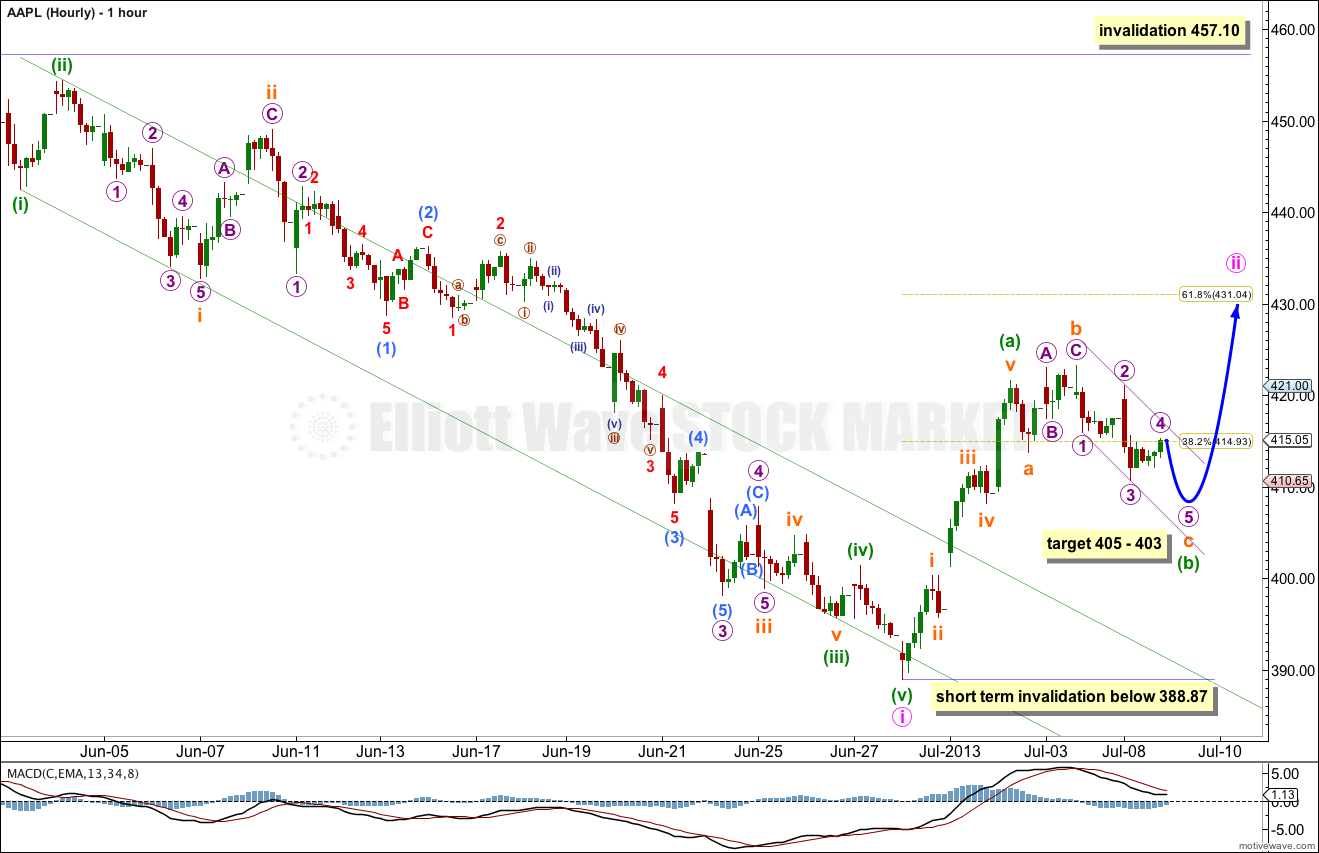

Minute wave ii may be unfolding as a zigzag. Within it minuette wave (a) unfolds very nicely as a five wave impulse. Minuette wave (b) is unfolding as an expanded flat correction.

Within the flat correction of minuette wave (b) subminuette wave c has passed 1.618 the length of subminuette wave a. At 403 subminuette wave c would reach 2.618 the length of subminuette wave a. At 405 micro wave 5 within subminuette wave c would reach equality in length with micro wave 3.

Minuette wave (b) may not move beyond the start of minuette wave (a). This wave count is invalidated in the short term with movement below 388.87.

When minuette wave (b) is complete then we should see another five wave structure upwards for minuette wave (c) to complete the zigzag for minute wave ii. At this stage I will expect the most likely point for minute wave ii to end is about the 0.618 Fibonacci ratio of minute wave i at 431.04. When we know where minute wave (b) has ended we may use the Fibonacci ratio between minuette waves (a) and (c) to calculate a target. We cannot do that yet.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement above 457.10.