Yesterday’s analysis expected more upwards movement towards a short term target at 1,672 to 1,677. This did not happen and movement below the short term invalidation point at 1,646.50 invalidated yesterday’s labeling on the hourly chart.

The degree of labeling for recent movement on the hourly chart is moved down one degree.

Click on the charts below to enlarge.

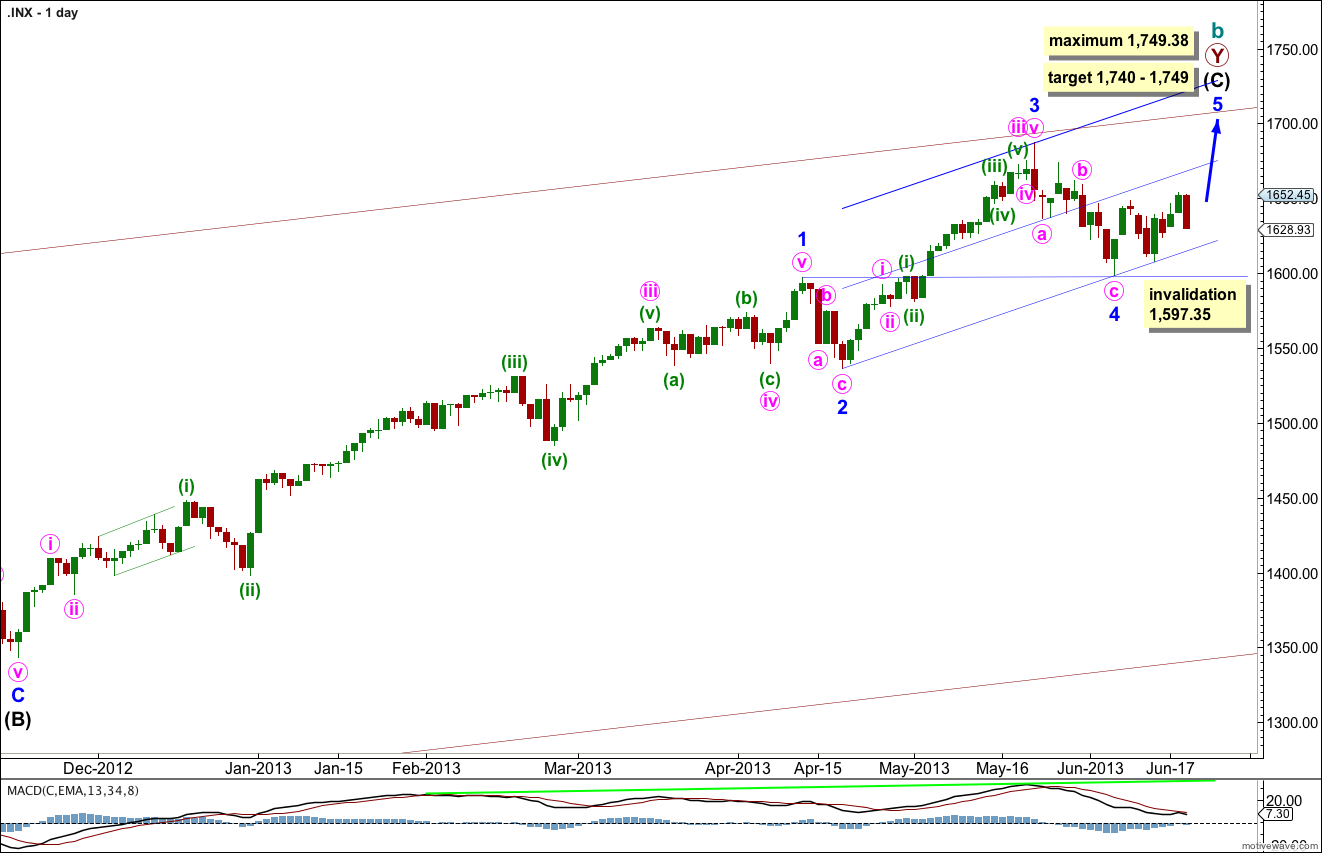

The bigger picture sees upwards movement from the end of the “credit crunch” at 666.76 as a double zigzag structure for a cycle degree b wave lasting so far 4.25 years. The second zigzag is almost complete. When it is done we should see another crash to make substantial new lows below 666.76, if the main monthly wave count is correct. If, however, the next upwards wave sees an increase in momentum beyond that seen for minor wave 3 then the alternate very bullish monthly wave count must be seriously considered. I will be watching momentum carefully over the next few weeks.

Within intermediate wave (C) minor wave 1 was extended.

Minor wave 3 is just 5.82 points short of 0.618 the length of minor wave 1. I would expect the upcoming minor wave 5 to reach equality with minor wave 3. This would be achieved at 1,749.38, and this is also a maximum point for upwards movement because minor wave 3 may not be the shortest wave.

At 1,740 intermediate wave (C) would reach equality with the orthodox length of intermediate wave (A). This gives us a 9 point target zone, and I favour the upper end of the zone because it is calculated at a lower wave degree.

If minor wave 4 were to continue any lower it may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,597.35.

Draw the channel about intermediate wave (C) using Elliott’s second technique. Draw the first trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the hight of minor wave 3. Add a mid line to the channel. Expect minor wave 5 to end about the mid line, or to find resistance at the upper edge.

The very wide maroon trend channel shown here is copied over from the monthly chart. We may find this movement ends as it finds resistance at the upper trend line.

At this stage there is no divergence on the daily chart level with price trending higher and MACD also trending higher. This is an indication that the upwards trend remains in place. I would expect to see some classic technical divergence before the end of this trend.

This structure unfolding upwards is still a diagonal, but it is extremely unlikely to be an ending diagonal for minor wave 5. It is much more likely to be a leading diagonal for minute wave i.

Because the upwards movement of the diagonal labeled minuette wave (iii) is shorter than minuette wave (i) the diagonal is contracting. This means the structure cannot be long enough to reach to a new high above minor wave 3 at 1,687.18. An ending diagonal is unlikely to be a fifth wave truncation, and even when that occurs it is only by the slimmest of margins (“Elliott Wave Principle” page 37). This structure would be severely truncated. So I have moved the degree of labeling within the diagonal all down one degree.

Minute wave i is unfolding as a leading contracting diagonal. Within the contracting diagonal minuette wave (iv) should be shorter than minuette wave (ii), so should not move below 1,613.57. Minuette wave (iv) is most likely to be within 0.66 to 0.81 the length of minuette wave (iii), between 1,624 and 1,617. Within this target range at 1,622 subminuette wave c would reach 4.236 the length of subminuette wave a.

Within minuette wave (iii) subminuette wave c is 2.5 points short of equality with subminuette wave c.

Within this hourly wave count the key is the upwards movement labeled minuette wave (iii). This movement cannot be a five; it does not subdivide into either an impulse or a diagonal because within both these possibilities the third wave would be the shortest violating a core Elliott wave rule. So this movement must be a three. Although it does not look completely satisfactory as a three, it simply cannot be a five.

I have considered alternate possibilities but cannot yet see an alternate that has a good enough fit and look for publication.

We may expect minuette wave (iv) to most likely move lower tomorrow, and it may end where it finds support at the lower edge of the parallel channel copied over here from the daily chart.

The following minuette wave (v) upwards to complete the leading diagonal may slightly overshoot the 1-3 trend line, the upper diagonal trend line.

Minuette wave (iv) may not move beyond the end of minuette wave (ii). This wave count is invalidated with movement below 1,608.07.

ABC down into 1527 … the our mother’s bounce into 1800’s

Hi Lara,

Looks like we might have a zig-zag in combination with an expanded flat for minor wave 4

Craig

That’s possible, if minor wave 1 ended lower.

Alternatively, cycle wave b is over.

I’m really concerned with the lack of divergence though if this is the big trend change…

today’s analysis will take a while…

Yes….I see what you mean.

I suppose you could tweak your minor wave 1 to finish where you currently have your minute wave (iii) of minor 1 , and leave minor wave 2 unchanged. That might fit better with the macD and allow room for the C-wave of a flat correction to finish below 1597 for minor wave 4.

Just a thought.