Last analysis expected a little downwards movement for a small degree second wave correction, to be followed by upwards movement. Price moved lower and has remained well above the invalidation point. It has not turned higher, yet.

The wave count remains the same. I have still the same two targets and the same end date.

Click on the charts below to enlarge.

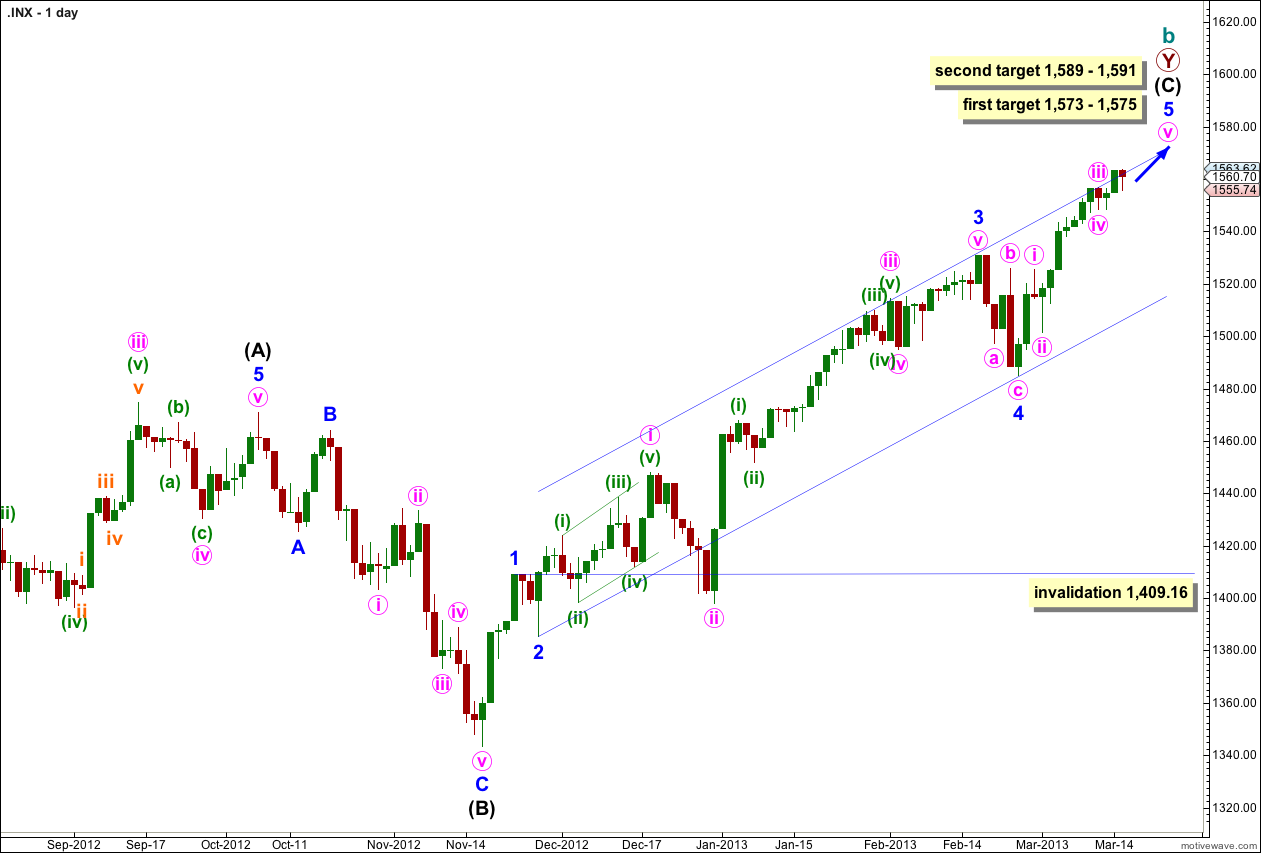

The structure is within the second zigzag of a double labeled primary wave Y. Within this second zigzag intermediate wave (C) is most likely incomplete.

Within intermediate wave (C) minor waves 1 through to 4 are most likely complete. We may use Elliott’s channeling technique to draw a channel about the impulse of intermediate wave (C). Draw the first trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the high of minor wave 3. At this stage it looks like minor wave 5 may end about the upper edge of this channel.

At 1,573 cycle wave b would reach 105% the length of cycle wave a. This is the minimum requirement for a B wave in relation to an A wave within an expanded flat, and as expanded flats are the most common type of flat this price point has a good probability of being reached.

Also at 1,573 minute wave v within minor wave 5 would reach 0.618 the length of minute wave i.

At 1,575 minor wave 5 would reach 0.618 the length of minor wave 3.

If price continues to move higher through the first target then we may use the second target. At 1,589 minute wave v within minor wave 5 would reach equality in length with minute wave i. At 1,590 intermediate wave (C) would reach 0.618 the length of intermediate wave (A). At 1,591 minor wave 5 would reach 1.618 the length of minor wave 1. This gives us a high probability two point target based upon three wave degrees.

Within intermediate wave (C) minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,409.16.

Within intermediate wave (C) minor wave 1 has no Fibonacci duration lasting 4 days, minor wave 2 lasted a Fibonacci 3 days, minor wave 3 lasted a Fibonacci 55 days, and minor wave 4 lasted a Fibonacci 5 days. So far minor wave 5 has lasted 13 days and is incomplete. A possible end may be at a Fibonacci 21 days which will be in another 8 sessions. If it does not end there then a further 13 sessions would take it to a Fibonacci 34. At each Fibonacci time duration I will look at the structure to see if it could be complete and if so we shall have an alternate wave count for that possibility.

At intermediate degree wave (C) has so far lasted 79 sessions. In another 9 sessions it will have lasted a Fibonacci 89.

The most likely end to this trend may be 27th March, 2013 (give or take one day either side). However, Fibonacci time relationships are not always reliable. This is a guideline only.

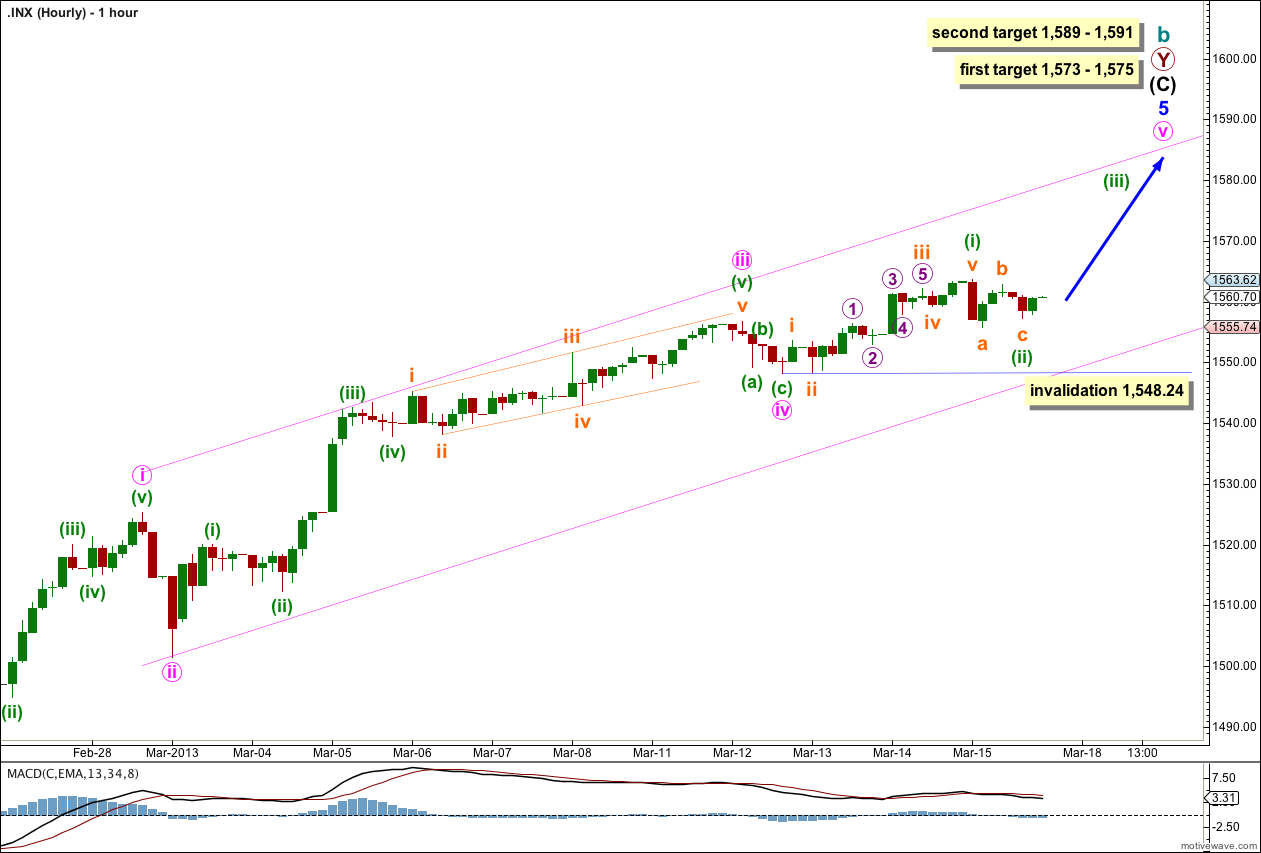

Downwards movement for Friday’s session subdivides as a zigzag with a truncated subminuette wave c.

This wave count agrees with MACD. The strongest momentum is within minuette wave (iii) of minute wave iii.

Targets remain the same and are explained on the daily chart.

The parallel channel is drawn first with a trend line from the highs of minute waves i to iii, then a parallel copy is placed upon the low of minute wave ii. I have pushed the upper trend line out to sit on the high of minuette wave (iii) within minute wave iii. Price may remain contained within this channel on the way upwards.

If minuette wave (ii) continues lower as a double combination or flat correction then it may not move beyond the start of minuette wave (i). This wave count is invalidated with movement below 1,548.24. If this wave count is invalidated with downwards movement then we may use the alternate below.

Alternate Hourly Wave Count.

This alternate is the same as the main hourly wave count up to the high of minuette wave (iii) within minute wave iii.

Thereafter, if we move the degree of labeling down one degree for the diagonal, it may be a leading diagonal for subminuette wave i within minuette wave (v), instead of an ending diagonal.

Minute wave iii may have just ended. Minute wave iv may have just begun.

I would expect minute wave iv to last another one session, two at the most. It would most likely be a shallow flat or combination. At 1,555 minuette wave (c) would reach equality with minuette wave (a).

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,525.34.

FX Market Opens, EUR Hammered, CHF Bid; S&P To Open -30pts http://www.zerohedge.com/news/2013-03-17/fx-market-opens-eur-hammered-chf-bid-sp-open-30pts // could you send out a update if the crash starts tonight?

No.

My time zone is +12GMT. New York opens in the small hours of my morning, when I’m fast asleep.