Analysis for yesterday expected Thursday’s session to see choppy, overlapping sideways movement which may possibly make a new high. This is exactly what happened.

The structure for this correction is unfolding as expected, so far. The wave count remains the same. I can now calculate a target for this correction to end which has a good probability.

The slight new high has invalidated the less likely alternate hourly wave count and we are left with just the one daily and one hourly wave count today.

Click on the charts below to enlarge.

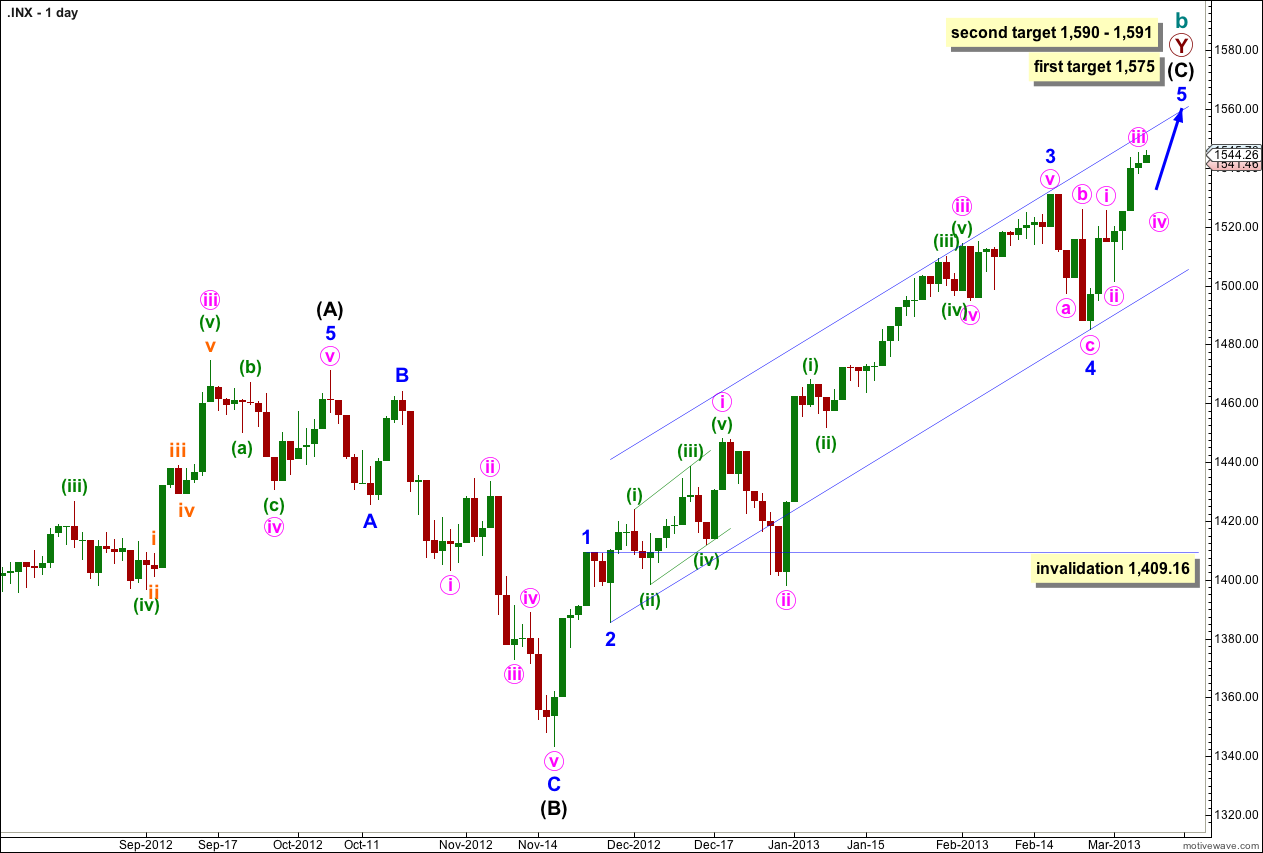

The structure is within the second zigzag of a double labeled primary wave Y. Within this second zigzag intermediate wave (C) is most likely incomplete.

Within intermediate wave (C) minor waves 1 through to 4 are most likely complete. We may use Elliott’s channeling technique to draw a channel about the impulse of intermediate wave (C). Draw the first trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the high of minor wave 3. At this stage it looks like minor wave 5 may end about the upper edge of this channel.

At 1,573 cycle wave b would reach 105% the length of cycle wave a. This is the minimum requirement for a B wave in relation to an A wave within an expanded flat, and as expanded flats are the most common type of flat this price point has a good probability of being reached.

At 1,575 minor wave 5 would reach 0.618 the length of minor wave 3.

If price continues to move higher through the first target then we should expect the next likely target to be at 1,590 where intermediate wave (C) would reach 0.618 the length of intermediate wave (A), and at 1,591 minor wave 5 would reach 1.618 the length of minor wave 1.

Within intermediate wave (C) minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,409.16.

Within intermediate wave (C) minor wave 1 has no Fibonacci duration lasting 4 days, minor wave 2 lasted a Fibonacci 3 days, minor wave 3 lasted a Fibonacci 55 days, and minor wave 4 lasted a Fibonacci 5 days. So far minor wave 5 has lasted 7 days and is incomplete. A possible end may be at a Fibonacci 13 days which will be in another 6 days. If it does not end there then a further 8 days would take it to a Fibonacci 21. At each Fibonacci time duration I will look at the structure to see if it could be complete and if so we shall have an alternate wave count for that possibility.

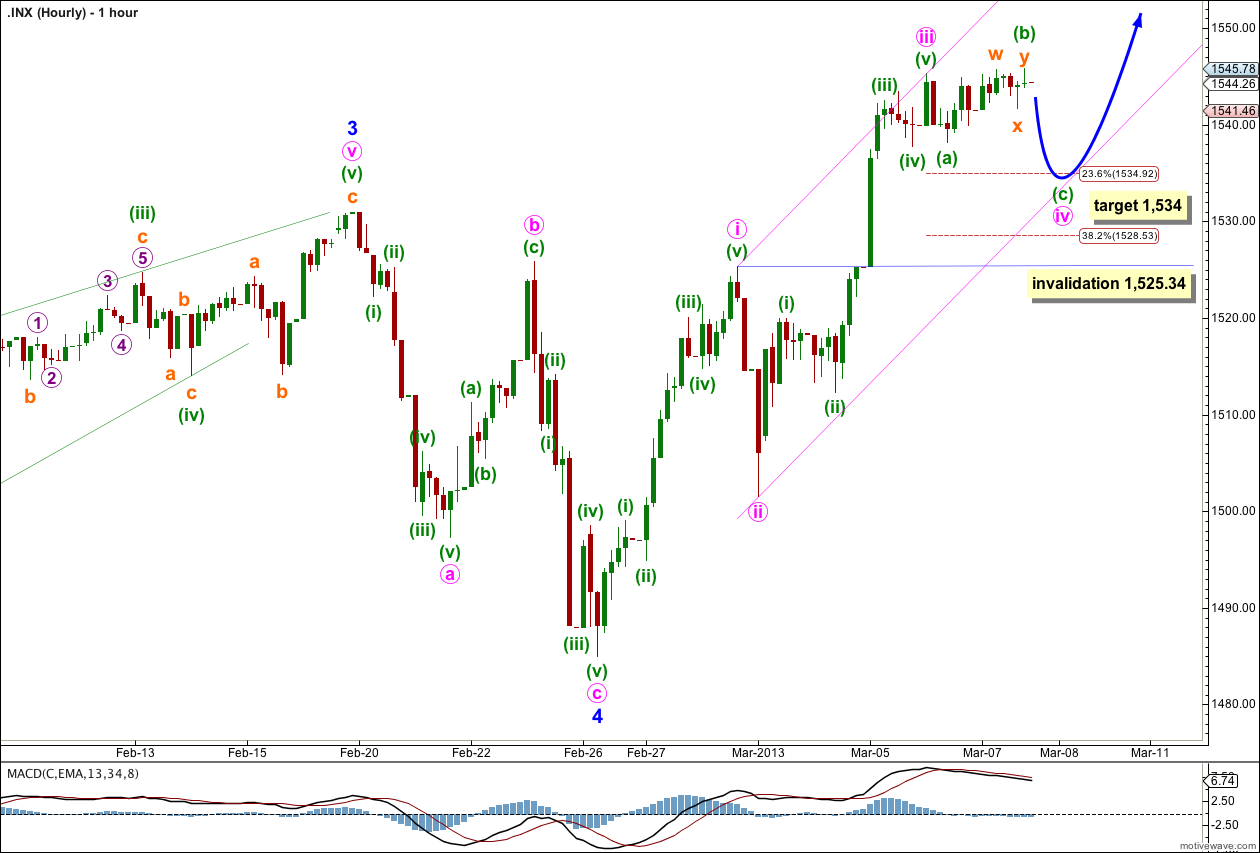

Minute wave iv is likely to be unfolding as a common expanded flat correction. Within it minuette wave (b) is a 107% correction of minuette wave (a); the minimum for an expanded flat of 105% has been met and passed.

At 1,534 minuette wave (c) would reach 1.618 the length of minuette wave (a). This is the most common length between A and C waves within an expanded flat.

The target of 1,534 would bring price to just below the 0.236 Fibonacci ratio of minuette wave (iii) at 1,534.92 and would see minute wave iv exhibit perfect alternation with minute wave ii.

Downwards movement is likely to find support about the lower edge of this channel drawn using Elliott’s technique. Draw this channel first with a trend line from the highs of minute waves i to iii and place a parallel copy upon the low of minute wave ii.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 1,525.34.

If this wave count is invalidated with downwards movement then I would expect it could be a deep second wave correction. The invalidation point would move down to 1,485.01.

I know it is a Bow-Tie or Diametric // Futures /ES can push into 1630+

Looks like Wave (e) of (iv) ended last night?

It’s not a triangle.

It does not fit the rules for either contracting or expanding triangles. Not at all.

It may be minuette wave (b) extending higher, or it may be minuette wave (v) of minute wave iii ending with minute wave iv not even yet begun.