Last analysis of AAPL expected some upwards movement. Price did move slightly higher but has fallen well short of the target which was at 467.

The wave count is the same and both daily charts expect the same direction in movement for a few weeks yet.

Click on the charts below to enlarge.

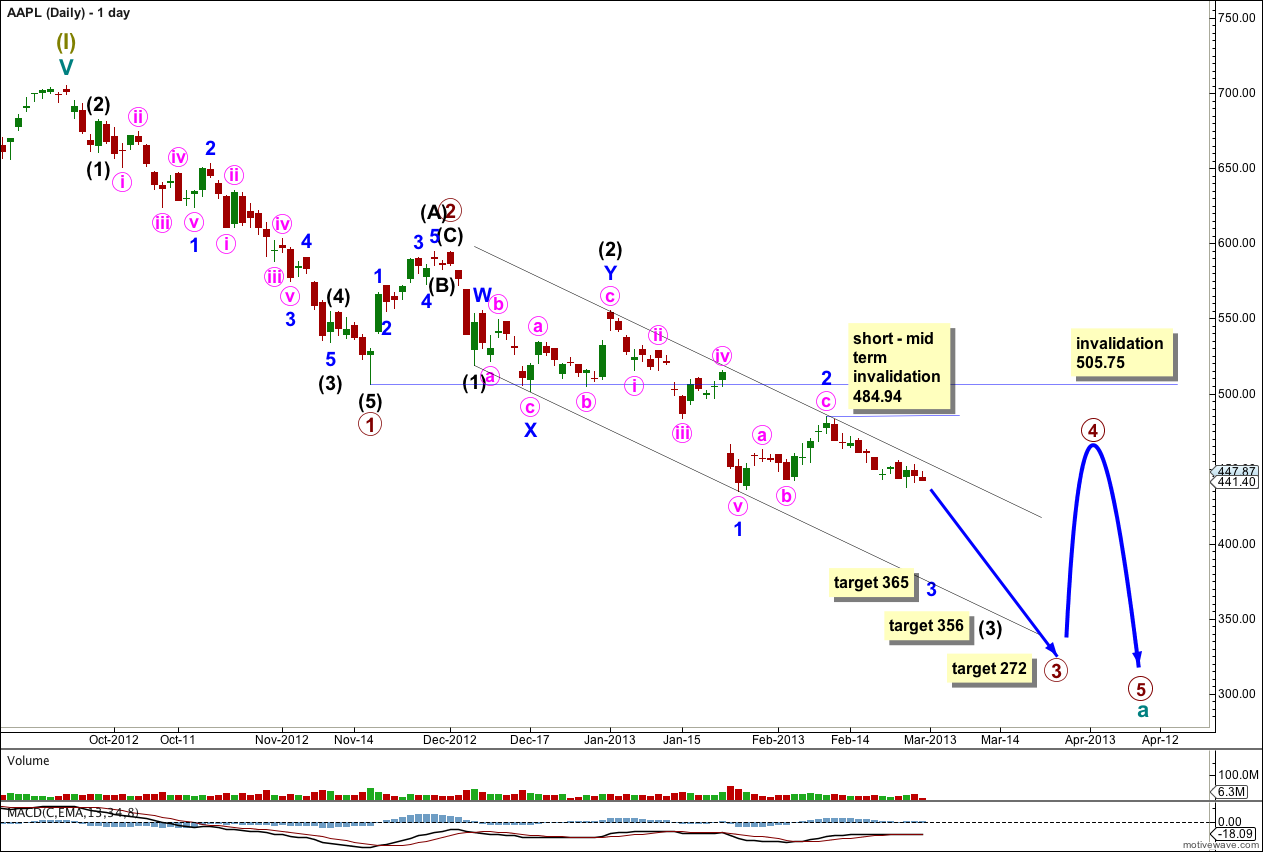

Main Wave Count.

This main wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse price is within a third wave at primary degree. The strongest part of downwards movement is yet to unfold.

At 365 minor wave 3 would reach equality with minor wave 1. While minor wave 3 is in progress no second wave correction may move beyond the start of its first wave. In the short term this daily wave count is invalidated at minor degree with movement above 484.94.

At 356 intermediate wave (3) would reach 2.618 the length of intermediate wave (1).

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. Thereafter, primary wave 4 should last a couple of weeks to a month or so and may not move back into primary wave 1 price territory. This wave count is invalidated at that stage with movement above 505.75. This is the price point which differentiates this main wave count from the alternate daily chart below.

It looks most like minute wave ii is complete as a shallow zigzag. Within it minuette waves (a) and (c) have no Fibonacci ratio to each other.

If minute wave iii has begun then this wave count expects an increase in downwards momentum over the next couple of weeks. If we do not see an increase in downwards momentum then I will consider the alternate wave count below slightly more likely.

At 375 minute wave iii would reach 1.618 the length of minute wave i.

If minute wave ii is incomplete and it moves further sideways and higher then it may not move beyond the start of minute wave i. This wave count is invalidated with movement above 484.94.

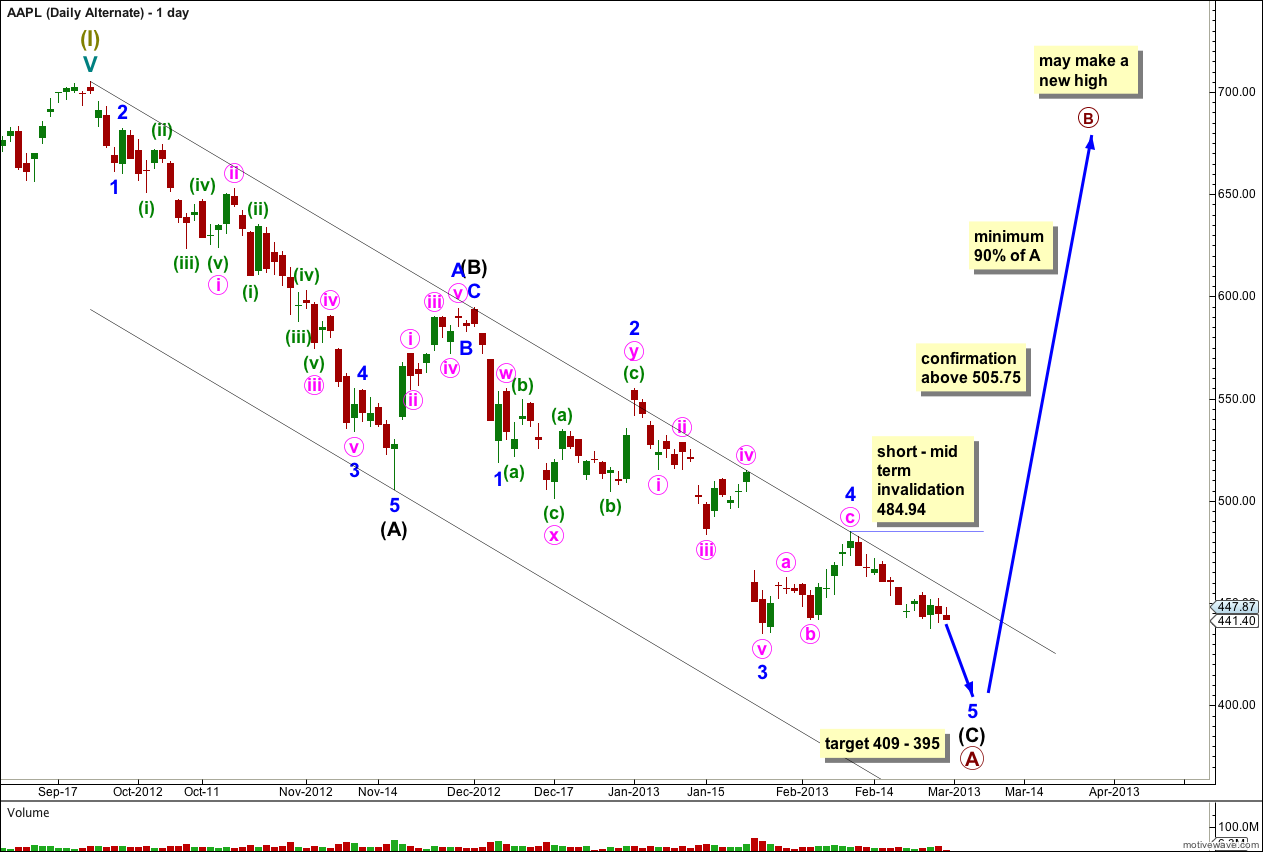

Alternate Wave Count.

If momentum downwards fails to increase then this alternate would be a good explanation.

If cycle wave a is unfolding as a flat then primary wave A within it may be a zigzag.

At 409 minor wave 5 would reach equality in length with minor wave 1.

At 395 intermediate wave (C) would reach equality in length with intermediate wave (A).

When primary wave A is complete then primary wave B must reach at least 90% the length of primary wave A, and may make a new high. At that stage if price moves above 505.75 the main wave count above would be invalidated and this alternate would be confirmed. If that happens then we will know that price must continue to rise to the point where primary wave B equals 90% of primary wave A, at minimum.