Last analysis expected to see some upwards movement for Friday’s session which was expected to last for some or all of the session. Upwards movement lasted for the whole session and has remained below the invalidation point.

The wave count is the same and so far is describing recent movement nicely. Both the main and alternate wave counts expect the same movement next; they do not yet diverge and may not diverge for another couple of sessions.

Click on the charts below to enlarge.

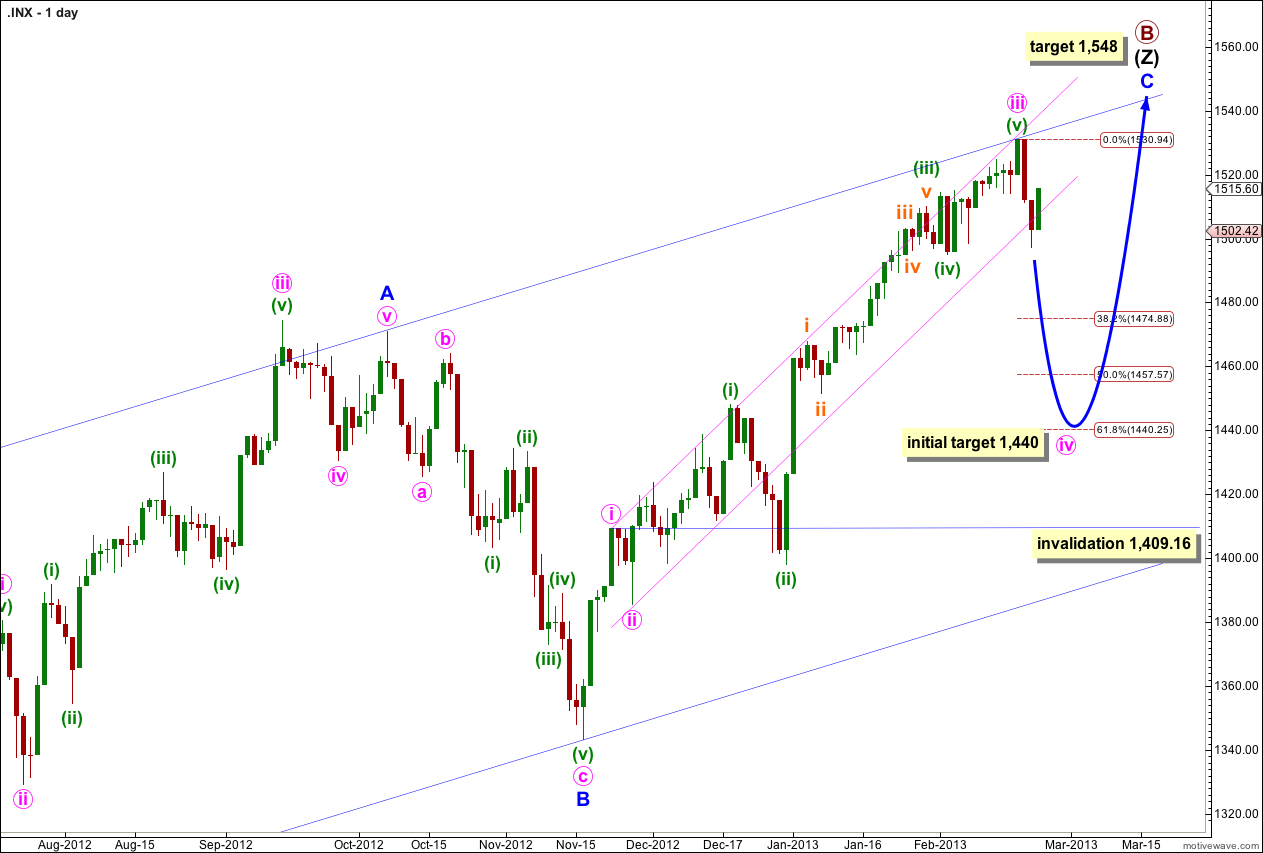

Main Wave Count.

Wave iv pink should exhibit choppy overlapping downwards movement for about a week.

Because wave ii pink was a shallow 36% correction of wave i pink then wave iv pink may end about 1,440 at 0.618 the length of wave iii pink, given the guideline of alternation. Now that price has breached the narrow channel containing wave C blue it looks like we may see alternation in depth as well as structure.

Wave ii pink was a zigzag so we may expect wave iv pink to be a flat, double or triangle. A flat is most likely.

The most common type of flat is an expanded flat which has a B wave that makes a new price extreme beyond the end of the A wave. A new high above 1,530.94 is possible if wave iv pink unfolds as a flat.

If wave iii pink was over on Friday it lasted a Fibonacci 55 days. Within it wave (i) green lasted 14 days, one more than a Fibonacci 13, wave (ii) green lasted a Fibonacci 8 days, wave (iii) green lasted 20 days, one less than a Fibonacci 21, wave (iv) green lasted a Fibonacci 3 days, and wave (v) green may have had no Fibonacci duration.

This main wave count expects wave iv pink to last about a week or so. Thereafter, wave (v) pink may move price to a new high (although it does not have to) and may end again on the upper edge of the wider parallel channel containing the zigzag of wave (Z) black.

At 1,548 wave C blue would reach equality in length with wave A blue. When wave iv pink is complete I will recalculate this target at pink degree.

Wave iv pink may not move into wave i pink price territory. This wave count is invalidated with movement below 1,409.16.

If this main wave count is invalidated then the alternate below will be strongly confirmed.

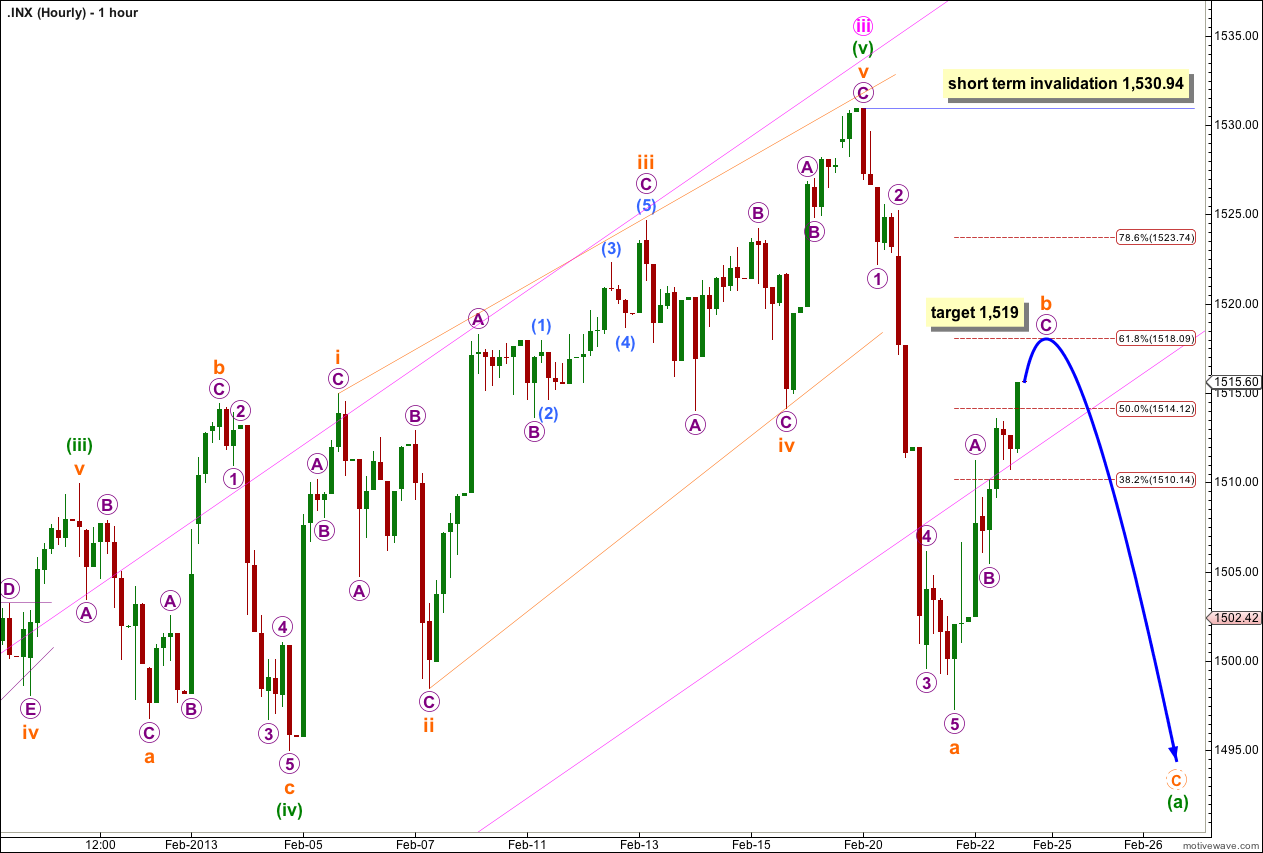

The zigzag for wave b orange is incomplete and did not end during Friday’s session. Within it wave A purple moved higher. At 1,519 wave B purple would reach equality in length with wave A purple and wave b orange would reach to about the 0.618 Fibonacci ratio of wave a orange.

When wave b orange zigzag is complete then we may expect more downwards movement for wave c orange which is extremely likely to make a new low below the end of wave a orange at 1,497.29 (although it does not have to). When wave b orange is complete then I will calculate a target downwards for wave c orange for you.

Wave b orange may not move beyond the start of wave a orange. this wave count is invalidated with movement above 1,530.94 (at this stage).

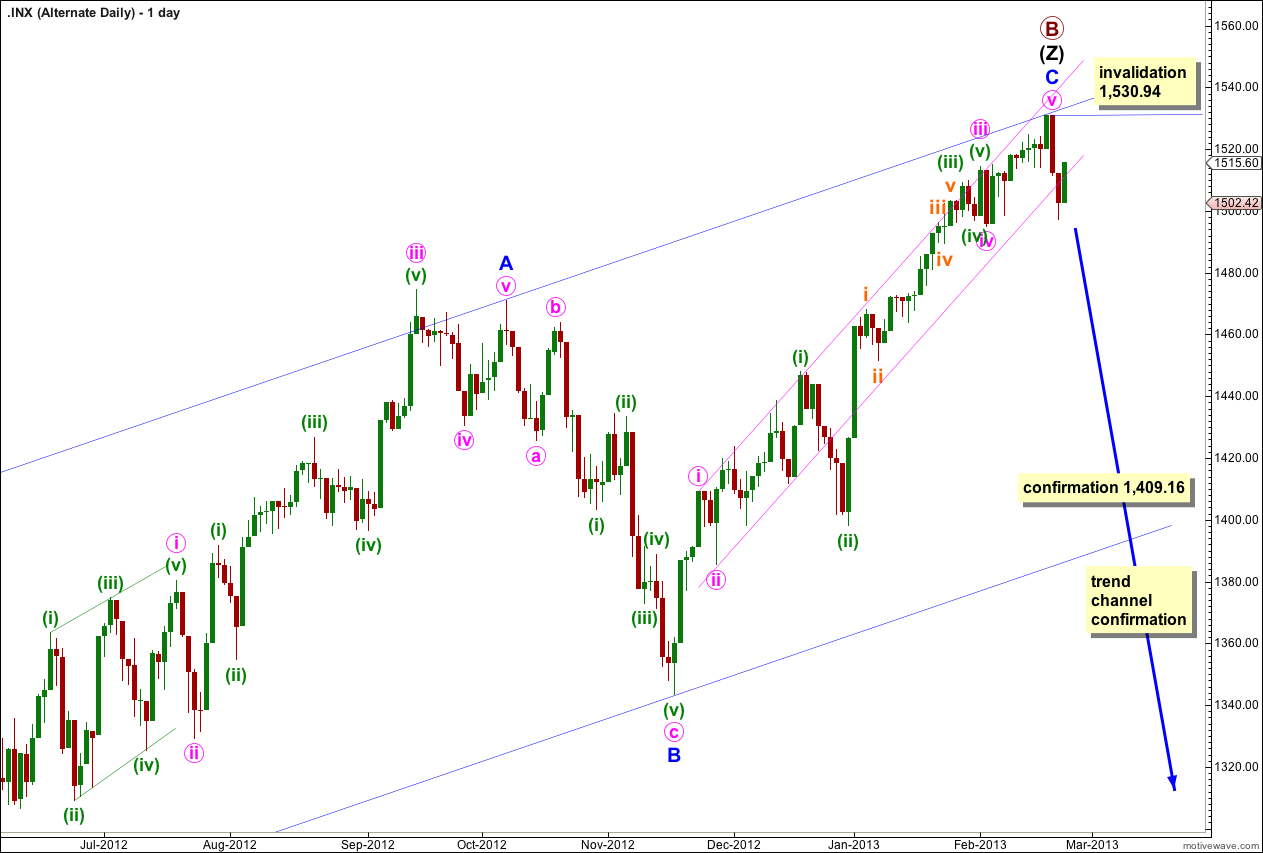

Alternate Wave Count.

It is possible that we have seen a big trend change at primary wave degree. The bearish engulfing candlestick reversal pattern indicates a trend change and price may have bounced off the upper edge of the wider parallel channel.

If primary wave B triple zigzag is complete then it is a 160% correction of primary wave A. This is longer than the common length, so it is a bit unusual, but it is not unrealistic. I have seen B waves within flats that are this long.

We should always assume the trend remains the same, until proven otherwise. We should assume that the main wave count is correct, the trend remains upwards, until price moves below 1,409.16 to invalidate the main wave count. At that stage this alternate would be my only wave count and I will calculate downwards targets for you.

Further downwards movement below the parallel channel about the zigzag for wave (Z) black would provide confidence in this wave count.

Because primary wave B is a triple zigzag, and the maximum number of structures in a multiple is three, once the third zigzag is confirmed as complete then the entire correction must be complete. At cycle degree I cannot see another explanation for primary wave B which would allow for further upwards movement.

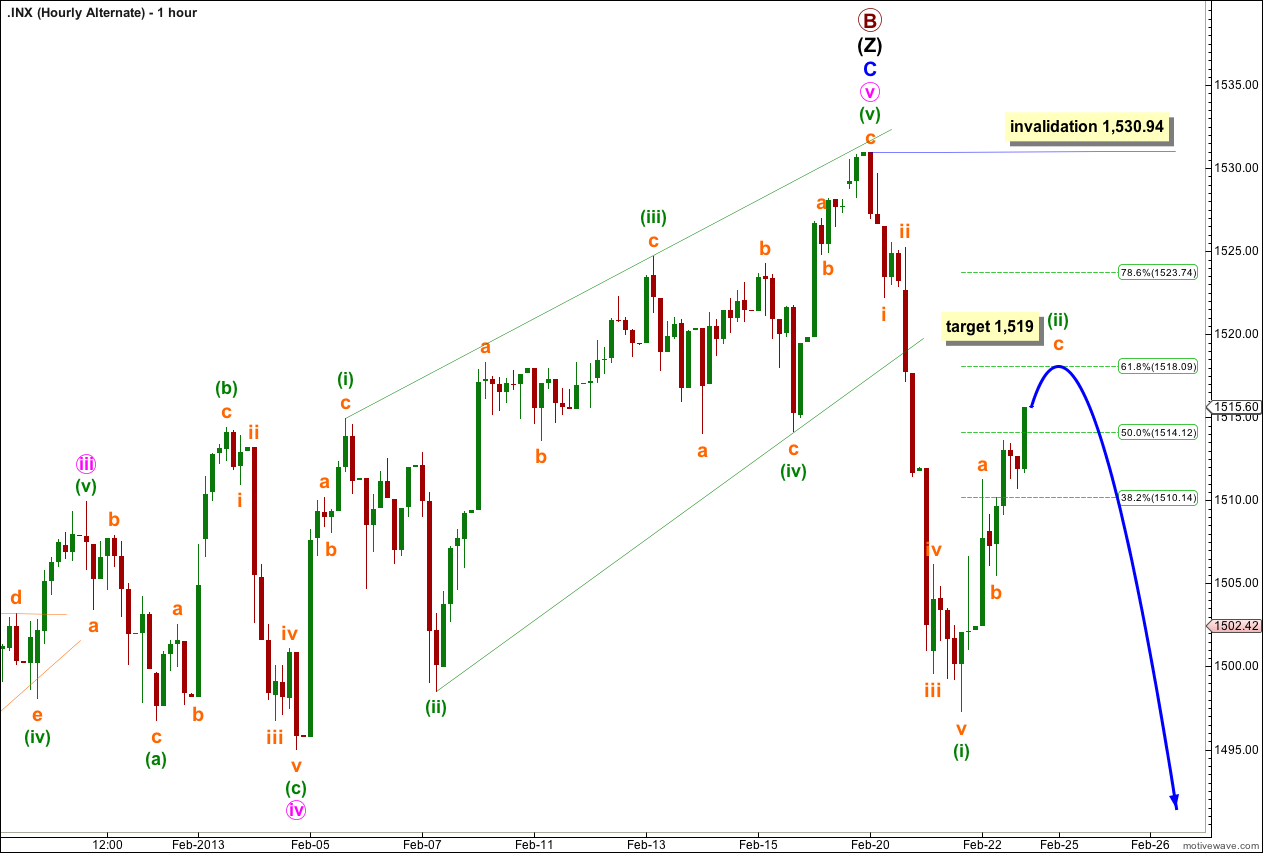

Within a new downwards trend we may have seen the end of a first wave for (i) green. Wave (ii) green is incomplete.

The target is the same. At 1,519 wave c orange would reach equality in length with wave a orange and wave (ii) green would reach the 0.618 Fibonacci ratio of wave (i) green.

Wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement above 1,530.94.

When the zigzag for wave (ii) green is complete wave (iii) green must make a new low below the end of wave (i) green at 1,497.29. Wave (iii) green must exhibit an increase in momentum beyond that seen for wave (i) green.

If momentum increases and the next wave down is longer than 34 points then this alternate wave count will increase in probability.

Nice call … it worked for me!