Last analysis expected upwards movement for Monday’s session which is exactly what happened.

I will be looking closely at the structure of this upwards movement to determine what should happen next.

I have still just the one wave count, with daily and hourly charts for you today.

Click on the charts below to enlarge.

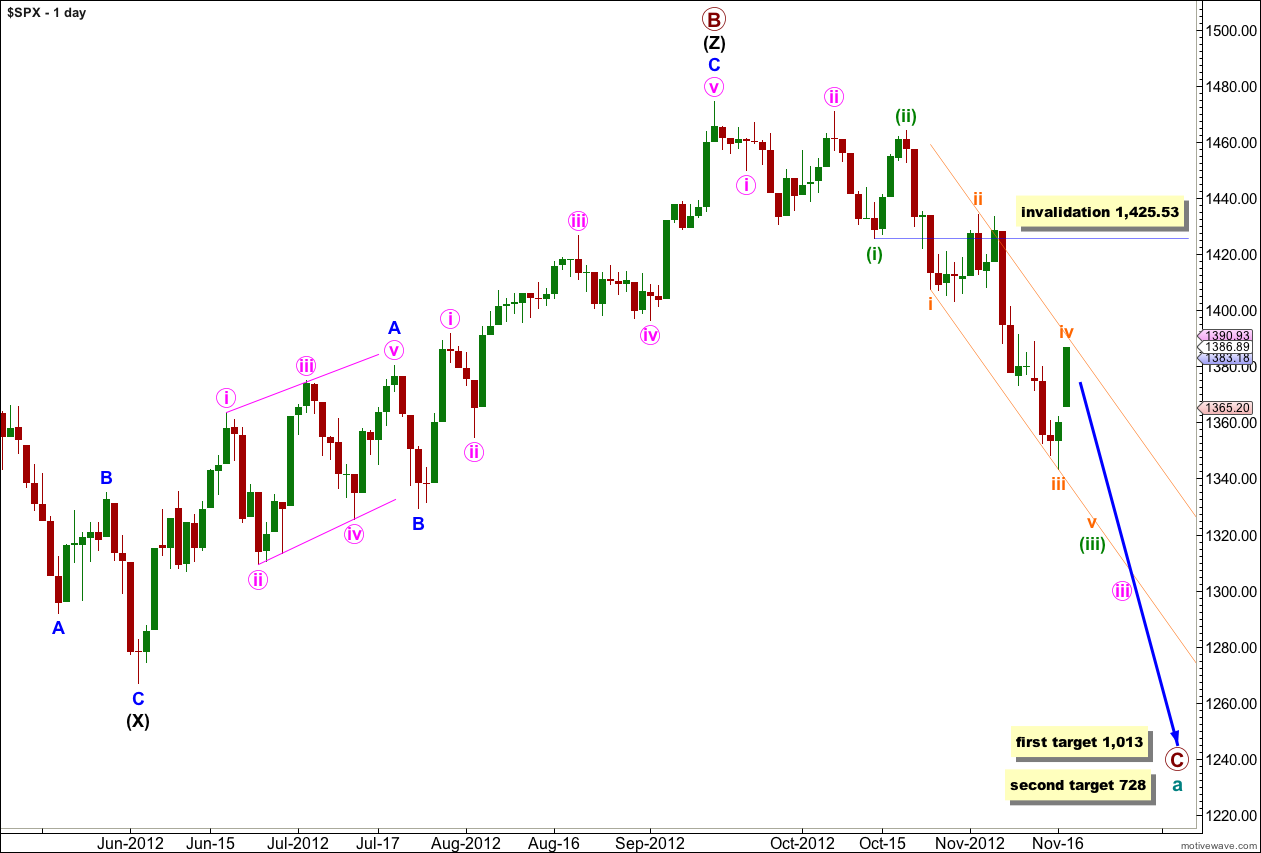

It looks highly likely that we have recently seen a major trend change in the S&P 500 and the DJIA. For both markets this trend change is confirmed. Targets are long term and they are months away.

Within the new downwards trend the upcoming wave (iv) green may not move into wave (i) green price territory. This wave count is invalidated at this stage with movement above 1,425.53.

Downwards movement looks most likely to be a series of overlapping first and second waves, with the middle of the third wave complete. We shall expect overall downwards movement with fourth wave corrections to come.

Cycle wave a is an expanded flat correction: primary wave A was a three wave structure, and primary wave B was a triple zigzag and 140% the length of primary wave A.

At 1,013 primary wave C would reach 1.618 the length of primary wave A. If price continues downwards through this first target then the next target is at 728 where primary wave C would reach 2.618 the length of primary wave A.

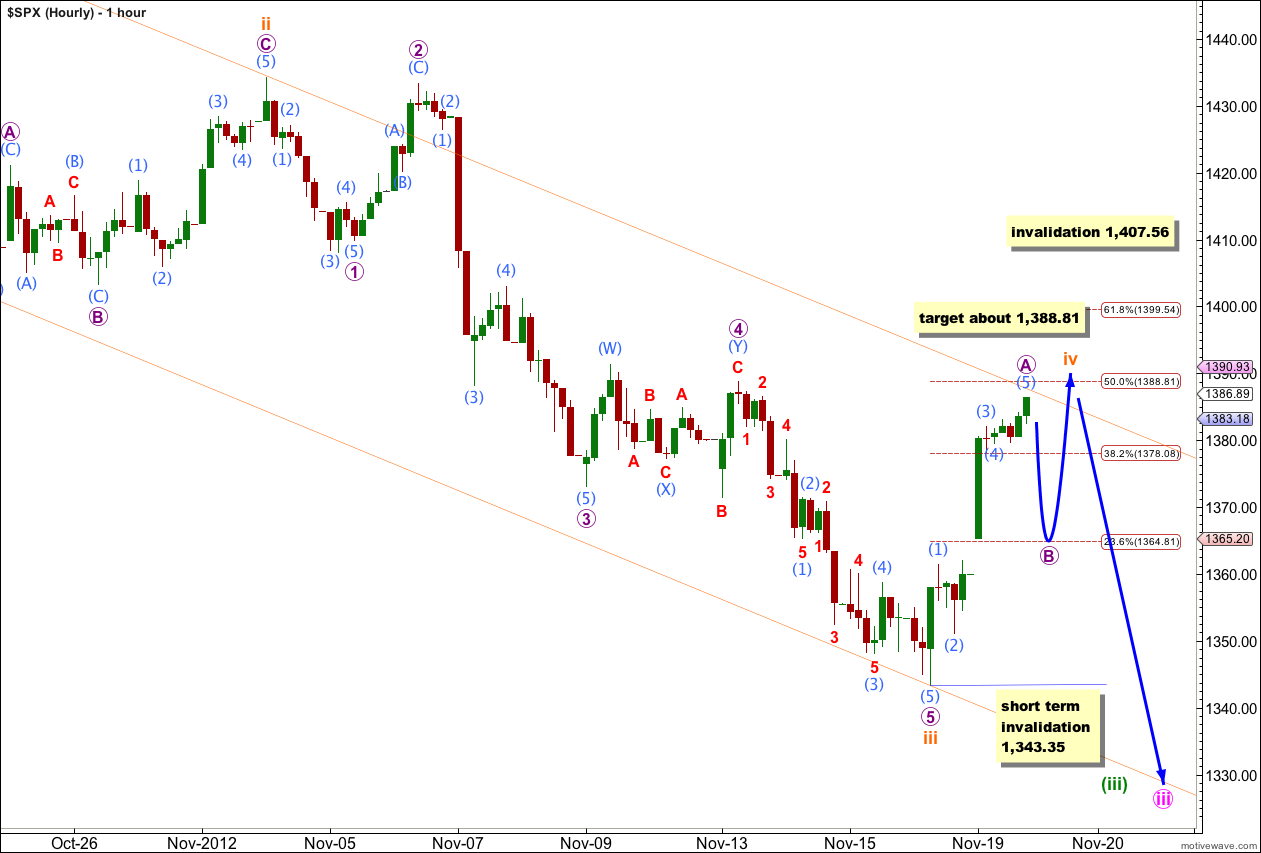

Wave iv orange has begun as expected during Monday’s session.

Wave iv orange should continue for most of or all of this week.

Wave iv orange is most likely to subdivide into a 5-3-5 zigzag structure. So far upwards movement looks very much like a five wave impulse and therefore the correction cannot be over here. It must have further to go.

Ratios within wave A purple are: wave (3) aqua is 1.76 points longer than 1.618 the length of wave (1) aqua and so far wave (5) aqua is just 0.08 points short of 0.382 the length of wave (1) aqua. However, we may not necessarily see a Fibonacci ratio between wave (5) aqua and either of (1) or (3) aqua. There is not any downwards movement at the end of wave (5) aqua and so it cannot be confirmed as complete at the end of Monday’s session. It may move higher at the start of tomorrow’s session.

When wave A purple is complete (and it may or may not move higher) we should expect choppy downwards movement for wave B purple. Wave B purple may begin tomorrow.

When wave B is complete we should expect another five up for wave C purple, which may be an ending diagonal to achieve alternation with wave A purple.

Wave B purple may not move beyond the start of wave A purple. This wave count is invalidated in the short term with movement below 1,343.35.

Wave iv orange may not move into wave i orange price territory. This wave count is invalidated with movement above 1,407.56.

Overall I will be expecting choppy, overlapping movement for the next few sessions. Wave B may take one or more sessions to unfold, depending upon its structure.

Sorry, I said ‘yellow’ for the wave count. But I meant ‘orange’. Blame my color blindness!

Rodney

For this current wave iv (yellow), why are you expecting a 50% retracement over a 61.8% retracement?

Keep up the great work. I find your analysis very helpful.

Thanks,

Rodney Mruk

At this stage I’m expecting it to be over 50%.

When we have the end of B purple then I’ll recalculate the target using the ratio between A and C purple.