At this stage I have three monthly wave counts.

The first two have about an even probability at the time of writing.

The first is mid term bullish. The second is short term bullish and mid term bearish.

The alternate monthly wave count is extremely bullish.

If price moves below the invalidation point for the first monthly wave count the second will be confirmed. If price does not break below this point then we should assume that the trend remains the same.

This analysis will be updated if any of these three monthly wave counts is invalidated, or if the probability of any one of them changes significantly.

Click on the charts below to enlarge.

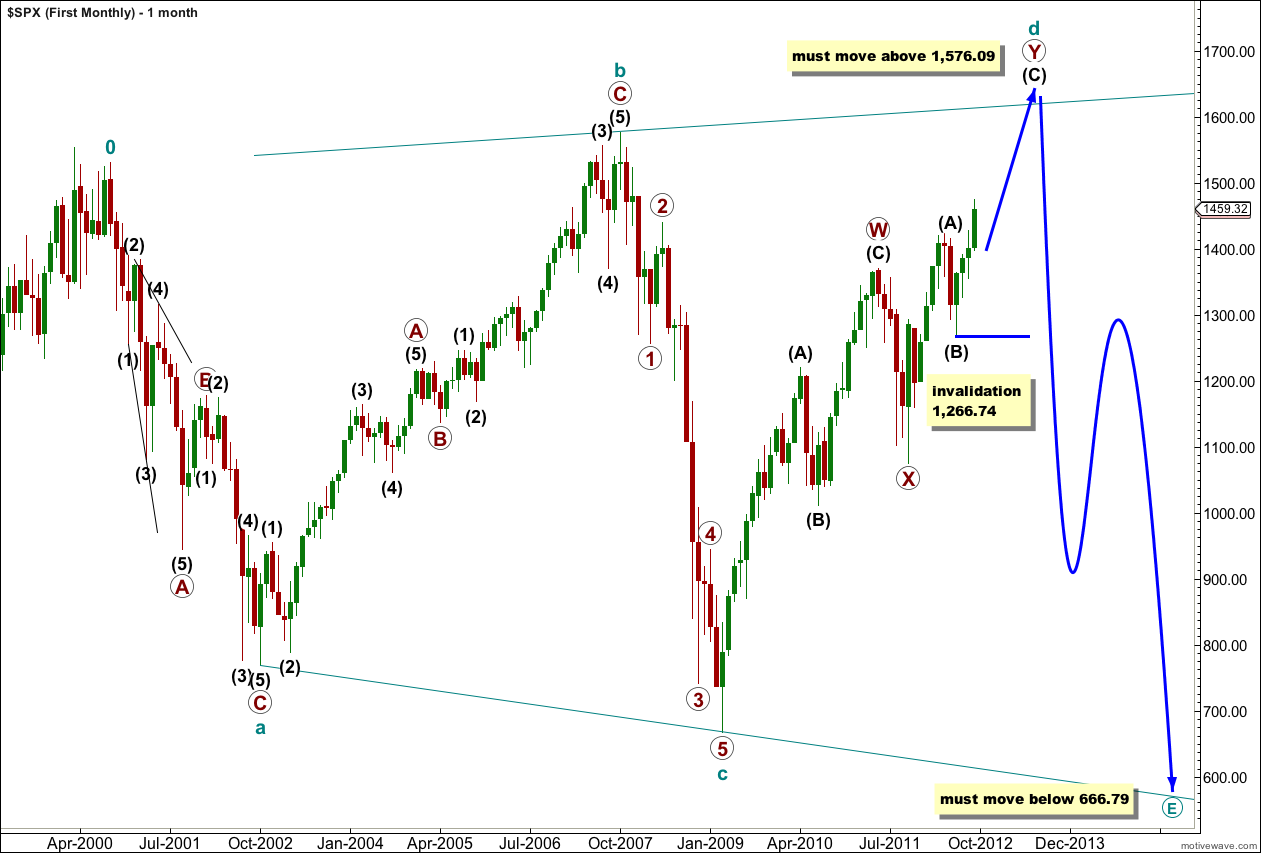

First Wave Count.

This wave count was an alternate monthly wave count that I have had for some time and have been referring to recently.

At super cycle degree this wave count sees an expanding triangle unfolding. Within the triangle cycle wave d is unfolding as a longer lasting and more complicated double zigzag structure.

Within this double zigzag the second zigzag labeled primary wave Y is incomplete.

Within primary wave Y wave (C) black is incomplete.

The triangle is expanding because cycle wave c ended below the low of cycle wave a. Within an expanding triangle wave d must move beyond the end of wave b, so cycle wave d must make a new all time high above 1,576.09.

When cycle wave d is complete (probably in a few more months) then cycle wave e should crash to new lows. Cycle wave e must move price below the end of cycle wave c at 666.79.

To the downside within wave (C) black no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,266.74 in the mid term.

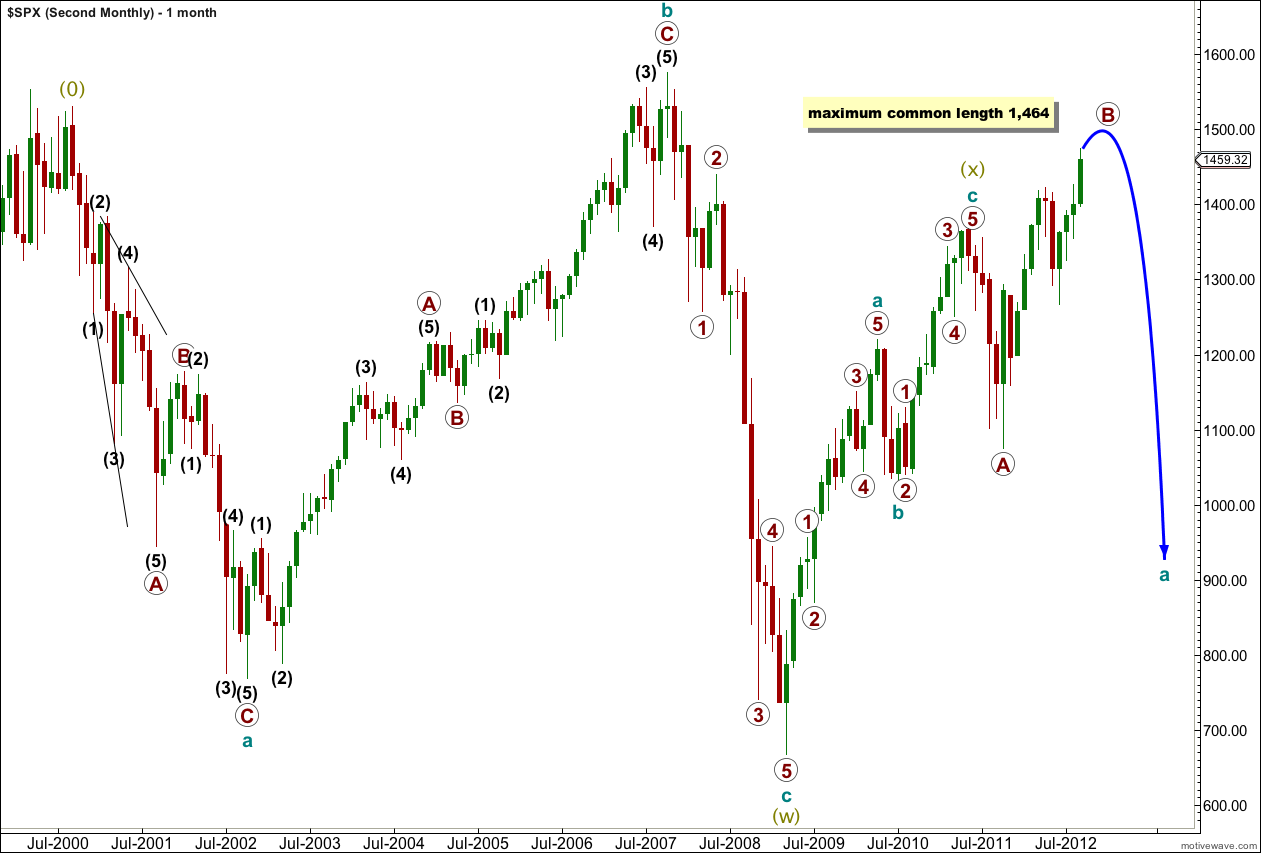

Second Wave Count.

This is the wave count that I have had as a main wave count for a long time now.

At grand supercycle degree a double flat is unfolding. This is a fairly common structure.

Within the double flat the first structure labeled wave (w) olive green is complete. The three in the opposite direction is a zigzag labeled wave (x) olive green. The second flat in the double labeled wave (y) olive green is underway.

Within super cycle wave (y) olive green cycle wave a is unfolding as a three wave structure, itself a flat correction.

Within cycle wave a primary wave A down was a three and now primary wave B upwards is also a three. Primary wave B has just recently passed the maximum common length of a B wave in relation to an A wave for a flat at 1,464. This reduces the probability of this wave count, but does not invalidate it. There is no maximum allowable length of B in relation to A for a flat correction.

Within primary wave B the structure is unfolding as a triple zigzag. The rarity of this structure reduces the probability of this wave count.

The rarity of a triple zigzag along with price movement above 1,464 reduces the probability of this wave count to about even with the first monthly wave count.

Alternate Monthly Wave Count.

Finally, it is just possible that the S&P 500 is in a new five wave structure upwards which will continue to new highs and has no upper limit.

This wave count I consider to have a very low probability because the upwards movement labeled here primary wave 1 from the low of 666 in March 2009 to the high of 1,370.58 in May 2011 (which was not the end of the structure but is the price high) looks very much like a three wave structure on monthly, weekly and daily charts.

Trying to see this as a five and not a three seems to be too elastic with rules of Elliott wave and does not take into account the “right look”. I will only consider this possibility because I want to consider all options, and because very occasionally a movement looks like a three or five only to later show that it was the other. However, I can accept this happening sometimes on hourly charts, but on daily weekly and monthly charts it is a big stretch.

This is a long wave with many subdivisions. Unfortunately, it cannot be absolutely determined as either a three or a five and it is open to some debate.

If this wave count is correct then the end of the “credit crunch” was probably a fourth wave at super cycle degree, and it was an expanded flat correction. The subdivisions here fit perfectly and this structure does look very much like a flat, with a nice strong C wave to end it.

Thereafter, we may be in the early stages of a new bull market to last another decade or so.

Within that new bull market primary waves 1 and 2 would be over. Primary wave 3 may have begun with a leading diagonal for its first wave, intermediate wave (1) which is incomplete. At 1,530 wave 5 blue would reach equality with wave 3 blue. Because the diagonal is expanding wave 5 should end at or above this target. Thereafter we should expect a very deep second wave correction for black wave (2).

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement below 1,074.77. This price point differentiates this outlying alternate with our second wave count which expects movement below this point.

Hi Lara,

With reference to your second monthly wave count where you have a double flat unfolding at Grand Supercycle degree you have the March 2009 low labelled (W) at supercycle degree. You then have another supercycle degree zigzag wave up to early May 2011 labelled (X) that takes just 2.25 years. So my query is whether this 2.25 years is suitable duration for a supercycle degree wave? I was thinking cycle degree may be more suitable but you obviously have your reasons.

I like the wave count but interested in the reasons behind this supercycle degree wave in the 2.25 year duration.

Thanks (:-)