Price again moved mostly sideways during Friday’s session, slightly breaching the very short term invalidation point at 1,396.13 but remaining above the main wave count invalidation point.

I still have two wave counts to end the week. At this stage the wave counts diverge. Confirmation / invalidation points are close by. When price breaks out of the narrow range it has traded in over the last three days we should have some clarity.

Click on the charts below to enlarge.

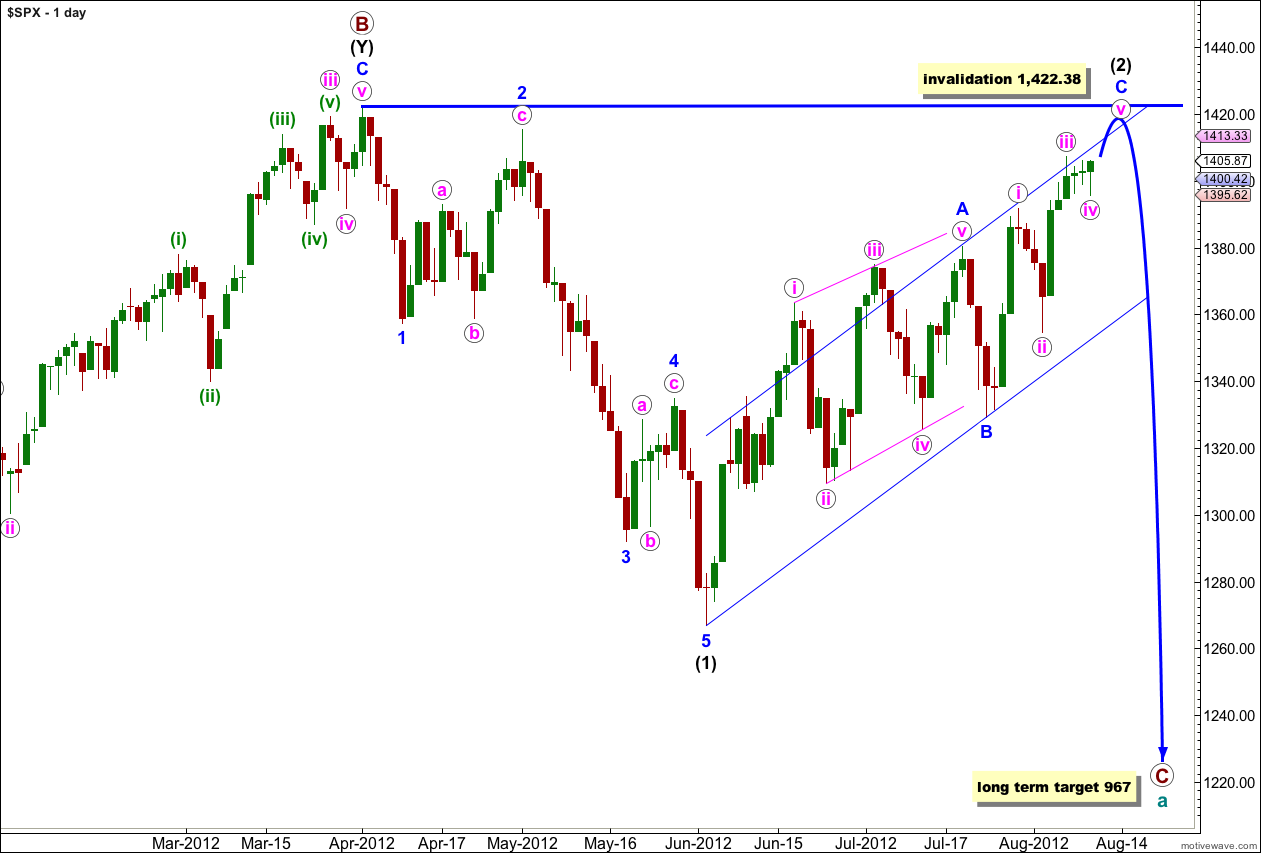

Main Wave Count.

If wave (2) black is a single zigzag then wave A blue was a leading diagonal and it would be likely that wave C blue would be an impulse to see alternation between the two.

We may use Elliott’s channeling technique to draw a parallel channel about wave (2) black. When this channel is breached by downwards movement we should have confirmation of a trend change. Prior to confirmation of a trend change we should expect more upwards movement.

When wave C blue is confirmed as complete then the only way that wave (2) black could continue further would be as a very rare triple zigzag. The rarity of triples means the probability of wave (2) black continuing further is extremely low. Also, for the S&P 500 to continue further within this correction it would diverge significantly with the Dow. For the Dow the only corrective structure which fits the upwards movement and meets all rules is a triple zigzag, so when this last movement is over the correction cannot continue further.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,422.38.

Sideways movement over the last three sessions looks like a fourth wave correction and so may be wave iv pink.

On the 5 minute chart movement within iv pink looks most like an incomplete flat correction. I have considered various possibilities for this movement and this has by far the best fit.

Wave (a) green is a three wave zigzag, wave (b) green is an incomplete flat correction with wave a orange a double zigzag, wave b orange a double zigzag, and wave c orange upwards an incomplete impulse.

At 1,412 wave c orange would reach 1.618 the length of wave a orange.

Thereafter, wave (c) green downwards should subdivide into a five wave structure and complete wave iv pink.

Wave iv pink may not move into wave i pink price territory. This wave count is invalidated with movement below 1,391.74.

When wave iv pink is complete a final upwards wave v pink would complete this structure at all wave degrees up to intermediate (black).

This main wave count expects overall sideways movement for another one to three sessions, followed by a new high for a final upwards thrust which may take two to three sessions.

Movement to a new high above 1,407.14 would add a little confidence to this wave count.

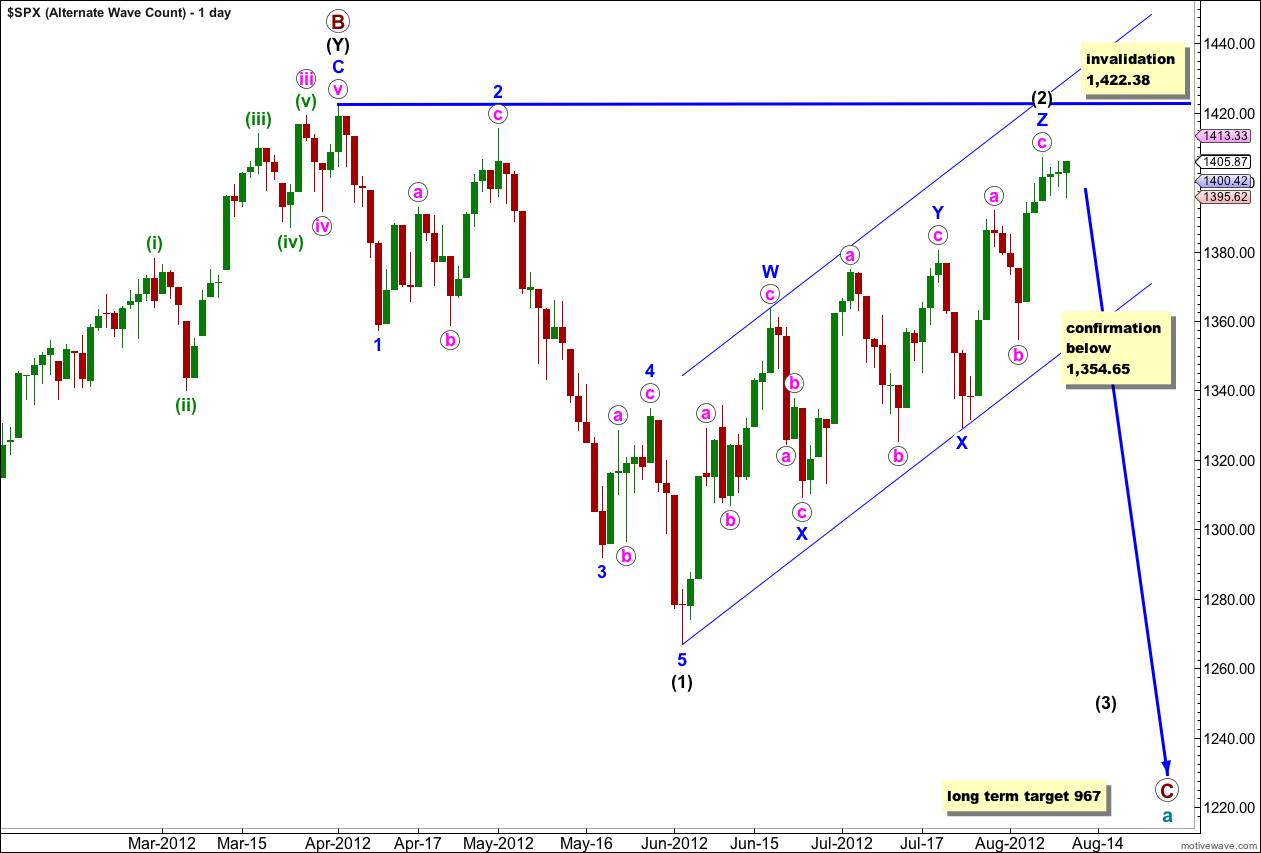

Alternate Wave Count.

It is also possible that wave (2) black is a very rare triple zigzag. Although the rarity of this structure reduces the probability of this wave count, it is valid and all subdivisions do fit.

If this is correct then the final wave c pink of wave Z blue may be almost complete. Downwards movement below the start of wave c pink at 1,354.65 would confirm a trend change.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,422.38.

Because within an ending diagonal all subwaves must be zigzags this structure does not fit recent movement. The sideways movement over the last three days is not a zigzag, but either a flat, double or triple combination. For that reason the only explanation I can see for this alternate wave count at the hourly chart level is that wave (2) black is over.

Recent movement for wave ii orange subdivides into an almost complete flat correction. Within wave C purple only the very final fifth wave needs to complete.

Thereafter, downwards movement should increase in momentum.

Movement below 1,391.74 would add a little confidence to this wave count.

Wave ii orange may not move beyond the start of wave i orange. This wave count is invalidated with movement above 1,407.14.

Test level #7 http://www.stocktiming.com/Monday-DailyMarketUpdate.htm over this line and new 52 week highs easy.

It looks to me that the wave count will become more realistic once we see that the 52 week highs are not going to hold.

The start of the bear market started in 2008 at 1440.24 high level consolidation can only mean one thing .. we are going over 1440.24.

Weekly:

On Balance Volume .. Breakout over (1422.38)

SPXA50R .. Breakout over (1422.28)

Upper BB line 1430.22

See Chart.. http://scharts.co/ObzRbn

What do you think??