Movement above 1,363.46 has given us some clarity with invalidation of the main wave count and confirmation of the alternate.

Today, I have only one daily wave count and two hourly wave counts. We can use confirmation / invalidation points to work with these two wave counts tomorrow.

Click on the charts below to enlarge.

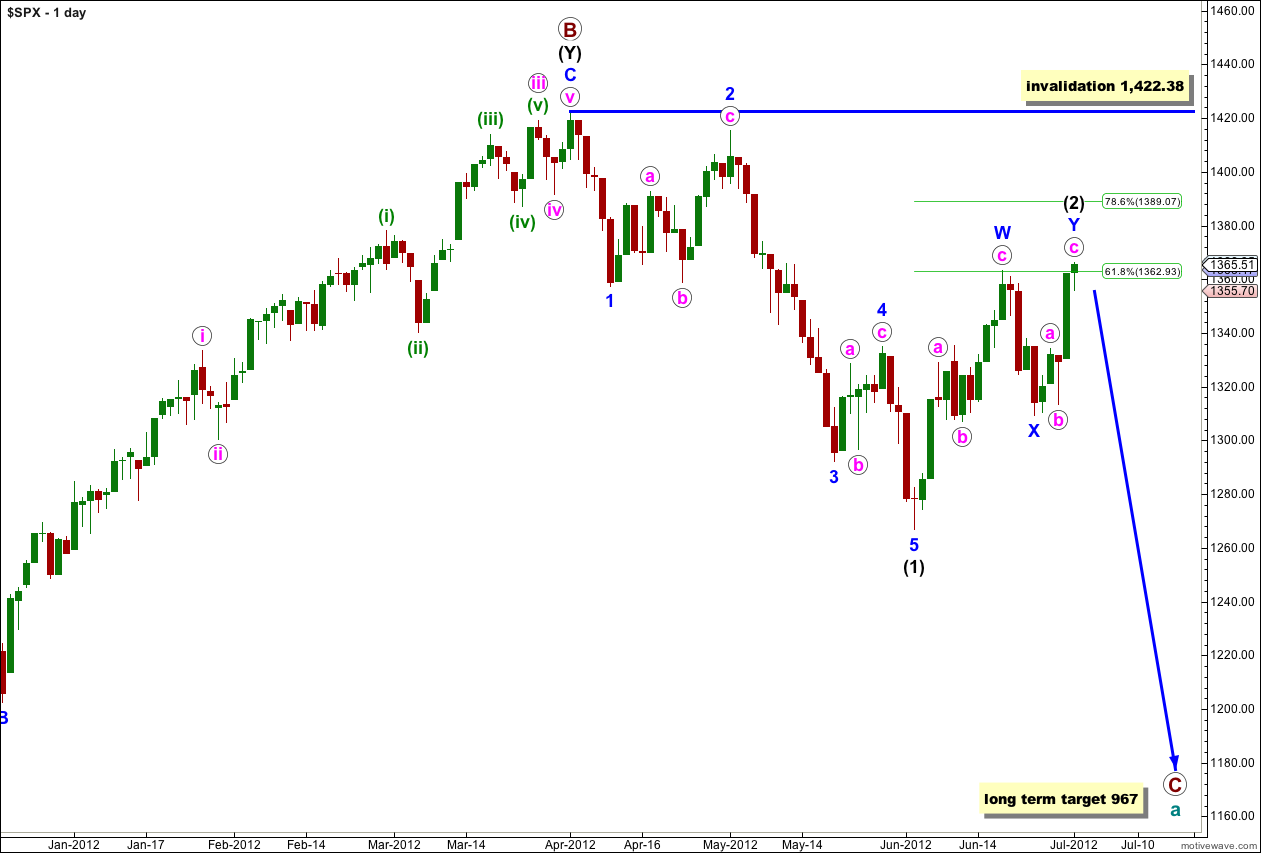

This wave count sees a big trend change at the price high of 1,422.38. Primary wave C should make substantial new lows below the end of primary wave A which had its low at 1,074.77. Primary wave C would reach 1.618 the length of primary wave A at 967, completing a typical expanded flat for cycle wave a.

Within primary wave C wave (1) black is a complete five wave impulse downwards. Wave (2) black is unfolding as a double zigzag structure. The purpose of a double zigzag is to deepen a correction. For that reason we must seriously consider the possibility that wave (2) black is not over and may continue higher towards the 0.786 ratio or higher. I have an alternate hourly wave count looking at this possibility.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,422.38.

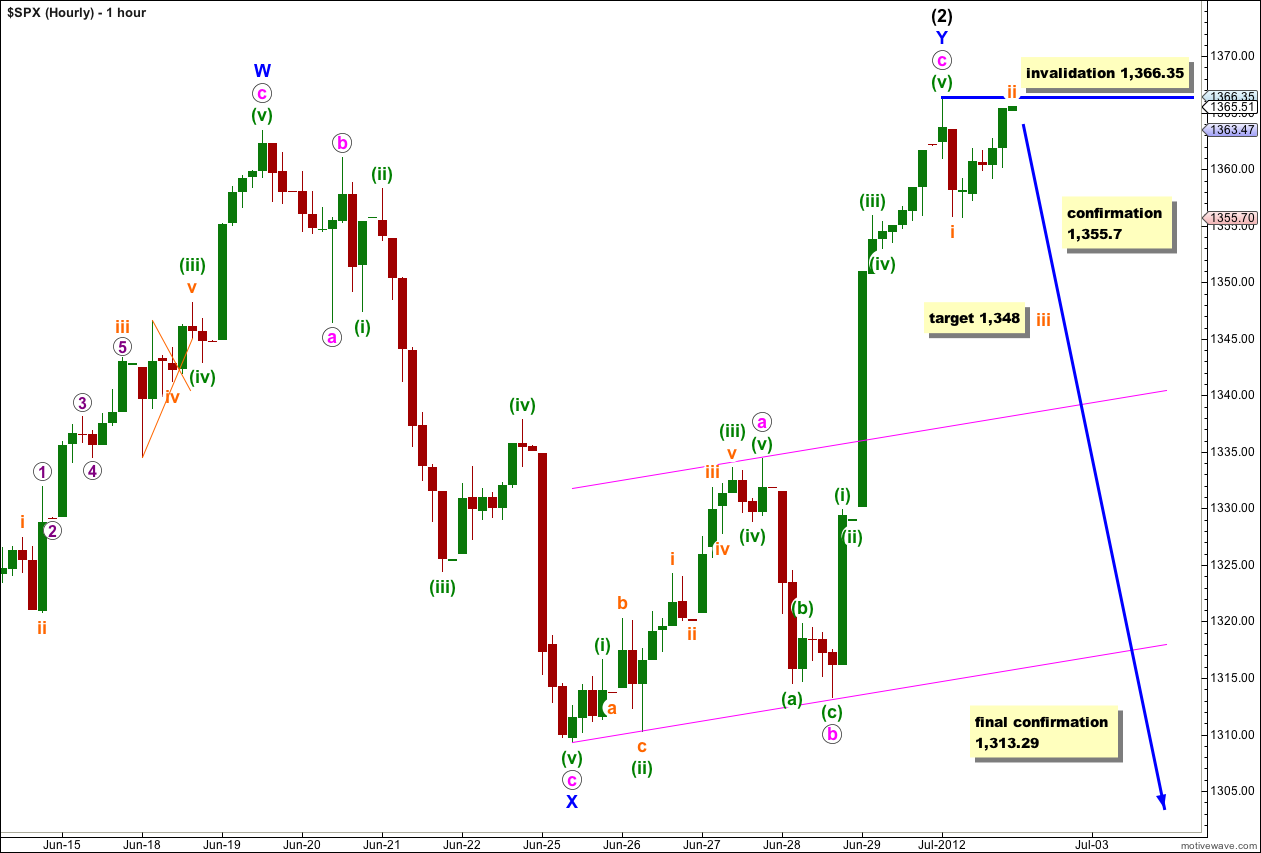

Main Hourly Wave Count.

At this stage it is possible to see wave (2) black as a complete double zigzag, but the second zigzag barely deepened the correction and has behaved more like a double combination.

Within the second structure wave Y blue wave c pink is a complete impulse. This looks complete on the hourly and 5 minute charts.

There is no Fibonacci ratio between waves a and c pink.

Ratios within wave c pink are: wave (iii) green is just 0.98 points longer than 1.618 the length of wave (i) green, and wave (v) green has no Fibonacci ratio to either of waves (i) or (iii) green.

If this wave count is correct then when markets open tomorrow we should see a low degree third wave downwards. At 1,348 wave iii orange would reach 1.618 the length of wave i orange.

Movement below 1,355.7 would provide some initial confirmation of this main wave count as at that stage the alternate below would be invalidated. Final confirmation that wave (2) black is over would come with movement below 1,313.29 and a breach of the parallel channel containing the zigzag of wave Y blue.

Wave ii orange may not move beyond the start of wave i orange. This wave count is invalidated with movement above 1,366.35.

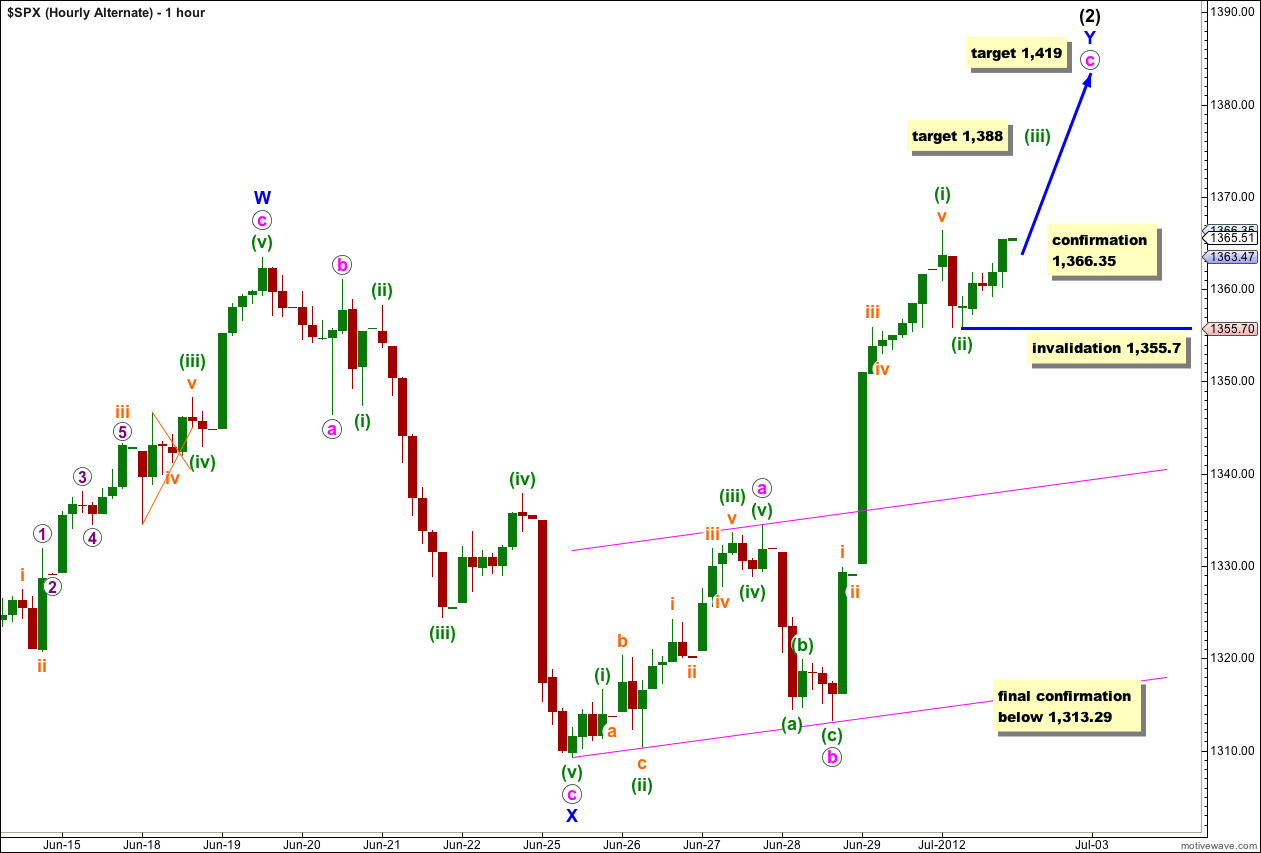

Alternate Hourly Wave Count.

By simply moving the degree of labeling with wave c pink all down one degree we may have seen only wave (i) green within wave c pink complete.

Downwards movement during Monday’s session may have been wave (ii) green (or may be only wave a orange within wave (ii) green, and this is why we have the final confirmation point). On the 5 minute chart this does not have nearly as good a fit as the main wave count, but it is possible.

Movement above 1,366.35 would confirm this alternate and invalidate the main hourly wave count. If this alternate is correct then confirmation should happen quickly during tomorrow’s session.

At 1,388 wave (iii) green would reach 0.618 the length of wave (i) green.

At 1,419 wave c pink would reach 4.236 the length of wave a pink. However, a better way to find a target for this upwards wave of c pink to end would be to use the green degree. This can be done once we have the ends of (iii) and (iv) green. This target of 1,419 would probably change for this reason.

Within wave (iii) green no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,355.7.

Wave (2) black may not move beyond the start of wave (1) black. This wave count is invalidated with movement above 1,422.38.

With NYMO hitting 101 + today we could put in one more X Wave ES HOD 1369.50

OK. Thanks.

actually, I do have a bullish wave count, it’s in the historic analysis. I’ve gone over it in today’s video. It has a very very low probability so I’m not going to take it seriously until it shows itself to be correct.

at this stage this alternate is the only bullish wave count that I can see.

Hi Lara,

Is it unreasonable to request for a bullish wave count as an alternate?

Do we have to wait until 1422 gets taken out?

If I can see a bullish wave count which fits I’ll publish it, but I will not publish a wave count which does not fit just to have a bullish count.