Yesterday’s analysis expected downwards movement for Wednesday’s session which was not what happened. Within the first 5 minutes the main hourly wave count was invalidated with movement above 1,324.41 and the second hourly wave count was confirmed.

I still have two wave counts which expect the same direction next. Invalidation points are the same but targets are different.

Click on the charts below to enlarge.

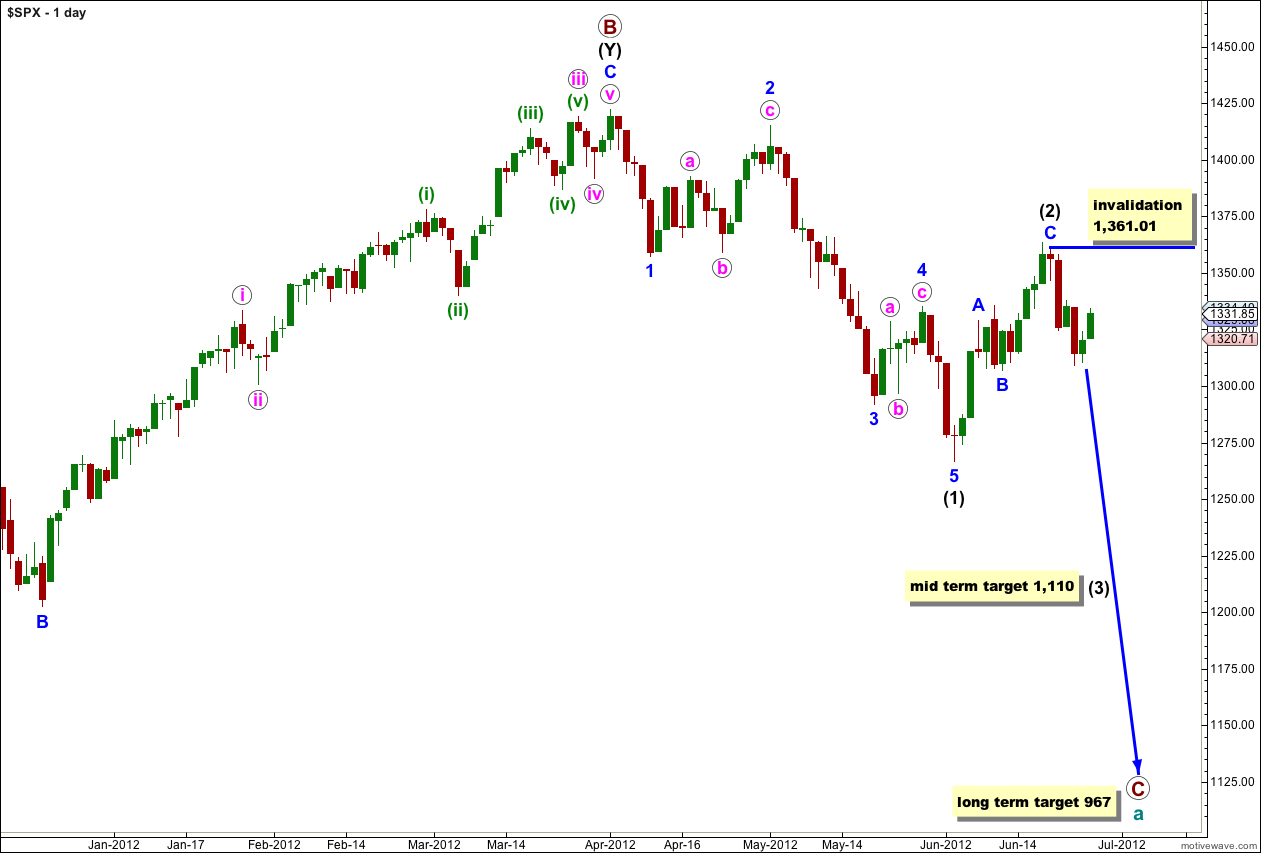

Main Wave Count.

This wave count sees a big trend change at the price high of 1,422.38. Primary wave C should make substantial new lows below the end of primary wave A which had its low at 1,074.77. Primary wave C would reach 1.618 the length of primary wave A at 967, completing a typical expanded flat for cycle wave a.

At this stage the zigzag labeled wave (2) black is probably complete. At 1,110 wave (3) black would reach 1.618 the length of wave (1) black.

At this stage the only variable is whether or not wave (2) black will be a single zigzag structure or may continue further as a double. The alternate looks at this possibility. However, with a clear five down on the hourly chart the alternate possibility is less likely. This main wave count has a very good probability that we are now within a third wave at intermediate degree.

Within wave (3) black no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,361.01.

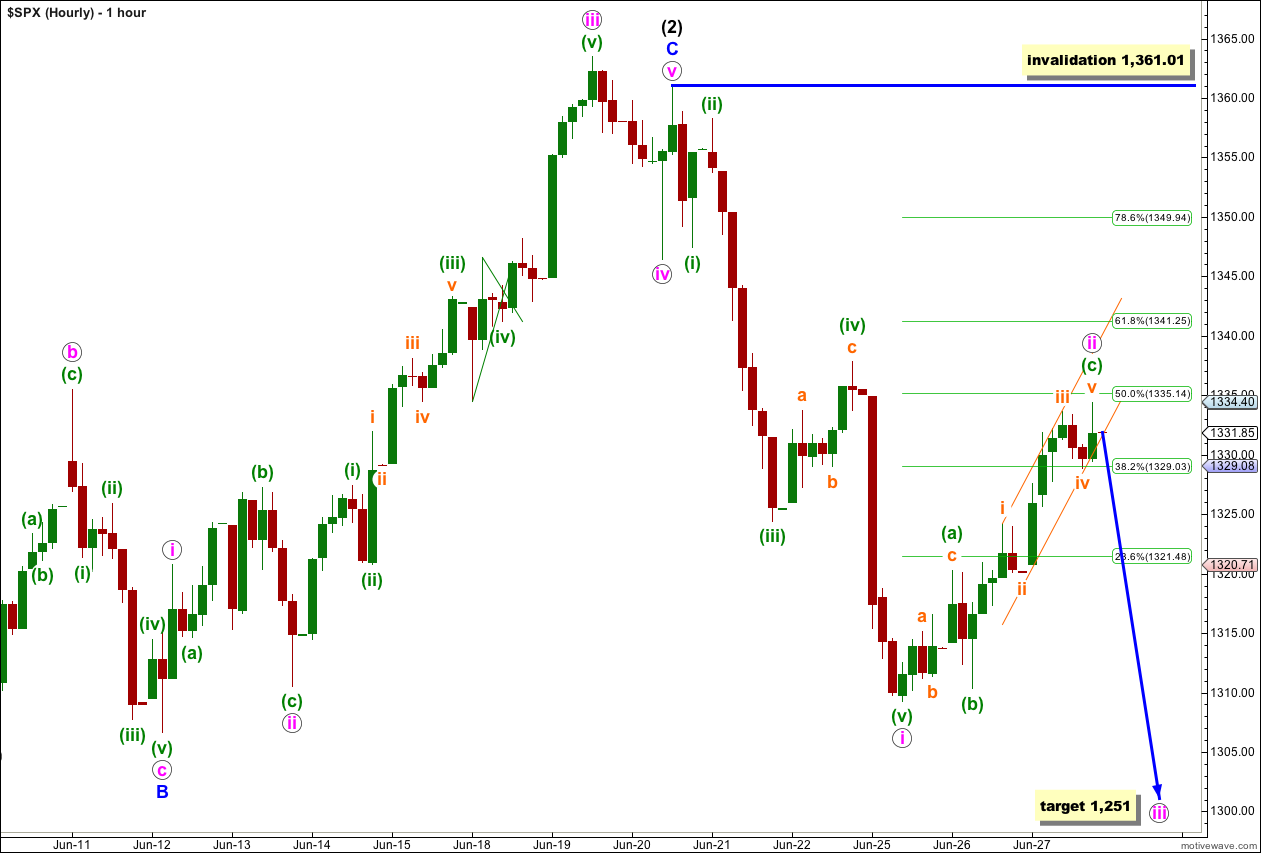

Movement above 1,324.41 confirmed that the downwards movement labeled i pink is a complete five and upwards movement is correcting it. Although this wave count does not agree with MACD it is correct (this is why MACD is a useful guideline but cannot be solely relied upon because it is not foolproof).

So far wave ii pink is a relatively shallow correction, remaining just below the 50% level of wave i pink. The structure looks complete on the 5 minute chart but there is not enough downwards movement at the end of Wednesday’s session to confirm that upwards movement is over.

Wave (c) green has no Fibonacci ratio to wave (a) green.

Ratios within wave (c) green are: wave iii orange is just 0.33 points short of equality with wave i orange, and wave v orange is just 0.21 points longer than 0.382 the length of wave i orange.

Wave ii pink is a flat correction with a long C wave. This does not fit well into a parallel channel. The channel we can use is drawn about wave (c) green from the highs of waves i to iii orange, and a parallel copy placed upon the low of wave ii orange. When this channel is clearly and strongly breached by downwards movement we shall have our first indication that wave ii pink may be over and wave iii pink downwards may have begun.

We shall still have to consider the alternate possibility that wave ii pink may yet continue further as a double flat or double combination. Both of those structures have their primary purpose to move price sideways and take up time. Because so far wave ii pink has lasted just over 2 sessions it is quite possible that it is too brief and may continue further as a double. To eliminate this possibility we will have to see a clear five downwards on the hourly chart.

At 1,251 wave iii pink would reach 1.618 the length of wave i pink. If wave ii pink moves any higher this target must be recalculated.

Wave ii pink may not move beyond the start of wave i pink. This wave count is invalidated with movement above 1,361.01.

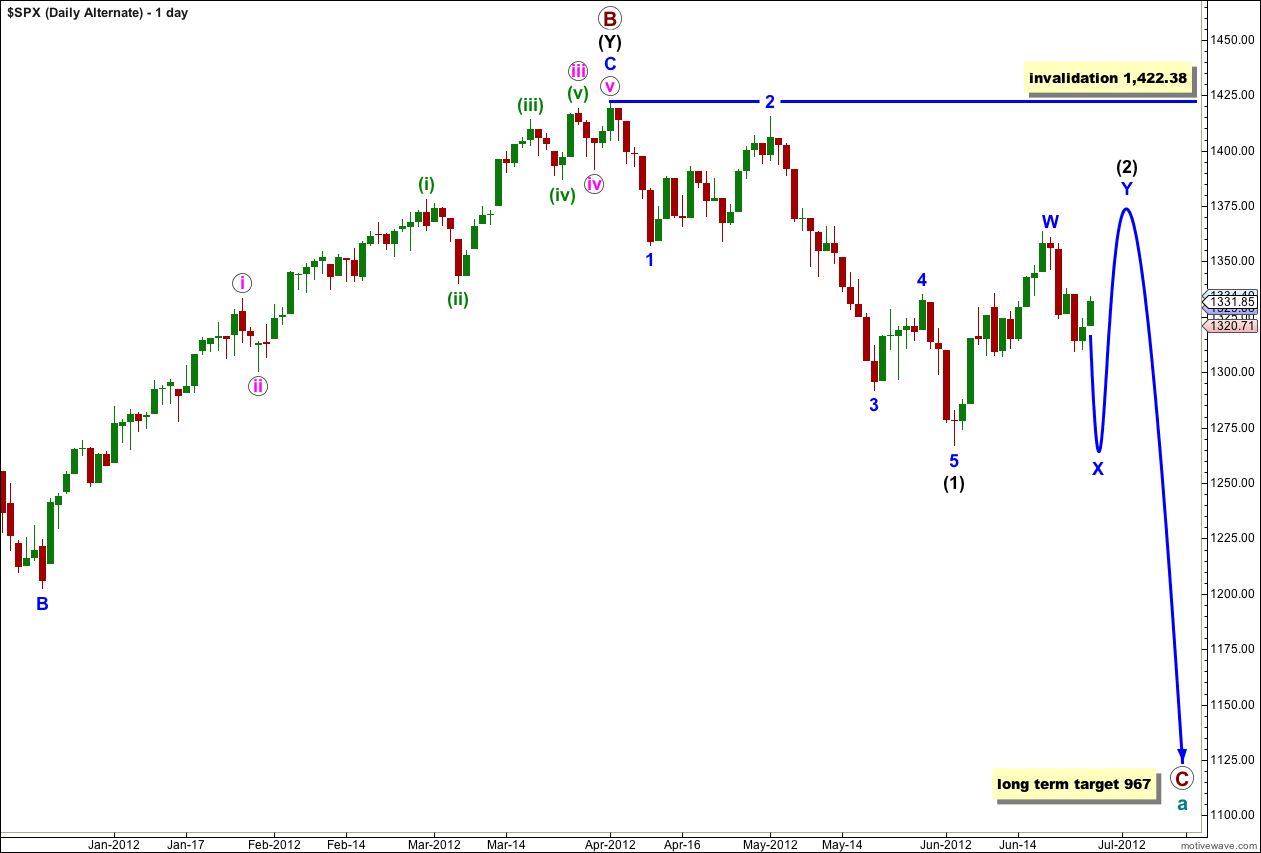

Alternate Wave Count.

This alternate wave count is identical to the main wave count with the sole exception of looking at wave (2) black as a double rather than a single.

If this wave count is correct then the next movement would be downwards in a three wave structure for an X wave. This is most likely to be a zigzag. So far waves a and b pink within a possible zigzag may be complete.

Wave X blue may make a new low below the start of wave W blue, but it is unlikely to. There can be no downwards invalidation point for this reason. We will have to pay close attention to structure to indicate which of our two wave counts is correct.

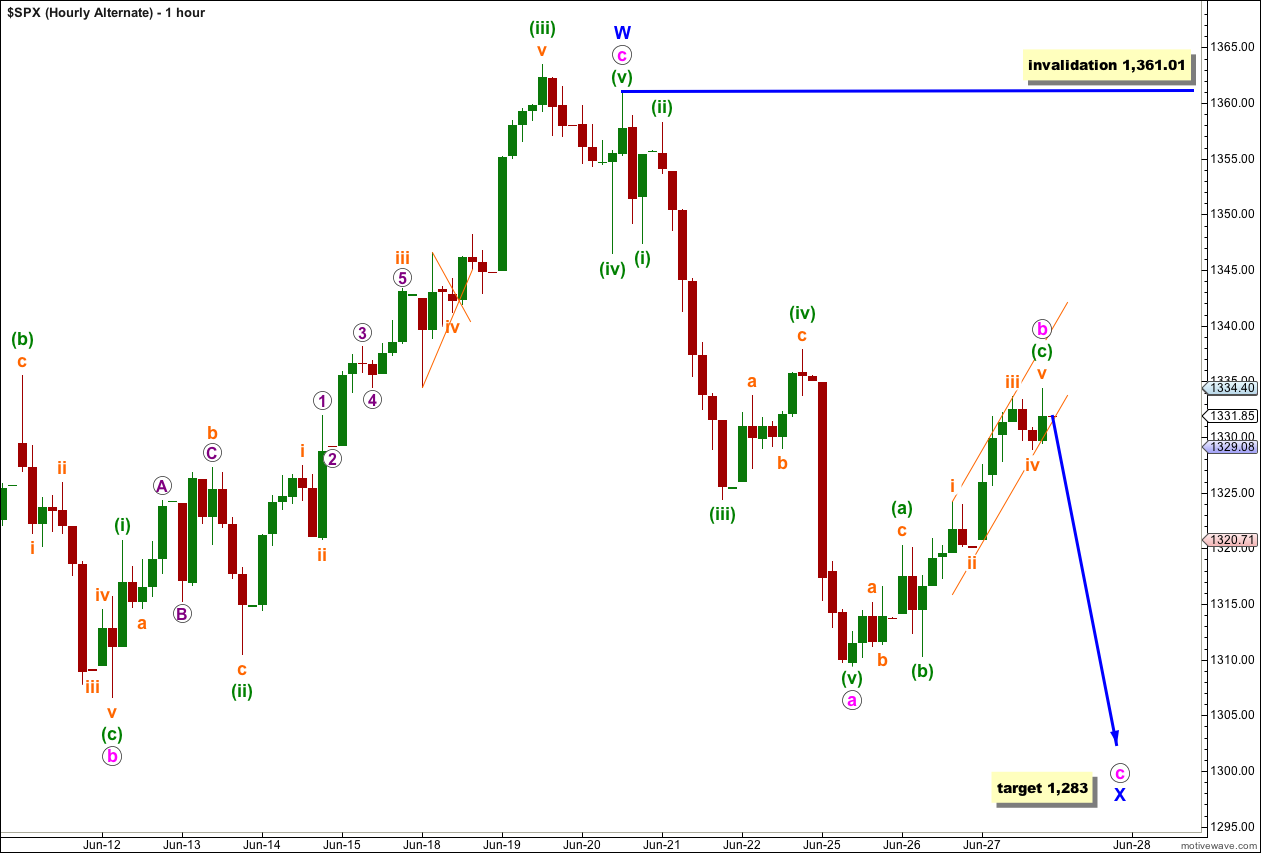

This alternate hourly wave count is essentially the same as the main hourly wave count in that so far subdivisions are the same.

For a zigzag the more common length between A and C is one of equality. At 1,283 wave c pink would reach equality in length with wave a pink.

Any further upwards movement of wave b pink may not move beyond the start of wave a pink. This wave count is invalidated with movement above 1,361.01.

NOW that was a fast 18 points up 🙂

The top yesterday could be W – Wave and today lows X – Wave … which means we need to finish Wave 2 1331.75 area