Yesterday’s analysis expected one final upwards push before a trend change. However, this was not what happened. The channel on the daily chart is clearly breached and now I can calculate targets for the mid term.

This is the point at which the two wave counts diverge. They both expect the same direction in the short term, and we shall have to pay close attention to structure to see which wave count is correct.

Click on the charts below to enlarge.

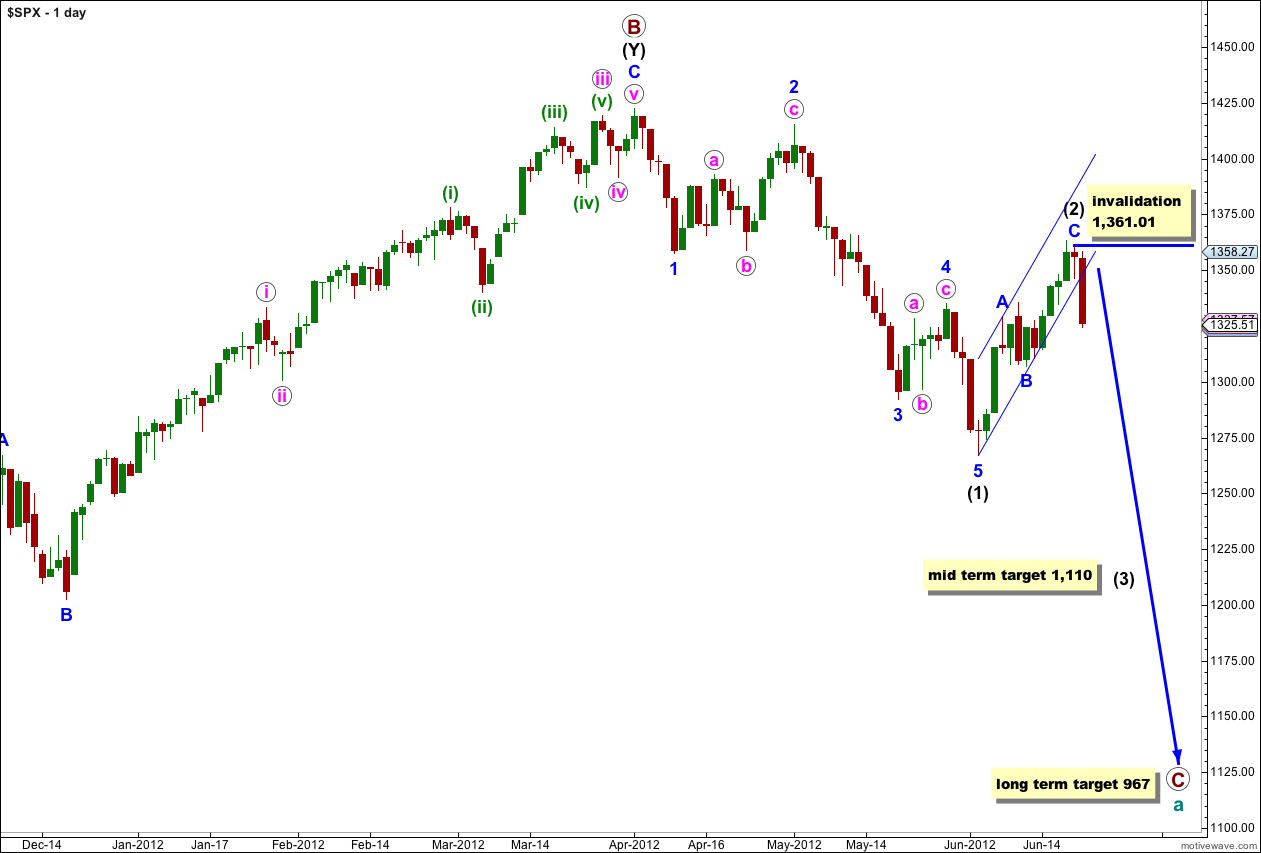

This wave count sees a big trend change at the price high of 1,422.38. Primary wave C should make substantial new lows below the end of primary wave A which had its low at 1,074.77. Primary wave C would reach 1.618 the length of primary wave A at 967, completing a typical expanded flat for cycle wave a.

At this stage the zigzag labeled wave (2) black is probably complete. The parallel channel around it is clearly breached by downwards movement. At 1,110 wave (3) black would reach 1.618 the length of wave (1) black.

At this stage the only variable is whether or not wave (2) black will be a single zigzag structure or may continue further as a double. The alternate looks at this possibility.

Within wave (3) black no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,361.01.

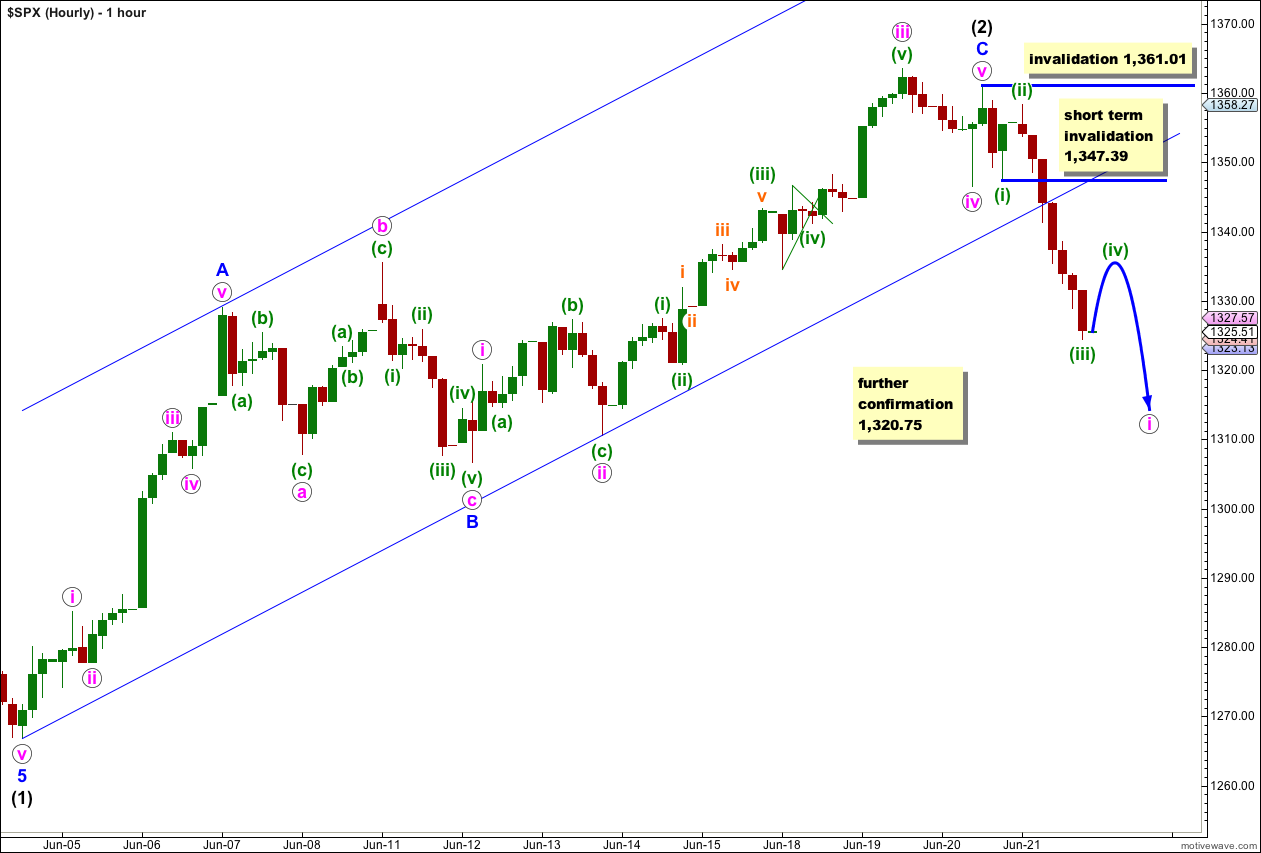

I expect that we saw a truncated fifth wave to complete wave (2) black because this labeling fits subdivisions on the 5 minute chart.

Ratios within wave C blue are: there is no Fibonacci ratio between wave iii pink and wave i pink, and wave v pink is just 0.43 points longer than equality with wave i pink.

There is no Fibonacci ratio between waves A and C blue.

No matter how the channel about wave (2) black is drawn it is very clearly breached by downwards movement. For this main wave count we shall expect downwards movement to unfold as a five wave structure.

On the 5 minute chart it is possible to see downwards movement labeled (i) green as an impulse. Wave (ii) green is very ambiguous. Wave (iii) green is very clearly an impulse and the count is complete; it is likely it was over at the end of Thursday’s session.

Friday’s session may begin with a very little upwards movement for a small fourth wave correction which may not move into wave (i) green price territory. In the very short term this wave count is invalidated with movement above 1,347.39.

After wave (iv) green is complete one more downwards wave for (v) green will complete a five down. At that stage we should look out for a second wave correction. Draw a Fibonacci retracement along the length of wave i pink and expect wave ii pink to reach most likely to the 0.618 Fibonacci ratio. Wave ii pink may not move beyond the start of wave i pink. This wave count is invalidated with movement above 1,361.01.

Alternate Wave Count.

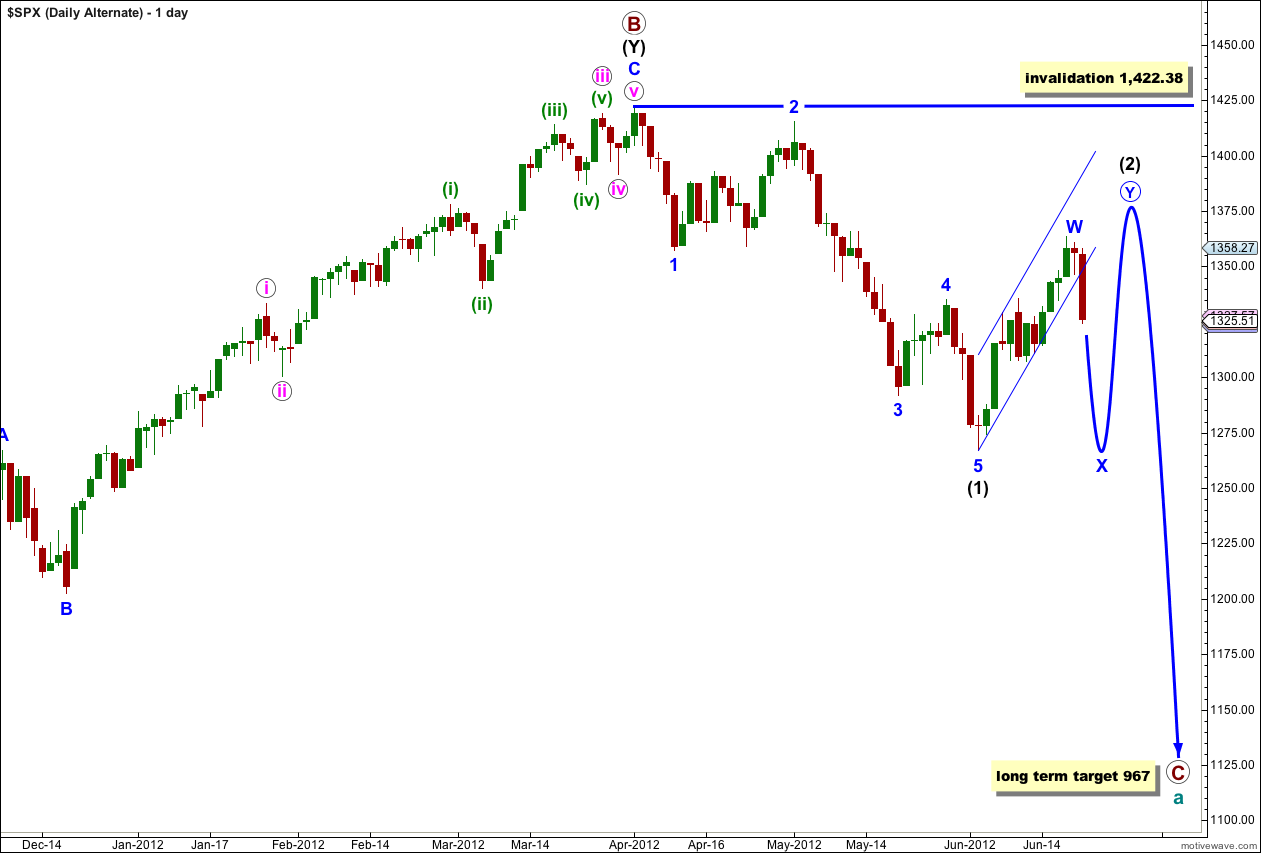

This alternate wave count is identical to the main wave count with the sole exception of looking at wave (2) black as a double rather than a single.

If this wave count is correct then the next movement would be downwards in a three wave structure for an X wave. This is most likely to be a zigzag.

Wave X blue may make a new low below the start of wave W blue, but it is unlikely to. There can be no downwards invalidation point for this reason. We will have to pay close attention to structure to indicate which of our two wave counts is correct.

Wave X blue may be unfolding as a more time consuming zigzag as labeled here, and still within wave a pink. Or we may move the degree of labeling from the high labeled W blue up one degree and wave X blue could possibly already be over. If the short term invalidation point at 1,361.01 is breached without further downwards movement then that would be the only wave count I can see that would fit.

It seems more likely that wave X blue would take longer than just one session to unfold.

Within wave a pink the subdivisions and expectation is exactly the same as for the main wave count: a small fourth wave correction followed by another downwards wave for (v) green. Thereafter, wave b pink may not move beyond the start of wave a pink above 1,361.01.

hi Lara,

in the hourly count, what is ur target for i pink ?

This could not be calculated yesterday because we did not know where (iv) green ended. Now we have an end to (iv) green I can calculate a target for (v) green to complete i pink in the end of week analysis.