Last analysis expected a small correction to complete within the last session, and thereafter for downwards movement towards a short / mid term target at 1,293 to be reached within two sessions, but this target was slightly exceeded within Friday’s session.

This structure is unfolding as expected. We may expect mid term targets to be reached the week after next, most likely.

Click on the charts below to enlarge.

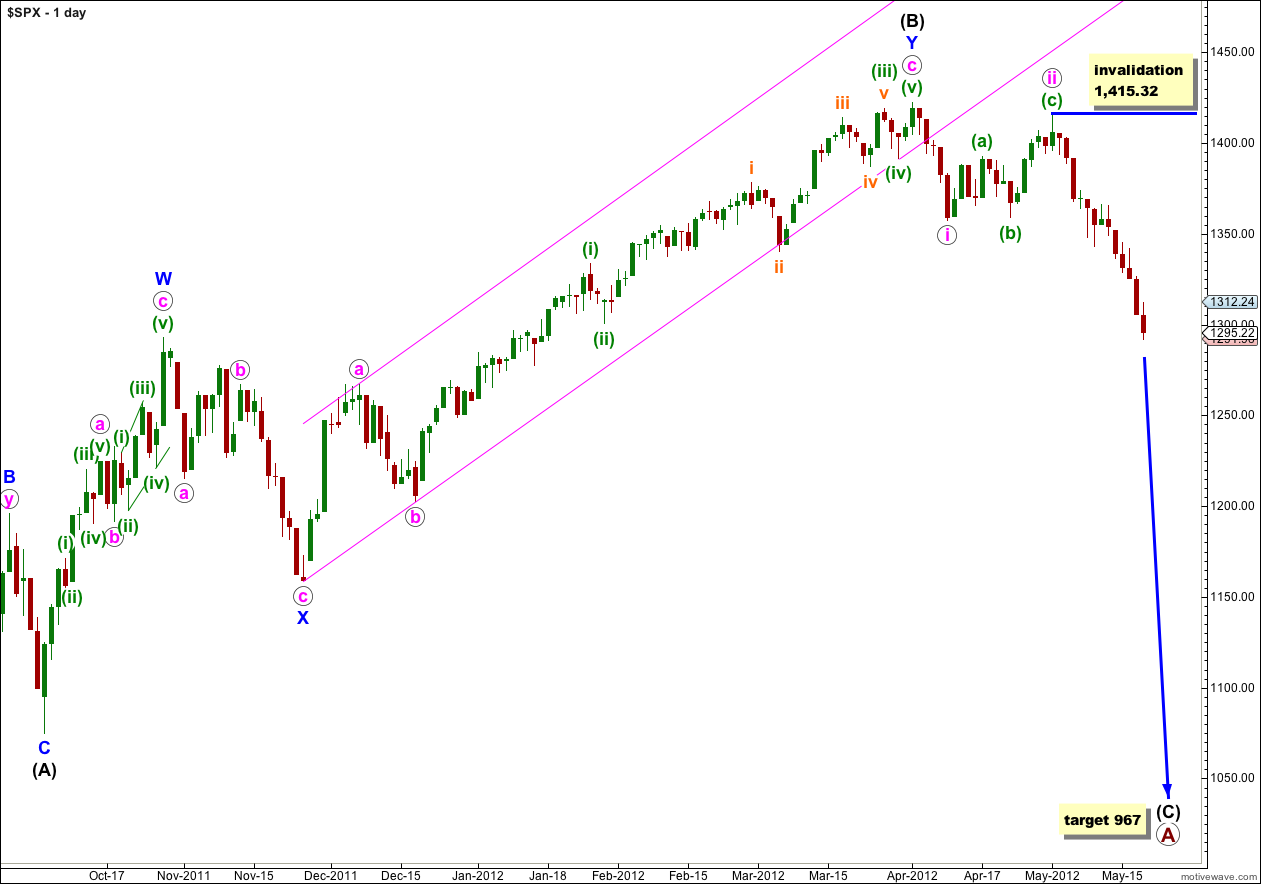

We have recently seen a very large trend change on the S&P 500 and a new downwards trend, to last months, has begun.

I have moved recent movement downwards from the start of wave (C) black all up one degree.

At primary degree wave A is an expanded flat correction. Wave (A) black within it subdivides into a three, and wave (B) black is over 105% of wave (A) black at 123%. The minimum requirements for an expanded flat are met. We should expect wave (C) black to subdivide into a five and move price substantially beyond the end of wave (A) black at 1,074.77.

At 967 wave (C) black would reach 1.618 the length of wave (A) black. If price continues through this first target, or it gets there and the structure is incomplete, then our second (less likely) target is at 685 where wave (C) black would reach 2.618 the length of wave (A) black.

Wave (A) black lasted 4 months. Wave (B) black lasted 6 months. We may expect wave (C) black to last at least 4 months, if not longer.

Within wave iii pink no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 1,415.32. When the structure of wave iii pink is complete then the invalidation point can be moved to the low of wave i pink at 1,357.38.

Within wave iii pink waves (i) and (ii) green are complete. Wave (iii) green is very close to completion and it just needs the final fifth wave of v orange to end it.

When wave v orange is complete then we may expect a longer lasting correction for wave (iv) green. Wave v orange may end during Monday’s session.

Wave iii orange within wave (iii) green was just 1.22 points longer than 1.618 the length of wave i orange. With a nice Fibonacci ratio already between two of the three actionary waves within wave (iii) green the probability of the last actionary wave, v orange, exhibiting a Fibonacci ratio reduces. At 1,280 wave v orange would reach equality with wave i orange. This target has a low probability.

While wave v orange is incomplete any second wave correction within it may not move beyond the start of its first wave. This wave count is invalidated in the very short term with movement above 1,307.45. When wave v orange is over then movement above 1,307.45 would confirm an end to the entirety of wave (iii) green and wave (iv) green would then be in progress.

Wave (iv) green should last at least one entire session, and could last two or three sessions. It depends upon the structure of the fourth wave.

Wave (iv) green may not move into wave (i) green price territory. This wave count is invalidated with movement above 1,343.13.

When wave v orange ends wave (iii) green then we may use Elliott’s channeling technique to redraw this channel. Draw the first trend line from the lows of (i) green to the end of wave (iii) green, then place a parallel copy upon the high of wave (ii) green. The channel may show where wave (iv) green would find resistance.

The target for wave iii pink to end remains at 1,245 where it would reach 1.618 the length of wave i pink. This target is still about two weeks away.

Hey Lara,

We are playing out a few ideas …

Looks like one big expanding triangle after this 3-5 day rally (NYMO -110.33 extremely oversold) we are looking for one more drop. If this is an expanding triangle we should see bullish divergence on the NYMO when we drop down to 1250 going into June 20th (Two Day Fed Meeting).

I suspect the US, IMF, ECB, EU, and the Federal Reserve to “come up with something to save the economy” as soon as the correction ensues further and nears 1250.

Our top end target for the expanding triangle is 1434.44 going into 8/3/2012.

Looks like it will be on the Feds once again.

so, the bull count is completely invalitated?

Yes.