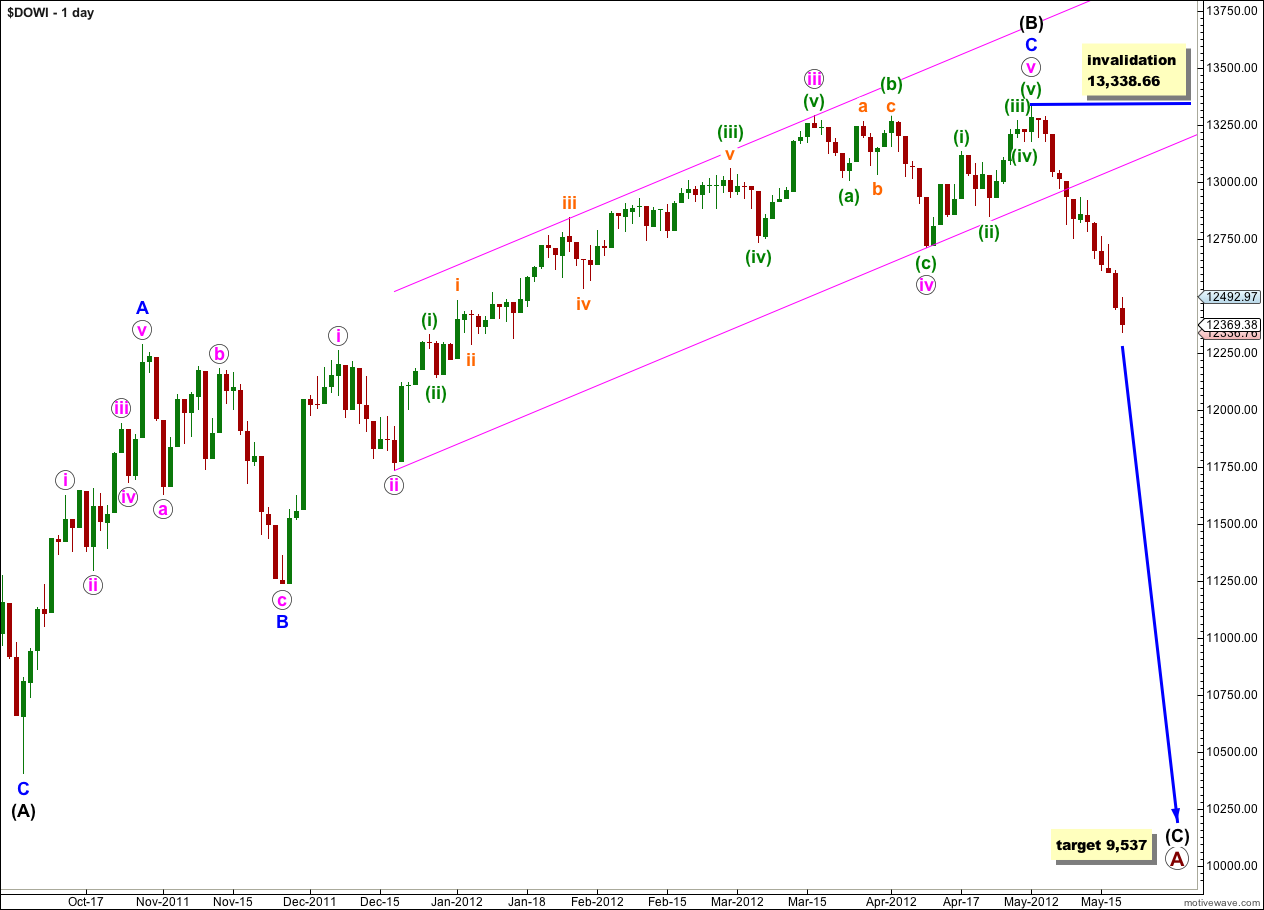

Movement below 12,710.56 early last week invalidated the alternate wave count and confirmed the main wave count. At that stage we had only one wave count and much more clarity.

Price has continued lower last week which is overall what the sole remaining wave count expects.

Click on the charts below to enlarge.

Primary wave A is an expanded flat correction and has begun on the final wave (C) black downwards. Expanded flats expect C waves to move substantially beyond the end of A waves, and at 9,537 wave (C) black would achieve this and be 1.618 the length of wave (A) black.

Wave (C) black must subdivide at blue (minor) degree into a five wave structure. The Dow is still within this first blue wave 1 downwards.

Within wave (C) black wave 2 blue may not move beyond the start of wave 1 blue. This wave count is invalidated with movement above 13,338.66.

I have moved the degree of labeling within recent movement up one degree. Within wave i pink I expect we have waves (i) and (ii) green complete, and wave (iii) green is very close to completion.

The second wave correction of wave (ii) green was a remarkably brief and shallow correction for a second wave. We may see a deeper correction to come for wave (iv) green.

At 12,092 wave (iii) green would reach equality with wave (i) green. There would be no Fibonacci ratio between waves v orange and either of i or iii orange.

Wave (iii) green may find support about the lower edge of the parallel channel drawn here as a best fit.

When we have some more downwards movement for wave v orange to end wave (iii) green then redraw the channel using Elliott’s first technique. Draw the first trend line from the low of (i) green to the low of (iii) green. Place a parallel copy upon the high of (ii) green, and perhaps another parallel copy on the high of ii orange or 2 purple within wave (iii) green, depending on how it looks. Expect wave (iv) green to find resistance about the upper edge of such a parallel channel.

Wave (iv) green may not move into wave (i) green price territory. This hourly wave count is invalidated with movement above 1,2661.48.

When wave (iv) green is complete then expect more downwards movement to complete a five wave impulse for wave i pink. At this stage I cannot calculate a target for wave (v) green to complete wave i pink for you, but expect wave (v) green to be about 418 points in length (0.618 the length of wave (i) green).

Overall next week we should expect to see new lows, but look out for a more time consuming fourth wave correction which could last about one to three sessions depending upon what structure it takes.

Lara, do you also have a longer term analysis of the wave count after wave C down? Thanks

yes I do, and I’m sorry, I have not updated the historic Dow analysis for too long. I will be doing it this week