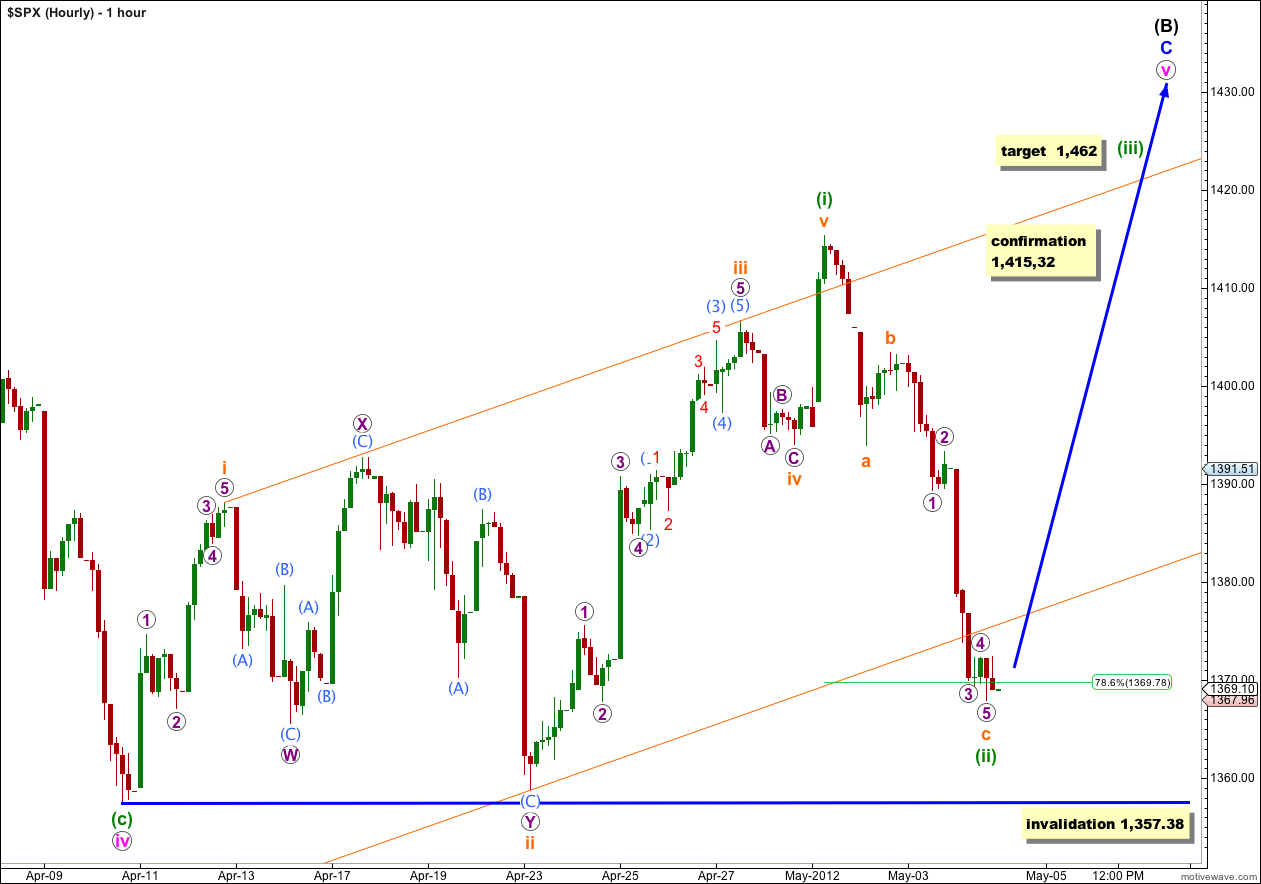

Strong downwards movement during Friday’s session has breached the parallel channel on what is at the moment our main wave count. Price is just above the invalidation point. If this wave count is incorrect we should see it invalidated early next week. The invalidation / confirmation point is crucial, and while price remains above this point the possibility of new highs will remain.

Click on the charts below to enlarge.

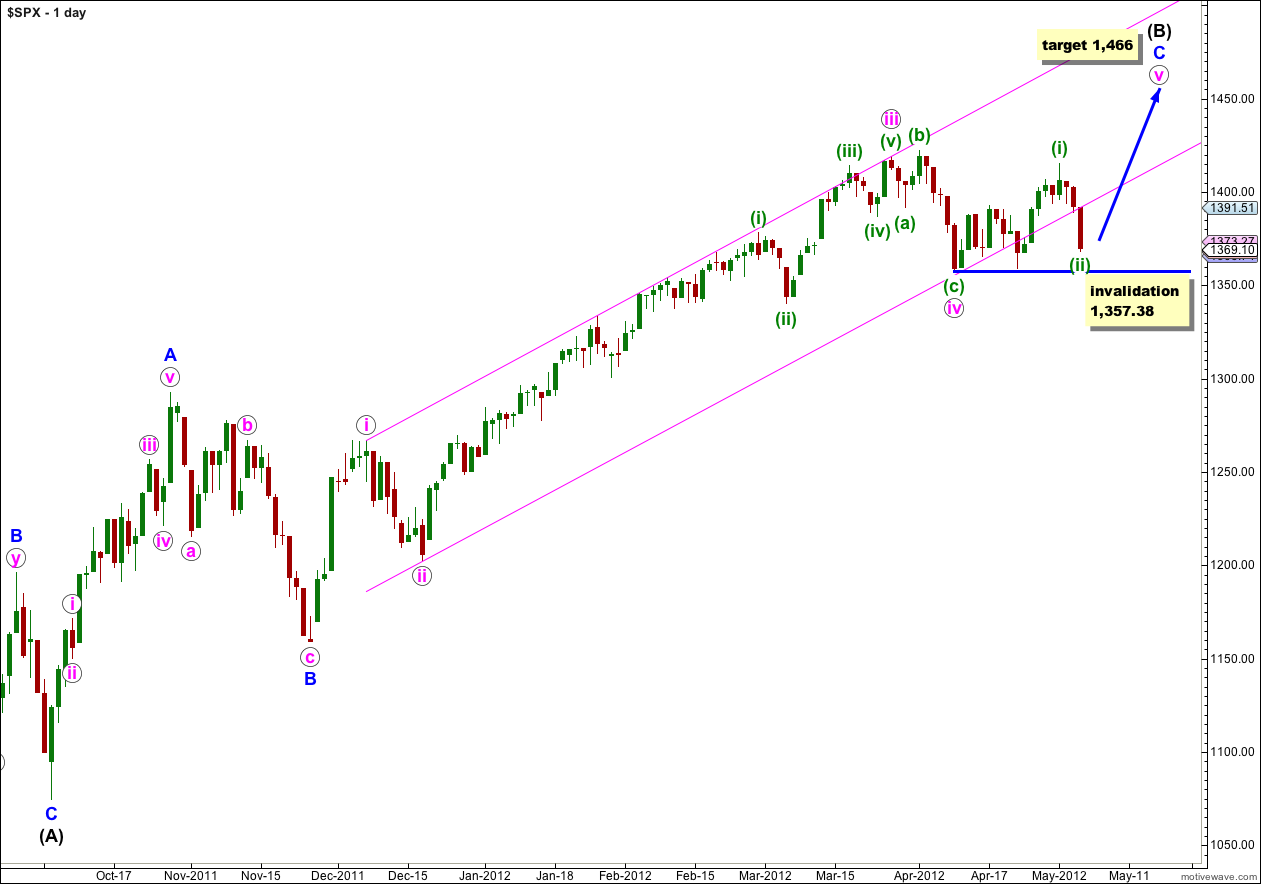

Main Wave Count.

The parallel channel now has a very clear and convincing breach. At this stage I consider both our wave counts to be of reasonably equal probability. We should finally have clarity in another one or two sessions, and if the alternate wave count is correct then only one more session should show it.

This wave count expects the S&P 500 is within a final fifth wave upwards to complete a single zigzag correction for wave (B) black.

When wave v pink is complete we shall look out for a big trend change. Movement below 1,357.38 will confirm a big trend change and the start of wave (C) black downwards. This price point will be extremely important for us because while price remains above that point the risk of new highs will remain.

The target of 1,466 is where wave v pink would reach equality with wave i pink, but Wave (B) black would reach its maximum common length, 138% of wave (A) black, at 1,464. It is likely we shall see a trend change before this point.

Upwards movement so far can be subdivided into a five wave impulse. This may be only wave (i) green within wave v pink.

Ratios within wave (i) green are: wave iii orange is just 1.9 points short of 1.618 the length of wave i orange, and wave v orange has no Fibonacci ratio to either of i or iii orange.

Ratios within wave i orange are: wave 3 purple has no Fibonacci ratio to wave 1 purple, and wave 5 purple is just 0.38 points short of 0.236 the length of wave 3 purple.

Ratios within wave iii orange are: wave 3 purple has no Fibonacci ratio to wave 1 purple, and wave 5 purple is just 1.09 points short of equality with wave 3 purple.

Ratios within wave 5 purple of wave iii orange are: wave (3) aqua has no Fibonacci ratio to wave (1) aqua, and wave (5) aqua is 0.75 points short of 1.618 the length of wave (1) aqua.

Ratios within wave (3) aqua of wave 5 purple of wave iii orange are: wave 3 red has no Fibonacci ratio to wave 1 red, and wave 5 red is 0.49 points short of equality with wave 1 red.

On the 5 minute chart wave v orange subdivides perfectly into a five wave impulse.

Within wave (ii) green wave c orange is 0.8 points short of 1.618 the length of wave a orange.

Ratios within wave c orange are: wave 3 purple is 0.69 points longer than 1.618 the length of wave 1 purple, and wave 5 purple has no Fibonacci ratio to either of 1 or 3 purple.

We may also move the degree of labeling for this wave all up one degree, and this whole movement could be over for this wave count. At this stage I would prefer to assume that the trend remains the same (up) until proven otherwise with movement below 1,357.38.

If this degree of labeling is correct then wave (iii) green would reach 1.618 the length of wave (i) green at 1,462.

Any further downwards movement of wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement below 1,357.38.

Movement above 1,415.32 would invalidate the alternate wave count below and confirm this main wave count.

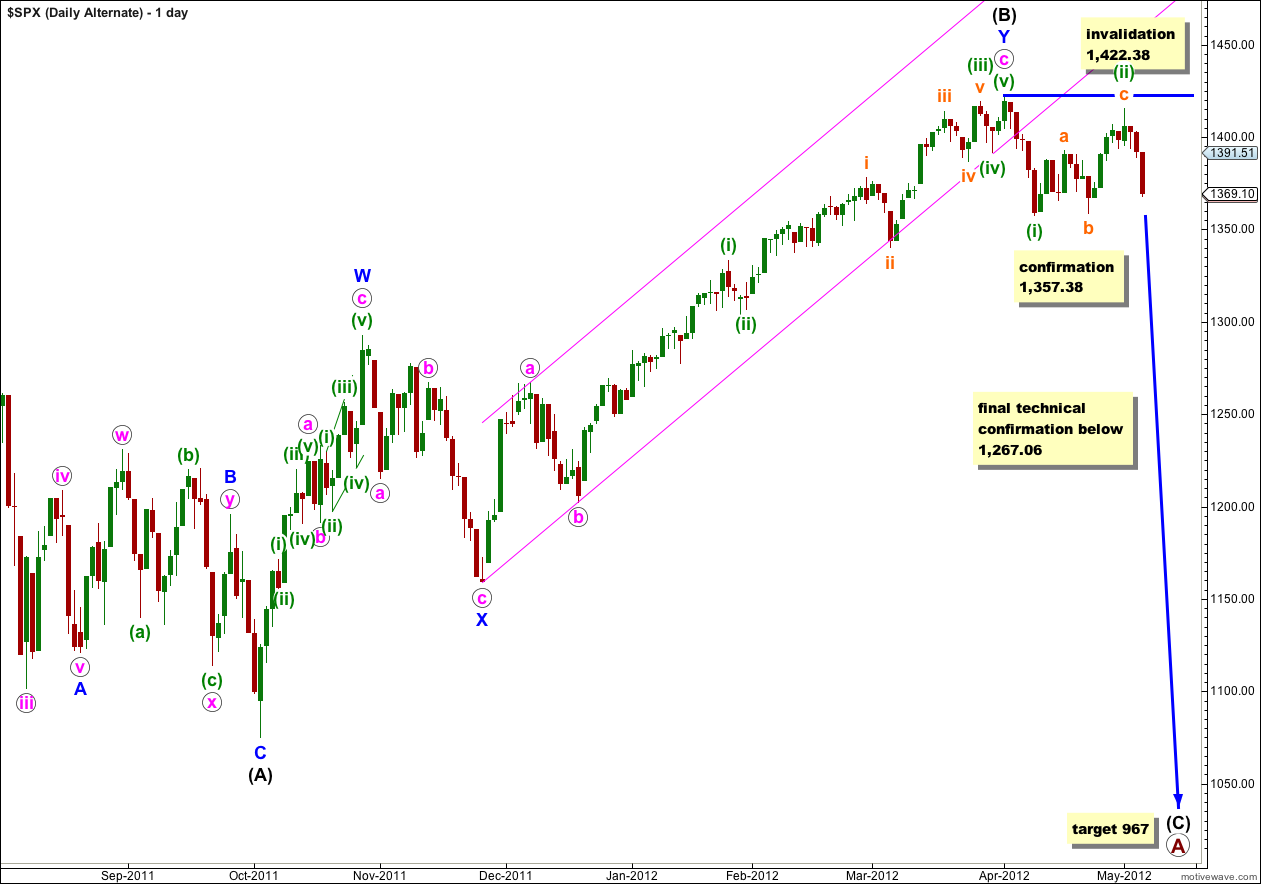

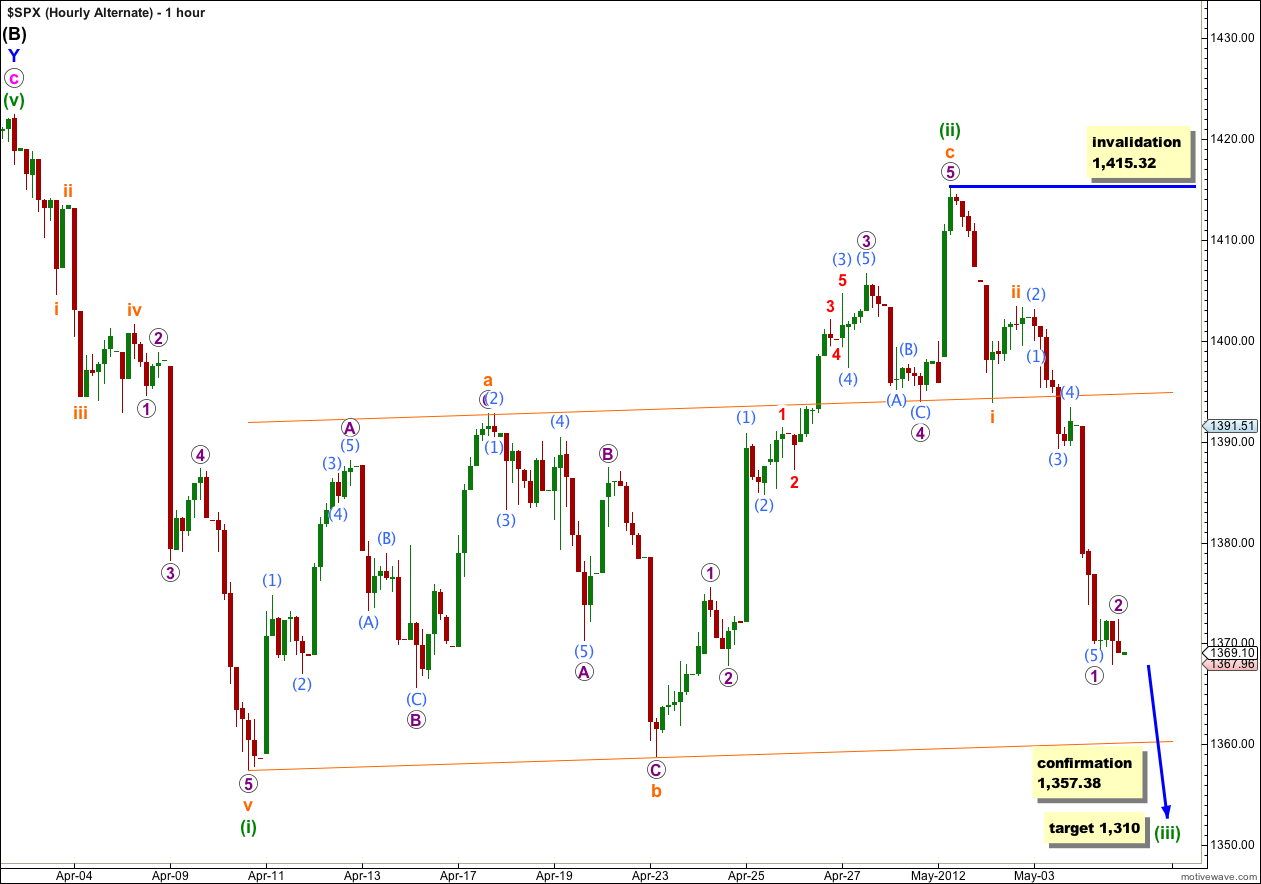

Alternate Wave Count.

If the huge channel breach of the main wave count is an indication of a major trend change then this would be the most likely scenario.

Wave (B) black subdivides most easily into a double zigzag structure. A low degree second wave correction for (ii) green, a regular flat correction, completed this week. Thereafter, wave (iii) green down has begun and is gathering momentum.

At primary degree this structure is an expanded flat correction, and wave (B) black was a 123% correction of wave (A) black. Expanded flats normally expect C waves to move substantially beyond the end of the A wave. At 967 wave (C) black would reach 1.618 the length of wave (A) black.

Any further upwards movement of wave (ii) green may not move beyond the start of wave (i) green. This wave count is invalidated with movement above 1,422.38.

Wave (ii) green is a regular flat correction. Wave b orange is a 96% correction of wave a orange. Wave c orange is just 0.71 points short of 1.618 the length of wave a orange.

Within wave iii orange of wave (iii) green only wave 1 purple may be complete. Ratios within wave 1 purple are: wave (3) aqua has no Fibonacci ratio to wave (1) aqua, and wave (5) aqua is 1.21 points longer than 1.618 the length of wave (3) aqua.

If a third wave is underway then this wave count should be confirmed on Monday with movement below 1,357.38.

At 1,310 wave (iii) green would reach 1.618 the length of wave (i) green.

Within wave (iii) green any second wave correction may not move beyond the start of the first wave. This wave count is invalidated with movement above 1,415.32.

The Bullish Butterfly Pattern — off 1350 in the morning??