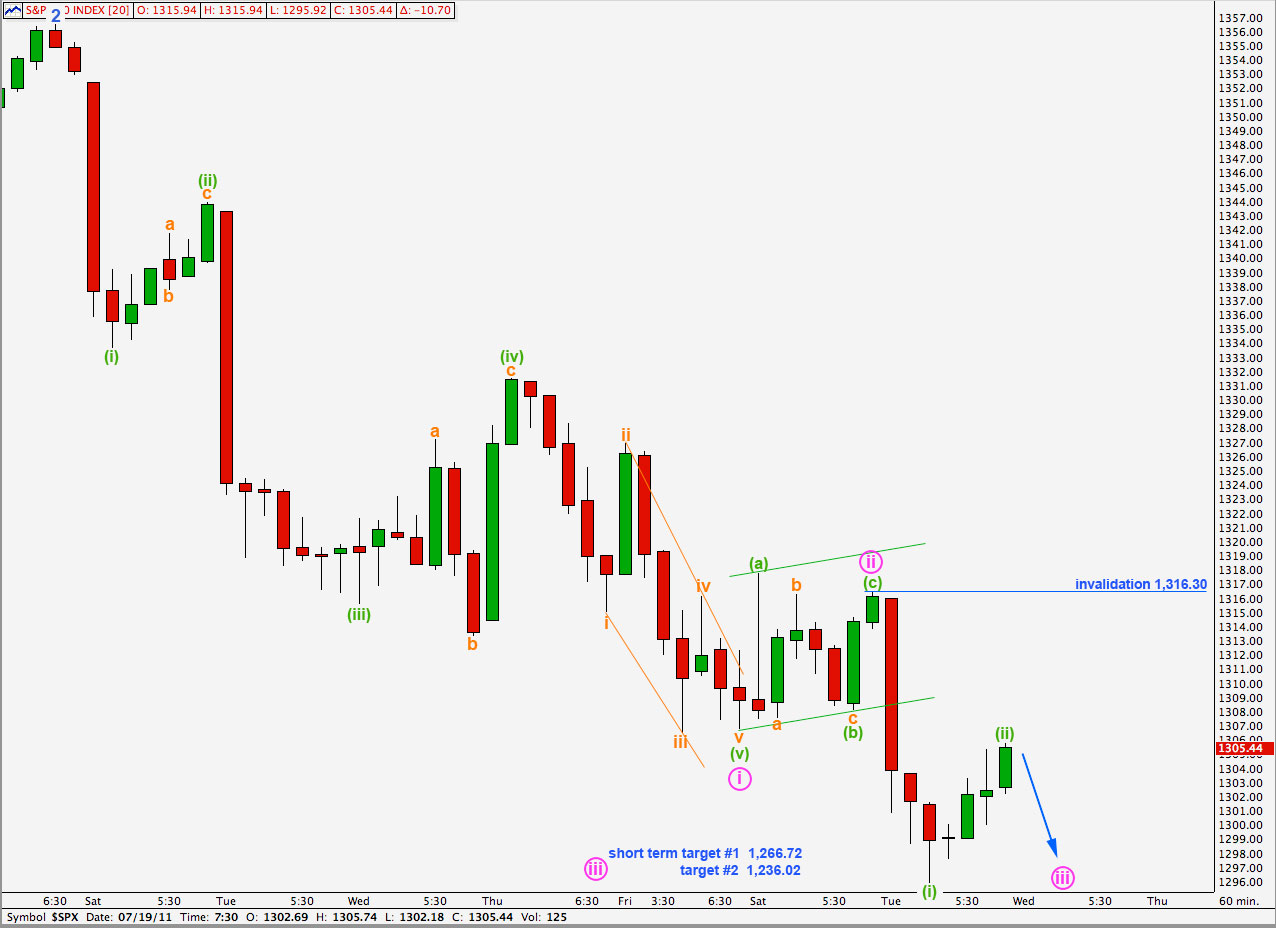

Elliott Wave chart analysis for the S&P 500 for 18th July, 2011. Please click on the charts below to enlarge.

Main Wave Count.

We had expected more upwards movement to complete a correction before price turned down again and this did not happen. Movement below the parallel channel containing the correction indicated a trend change within the first hour of markets opening.

If this wave count is correct then we have just seen a relatively brief and shallow second wave correction within wave 3 blue downwards.

Positives for this wave count:

– it has a good fit in its trend channel.

– within primary wave C the proportions of black and blue waves look good.

– it explains the strong trend channel breach with recent downwards movement.

Negatives for this wave count:

– within the ending diagonal of wave 5 black it must see waves 1 and 3 blue as zigzags and this is stretching credulity a bit.

– I would have expected cycle B to reach 90% of cycle A at 1,494.15 because cycle A is most easily seen as a three wave structure, so this would be a super cycle flat correction.

Wave 2 blue may not move beyond the start of wave 1 blue. This wave count is invalidated with movement above 1,359.44.

We expected further upwards movement to complete wave ii pink about 1,325.75 and this did not happen. Wave (c) green within wave ii pink is slightly truncated. There is no Fibonacci ratio between waves (a) and (c) green within ii pink.

Wave (i) green downwards is a five wave impulse on a five minute chart and so cannot be a continuation of wave ii pink.

Wave iii pink may end by the end of this week. At 1,266.72 wave iii pink would reach equality with wave i pink. This is our first target. At 1,236.02 wave iii pink would reach 1.618 the length of wave i pink. This is the second target.

Any further extension of wave (ii) green upwards may not move beyond the start of wave (i) green. This wave count is invalidated with movement above 1,316.30.

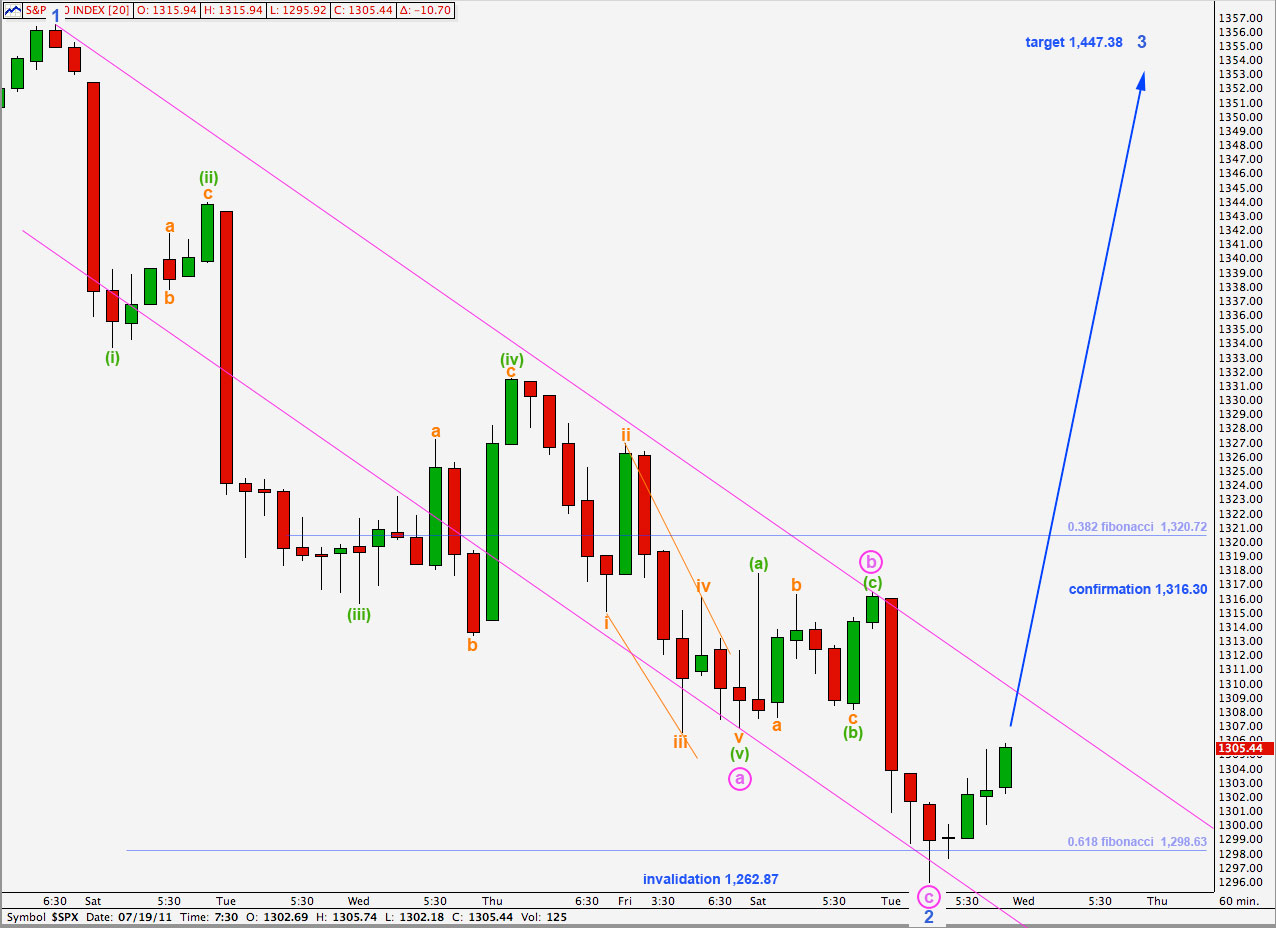

Alternate Wave Count.

Wave 2 blue is now a complete zigzag structure on the hourly chart, reaching just below the 0.618 fibonacci ratio of wave 1 blue. If this wave count is correct then the correction has most likely ended here.

At this stage this alternate wave count diverges in its expectation of the next direction with our main wave count.

Positives for this wave count:

– recent upwards movement labeled 1 blue fits very well and has the right look on the hourly chart.

– we can see cycle wave A as a three wave structure and expect upwards movement for cycle wave B to reach at least to 1,494.15 where it will be 90% the length of cycle wave A.

– the problem of how to see the last piece of upwards movement to end black wave 3 is completely resolved.

– so far recent downwards movement is not behaving completely according to expectations for the main hourly wave count and may fit this wave count better

Negatives for this wave count:

– wave 4 pink within wave 3 blue within wave 3 black is out of proportion to other corrections of a higher wave degree; it is too large.

– it does not have as good a fit within its trend channel as the main wave count does.

Wave 2 blue may not move beyond the start of wave 1 blue. This wave count is invalidated with movement below 1,262.87.

Wave 2 blue is a complete zigzag structure. Wave c pink is just 1.5 points longer than 0.382 the length of wave a pink.

The pink channel is drawn here using Elliott’s technique. When we can see at least one full hourly candlestick above this channel we may have indication that wave 2 zigzag is complete and wave 3 blue upwards is underway.

At 1,447.38 wave 3 blue will reach 1.618 the length of wave 1 blue. This target may be at least two weeks away.

If wave 2 blue extends any lower it may not move below 1,262.87.

Movement above 1,316.30 would provide confidence in this wave count as at that stage upwards movement may not be a correction within wave c pink and so wave c pink would have to be over, and also at that point the main hourly wave count would be invalidated.

Lara,

It appears that the main wave count has been invalidated. Is there any scenario under which you can continue to see the main (bearish) wave count playing out. I am trying to see one, but cannot see how pink (ii) could still be playing out. Thanks.

Peter

Hi Peter,

I did not want to answer your question until I had a very good look at the charts. Now I have my answer is yes, just. I can see one possibility where the bearish wave count could still be valid, but it does not have a good look at all on the hourly chart. It sees pink i as ending at the low at 1,295.92.

I will publish it, but with the caveat that I think it has a low probability. It would be invalidated with movement above 1,356.48.

– edit: I’ve discovered a problem with that wave count I was working on. It’s not valid. I’ll keep looking for another possibility.