Elliott Wave chart analysis for the SPX500 for 28th March, 2011. Please click on the charts below to enlarge.

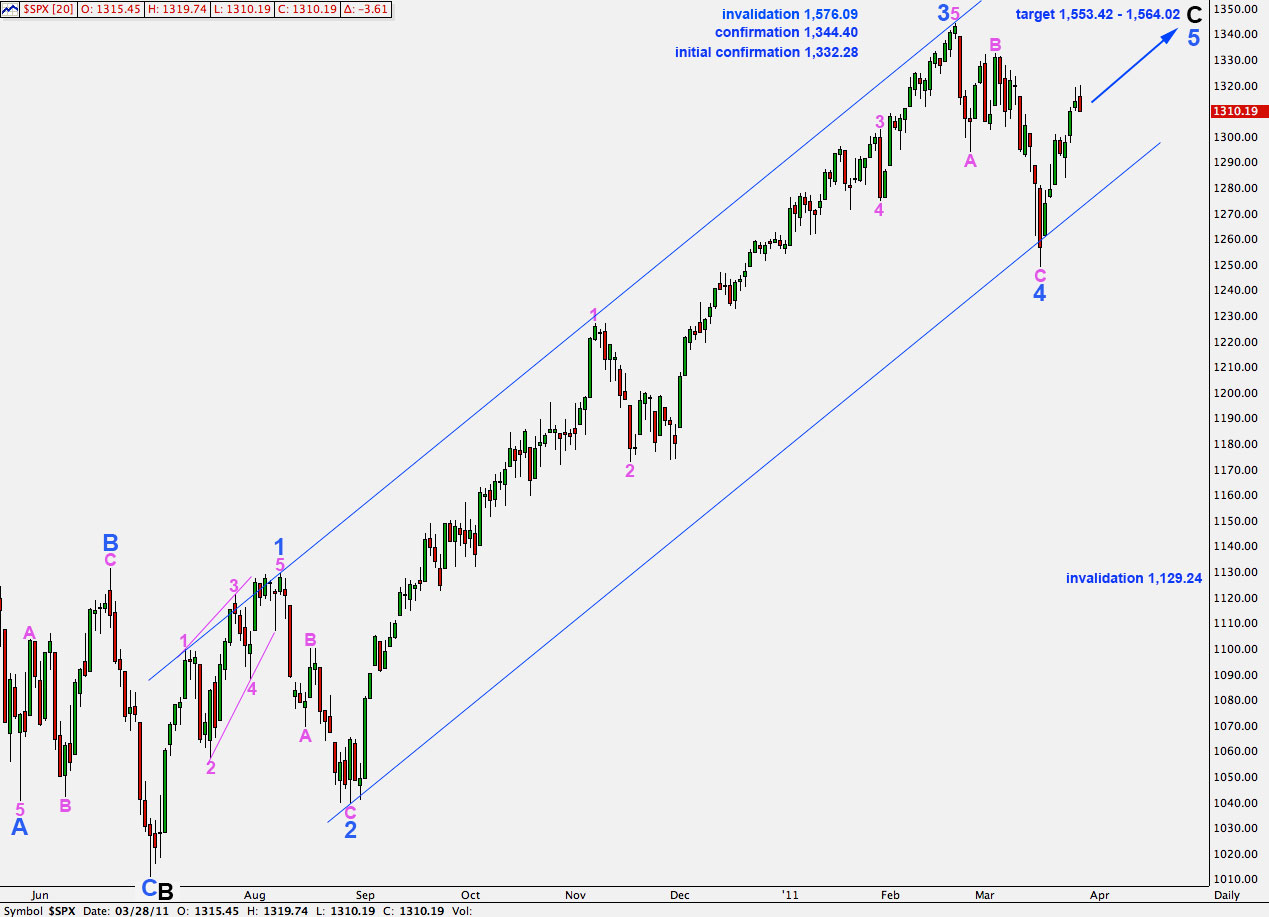

Analysis to end last week saw this as our main wave count, which expects further upwards movement.

Movement above 1,332.28 would provide initial confirmation of this wave count. However, at this stage, both the Dow and Russell 2000 have invalidated their wave counts which saw primary wave 2 as over. Today it is looking increasingly likely that the S&P will do the same this week.

At 1,553.42 wave 5 blue will reach equality with wave 3 blue.

At 1,564.02 wave C black will reach equality with wave A black.

This wave count is invalidated with movement above 1,576.09.

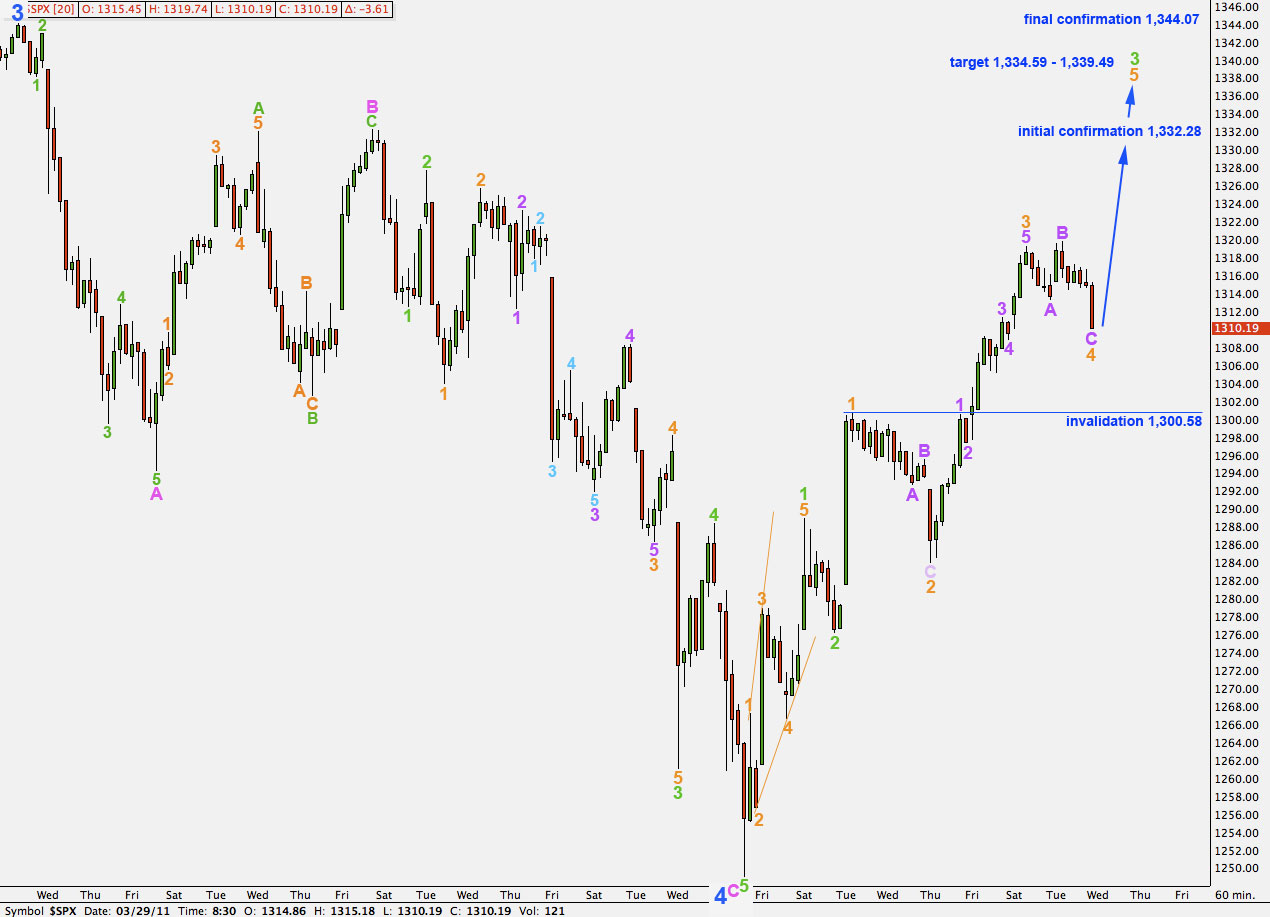

This wave count expected a little downwards movement for wave 4 orange and this is what Monday’s session achieved. The following upwards wave may unfold tomorrow.

Wave 4 orange is an expanded flat correction: wave B purple is a 110% correction of wave A purple and wave C purple is just 0.17 points longer than 1.618 the length of wave A purple.

There is nice alternation between waves 2 and 4 orange: wave 2 is a deep zigzag correction and wave 4 is a shallow expanded flat.

At 1,334.59 wave 5 orange (if it begins at 1,310.19 and if wave 4 orange does not move any lower) will reach equality with wave 1 orange.

At 1,339.49 wave 3 green will reach 1.618 the length of wave 1 green.

This is a short term target which may be met within another 2 – 3 days.

Any further downwards extension of wave 4 orange may not move into wave 1 orange price territory. This wave count is invalidated with movement below 1,300.58.

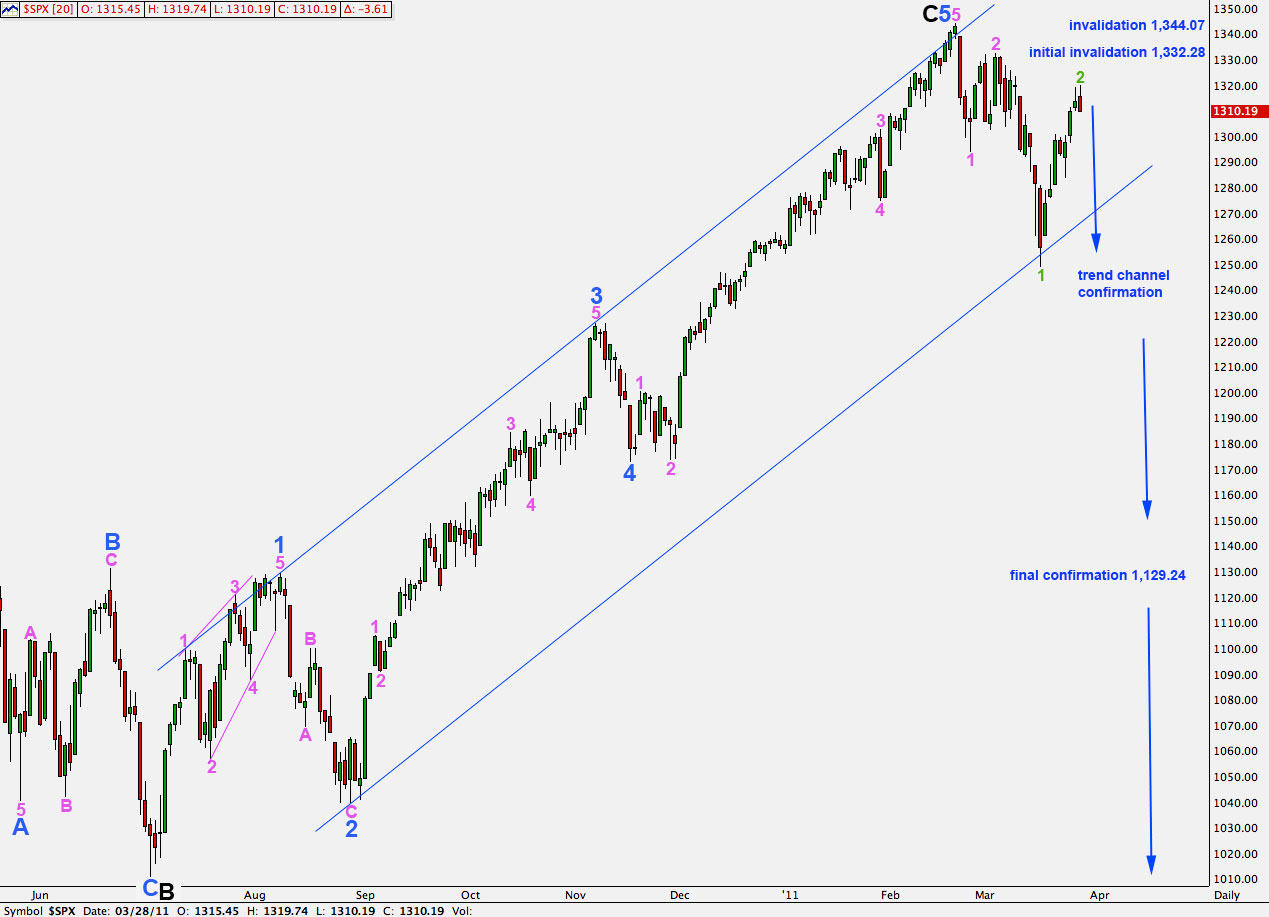

Alternate Wave Count.

This alternate wave count is similar for the Dow and the Russell 2000, which have both invalidated their respective alternates by upwards movement. For the Dow and Russell 2000 primary wave 2 cannot be over and downwards movement from the last high to the last low on the daily chart is a clear three wave zigzag.

I will continue to chart and present this alternate until it is correctly invalidated by movement above 1,332.28. It looks increasingly unlikely today that this wave count could be correct.

This wave count would have to see imminent downwards movement if it was to have any validity.

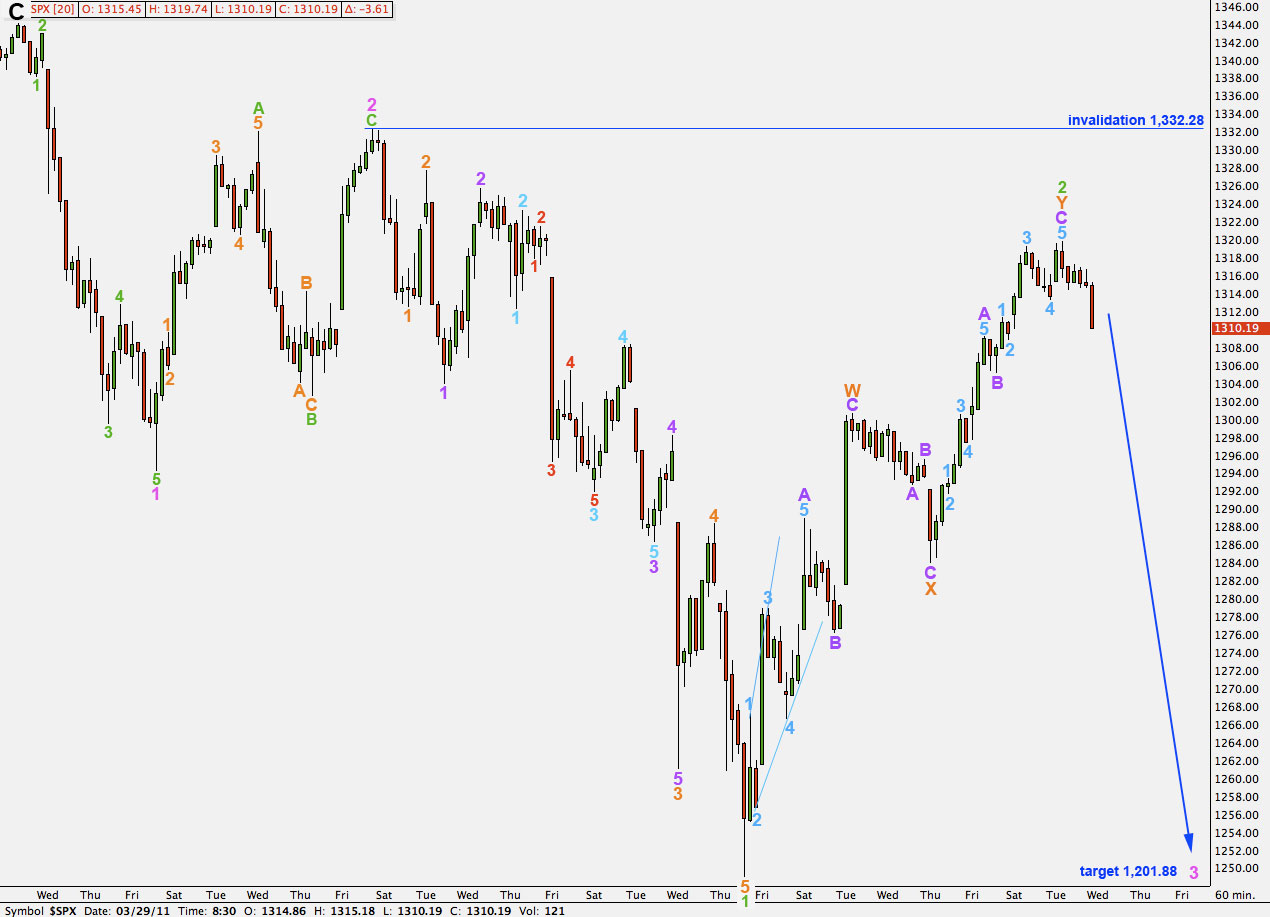

Wave 2 green here is labeled as a complete double zigzag correction. We could not place the label for wave 2 pink and the start of wave 1 green any higher.

Wave 2 green may not move beyond the start of wave 1 green. This wave count is invalidated with movement above 1,332.28.

The photo is a sunset at my local beach just down the road. It’s very beautiful.

Without a chart of your idea I’m struggling to see what you mean. From 30th April 2010 to 27th August 2010 it would be a zigzag with a truncated C wave. It could not be a flat because there is no B wave reaching beyond the start of A.

The outcome is pretty much the same as our main wave count anyway; we are within the fifth wave of wave C to end primary wave 2.

Actually, the S&P is way way easier than analysing forex markets and so I’m glad I’ve done it. Especially with this new data, there’s half the waves to analyse!

Forex is really horrible. The waves behave quite differently to stock markets. But then EW was written for stock markets, not forex.

Hi Lara-I love your photograph! Simply beautiful.

Just wondering if there might be a case to be made that the movement from 4/27/10 to the end of Aug 2010 could be a rare running flat and that 11/9/10 was the end of W1 with 2/18/11 the top of W3 and we are now finishing W5 of PW2.

Is this a possibility? I know it seems outside the box but this entire 2nd wave has been nothing if not opaque in nature. (obtuse)

Nothing would surprise me at this point. Aren’t you glad you began analyzing the S&P? What a grinding drama. (-:

Very best regards,

Robert