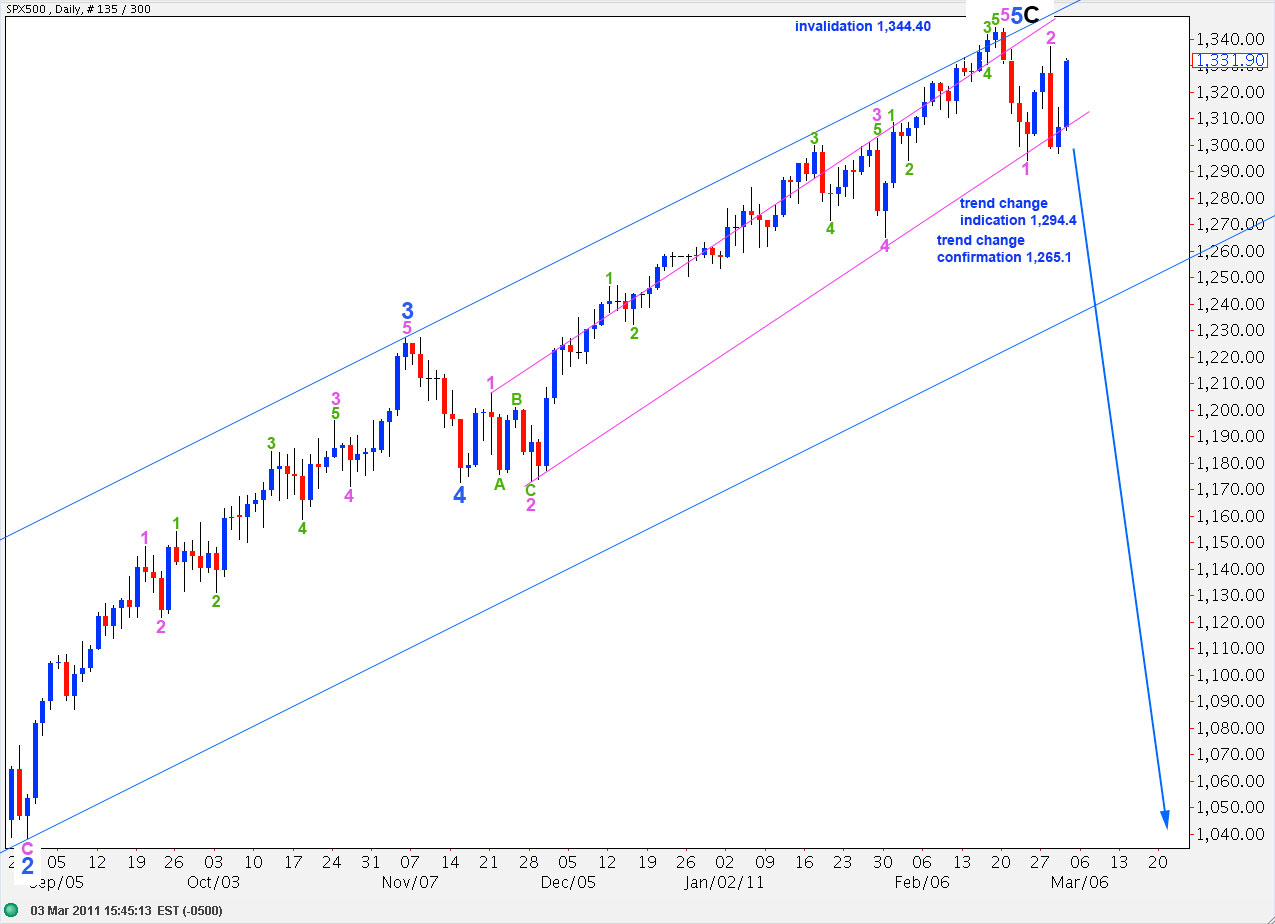

Elliott Wave chart analysis for the SPX500 for 3rd March, 2011. Please click on the charts below to enlarge.

The S&P has moved higher for a deep second wave correction and price remains below the invalidation point at 1,337.1 on the hourly chart.

The trend change still looks likely today. However, it remains unconfirmed. We need to see movement below the pink parallel channel containing wave 5 blue impulse upward and movement below 1,265.1 to confirm it. Until this trend change is confirmed we must allow that the S&P could yet continue to rise to new highs, and that primary wave 2 is not yet over.

I am still having difficulty seeing a decent looking wave count which allows for more upward movement to a new high for the S&P. So I will continue to present the most likely wave count which has the best fit and best ratios.

When this correction is over this wave count expects a resumption of strong downward movement.

It is possible to see wave A orange as either a three (labeled yesterday) or possibly as a five wave leading diagonal (labeled as such today). Either way, the following movement is most likely a B wave (or an X).

If price turns down here and we see no final upward wave above 1,332.6 then wave 2 green was a double zigzag.

If price continues upward for one final wave then wave C orange will reach 1.618 the length of wave A orange at 1,333.9. At that stage upward movement will be a complete corrective wave count.

The next move when this second wave is complete should be a strong third wave downward, which must end beyond the end of wave 1 green and must take price below 1,296.9.

Likewise wave 3 pink must end beyond the end of wave 1 pink and must take price below 1,294.4.

At 1,256.2 wave 3 pink will reach 1.618 the length of wave 1 pink. This is our short term target which may be achieved in another one to few days. The duration depends upon how swiftly wave 3 green moves downward.

Wave 2 green may not move beyond the start of wave 1 green. Therefore, it may not move above 1,337.1.

Thanks Lara. I had seen the double zig zag in my counts. I’m very curious to see what unfolds.

John

So far it’s doing pretty much what we expect; a deep second wave correction followed by strong downwards movement.

The depth of these second waves and the failure of the last downwards wave to move beyond the end of it’s predecessor it slightly concerning. I’m going to develop an alternate over the weekend and use it until its invalidated.

I still want to see a trend channel breach to have more confidence that we’ve had a trend change.