Elliott Wave chart analysis for the SPX500 for 27th January, 2011. Please click on the charts below to enlarge.

We have a little further upward movement to a new high. Therefore, we have only one hourly wave count today.

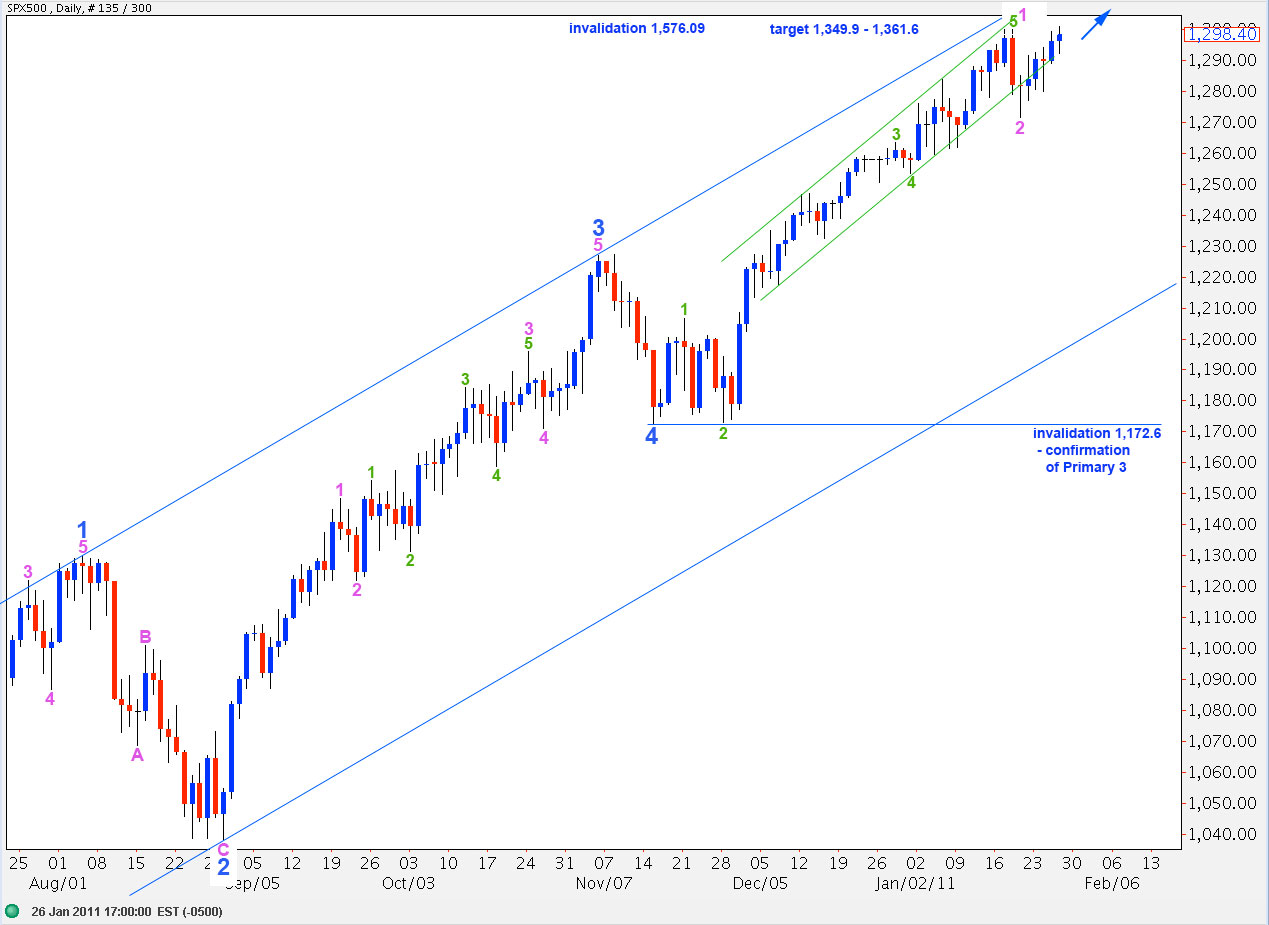

We should expect price to continue higher for at least another session, if not another couple of days. It may even make it up into the target zone before a trend change. At 1,349.9 wave 5 blue will reach equality with wave 3 blue. At 1,361.6 wave C black will reach 0.618 the length of wave A black.

This degree of labeling sees recent downward movement as a second wave at minute degree. The S&P would, therefore, be within a third wave within wave 5 blue.

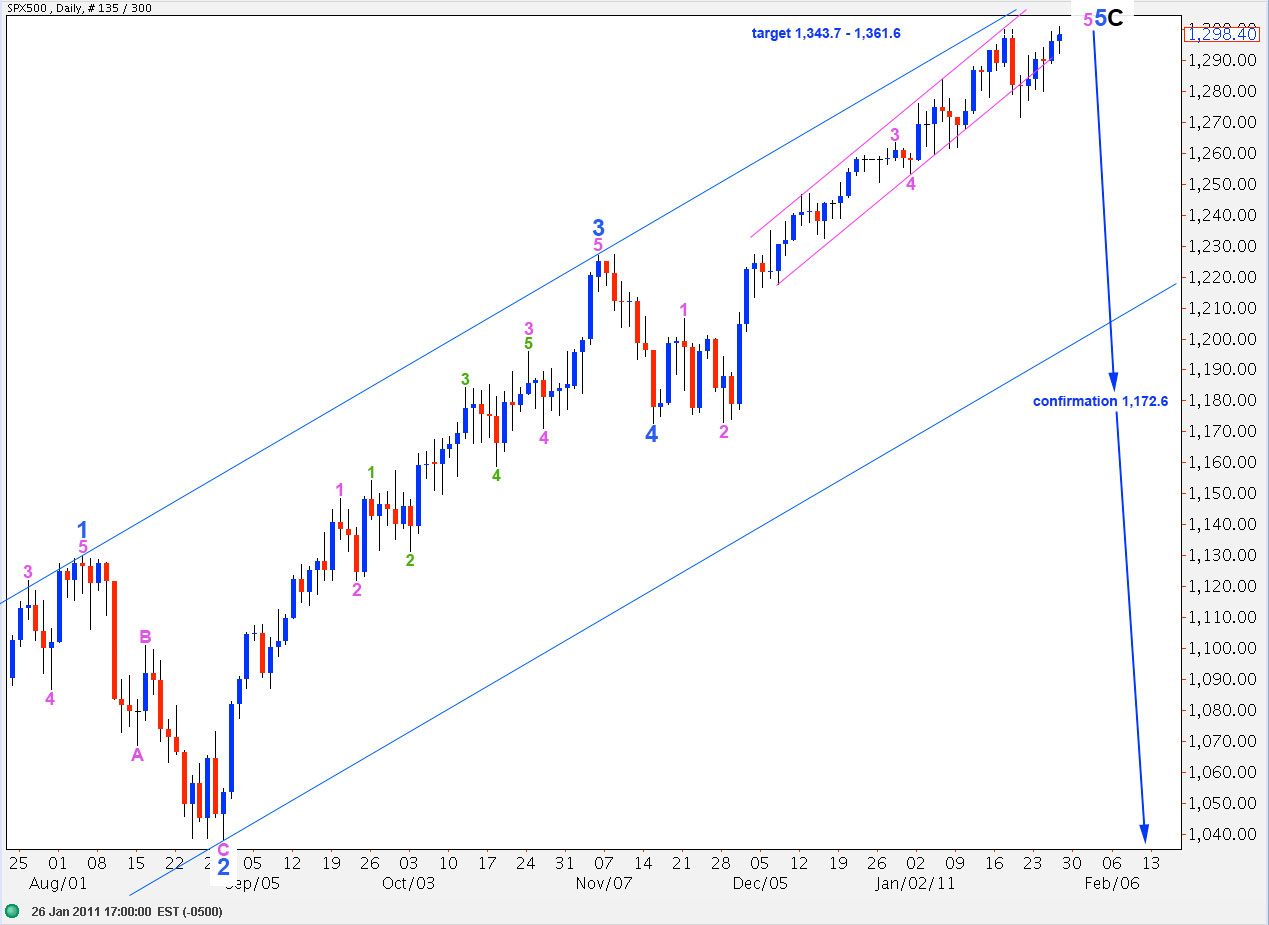

This degree of labeling has a slightly different target zone.

At 1,343.7 wave 5 pink will reach equality with wave 3 pink. At 1,361.6 wave 5 blue will reach equality with wave 3 blue. At 1,349.9, within the target zone, wave C black will reach 0.618 the length of wave A black.

My alternate daily wave count has a minimum upward requirement of 1,485.2. We shall only use this wave count if the S&P rises that high.

Movement above 1,299.9 invalidated the wave count which saw a high in place and confirmed that the S&P has yet further up to go before a trend change.

We should always assume that the trend remains the same, until proven otherwise. At this stage movement below 1,271.4 would be confirmation of a trend change.

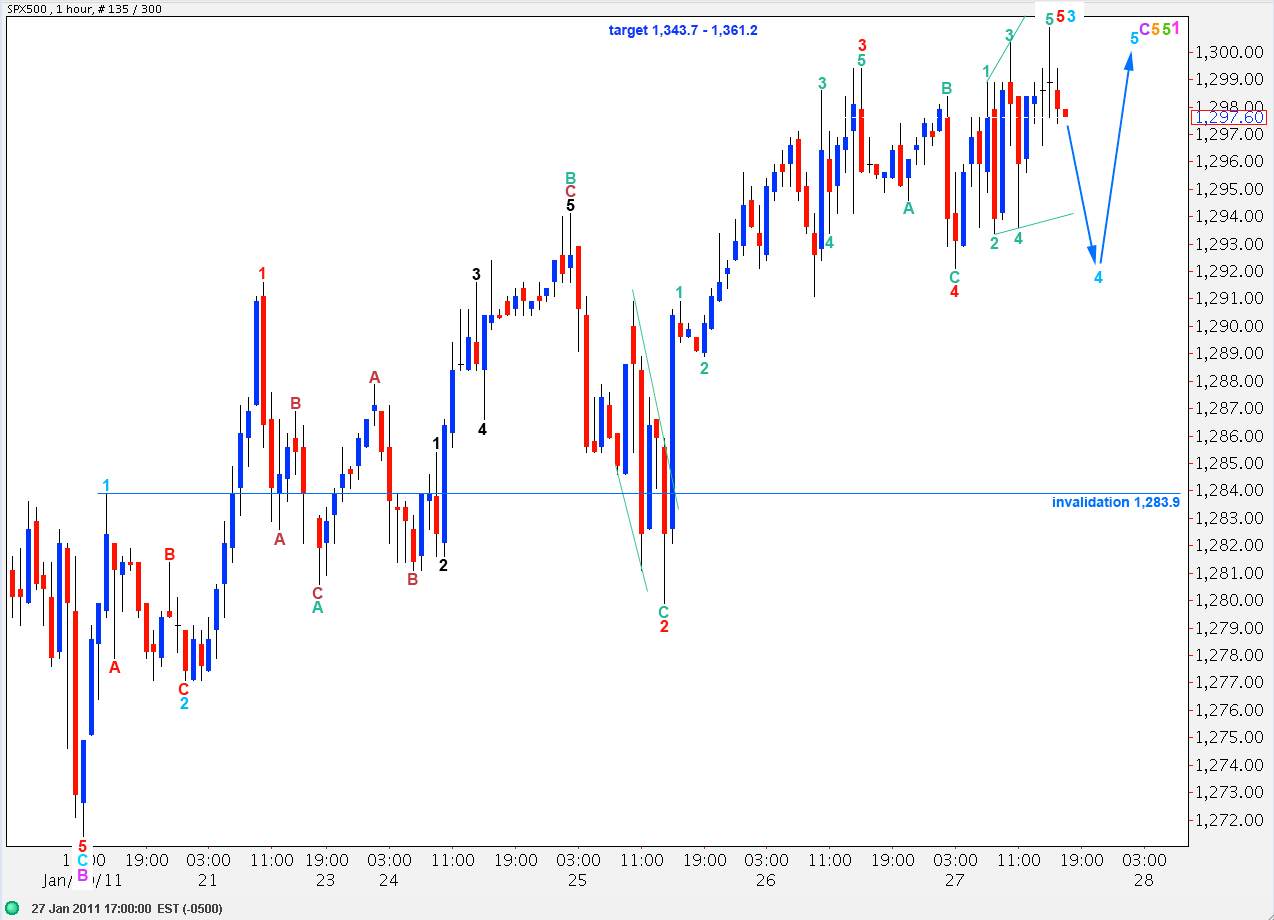

This degree of labeling in the hourly chart is in line with the first daily wave count degree of labeling. For the alternate degree of labeling we should move everything up one degree.

This terminal fifth wave at green degree is unfolding as an expanding diagonal. Wave 5 orange of it, the last fifth wave, is a zigzag.

Within wave C purple so far it is unfolding as an impulse. Wave 3 aqua is 3.6 points longer than 1.618 the length of wave 1 aqua.

Ratios within wave 3 aqua are: wave 3 red has no fibonacci ratio to wave 1 red and wave 5 red is just 0.16 short of 0.618 the length of wave 1 red.

This structure requires a fourth wave at aqua degree, which may not move into wave 1 aqua price territory, to be followed by a final fifth wave to the upside at aqua degree. At that stage we shall have a complete wave structure at all degrees of labeling.

Wave 4 aqua may not move into wave 1 aqua price territory. Therefore, movement below 1,283.9 would invalidate this wave count.

Thanks Lara!!

John