Elliott Wave chart analysis for the SPX500 for 21st December, 2010. Please click on the charts below to enlarge.

As expected from last analysis the S&P has moved higher. It is now within our target zone for upward movement to end.

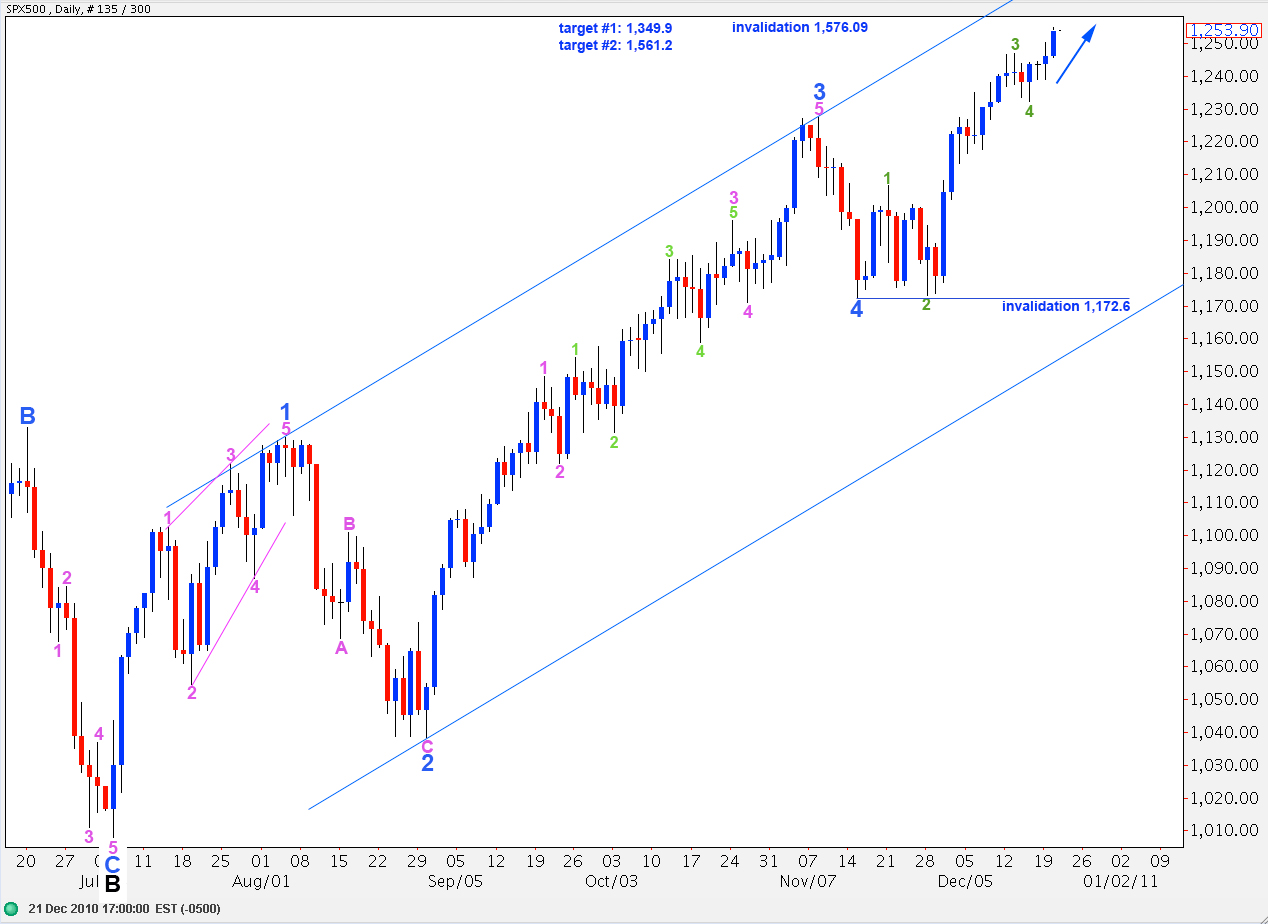

In the long term we may see wave C black end about 1,349.9 where it reaches 0.618 the length of wave A black, or at 1,561.2 where it reaches equality with wave A black. This second target is more likely as equality is the most common relationship between waves A and C.

Upward movement may not move above 1,576.09 as primary wave 2 may not move beyond the end of primary wave 1.

Downward movement for this wave count may not move below 1,129.9 as wave 4 blue may not move into wave 1 blue price territory. If this wave count is invalidated by downward movement then we must consider the possibility that primary wave 2 is over and primary wave 3 is underway.

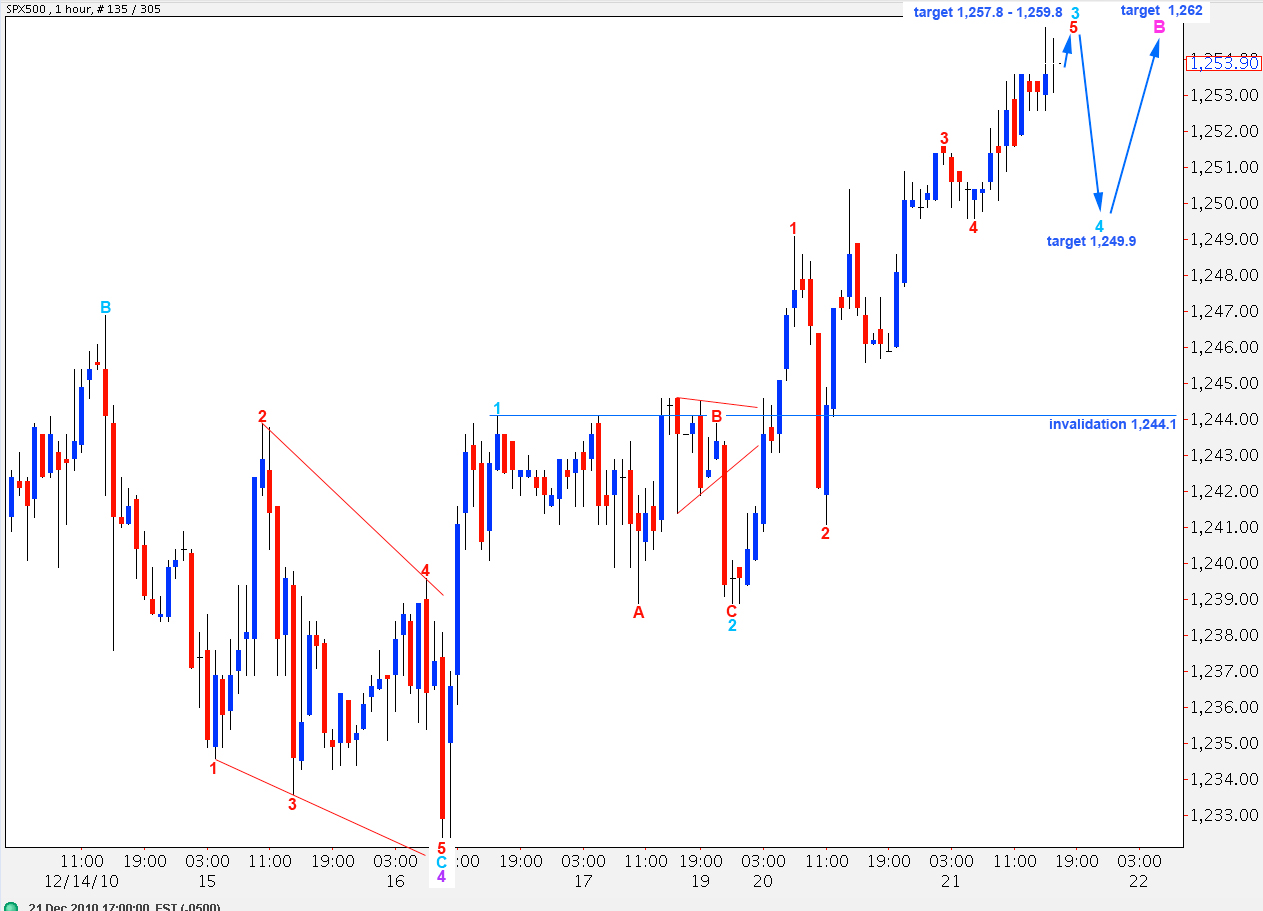

As expected from yesterday’s analysis the S&P moved higher into the target zone.

Wave 5 orange is completing as a simple impulse and of this wave 5 purple is completing also as an impulse.

Within wave 5 purple wave 3 aqua will reach 1.618 the length of wave 1 aqua at 1,257.8. This is the lower end of the first upside target zone.

Within wave 3 aqua wave 4 red is just 0.3 longer than wave 1 red. If wave 5 red reaches equality with wave 1 red then it will end at 1,259.8. This is the upper end of the small target zone for this current wave to end.

About 1,257.8 to 1,259.8 we may see a short term trend change for a fourth wave correction at aqua degree.

Wave 4 aqua may not move into wave 1 aqua price territory. Therefore, the invalidation point today is at 1,244.1.

Wave 4 aqua is likely to correct to about the fourth wave of one lesser degree about 1,249.9.

Thereafter, a final upwards five wave structure will end wave B pink about 1,262.

Alternate Daily Wave Count.

This wave count sees wave 4 blue as over, and remarkably brief, lasting only 6 days. However, with further upward movement this wave count continues to be technically valid.

Movement below 1,172.6 would invalidate this wave count.

Upward long term targets and invalidation points are the same as the main daily wave count.

Lara,

How can you tell that there are not four pairs of 1 and 2’s, two of which you labeled in blue and oragne? The other two I am refering to are between the 1/2 and 3/4 orange and the other one is the 3/4 orange itself.

Mike

It is certainly possible, its another alternate. I guess I’m biased to seeing an end closer to the target zone I have. It’s in there now so I’ll be looking to see if we have a complete structure, and if we do it could be about to turn. With this very long upwards movement there will be several alternates and so I’ll also be looking for an alternate which could see further upwards movement. Then we’ll have to work with invalidation and confirmation points.