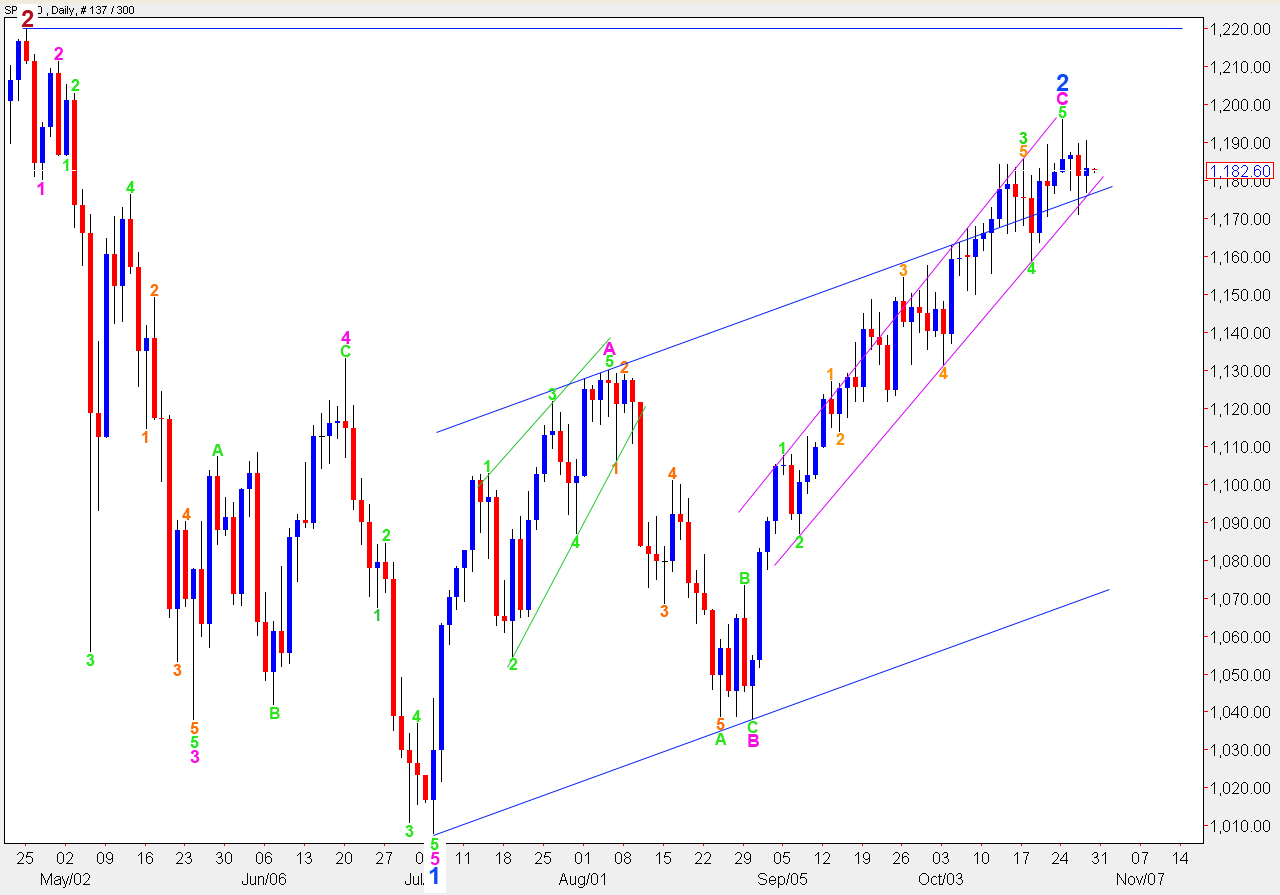

Elliott Wave chart analysis for the SPX500 for 28th October, 2010. Please click on the charts below to enlarge.

We still have two wave counts for the S&P. Downwards movement has again found resistance at the lower trend line for wave C pink.

While price remains above 1,158.9, and within the pink parallel channel drawn on the daily chart, we must assume the trend remains up.

Main Wave Count.

This wave count follows on from yesterday which sees an end to upwards movement. However, the trend change is unconfirmed. When we can see a full candlestick outside the lower edge of the pink parallel channel on the daily chart then we will have confirmation that the trend has changed from up to down.

Within wave 2 blue there is no fibonacci ratio between waves A and C pink.

Ratios within wave C pink are: wave 3 green is 13.7 points short of 1.618 the length of wave 1 green and wave 5 green is just 0.4 points short of 0.382 the length of wave 3 green.

This wave count is invalidated by movement above 1,196.1.

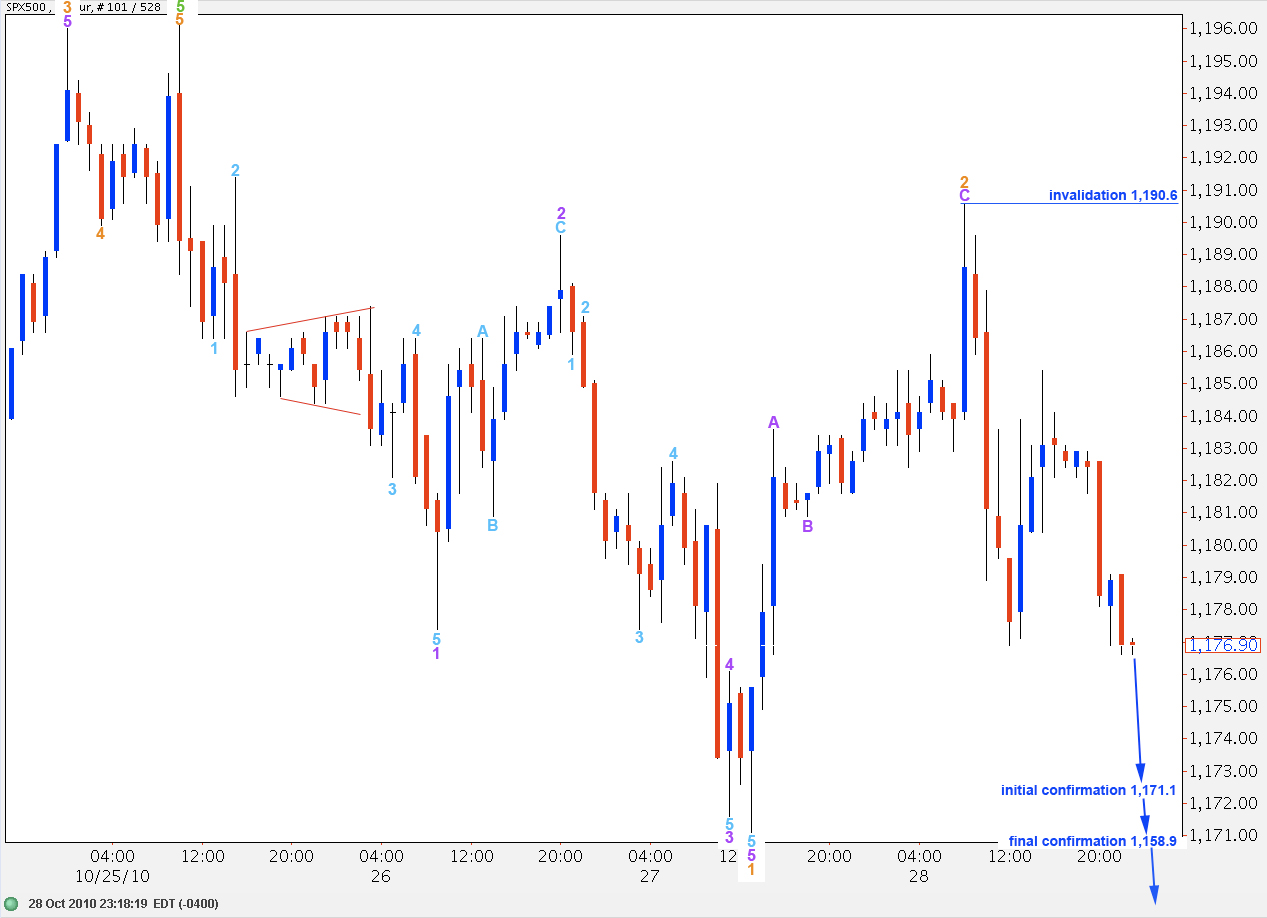

I have adjusted the wave count for wave 1 orange from yesterday’s interpretation. This wave count has a slightly better fit.

Wave 2 orange may have been over at 1,190.6. Alternatively, this may have been only wave A of wave 2 orange. If wave 2 orange extends further upwards it cannot move above the start of wave 1 orange at 1,196.1.

Ratios within wave 2 orange are: wave 3 purple has no fibonacci ratio to wave 1 and wave 5 purple is just 0.35 points short of 0.382 the length of wave 1.

Within wave 2 orange if it was over here wave C purple is just 2 points longer than 0.618 the length of wave A purple.

Because wave 3 orange must move beyond the end of wave 1 orange this wave count will be initially confirmed with movement below 1,171.1.

We will have final confirmation of a trend change with a breach of the trend channel and movement below 1,158.9.

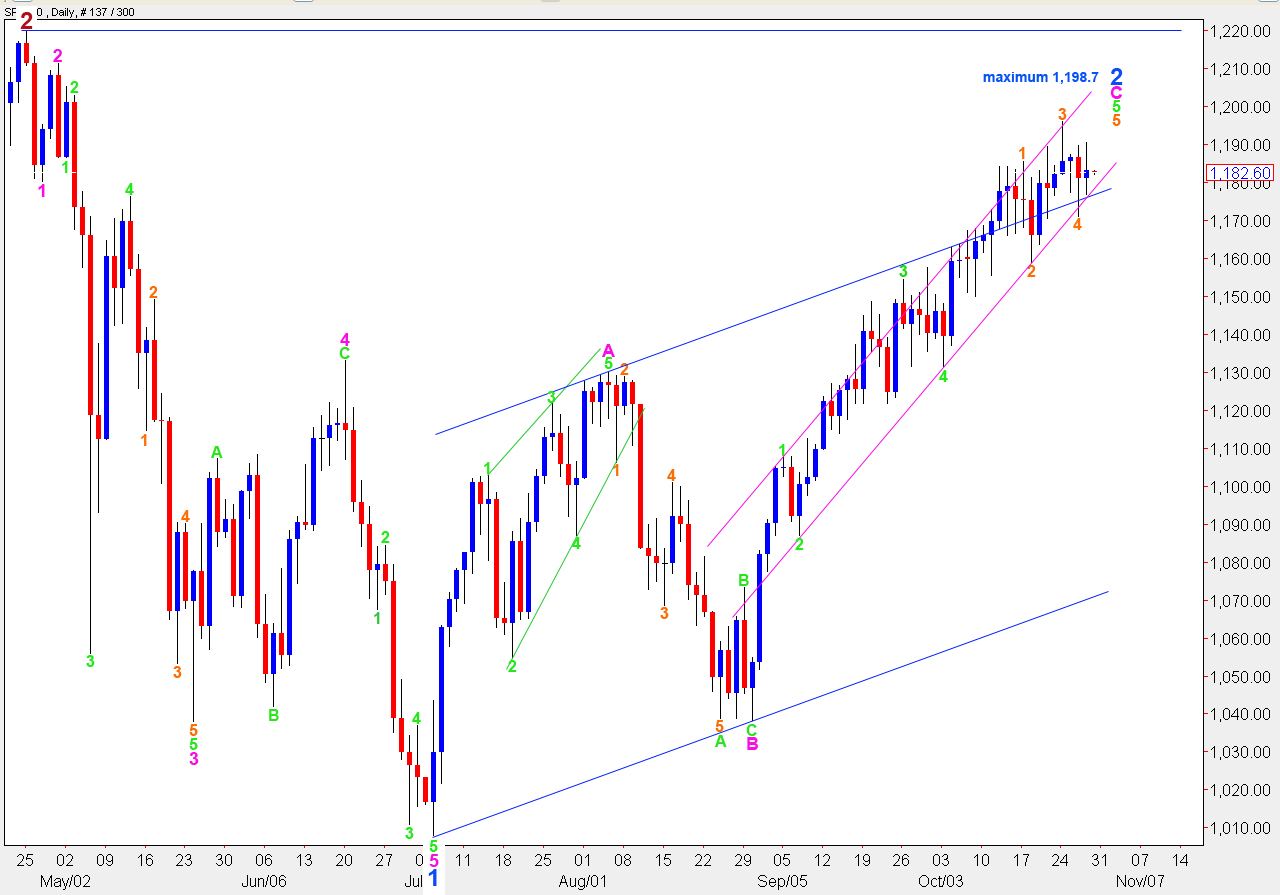

Alternate Wave Count.

This alternate wave count expects further upwards movement.

Because wave 3 green is 1.9 points shorter than wave 1 green this wave count has a maximum allowable upwards movement for wave 5 green to equality with wave 3 green, because wave 3 cannot be the shortest. Therefore, upwards movement cannot move above 1,198.7.

Wave 5 green is unfolding as an ending contracting diagonal. Each subwave of an ending diagonal must subdivide into a zigzag.

Wave 4 orange of the ending diagonal is best seen as a double zigzag.

Within wave W purple wave C aqua is just 1.5 points short of equality with wave A aqua.

Within wave X purple wave C aqua is just 0.3 short of equality with wave A aqua.

Within wave Y purple wave C aqua is just 0.7 points short of equality with wave A aqua.

For upwards movement labeled wave A purple ratios are: wave 3 aqua is just 0.78 short of 2.618 the length of wave 1 aqua and wave 5 aqua is just 0.4 short of 1.618 the length of wave 1 aqua.

At 1,194.1 wave 5 orange to end this diagonal will reach 0.618 the length of wave 3 orange. This would see a fifth wave truncation.

If we see movement below 1,171.1 then we should use the main wave count.

Is it possible the same chart can be viewed from the bull side ? Tag that top at 1193 as end of the preceding bull run, which he neglected in the chart. Then then entire 5 wave down is the corrective A down to 1168. It goes up to red 2 which can be viewed as B. Now in the corrective C, which would show the other side of the argument ?

Yes, that’s certainly possible. 1-2-3 has the same look as a zigzag A-B-C, it’s not until you are into wave 4 that you can figure out invalidation points and confirmation points for the difference and then see which way the market goes. That’s also why a trend channel breach is so important.

in the cash index we are in a tight little triangle and i have a tight stop right above it’s 5th wave just in case. can’t trust this market in short term. i think we’ve all learned this painful lesson. (-:

Hi Lara-Glad to know you’re having a great visit.

Doing any line dancing? (-:

I have added a link to a chart of ES-Mini. What I am seeing is an expanding leading diagonal with a correction up to wave 2 of the diagonal which, of course is common.

Perhaps we have seen the end of this long and dusty trail (as they say in Texas cattle drives).

http://www.screencast.com/t/GFbQf75HHv3

Very best regards,

Robert

That’s a good wave count, meeting all rules and many guidelines. It’s a nice five waves down. I’m expecting that the end is very close now, and I sure hope so because this long wait is too drawn out for my liking.

The pound and euro still have solid breaches of their trend channels. I hope to update the dollar today.

I’m not a fan of line dancing, but I have had a few Salsa lessons. We have done a wee bit of Latin dancing. I’m visiting Houston next week, that city is amazing to me. There are more people in that one city than my entire country! I’ll be visiting Houston, Corpus Christi, San Diego and San Francisco before we go back home. All friends and family visits. We may drive up to Dallas just for a day; I used to watch “Dallas” when I was a kid and I’d get a kick out of visiting the city.

The ACL festival was fun. I’m going to check out some live Reggae here in Austin, and I’ll see if I can find some Jazz too. The weather is nice and warm. I’m having a fabulous time.

I have not driven here in the US yet, you all drive on the other side of the road. I’m used to how it looks now, so I may give it a go. So if you’re in one of those locations and you see a crazy Kiwi driving looking somewhat confused, that’ll be me 🙂

Love Corpus Christi. Bright light. Lots of white stucco. Tile roofs. Beautiful beach. Serious Spanish influence in architecture. Used to live in SF. Incredibly beautiful city and area. Used to crew on sailboat every weekend in the bay.

Enjoy!