Last analysis again expected upwards movement, which is exactly how the week ended, with a strong green candlestick for Friday.

Summary: The target is now at 2,922.

Traders with a lower risk appetite may set stops just below yesterday’s low. For those comfortable with the possibility of an underwater position for a few days, stops may be just below 2,553.80.

A more cautious approach here may be to wait for an upwards breakout above the triangle B-D trend line before entering another long position.

There is again bullish divergence between price and On Balance Volume, VIX and the AD line. It looks like a low is in place.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

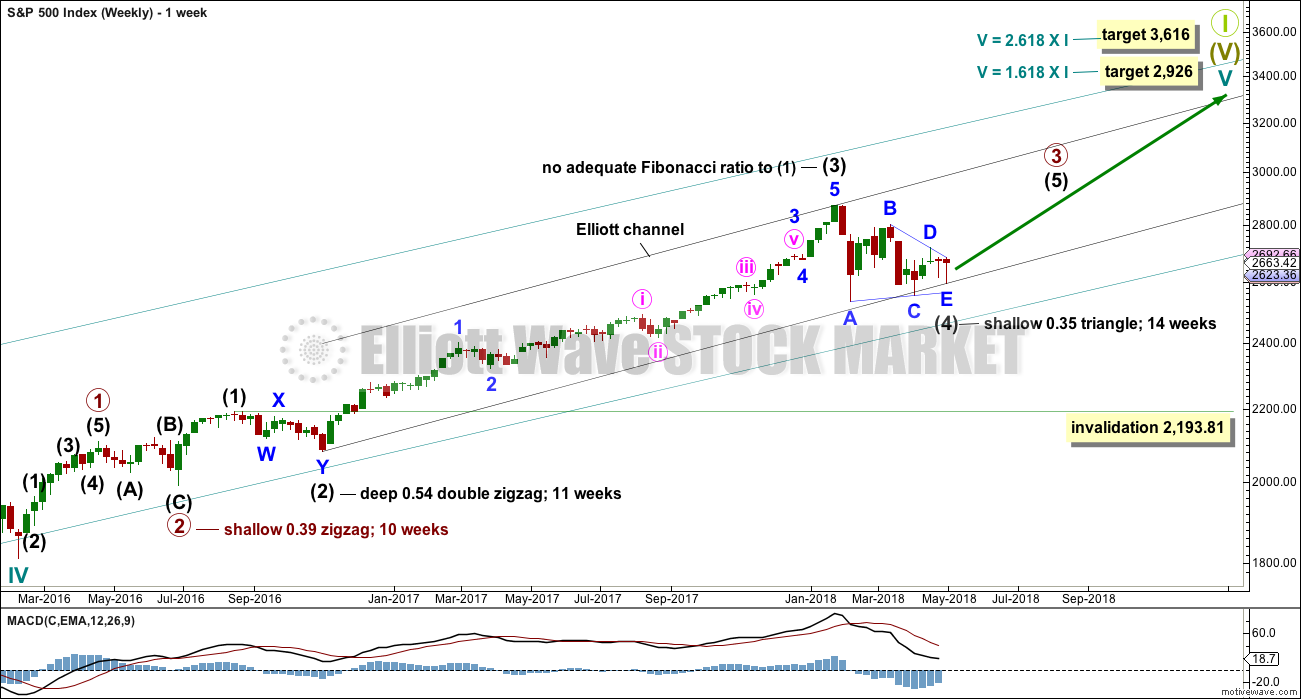

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

At least three wave counts remain valid at the daily chart level. It is possible still that a low may not be in place; intermediate wave (4) could still continue further. Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. However, it would be extremely likely to remain within the wider teal channel (copied over from the monthly chart) if it were to be reasonably deep. This channel contains the entire bull market since the low in March 2009, with only two small overshoots at the end of cycle wave IV. If this channel is breached, then the idea of cycle wave V continuing higher would be discarded well before the invalidation point is breached.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, there are still three possible structures for intermediate wave (4): a triangle, a combination, and a flat correction. All three will be published. The triangle is preferred because that would see price find support about the 200 day moving average. While this average provides support, it is reasonable to expect it to continue (until it is clearly breached).

The triangle may be complete now, but the other two possibilities of a flat and combination may be incomplete.

DAILY CHART

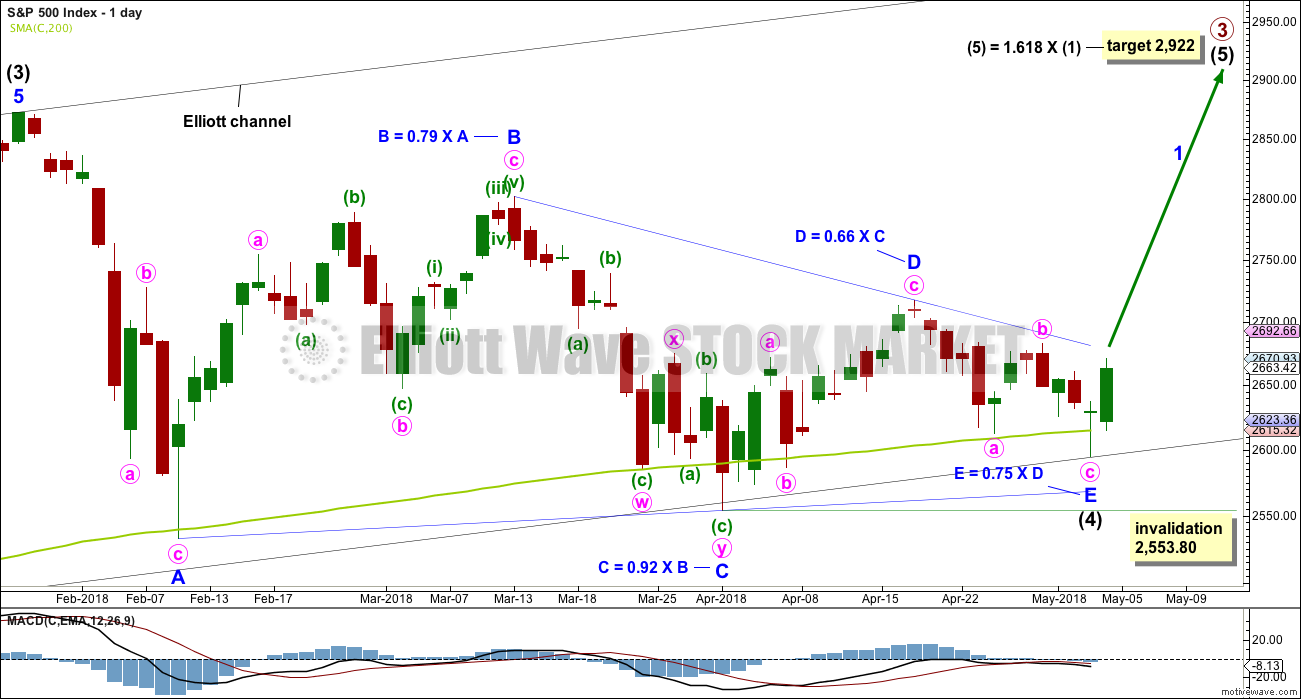

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just above the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

It must still be accepted that the risk with this wave count is that a low may not yet be in place; intermediate wave (4) could continue lower. For this triangle wave count, minor wave E may not move beyond the end of minor wave C below 2,553.80.

When price has clearly broken out above the upper triangle B-D trend line, then the invalidation point may be moved up to the end of intermediate wave (4).

HOURLY CHART

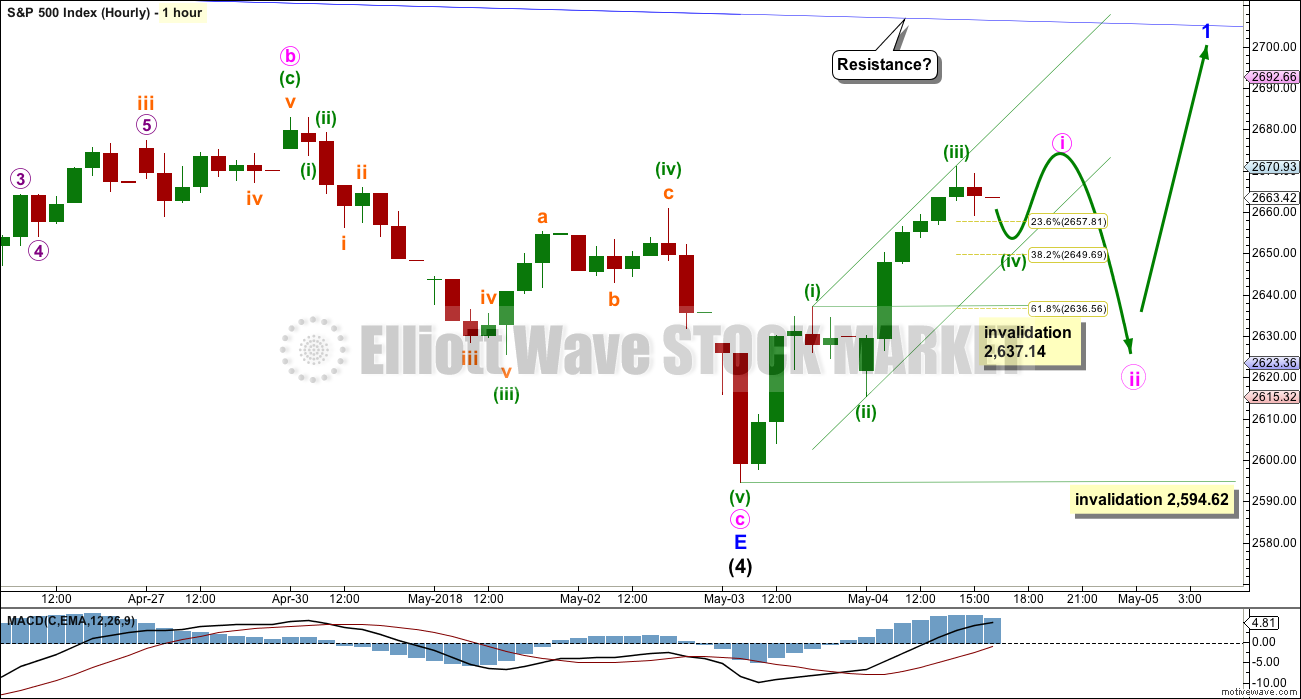

If the triangle for intermediate wave (4) is complete, then intermediate wave (5) upwards should begin with a five up on the hourly chart. This looks incomplete. It is labelled minute wave i.

Within minute wave i, minuette waves (i), (ii) and (iii) may be complete. There is no Fibonacci ratio between minuette waves (i) and (iii). Minuette wave (iv) may not move into minuette wave (i) price territory below 2,637.14.

A small channel is drawn about minute wave i using Elliott’s first technique. The lower edge of this channel may provide support for minuette wave (iv). Minuette wave (ii) was a relatively deep 0.51 zigzag. Given the guideline of alternation, it is reasonable to expect minuette wave (iv) to be a shallow correction, reaching to only the 0.236 or 0.382 Fibonacci ratios. It is most likely to be one of a flat, combination or triangle. These are sideways types of structures.

When minuette waves (iv) and (v) are complete, then a five wave impulse upwards for minute wave i may be complete. The following pullback for minute wave ii may not move beyond the start of minute wave i below 2,594.62.

Along the way up, it is possible that price may find resistance at the upper edge of the triangle B-D trend line, which is copied over here from the daily chat and extended outwards. It is also possible that price may cleanly slice through this trend line; if that happens, it would offer confidence in this wave count.

Once resistance at the triangle B-D trend line is breached it may then offer support.

ALTERNATE WAVE COUNTS

DAILY CHART – COMBINATION

I have charted a triangle a great many times over the years, sometimes even to completion, only to see the structure subsequently invalidated by price. When that has happened, the correction has turned out to be something else, usually a combination. Therefore, it is important to always consider an alternate when a triangle may be unfolding or complete.

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double should be joined by a three in the opposite direction labelled minor wave X, which may be a complete zigzag. X waves within combinations are typically very deep; if minor wave X is over at the last high, then it would be a 0.79 length of minor wave W, which is fairly deep giving it a normal look. There is no minimum nor maximum requirement for X waves within combinations.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but at this stage the expected direction for that idea does not differ now from the main wave count.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag. It may also be a double zigzag.

Minute wave b must now reach a minimum 0.90 length of minute wave a. Minute wave b may be unfolding as a double zigzag. Within a double zigzag, the second zigzag exists to deepen the correction when the first zigzag did not move price deep enough. Double zigzags normally have a strong slope like single zigzags. To achieve a strong slope the X wave within a double zigzag is normally brief and shallow, most importantly shallow (it rarely moves beyond the start of the first zigzag). A new low now below 2,586.27 should see the idea of a double zigzag for minute wave b discarded.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average, which looks unlikely but does have precedent in this bull market.

Minute wave b may make a new high above the start of minute wave a if minor wave Y is an expanded flat. There is no maximum length for minute wave b, but there is a convention within Elliott wave that states when minute wave b is longer than twice the length of minute wave a the idea of a flat correction continuing should be discarded based upon a very low probability. That price point would be at 3,050. However, if price makes a new all time high and upwards movement exhibits strength, then this idea would be discarded at that point. Minute wave b should exhibit obvious internal weakness, not strength.

At this stage, the very bullish signal last week from the AD line making a new all time high puts substantial doubt on this wave count. It has very little support from classic technical analysis.

DAILY CHART – FLAT

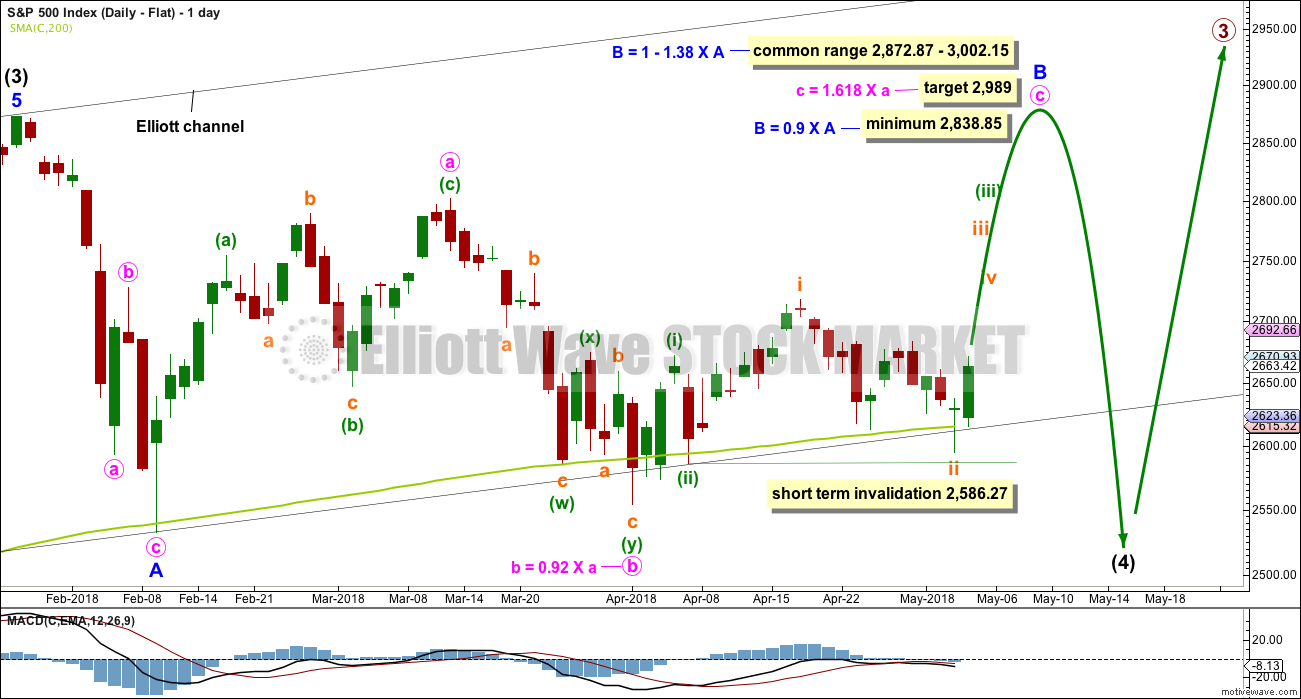

Flat corrections are very common. The most common type of flat is an expanded flat. This would see minor wave B move above the start of minor wave A at 2,872.87.

Within a flat correction, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,838.85. The most common length for minor wave B within a flat correction would be 1 to 1.38 times the length of minor wave A at 2,872.87 to 3,002.15. An expanded flat would see minor wave B 1.05 times the length of minor wave A or longer, at 2,889.89 or above. A target is calculated for minor wave B to end, which would see it end within the common range.

Minor wave B may be a regular flat correction, and within it minute wave a may have been a single zigzag and minute wave b may have been a double zigzag. This has a very good fit.

However, minute wave c must be a five wave structure for this wave count and now the depth and duration of subminuette wave ii looks wrong. The probability that minute wave c upwards is unfolding as an impulse is now reduced. It is possible that it could be a diagonal, but that too has a relatively low probability as the diagonal would need to be expanding to achieve the minimum price target for minor wave B, and expanding ending diagonals are not very common.

At its end minor wave B should exhibit obvious weakness. If price makes a new all time high and exhibits strength, then this wave count should be discarded.

This wave count would require a very substantial breach of the 200 day moving average for the end of intermediate wave (4). This is possible but may be less likely than a smaller breach. The bullish signal from the AD line making a new all time high puts substantial doubt on this wave count.

TECHNICAL ANALYSIS

WEEKLY CHART

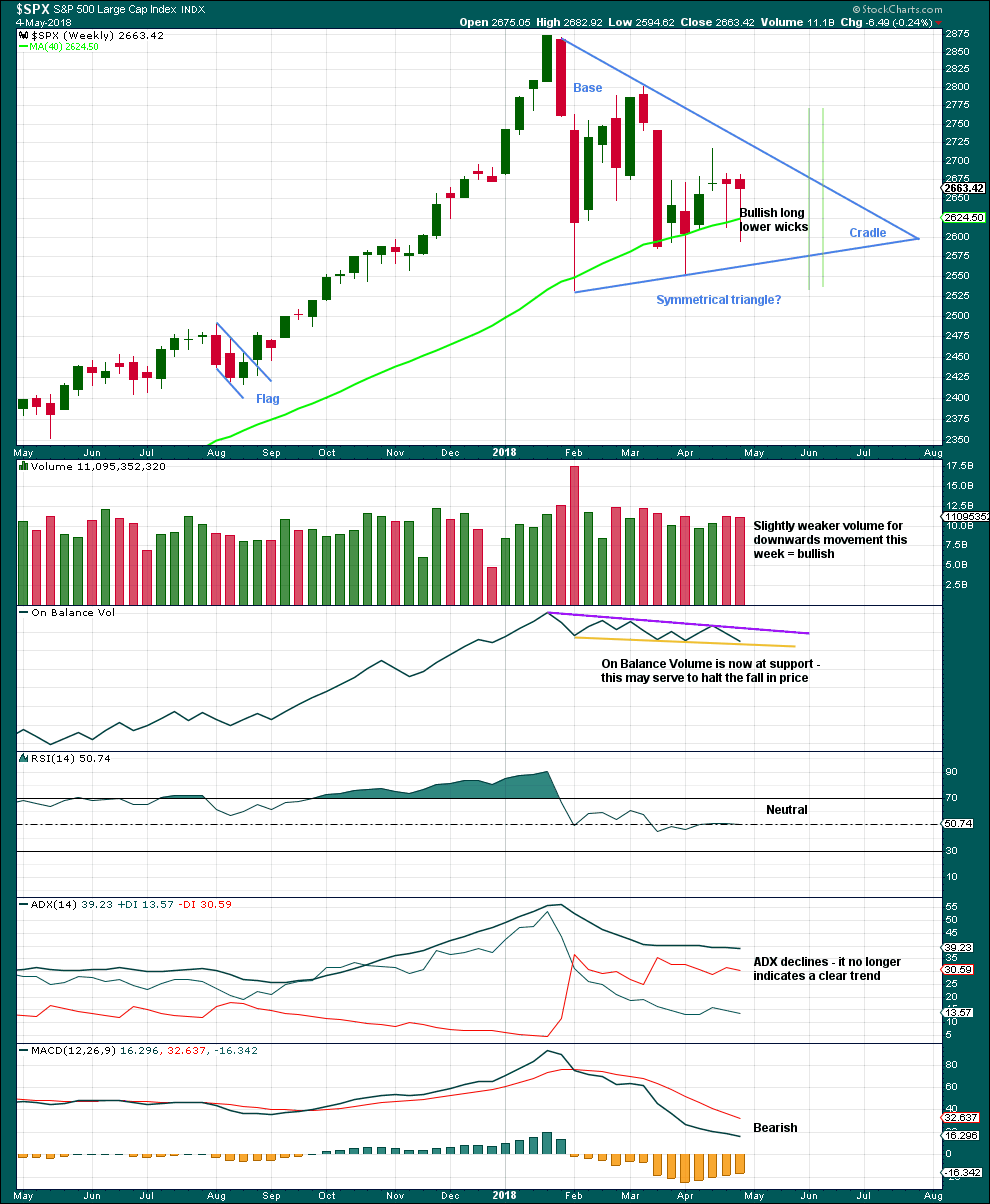

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle pattern may be forming. These are different to Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns, while Elliott wave triangles are always continuation patterns and have stricter rules.

The vertical green lines are 73% to 75% of the length of the triangle from cradle to base, where a breakout most commonly occurs.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout has not yet happened. There is a high trading range within the triangle, but volume is declining.

The triangle may yet have another 5 – 6 weeks if it breaks out at the green lines.

Now two bullish long lower wicks are complete, and the second wick is even longer so more bullish. On Balance Volume is at support, which may halt the fall in price. The resistance line on On Balance Volume this week is slightly adjusted to have stronger technical significance.

DAILY CHART

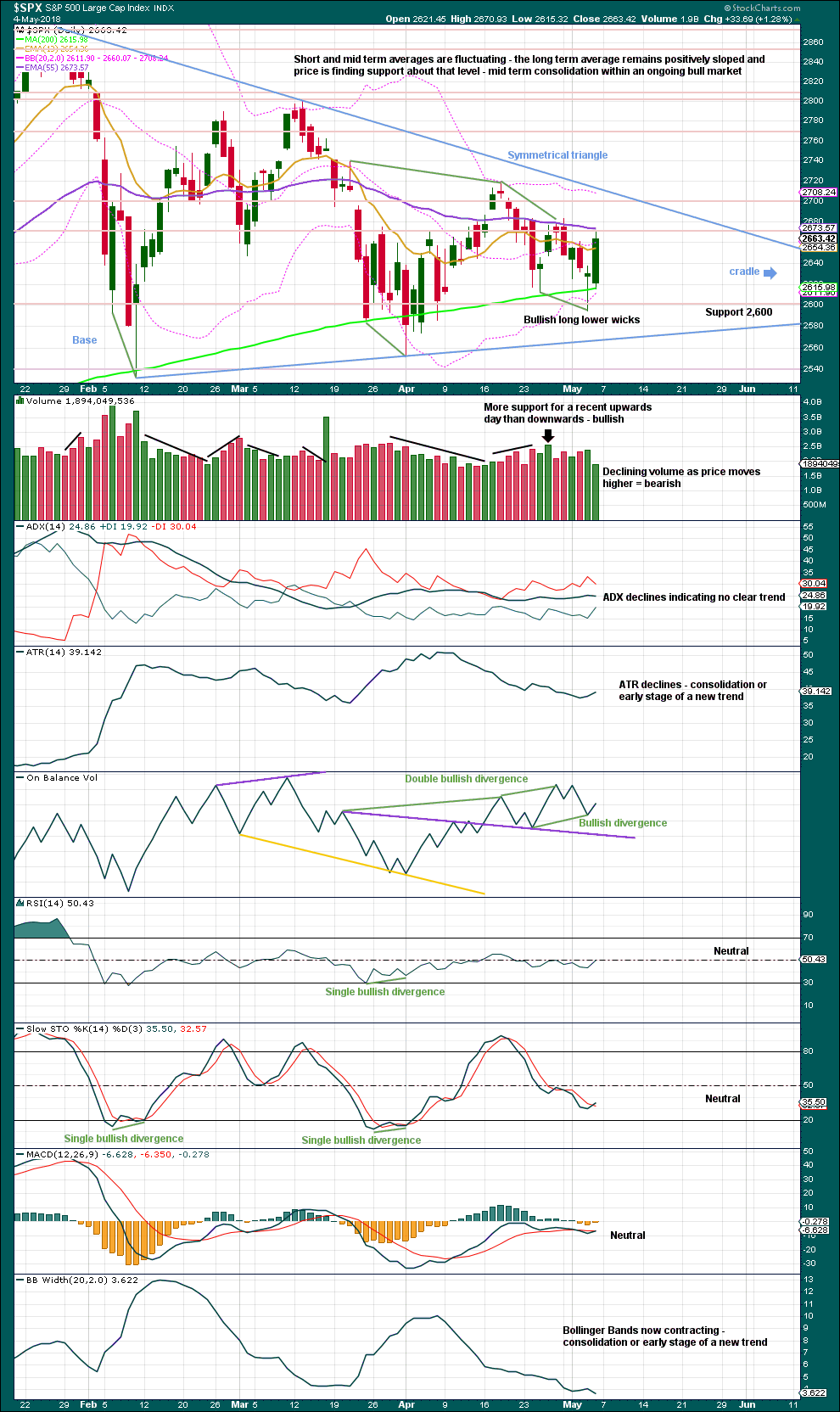

Click chart to enlarge. Chart courtesy of StockCharts.com.

During this large consolidation, there are two green daily candlesticks with strongest volume:

1. the 6th of February was a downwards day, but it closed green and the balance of volume that day was upwards; this has the strongest volume during the consolidation.

2. the 16th of March was an inside day, which closed green and has the balance of volume upwards; this has the next strongest volume.

This market has been range bound since the last all time high. Volume suggests an upwards breakout is more likely than downwards. With price coiling in an ever decreasing range, it looks like a classic symmetrical triangle is forming. These are similar but not completely the same as Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns while Elliott wave triangles are always continuation patterns.

Breakouts from symmetrical triangles most commonly occur from 73% to 75% of the length from base to cradle. In this instance, that would be in another 18 to 20 sessions. A breakout should be a close above or below the triangle trend lines, and an upwards breakout should have support from volume for confidence.

After an upwards breakout, pullbacks occur 59% of the time. After a downwards breakout, throwbacks occur 37% of the time.

After a breakout, the base distance (the vertical distance between the initial upper and lower reversal point prices) may be added to the breakout price point to calculate a target. Here, the base distance is 320.28 points.

There are now two instances of recent bullish divergence between price and On Balance Volume. Price has made a new swing low below the prior low of the 25th of April, but On Balance Volume has not. This indicates weakness in price and is bullish.

It is concerning for bulls though that despite a strong green daily candlestick for Friday volume was very light. But bullish signals from On Balance Volume should be given more weight.

VOLATILITY – INVERTED VIX CHART

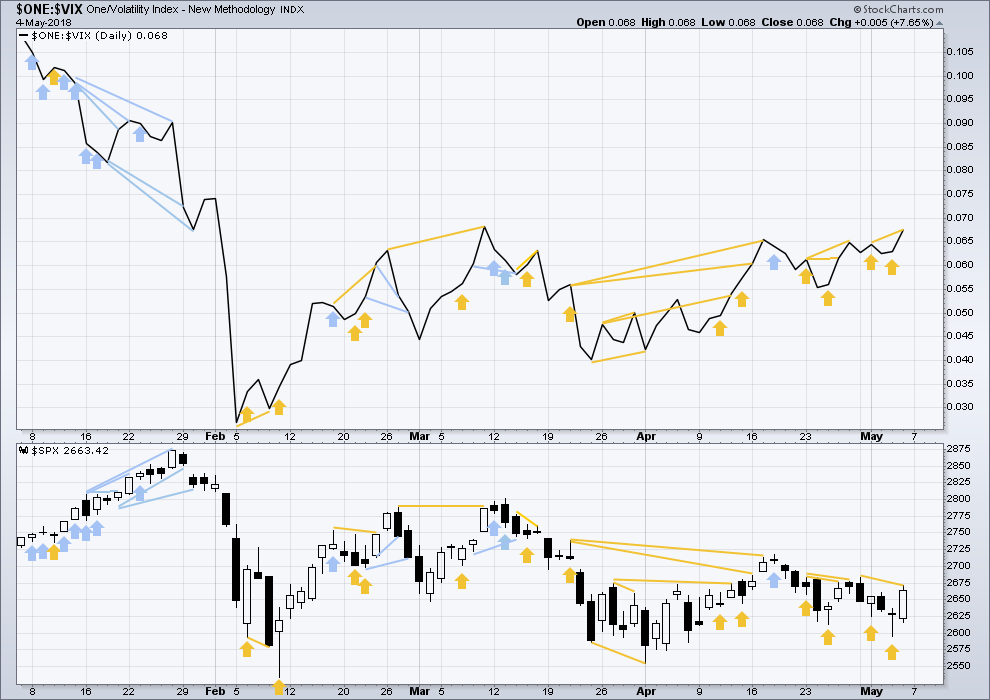

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still a cluster of bullish signals on inverted VIX. Overall, this may offer support to the main Elliott wave count.

Inverted VIX has made a small new swing high, but price has not. This divergence is bullish. The cluster of bullish signals is increasing.

BREADTH – AD LINE

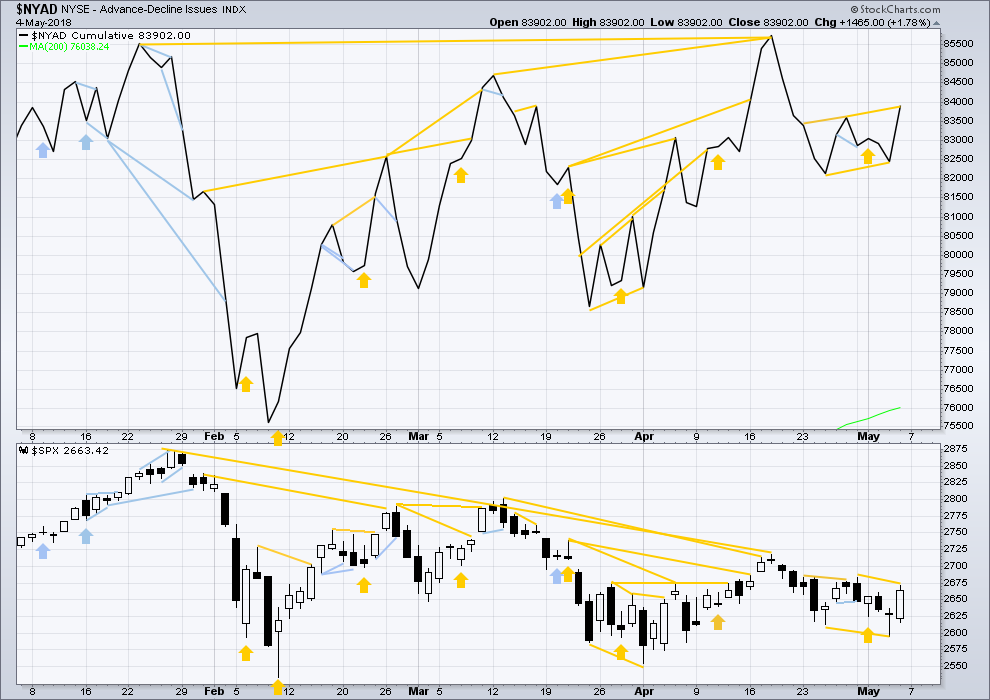

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. A new all time high from the AD line this week means that any bear market may now be an absolute minimum of 4 months away.

For most recent days, both mid and small caps have now made new small swing highs above the prior highs of the 30th of April (mid caps) and the 26th of April (small caps). Only large caps have not yet made new small swing high above the 30th of April. Small and mid caps may be leading the market. This divergence is interpreted as bullish.

Breadth should be read as a leading indicator.

The new all time high from the AD line remains very strongly bullish and supports the main Elliott wave count.This new all time high from the AD line will be given much weight in this analysis. This is the piece of technical evidence on which I am relying most heavily in expecting a low may be in place here or very soon.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

Last bullish divergence has been followed by a strong upwards day. There is new bullish divergence today: the AD line has made a small new swing high, but price has not. With the AD line a leading indicator, price may follow through with a new small swing high also.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:06 p.m. EST.

A big thank you to Verne today for sharing how to do a bear call spread.

And a thank you to all other members who share their trades from time to time.

To newer members: we have some very experienced traders here, trading large $$. They’re offering a great opportunity to learn from experts.

When you have a go following their examples, remember to always always follow my 2 risk management rules:

1. Always trade with stops. I guarantee you all experienced members are doing this. Trading without stops exposes your entire equity to risk. Don’t do that.

2. Risk only 1-5% of equity on any one trade.

Here’s another idea that I personally like very much: when a position becomes profitable, move stops up to break even or to lock in a small profit. Reduce risk to zero. If it’s closed out for a small profit or nothing, then you have an opportunity to try again and haven’t lost anything.

Very occasionally a newer member will make a comment indicating they’re trading without stops. My policy if / when that happens is to immediately remove that person from the membership and black list them.

It may sound harsh, but I’ve learned over the years that keeping them here doesn’t end well for me or them.

So please, know this is how serious I am about risk management.

Lecture over. As you were.

I can see a five up complete and now the channel about that five up is breached.

So a first wave up now done, and a second wave correction now begun.

I like it!! 🙂

I did not post over you today dear Lara! Yipee!

Looking a bit more now at minute ii, I think your call for an expanded flat is spot on Verne.

I’m going to use 2.618 for the target, as 1.618 leaves minute ii just too shallow for a second wave.

So here’s what looks like a reasonable target.

The risk here is that minute ii could possibly be over at today’s low. Minuette (c) has already moved below the end of minuette (a) avoiding a truncation, the expanded flat could be complete.

VIX confirming start of second wave. This late day ramp is much ado about nada. Kevin put up some good re-tracement levels so we will most likely hit one of ’em.

Have a great evening everyone! 🙂

What we don’t want to see is a gap down past this morning’s open gap….

At less than zero cost basis on long calls so exiting remaining short calls of call spread.

Nicely played Verne. “How to get long with zero risk in a volatile market”, indeed!

Now the question is, is this just another 4 in the 5 wave up (and a gap fill), or the start of a real 2 down? If it’s a 2 down, possible turns are:

2662 (23.6%) (unlikely, not deep enough)

2649 (38.2%)

2639 (50%)

2628 (61.8%) (most typical for 2’s)

The tag of the 50 day suggests to me it could be a second wave correction….one would expect the power of a third up to get past strong 50 day resistance….

Thanks bud.

I recommended a small position for folk new to spreads but you can see how powerful a technique this is if you traded 100 contracts as I did!

Not too many trades you can make with this kind of potential in my humble opinion.

Did anyone else trade spreads today? 🙂

100 contracts…oh my.

No spreads on the SPY today – I agree selling premium is the way to go . I did managed some spy straddles today – usually trade them everyday ( management of # of contracts ) – I have done SPY credit spreads in the past , but can get a bit confusing for me to manage sometime . I usually trade a short iron condor when I think the market has a big move coming . Everyone has a trading style / management style that they are comfortable with . Enjoy your comments and insights – Vern .

Verne, i did not cause im already long from last week! Appreciate you sharing the idea though! Will use that technique nxt time

As anticipated, we are setting up for a fall into the close. I initially figured it would be a bull trap but we could be setting up for a very deep corrective wave that continues into the a.m. tomorrow.

RUT also tagging top BB.

Some interesting observations: SPX and DJI both met resistance at the underside of 50 day as expected.

Nasdaq jumped above the 50 day and tagged the upper B band.

All this I think points to a probable deep second wave correction.

A move of Nasdaq back below the 50 day would be bearish….

This move down needs to find support at the top of the small triangle….!

Just about the area of the open gap…

I am at break-even so buying back half my short calls…..

I see 3 corrections in the run up off thursday’s low on the SPX hourly. Every well formed impulse needs an even #. Let’s rock market….

What we are seeing is a “managed decline”. The move down and reversal will probably be sharp and tough to trade if you are not pre-positioned.

Looking good. If you are trading spreads, remember the aim of the counter trend trade is not to make a killing but rather to get positioned courtesy of Mr. Market. The real gains will come from the long position when the uptrend resumes…no need to get cute! Just saying…! 🙂

Here’s another view to consider, daily SPX. The 3 white horizontal lines mark the symmetric projections of the 3 prior major up swings on the chart, projected from the May 3 low. Also show are the key fibo’s that mark potential turn zones (lots when price has been in this kind of consolidation zone with such wide ranging action).

The island reversal on April 5-6 could be setting up here again. A gap down open followed by selling will certainly trigger me in short tomorrow, if it happens.

They are going to probably whipsaw traders with a late session C down just in time to spring a bear trap. I am opening a BTC limit order on my short calls so I don’t have to babysit the position…got errands to run! Later…! 😉

I like the set up approaching for your short Verne. LOTS of room to fall on the hourly. That said, I won’t enter until I see (1) my 5 minute bars going bright red (strong downtrend) and (2) my hourly bars going gray (from uptrend to neutral). I won’t short against an hourly chart showing bright green (strong uptrend), myself. My short here would be in the form of a short term hedge/scalp against a significant set of long positions…

Probably wise. I was willing to jump based on high confidence in Lara’s main count. I will consider bids on my short calls 10% (room for expanded flat) more than I paid for them a signal that I should exit…so far so good!

Also, looking at the wave structure up from May 3, I see well structured waves for 1, 2, 3 and 4 on the 5 minute. But the 5 wave looks very incomplete; it looks to me like this action here this morning is “2 of 5” action. Though I acknowledge the minimal req’ts for a complete 5 wave up are met. There’s just no 5 wave structure visible for wave 5, even though every other wave in this 5 wave up HAD visible structure. So…I’m doubtful this is the top of this 5 wave move. I think it’s going to extend more.

Another structural pattern that could be repeating, and in so doing, finishing the triangle properly, and consistently with the timing called for in Lara’s TA too (more filling time of triangle is needed). Essentially this model says waves A, B and C are complete. D is structurally similar to B and incomplete. And once it hits the upper triangle line, an E down will ensure. Something to consider and watch for, IMO.

the reason why I haven’t published that idea is because when I charted it, wave C needs to be a single zigzag down. and that move subdivides best as a double zigzag. for it to be a single involves a truncation.

so if wave C down is a double zz, then now wave D up needs to be a single zz.

which means the last wave up from the 2nd April low to the high of 18th April needs to be a five wave structure for minute a of minor D zz.

and it just doesn’t fit.

Possible b wave of flat met 90% required retrace of a wave…cool! 🙂

I agree. And this b is looking ugly. Nice c probably not far off.

I can also count five down in ES so a possible Zig Zag could be underway there…

Expanded flats are the favorite instruments banksters use to ambush traders.

Looking for a possible C down next….

We could be setting up a 3,3,5 flat correction. As long as VIX remains green I would not look for a completed correction.

Spread moving in the right direction…will post any sign of reversal…

As Kevin noted, correction may be quick so if you opened a bear spread keep a trigger finger ready…

If VIX prints red may be time to pull it…rather SQUEEZE it for you shooters… 🙂

Filled on bear call credit spread. Second wave correction probably underway. 🙂

ES looks to be leading for upcoming correction…

Waiting for trigger on bear call spread…will post when filled….

I don’t think the gap fills today. Looks like ABC correction off the high here on the 5 minute, pausing at the 38%, and the gap starts at precisely the 62%. We’ll see…

Perhaps not. Lots of reasons to expect it to be reasonably deep…gap may provide support…

Gap up open. A gap fill should be good reversal signal.

Guten Morgen!

Wave four may have been quite shallow and done Friday.

VIX however, signaling we will get a reversal today so fifth wave up may also conclude swiftly. A possible second wave correction could be deep. If we get a reversal today, this would be an excellent scenario to deploy a bear call spread. I am looking at the SPY 265/266 spread that has the potential to get one positioned for a possible third wave up for greatly reduced cost, or even a zero cost basis. I would mark the 68% retracement level for the second wave and exit the short 266 call just before price hits it. VIX should also lead the turn for additional confirmation. Newbies can try it with just one contract and only 100.00 exposure to get the feel of the trade.

My, am I feeling magnanimous this morning!

Bo, if you are reading, there is your freebie bud….enjoy! 🙂

Wouldn’t the 266 be the long call?

Oops! Quite correct Gary, my bad! Thanks!

Thanks Verne. That looks like a nice simple explanation.

That’s very kind of you to share your knowledge here. I really appreciate it!

🙂

Of course I also meant 61.8% re-tracement. Typing faster than I think..! lol!

GS at daily level appears to have completed a WXY correction off a 5 wave move up, with a final perfect bounce off a tight cluster of fibonacci prices (a 78% retrace, 127% projection, and 162% extension: I just put a single white line there). As EW and fibo set ups go, I think this one is pretty good right here and now.

…and that final c wave down is a perfect 5 wave move as well, adding more confirmation that the bottom is in.

Thanks for the early delivery Lara!

Looking for a back test of top of smaller triangle and completion of fourth wave on Monday and up, up and awaaay! 🙂

If da wabbit is strongly bullish, that has to be everybody plus one. What happens with extreme bullish sentiment?? Off goes the alarm: “aaahOOOOOGaaa! aaahOOOOGaa!!! Sell, Sell, Sell, Sell…!!!!!!” (ps: not a recommendation…just something to think about!)

You’re welcome Verne. I had things to do, places to go and people to see, on the weekend. So work had to be done ASAP