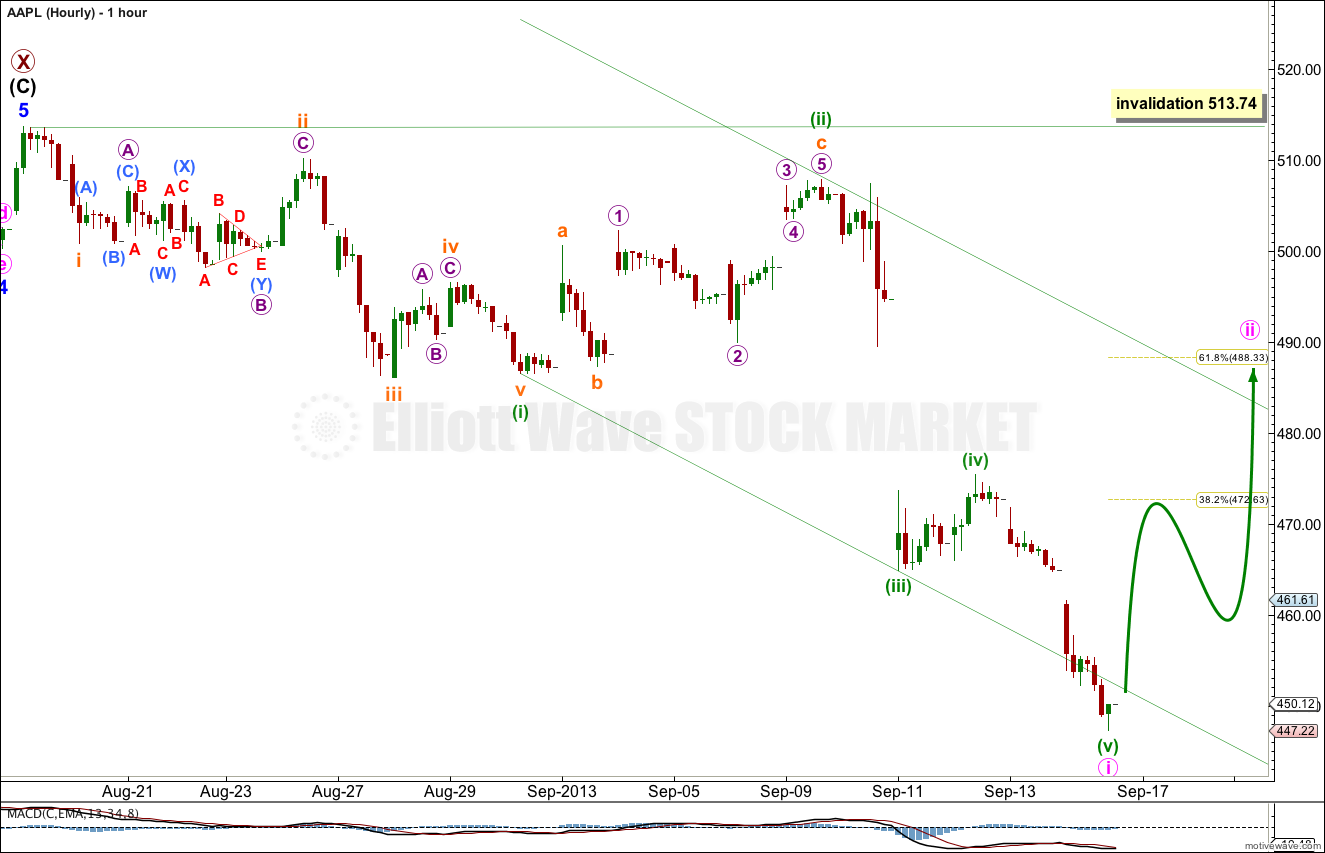

Last published AAPL charts expected more downwards movement to a short term target at 463.93. Price reached down to just 0.88 short of the target at 464.81 before turning up for a short term correction.

At this stage there is a gap to be filled, and a second wave to do it.

Click on the charts below to enlarge.

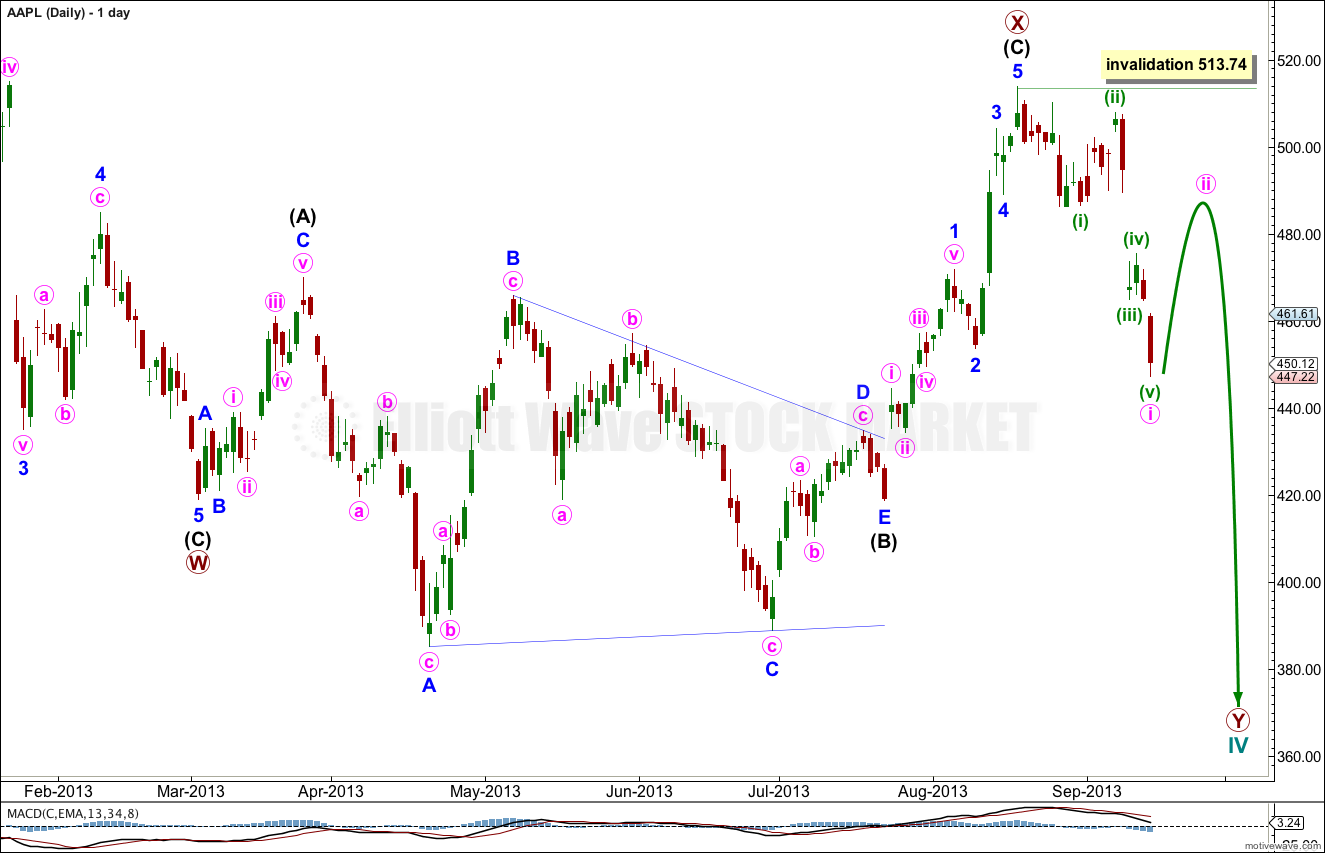

Primary wave X within the double zigzag of cycle wave IV is now complete.

At the low labeled primary wave W this downwards wave subdivides perfectly as a three wave zigzag. Because a new low was made after this zigzag was completed cycle wave IV cannot be over there, it must be continuing.

At cycle degree the structure unfolding is most likely a double zigzag. It may also be a double combination, but that would normally have a deeper retracement for the X wave; this double zigzag is relatively shallow and fits better the normal form for a double zigzag.

At this stage primary wave X is a complete flat correction because intermediate wave (A) within it subdivides as a three wave zigzag, and intermediate wave (B) is a corrective structure that is just over 100% the length of intermediate wave (A). Intermediate wave (C) subdivides nicely as a five wave impulse and has no Fibonacci ratio with intermediate wave (A).

Primary wave Y has begun and is most likely to be a large zigzag trending downwards. It should last months and take price to new lows. When the intermediate degree waves (A) and (B) within it are completed I can calculate a target for it to end. I cannot do that yet for you.

Within the zigzag of primary wave Y no second wave correction (or B wave) may move beyond the start of the first wave (or A wave). This wave count is invalidated with movement above 513.74.

There is now a completed five wave structure downwards. This should be followed by a corrective structure, subdividing into three waves, upwards.

Ratios within minute wave i are: minuette wave (iii) is just 0.88 short of 1.618 the length of minuette wave (i), and minuette wave (v) is just 0.99 longer than equality with minuette wave (i).

A channel drawn about minute wave i should be breached by upwards movement for minute wave ii.

Minute wave ii is most likely to end about the 0.618 Fibonacci ratio of minute wave i at 488.33. It should be choppy and overlapping. It should last about two to three weeks. Unfortunately there can be no downwards invalidation point for this correction. If minute wave ii is an expanded flat it may include a B wave which makes a new low below 447.22.

Minute wave ii may not move beyond the start of minute wave i. This wave count is invalidated with movement above 513.74.

Hi, looking at how big minute i is, do you think that could actually be a Minor wave?

Yes indeed, I believe you are right.

I’ll probably move that up one degree.