Last analysis expected upwards movement for Apple. Price moved a little lower and mostly sideways over the last three days, but remains above the invalidation point on the hourly chart (although this really is too far away to be useful). A breach of the parallel channel on the hourly chart was unexpected and has necessitated a reanalysis of the last upwards wave.

Click on the charts below to enlarge.

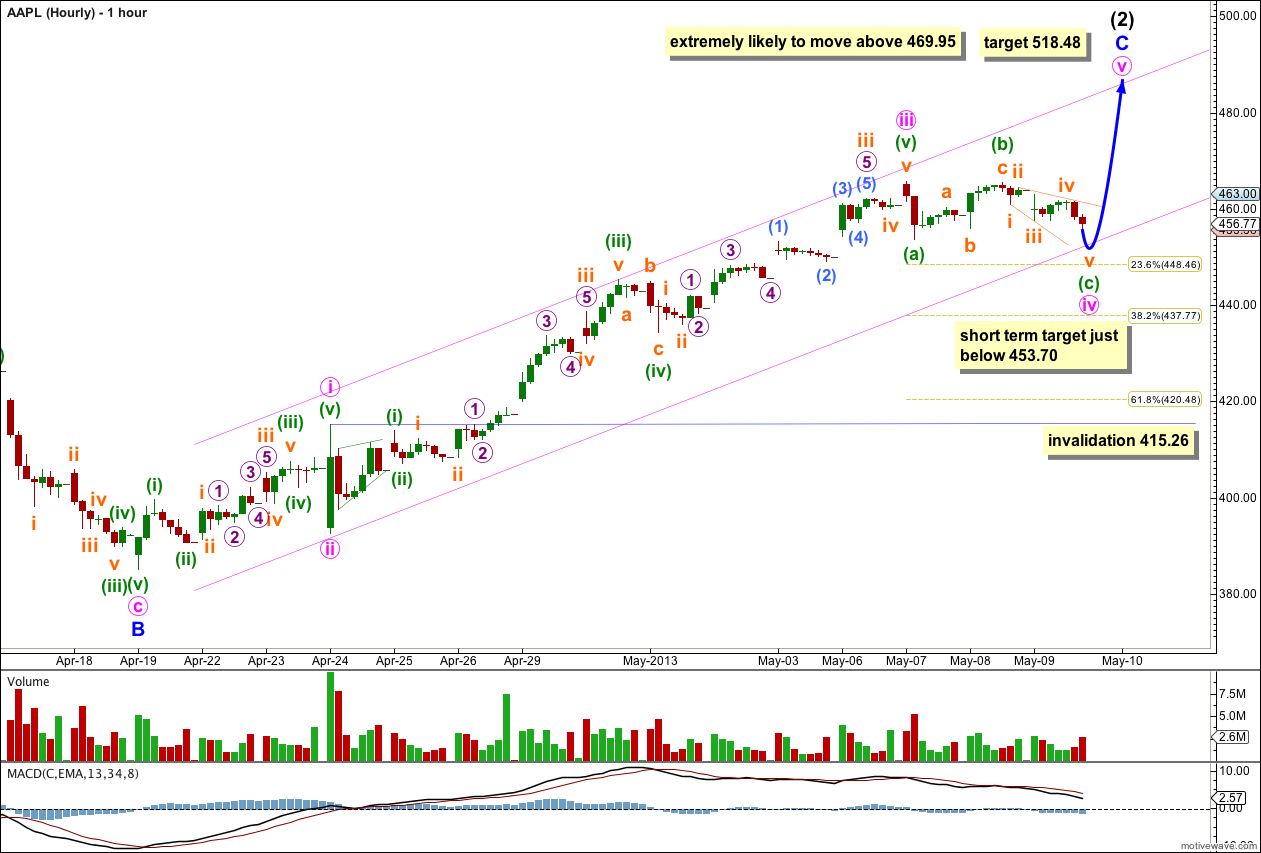

This wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Primary wave 3 is extending. Within primary wave 3 intermediate wave (1) is complete, and intermediate wave (2) is an incomplete flat correction. It is extremely likely that minor wave C within intermediate wave (2) will move above the high of minor wave A at 469.95 to avoid a truncation and a rare running flat.

Within intermediate wave (2) at 518.48 minor wave C would reach 2.618 the length of minor wave A.

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. This long term target is still months away.

Intermediate wave (2) may not move beyond the start of intermediate wave (1). This wave count is invalidated with movement above 594.59.

I have considered various possibilities for this downwards movement from the high labeled primary wave 2. What is most clear is that the middle of primary wave 3 has not yet passed because we have not seen momentum increase beyond that seen for primary wave 1. Primary wave 3 cannot be complete.

A channel drawn about intermediate wave (1) using Elliott’s channeling technique has been clearly breached. This indicates that this impulse is over and the correction to follow it has begun.

I have adjusted the wave count within minor wave C to have a better fit and look on the daily chart.

Within minor wave C minute wave ii was a brief deep 75% zigzag. So far minute wave iv is a shallow regular flat correction which is likely to be incomplete. I would expect minuette wave (c) of this flat to end about the same level as minuette wave (a) at 453.70, and likely to move slightly below that point to avoid a truncation.

Minute wave iii is 5.68 short of 2.618 the length of minute wave i (a 7.8% variation which is less than 10% and so considered acceptable).

Ratios within minute wave i are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is 1.25 short of equality with minuette wave (i).

Ratios within minuette wave (iii) of minute wave i are: subminuette wave iii is just 0.02 longer than 1.618 the length of subminuette wave i, and subminuette wave v has no Fibonacci ratio to subminuette waves i or iii.

Ratios within submineutte wave iii of minuette wave (iii) of minute wave i are: micro wave 3 is 0.59 short of 1.618 the length of micro wave 1, and micro wave 5 has no Fibonacci ratio to micro waves 1 or 3.

Ratios within minute wave iii are: minuette wave (iii) is 3.56 longer than 1.618 the length of minuette wave (i) (a 9.3% variation), and minuette wave (v) has no adequate Fibonacci ratio to either of minuette waves (i) or (iii).

Ratios within minuette wave (iii) of minute wave iii are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is 0.41 short of 2.618 the length of subminuette wave i.

Ratios within subminuette wave iii of minuette wave (iii) of minute wave iii are: micro wave 3 has no Fibonacci ratio to micro wave 1 and micro wave 5 is 0.42 longer than 0.382 the length of micro wave 3.

Within minuette wave (iv) of minute wave iii subminuette wave c is 0.88 longer than 2.618 the length of subminuette wave a.

Ratios within minuette wave (v) of minute wave iii are: subminuette wave iii is 1.24 longer than 4.236 the length of subminuette wave i, and subminuette wave v is 0.19 short of equality with subminuette wave i.

Ratios within subminuette wave iii of minuette wave (v) of minute wave iii are: micro wave 3 is just 0.13 longer than 1.618 the length of micro wave 1, and micro wave 5 is 0.51 longer than 1.618 the length of micro wave 3.

Ratios within the extended fifth wave of micro wave 5 within subminuette wave iii of minuette wave (v) of minute wave iii are: submicro wave (3) is 0.42 short of 1.618 the length of submicro wave (1), and submicro wave (5) is 0.36 longer than 0.618 the length of submicro wave (1).

Within minute wave iv minuette wave (b) is a 97% correction of minuette wave (a). Minuette wave (c) is unfolding as an ending expanding diagonal. On the five minute chart subminuette wave v within it looks incomplete and should move a little lower.

The channel drawn here is a best fit and must be redrawn if minute wave iv moves lower. Draw the first trend line from the lows of minute waves ii to iv, and place a parallel copy upon the high of minuette wave (iii) within minute wave iii. Expect minute wave v to end either midway within the channel, or to find resistance at the upper edge.

Minute wave iv may not move into minute wave i price territory. Movement below 415.26 would invalidate this wave count at minute wave degree and would be a strong indication that intermediate wave (2) should be over and intermediate wave (3) downwards may have begun.