My last AAPL analysis had three hourly wave counts. Price movement above 415.25 invalidated the first hourly wave count indicating further upwards movement for the second hourly wave count should be expected. Further movement above 426.40 invalidated the second hourly wave count leaving only the third and final hourly wave count as correct.

Click on the charts below to enlarge.

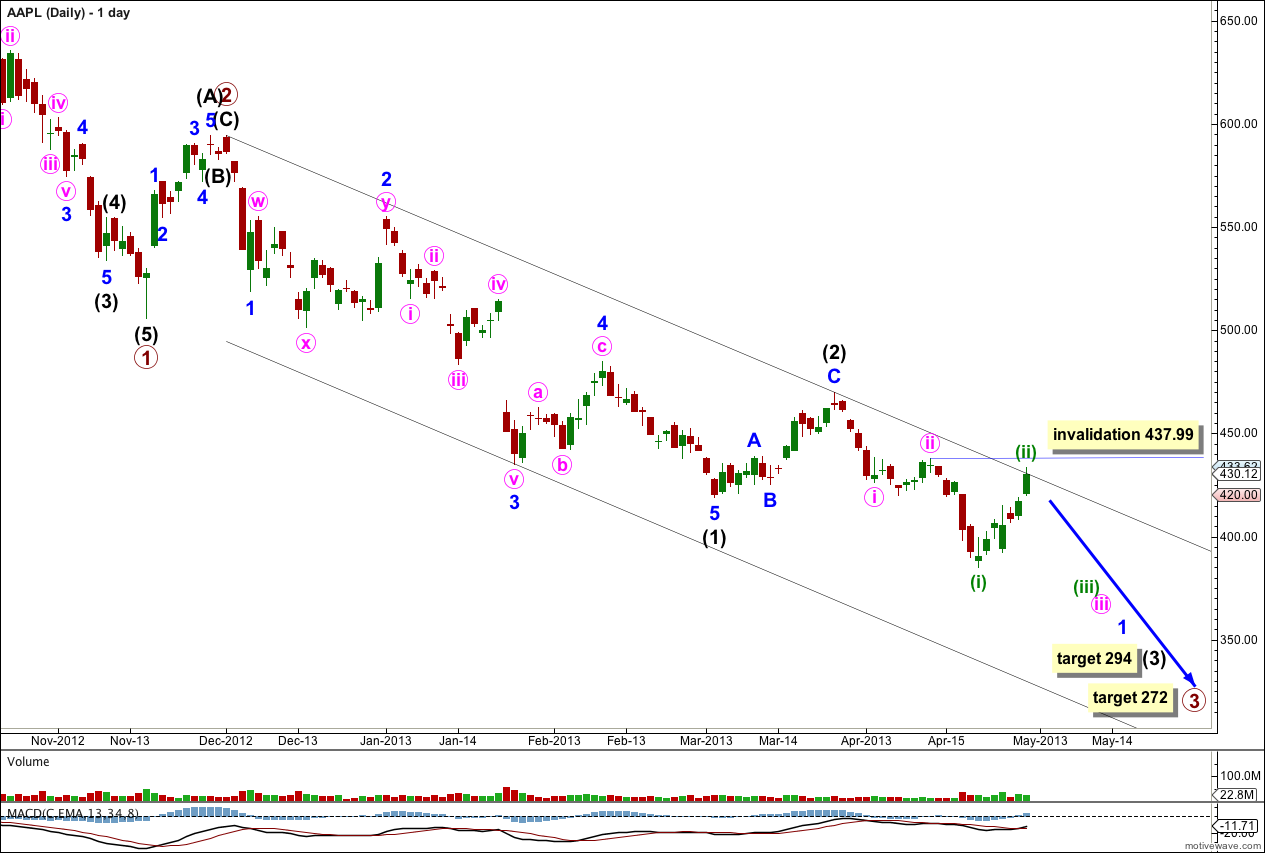

This wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Primary wave 3 may be extending. Within primary wave 3 intermediate waves (1) and (2) are complete. Intermediate wave (3) has begun.

At 294 intermediate wave (3) would reach equality in length with intermediate wave (1).

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. This long term target is still months away.

Intermediate wave (3) should see an increase in downwards momentum beyond that seen for intermediate wave (1). The strongest part of intermediate wave (3) should be its middle, minor wave 3. Downwards momentum indicates that this has not yet passed.

Within minute wave iii minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 437.99.

Price may find resistance about the upper edge of the trend channel here. This may be where a strong third wave down is initiated.

With the first two of my three hourly wave counts now invalidated this is my only wave count for you today.

I have looked carefully at the structure of minuette wave (ii) on the five minute chart. Within it subminuette wave b looks like a triangle, particularly on lower time frames.

Subminuette wave a subdivides perfectly into a five wave impulse. Subminuette wave c is also a complete impulse.

The channel drawn here is first drawn with a trend line from the start of subminuette wave a to the end of the triangle for subminuette wave b, then that trend line is pushed lower to contain the end of micro wave C of the triangle. A parallel copy is placed upon the high of micro wave B within the triangle. This upper trend line shows perfectly where minuette wave (ii) may have ended.

When this channel is breached by downwards movement we shall have an early indication that minuette wave (ii) may be over and a third wave down may have begun.

At 348 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

If minuette wave (ii) moves any higher then it may not move beyond the start of minuette wave (i). This wave count is invalidated with movement above 437.99. If this wave count is invalidated with upwards movement I would have to reanalyse it at intermediate degree. An invalidation would be significant at this point.