Another new low indicated further downwards movement. The target is not yet met.

Three short-term Elliott wave counts are provided today.

Summary: A new breakout of the blue Elliott / best fit channel and then a new high above 2,706.85 would indicate a low would most likely be in place. At that stage, a multi-week bounce may be expected to continue towards about 2,812 and possibly higher. There is some support for this view today: Price is extremely close to the teal trend line which may offer very strong support, RSI is oversold and still exhibits double bullish divergence with price, there is bullish divergence between price and VIX, and there is some divergence in breadth with small caps today failing to make new lows.

A new low below 2,604.04 tomorrow would indicate more downwards movement. The target remains at 2,544.

A primary degree correction should last several weeks and should show up on the weekly and monthly charts. Primary wave 4 may total a Fibonacci 8, 13 or 21 weeks. Look for very strong support about the lower edge of the teal trend channel on the monthly chart.

Primary wave 4 should be expected to exhibit reasonable strength. This is the last multi week to multi month consolidation in this ageing bull market, and it may now begin to take on some characteristics of the bear market waiting in the wings.

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last published monthly chart is here, video is here.

ELLIOTT WAVE COUNT

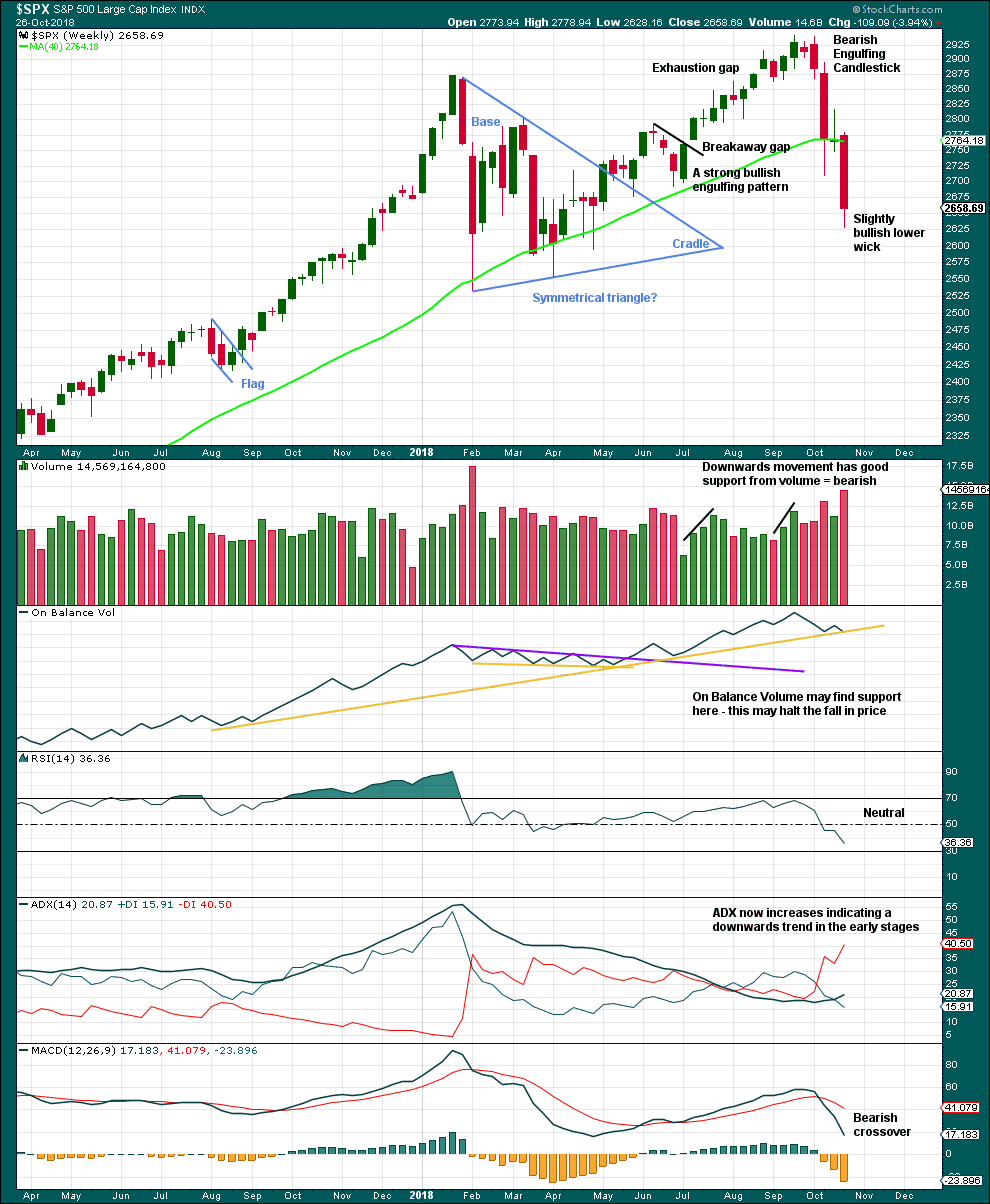

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. It is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Within primary wave 3, there is perfect alternation and excellent proportion between intermediate waves (2) and (4).

The channel is now drawn about primary degree waves. The first trend line is drawn from the ends of primary waves 1 to 3, then a parallel copy is placed upon the low of primary wave 2. The overshoot of the upper edge of this channel by the end of intermediate wave (3) looks typical. For the S&P, its third waves are usually the strongest portion of an impulse; they often exhibit enough strength to overshoot channels.

Primary wave 4 now has an overshoot on the lower edge of the channel. This is acceptable; fourth waves are not always neatly contained within channels drawn using this technique.

Now that primary wave 4 has broken out of the narrow maroon channel, it may find very strong support about the lower edge of the teal channel. This channel is copied over from the monthly chart and contains the entire bull market since its beginning in March 2009. While Super Cycle wave (V) is incomplete, this channel should not be breached at the weekly chart level.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

When primary wave 4 may be complete, then the final target may be also calculated at primary degree. At that stage, the final target may widen to a small zone, or it may change.

At this stage, the expectation is for the final target to be met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

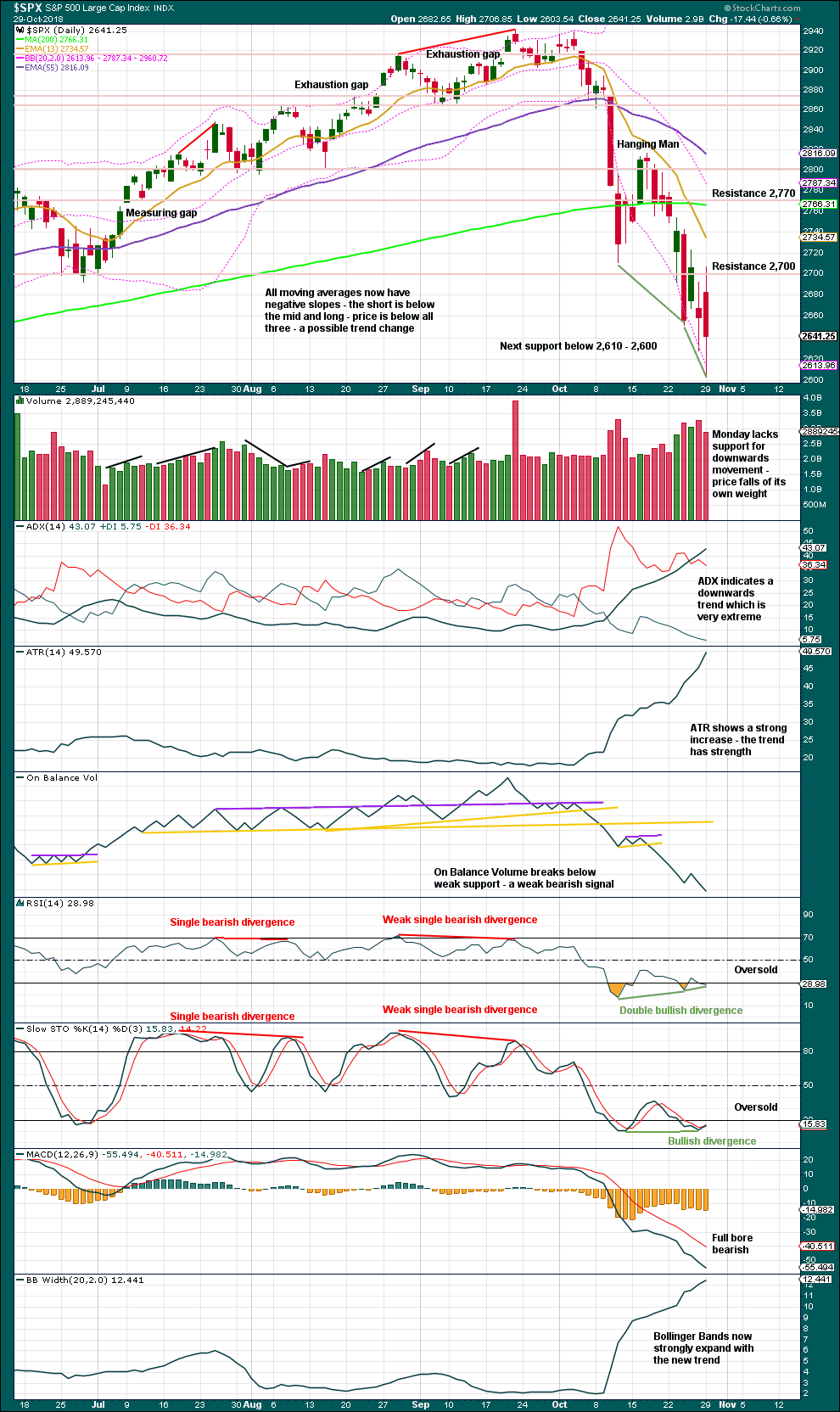

DAILY CHART

Primary wave 4 would most likely end somewhere within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) has its price territory from 2,872.87 to 2,532.69. Within this range sit the 0.236 Fibonacci ratio at 2,717 and the 0.382 Fibonacci ratio at 2,578.

The 0.382 Fibonacci ratio would expect an overshoot of the teal channel. This may be too low; price may find support at the lower edge of the channel. However, as primary wave 4 should be expected to exhibit reasonable strength, it may be able to overshoot the channel and that would look reasonable. This possibility is now more seriously considered.

Primary wave 2 unfolded as a shallow regular flat correction lasting 10 weeks.

Intermediate wave (A) is labelled as a possible complete five wave impulse. However, it must also be accepted that it could also be labelled as a complete zigzag. Once there is confidence that intermediate wave (A) is finally over, then this alternate idea will then be presented at the daily chart level.

The blue Elliott channel about downwards movement is drawn in the same way on all hourly charts below. Draw the first trend line from the highs labelled minor waves 2 to 4, then place a parallel copy on the low labelled minor wave 3. Only when this channel is clearly breached by upwards movement with at least one full hourly candlestick above and not touching the upper trend line may confidence be had that a low is in place.

If intermediate wave (A) is a five wave structure, then intermediate wave (B) may not move beyond its start above 2,940.91. If intermediate wave (A) is a three wave structure, then intermediate wave (B) may make a new high above 2,940.91 as in an expanded flat or running triangle. There is no upper invalidation point for this reason.

Primary wave 4 would most likely be a zigzag to provide structural alternation with the flat correction of primary wave 2; for this reason, intermediate wave (A) would most likely be a five wave structure.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Three hourly charts are published below, roughly in order of probability. However, the first hourly chart requires a breach of the trend channel for confidence.

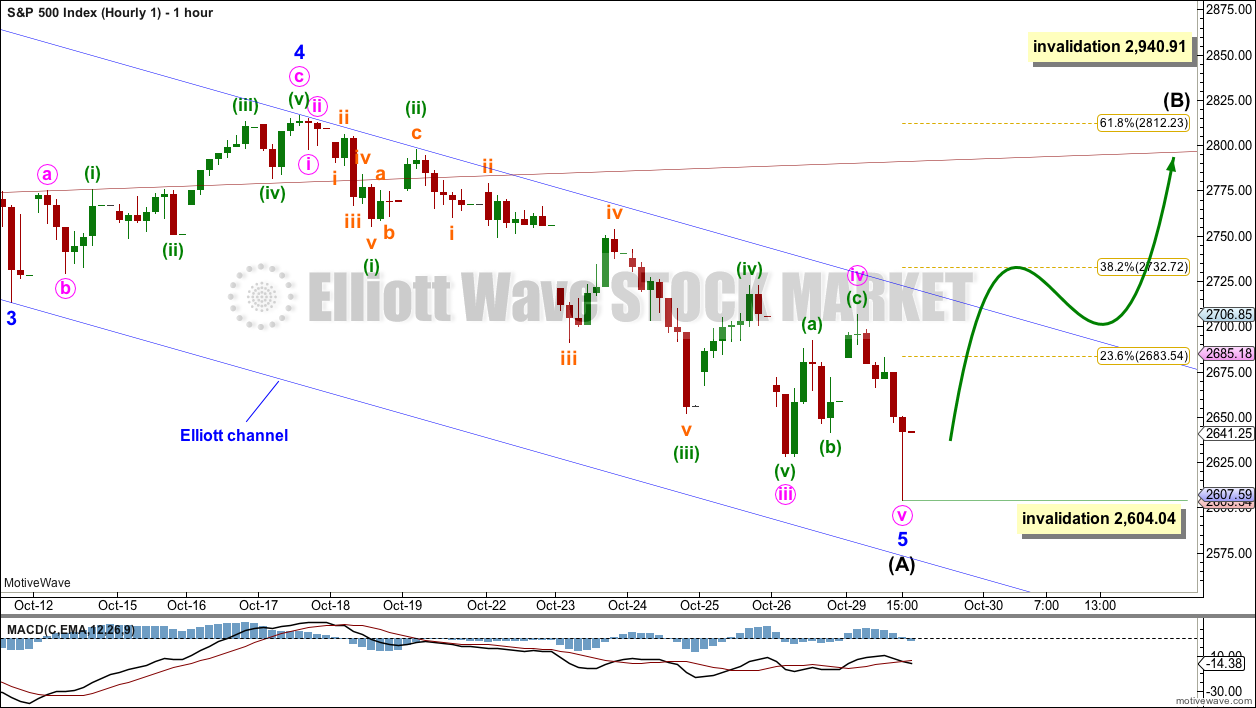

FIRST HOURLY CHART

A break out above the upper edge of the blue channel is required for confidence that a low is in place. A new high above 2,706.85 would provide further confidence.

Intermediate wave (B) may be expected to last a few weeks and be very deep. No second wave correction within intermediate wave (B) may move beyond the start of its first wave below 2,604.04.

Intermediate wave (B) may unfold as one of more than 23 possible corrective structures. B waves exhibit the greatest variety in structure and price behaviour. They can be very complicated time consuming sideways corrections, or equally as likely they can be quick sharp zigzags.

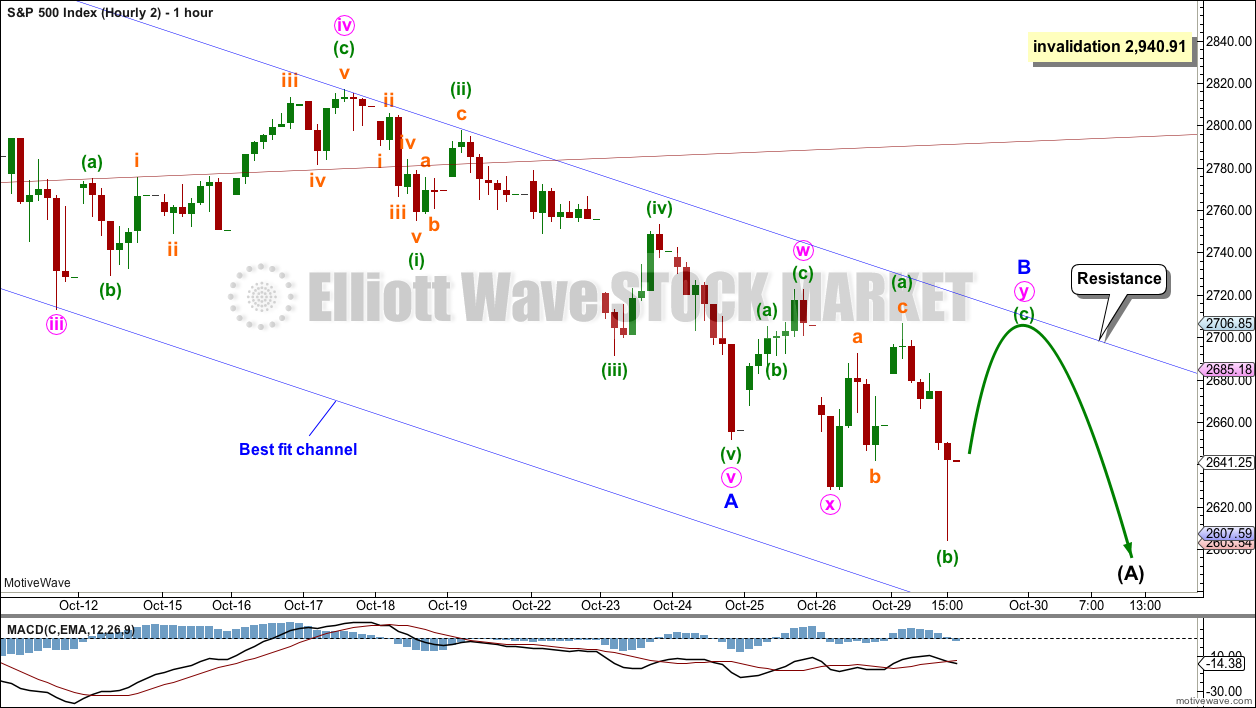

SECOND HOURLY CHART

Intermediate wave (A) may be an incomplete zigzag. Within intermediate wave (A), minor wave B may be underway.

Minor wave B is labelled here as an incomplete double combination: zigzag – X – flat.

Within the flat of minute wave y, minuette wave (c) would most likely make at least a slight new high above the end of minuette wave (a) at 2,706.85 to avoid a truncation and a very rare running flat. Minute wave y may end about the same level as minute wave w at 2,722.70, so that the combination effectively moves price sideways.

Minor wave B may not move beyond the start of minor wave A above 2,940.91.

When minor wave B is complete, then a relatively short wave down for minor wave C may end at support about 2,600 and at the teal trend line on the daily chart.

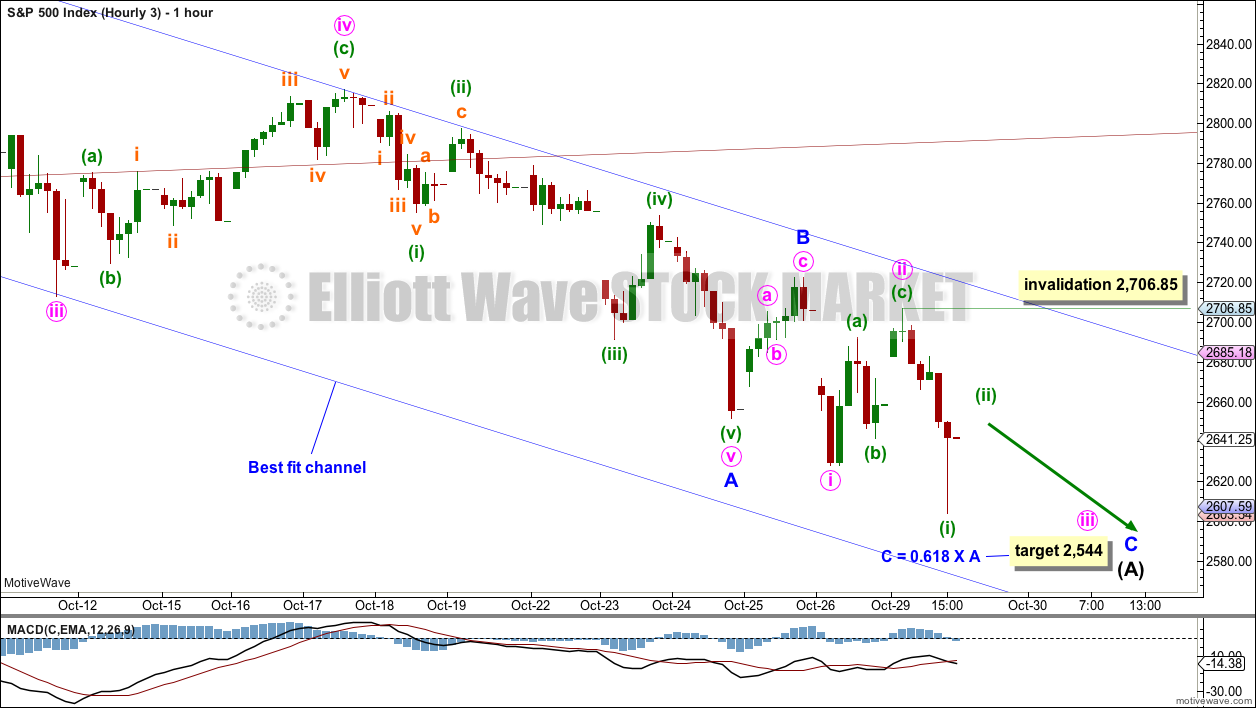

THIRD HOURLY CHART

This wave count is the same as the alternate wave count presented in the last week analysis.

It is possible that intermediate wave (A) may continue lower as a single zigzag, and that minor wave C within it is only just beginning. Within minor wave C, there may now be two overlapping first and second waves almost complete. This wave count would expect an increase in downwards momentum and a strong overshoot of the lower edge of the teal channel.

This is possible, but at this stage it looks less likely.

The target is calculated to allow enough room for the structure of minor wave C to complete.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

Support for On Balance Volume along with a slightly longer candlestick wick looks slightly bullish. A low for the first downwards swing within a consolidation may be found very soon this week.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

ADX is very extreme, so reversal signals should now be looked for. If a reversal signal shows up, it should be given weight.

However, there is no reversal signal today. There remains double bullish divergence between price and RSI; this downwards movement still exhibits some weakness at its end. This divergence on its own is not enough to signal a low in place, only that it may be here or approaching soon.

While a reversal candlestick pattern should be looked for, the absence of a reversal candlestick pattern does not mean a low cannot be in place.

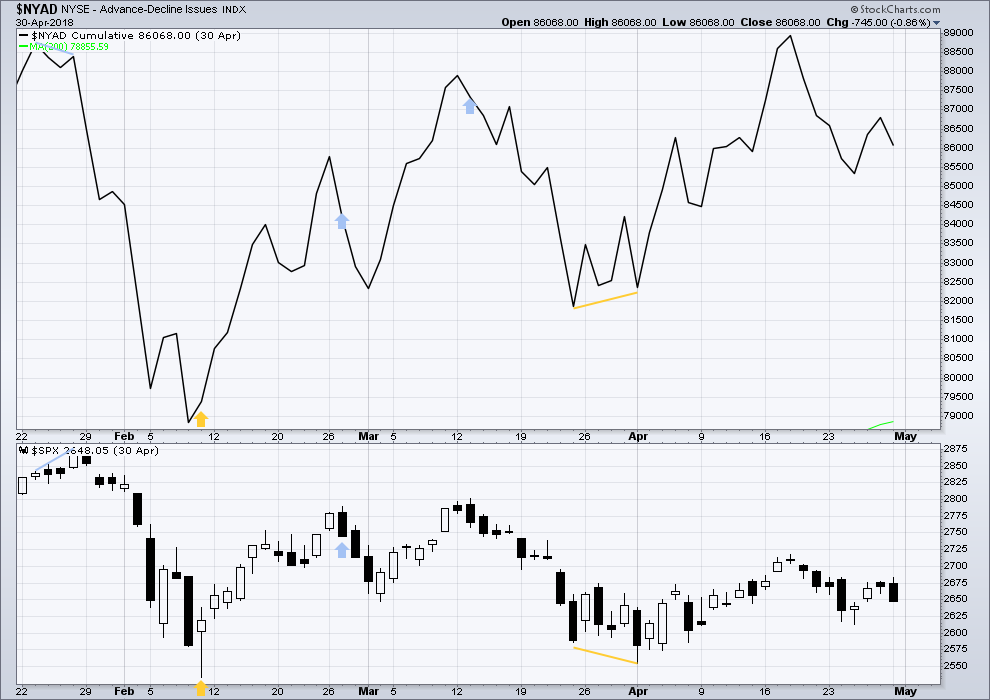

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Falling price has support from a decline in market breadth. Breadth is falling in line with price. There is no divergence either way.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line on the 29th of August means that the beginning of any bear market may be at the end of December 2018, but it may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Both price and the AD line moved lower today. The fall in price has support today from falling market breadth. There is no divergence.

Today large caps made a reasonable new low, mid caps made a very slight new low, and small caps have failed to make a new low. This indicates some lack of support from market breadth for falling price. This divergence is bullish and supports the main Elliott wave count.

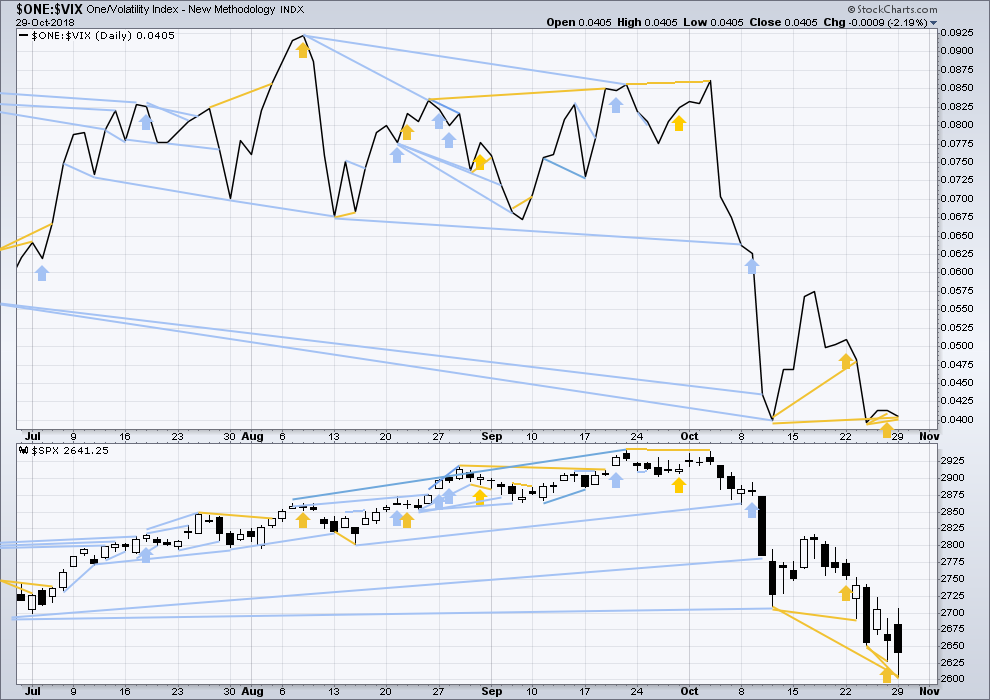

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The fall in price last week comes with a normal corresponding increase in volatility as inverted VIX also declines. There is no new divergence. Last noted mid term bearish divergence has now been resolved.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Price has made new lows below the last swing low of the 11th of October, but inverted VIX has still not made corresponding new lows. This divergence is bullish.

There is also short term bullish divergence between the lows today and the lows of the 24th of October.

Divergence between price and inverted VIX supports the main Elliott wave count.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,344.52.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

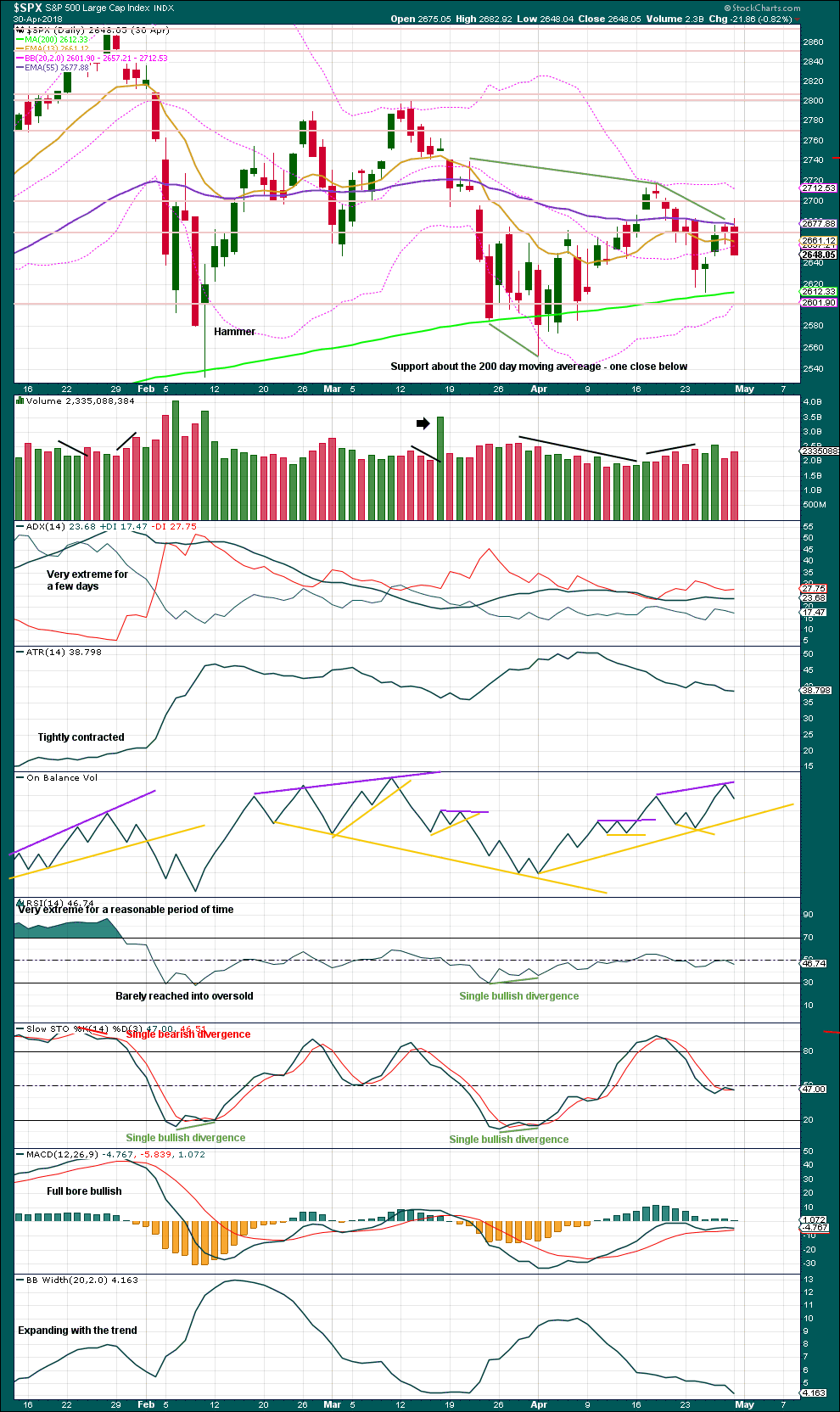

ANALYSIS OF INTERMEDIATE WAVE (4)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

Intermediate wave (4) was a large symmetrical triangle. The deepest wave was the first wave. At its low there was a clear candlestick reversal pattern and bullish divergence between price and Stochastics.

RSI barely managed to reach into oversold.

The current correction for primary wave 4 may behave differently, but there should be some similarities.

It is expected that primary wave 4 may be stronger than intermediate wave (4).

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

At the two major lows within intermediate wave (4), inverted VIX exhibited single short term bullish divergence.

At highs within intermediate wave (4), inverted VIX exhibited one single day bullish divergence with price.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

At the two major lows within intermediate wave (4), there was bullish divergence between price and the AD line. At the two major highs within intermediate wave (4), there was each one instance of single day bearish divergence.

Published @ 08:43 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

RUT daily.

Solid base. Today first bar in forever that is WHOLLY above my lower range indicator (BB+keltner). And a solid up day.

I have a short term bullish outlook here.

here’s the shorter term SPX trend lines I’m immediately concerned with. daily chart.

Hourly 1 updated:

A somewhat quiet day. So far this price action fits all three hourly charts.

While price remains within the channel we can’t have confidence that a low is in place.

Hourly 2 updated:

Minor B could end at resistance at the upper edge of the channel.

Hourly 3 updated:

If this wave count is correct, then when minuette (ii) is complete there would be two overlapping first and second waves complete. That would mean an increase in momentum to the downside as a third wave at two (low) degrees moves strongly lower.

I still think this wave count looks to be the least likely because it has least support from classic TA. But I’ve been wrong these last few days, and so I want to consider all possibilities. What if I’m wrong again and what if price falls strongly again? What wave count would be possible then? This one.

The confidence point on hourly 3 needs to change. It should be 2,604.04.

heck of a fight going on here

“consolidating” after 3+ weeks of very hard selling is how I view it. whether consolidation before another significant leg down…or some kind of B wave up…is the question. I’m starting to suspect this market goes exactly nowhere until the morning of next Wed.

into hour #2 of squeeze in SPX…

Can SPX break a down trend line on the hourly/daily? That would be huuuuge.

SPX stuck at 61.8% retrace (2667) of Monday’s high-low.

If it pushes higher, the 78.6% is at 2685 and the strongest down trend line is just about right there too. I expect strong resistance there…if it makes it.

Vern: The “old man” calling for a crash today or tomorrow… But if it doesn’t happen by Wednesday… it looks like he may be changing his overall view of his bear. We shall see.

On crash… says through Nov 5 or 6. Then bounce and then head to low in Nov or Dec. then multi month rally & then LT Bear

Who is the old man?

I am guessing her is referring to Robert Prechter at Elliott Wave International.

Hey Joe. Thanks for the info.

He has a one day window now that Tuesday is over. Wednesday is the day… so lets see what happens. Wednesday is suppose to be the biggest down day in his call. Then down Thursday, Friday, Monday & the final low Tuesday.

“If it (DOW) isn’t plunging by Wednesday, the analogy will no longer hold.”

Interesting call Joe!

TRIN suggesting he may be onto something this time!

Something big’s on deck… 🙂

He has been developing this call for a long time now. It keeps delaying.

Not sure what his next call is if Wednesday is not down Huge. I guess another Interim Report to be posted.

Lara has had the move spot on for the entire time… that he has been calling the top… I think since Aug 2017

First …. and long (at least for now)

Verne and Chris both long…that’s a pretty serious bullish indicator right there!

I doubled down pretty close to the lows today myself (but overall smaller positions because B waves are so tricky and dangerous), so let’s hope the VC signal is good here!

Full dicslosure, (not trading advice) I sold SPX futures just before 10am, and simultaneously took gains in short puts on DJIA and NASDAQ. I wanna see either a new low or channel break to enter long. Fully flat here for the first time in years. And also a rule to all, when positions go into green, update stops to no loss, and when gains are there do your best to take them. Again, this is very very dangerous market, and methinks the ETF blow up is right around the corner.

Agreed. I expect the leveraged/inverse ETFs to either collapse or be outlawed fairly soon after the bull market ends. Hopefully they survive this correction.

That advice to move stops to break even is really good advice.

One of my favourite tricks. It can mean positions close for zero (or occasionally a tiny loss because slippage) and leave you to have another go at finding an entry point. Sometimes it takes a few tries before the trade “sticks”.

yeah i “WAS” up 20 handles on 2 contracts and now I am even…… maybe I’ll dress up as a slaughtered pig tomorrow…. ha