Yesterday’s analysis gave a target for downwards movement at 2,637 to 2,635. Price moved lower to reach 2,625.41, 9.59 points below the small target zone. From there it bounced strongly higher, which was expected.

Summary: The short term target is at 2,730. The mid / long term target is at 2,940. This analysis expects an upwards breakout from a consolidation within a week.

Long positions may have stops pulled up to just below 2,625.41.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

At least three wave counts remain valid at the daily chart level. It is possible still that a low may not be in place; intermediate wave (4) could still continue further. Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. However, it would be extremely likely to remain within the wider teal channel (copied over from the monthly chart) if it were to be reasonably deep. This channel contains the entire bull market since the low in March 2009, with only two small overshoots at the end of cycle wave IV. If this channel is breached, then the idea of cycle wave V continuing higher would be discarded well before the invalidation point is breached.

Intermediate wave (4) may now be a complete regular contracting triangle lasting a Fibonacci thirteen weeks. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, there are still three possible structures for intermediate wave (4): a triangle, a combination, and a flat correction. All three will be published. The triangle is preferred because that would see price continue to find support about the 200 day moving average. While this average continues to provide support, it is reasonable to expect it to continue (until it is clearly breached).

The triangle may be complete now, but the other two possibilities of a flat and combination may be incomplete.

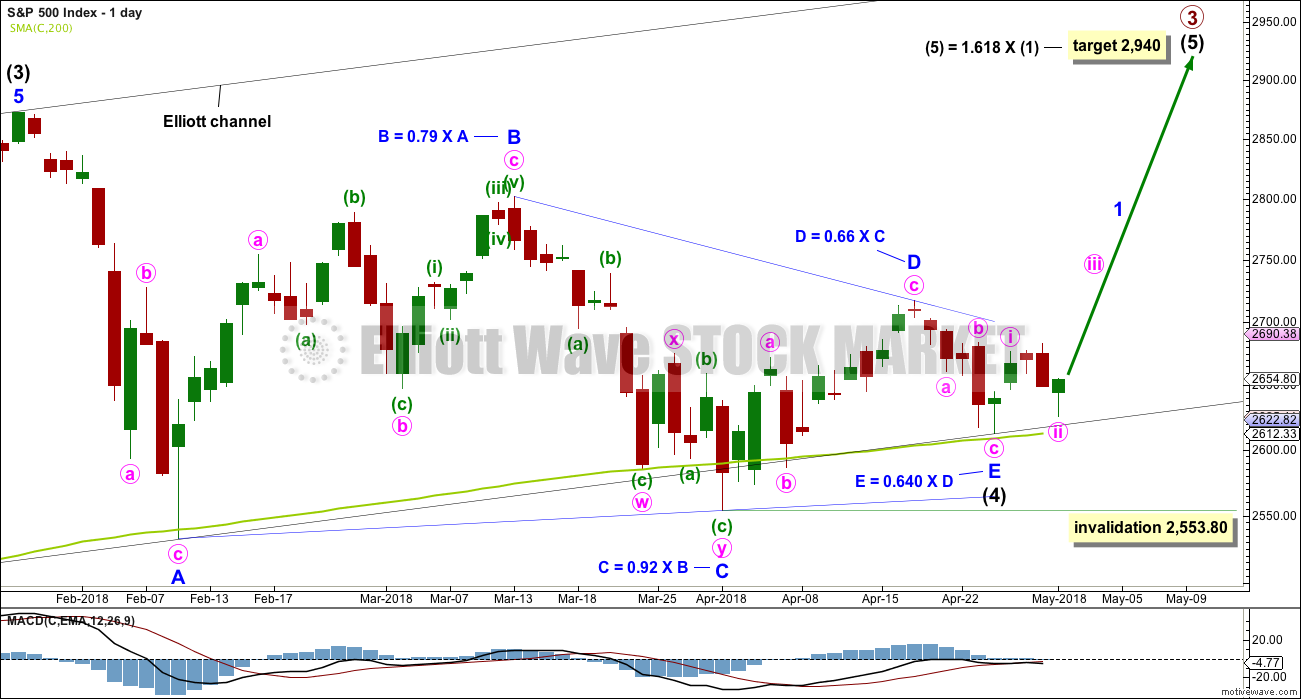

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just above the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

It must still be accepted that the risk with this wave count is that a low may not yet be in place; intermediate wave (4) could continue lower. For this triangle wave count, minor wave E may not move beyond the end of minor wave C below 2,553.80.

When price has clearly broken out above the upper triangle B-D trend line, then the invalidation point may be moved up to the end of intermediate wave (4).

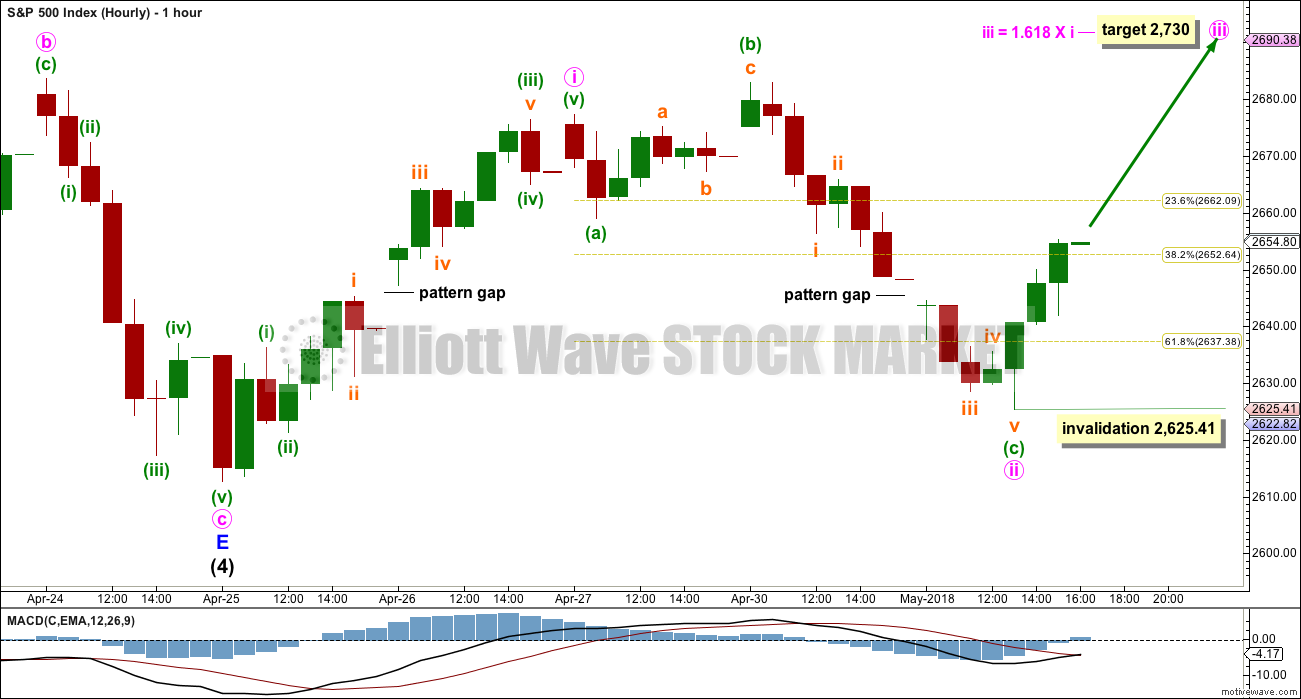

HOURLY CHART

Intermediate wave (5) must subdivide as a five wave structure. At the hourly chart level, the structure should begin to unfold with a five up. Minor wave 1 may be incomplete and subdividing as an impulse.

Within the impulse of minor wave 1, minute waves i and now ii may be complete. Minute wave iii may now exhibit an increase in upwards momentum in order to have the power to break above resistance at the triangle B-D trend line (seen on the daily chart).

Within minute wave iii, no second wave correction may move beyond the start of its first wave below 2,625.41.

When the impulse of minor wave 1 is complete, then minor wave 2 may not move beyond its start below 2,612.67. Minor wave 1 should be long enough to break above the upper B-D trend line of the triangle. Minor wave 2 may then pullback to test support there, at prior resistance.

ALTERNATE WAVE COUNTS

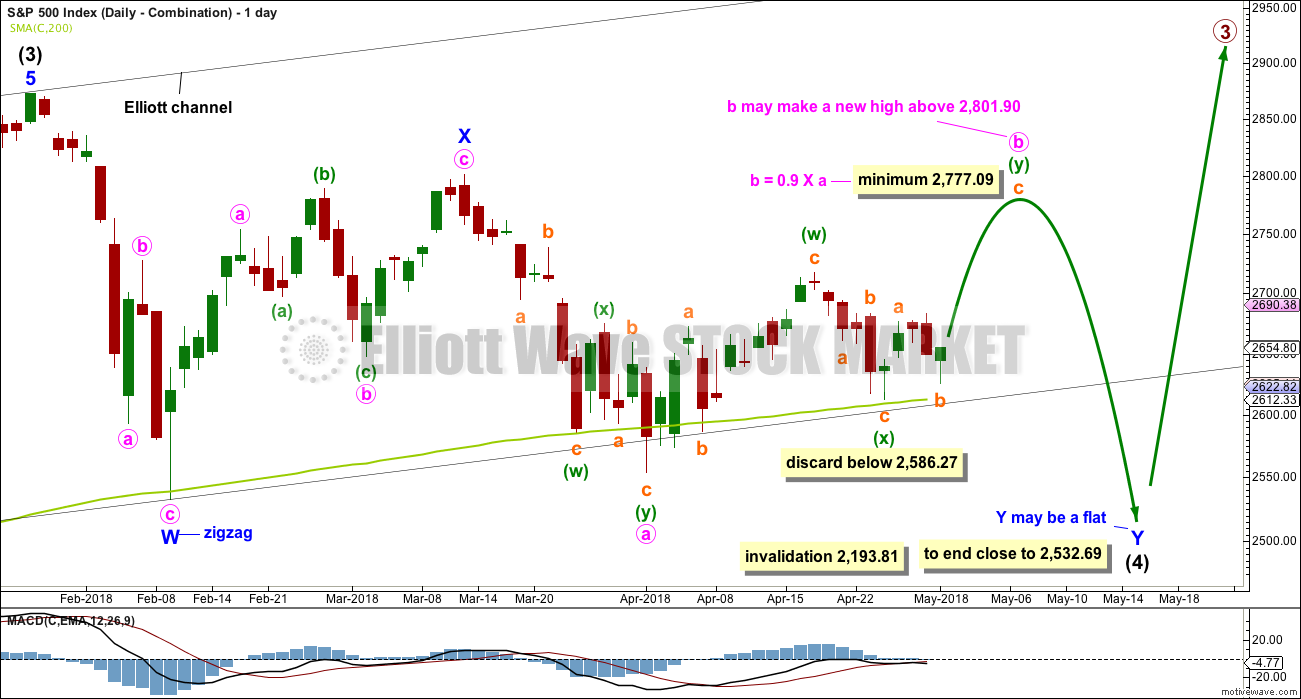

DAILY CHART – COMBINATION

I have charted a triangle a great many times over the years, sometimes even to completion, only to see the structure subsequently invalidated by price. When that has happened, the correction has turned out to be something else, usually a combination. Therefore, it is important to always consider an alternate when a triangle may be unfolding or complete.

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double should be joined by a three in the opposite direction labelled minor wave X, which may be a complete zigzag. X waves within combinations are typically very deep; if minor wave X is over at the last high, then it would be a 0.79 length of minor wave W, which is fairly deep giving it a normal look. There is no minimum nor maximum requirement for X waves within combinations.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but at this stage the expected direction for that idea does not differ now from the main wave count.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag. It may also be a double zigzag.

Minute wave b must now reach a minimum 0.90 length of minute wave a. Minute wave b may be unfolding as a double zigzag. Within a double zigzag, the second zigzag exists to deepen the correction when the first zigzag did not move price deep enough. Double zigzags normally have a strong slope like single zigzags. To achieve a strong slope the X wave within a double zigzag is normally brief and shallow, most importantly shallow (it rarely moves beyond the start of the first zigzag). A new low now below 2,586.27 should see the idea of a double zigzag for minute wave b discarded.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average, which looks unlikely but does have precedent in this bull market.

Minute wave b may make a new high above the start of minute wave a if minor wave Y is an expanded flat. There is no maximum length for minute wave b, but there is a convention within Elliott wave that states when minute wave b is longer than twice the length of minute wave a the idea of a flat correction continuing should be discarded based upon a very low probability. That price point would be at 3,050. However, if price makes a new all time high and upwards movement exhibits strength, then this idea would be discarded at that point. Minute wave b should exhibit obvious internal weakness, not strength.

At this stage, the very bullish signal last week from the AD line making a new all time high puts substantial doubt on this wave count. It has very little support from classic technical analysis.

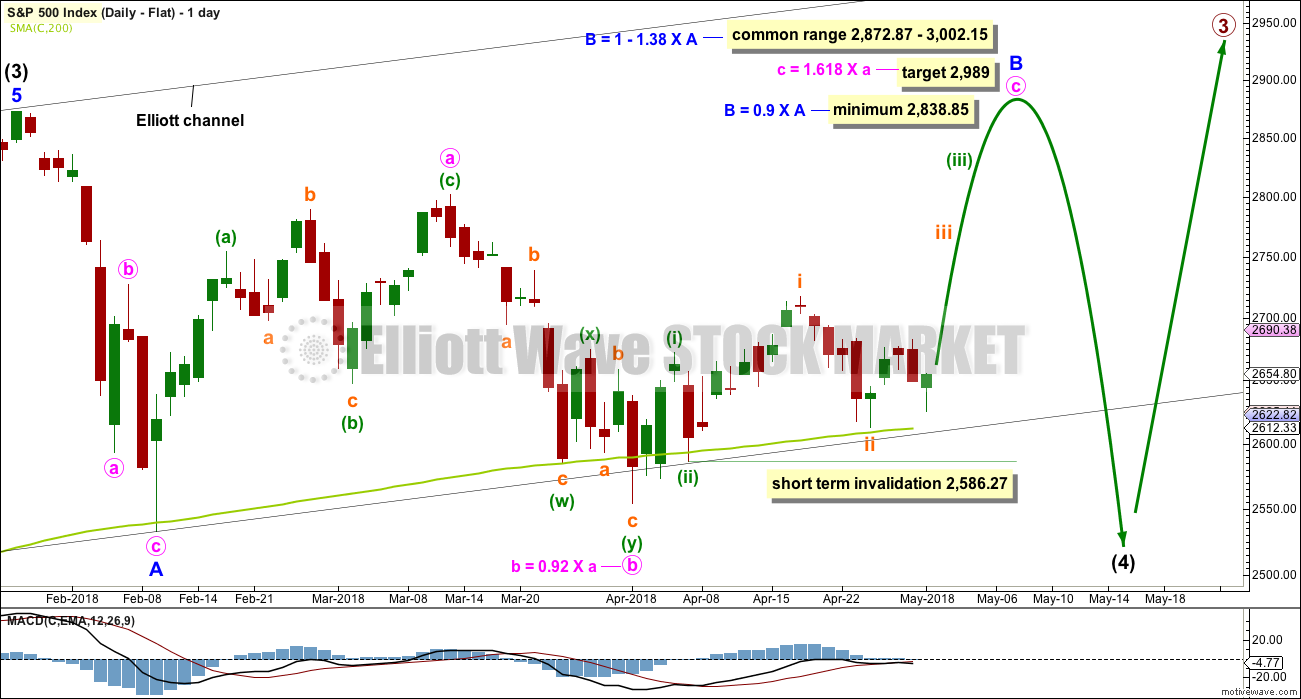

DAILY CHART – FLAT

Flat corrections are very common. The most common type of flat is an expanded flat. This would see minor wave B move above the start of minor wave A at 2,872.87.

Within a flat correction, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,838.85. The most common length for minor wave B within a flat correction would be 1 to 1.38 times the length of minor wave A at 2,872.87 to 3,002.15. An expanded flat would see minor wave B 1.05 times the length of minor wave A or longer, at 2,889.89 or above. A target is calculated for minor wave B to end, which would see it end within the common range.

Minor wave B may be a regular flat correction, and within it minute wave a may have been a single zigzag and minute wave b may have been a double zigzag. This has a very good fit.

However, minute wave c must be a five wave structure for this wave count and now the depth and duration of subminuette wave ii looks wrong. The probability that minute wave c upwards is unfolding as an impulse is now reduced. It is possible that it could be a diagonal, but that too has a relatively low probability as the diagonal would need to be expanding to achieve the minimum price target for minor wave B, and expanding ending diagonals are not very common.

At its end minor wave B should exhibit obvious weakness. If price makes a new all time high and exhibits strength, then this wave count should be discarded.

This wave count would require a very substantial breach of the 200 day moving average for the end of intermediate wave (4). This is possible but may be less likely than a smaller breach. The bullish signal from the AD line making a new all time high puts substantial doubt on this wave count.

TECHNICAL ANALYSIS

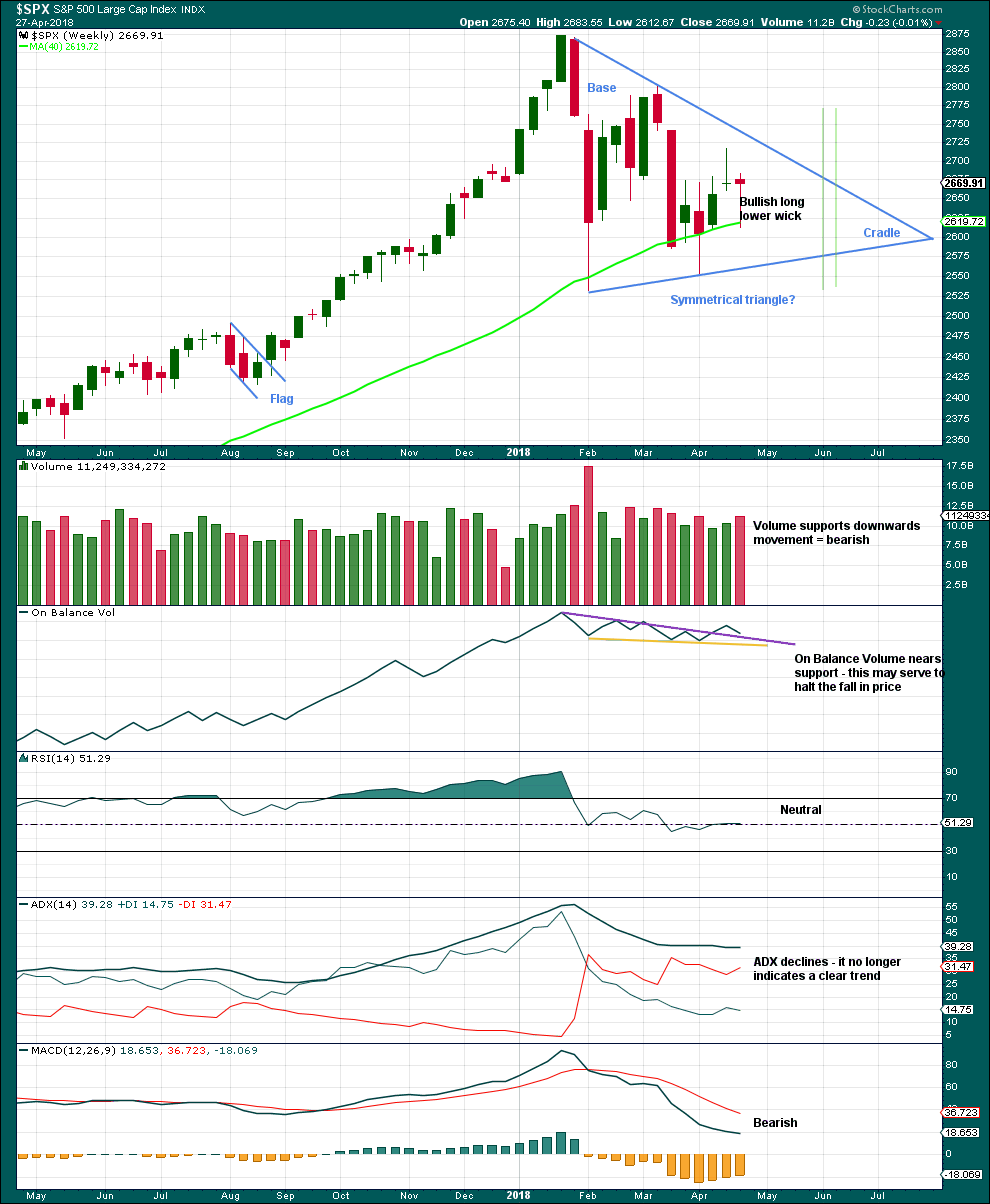

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle pattern may be forming. These are different to Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns, while Elliott wave triangles are always continuation patterns and have stricter rules.

The vertical green lines are 73% to 75% of the length of the triangle from cradle to base, where a breakout most commonly occurs.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout has not yet happened. There is a high trading range within the triangle, but volume is declining.

The triangle may yet have another 6 – 7 weeks if it breaks out at the green lines.

A bullish long lower wick and support here or very close by for On Balance Volume suggest the pullback last week may be over, despite volume increasing. Looking inside the week at daily volume gives a clearer picture of where greatest support was.

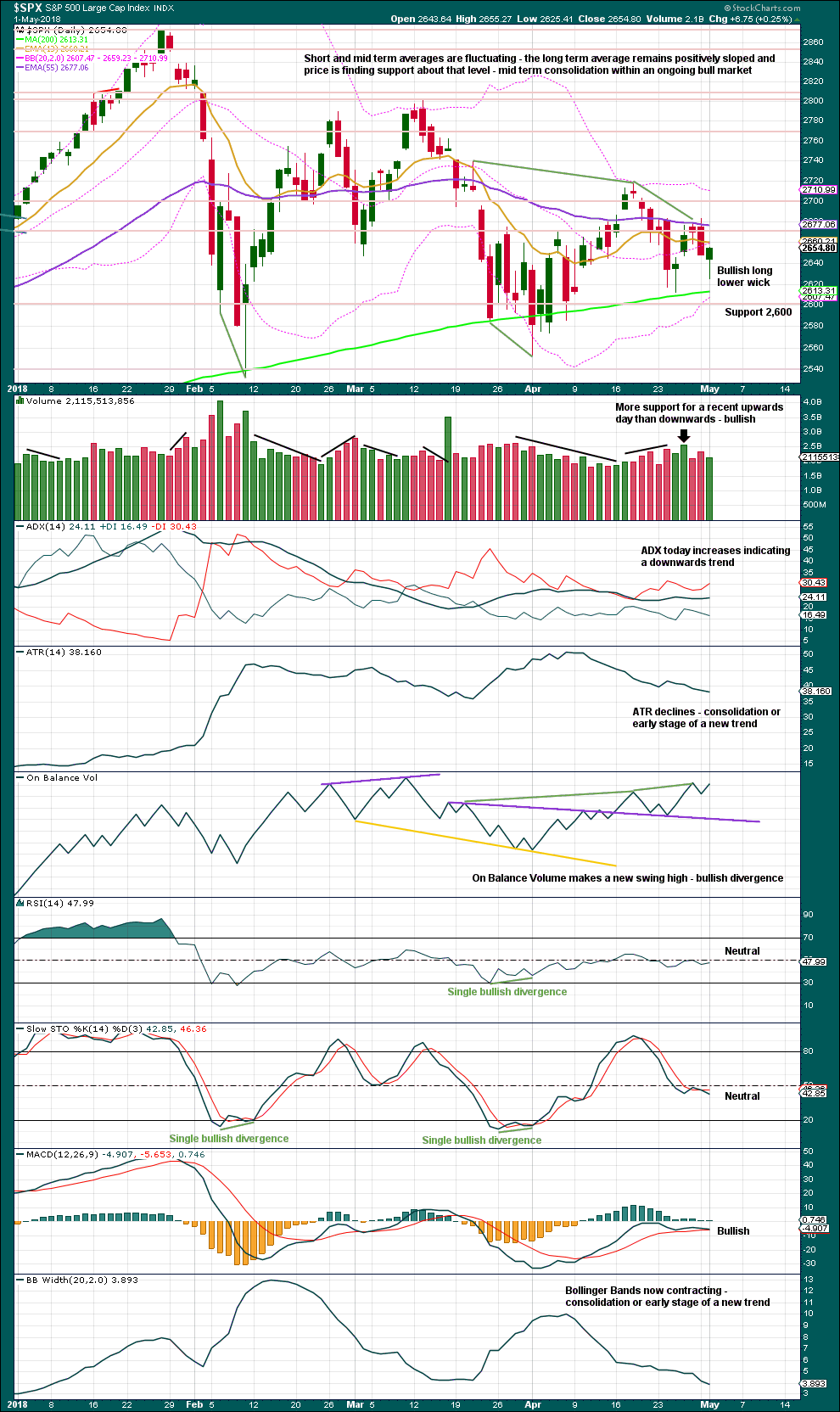

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It looks like a low is in place today. The only indicator which is not bullish is ADX. Overall, this chart is very bullish.

If On Balance Volume makes a new all time high in the next few days, that would be a very bullish signal and should be taken very seriously.

Price is finding strong support here about the 200 day moving average. Expect support there to continue, unless it is clearly breached.

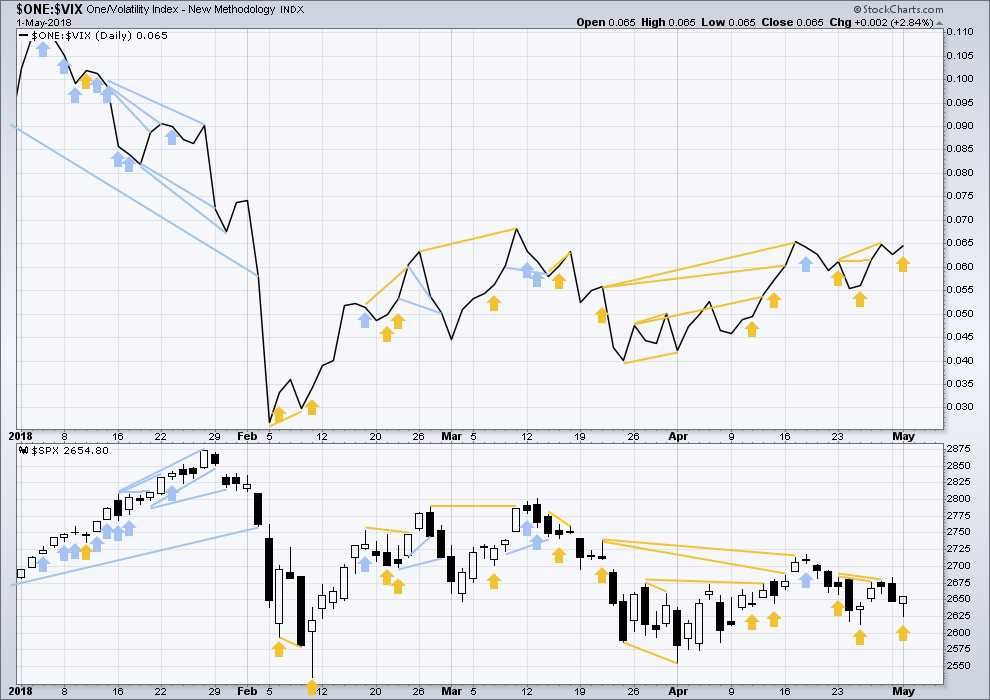

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still a cluster of bullish signals on inverted VIX. Overall, this may offer support to the main Elliott wave count.

Price made a lower low and lower high today, the definition of downwards movement. But inverted VIX has moved higher. This divergence is bullish and supports the Elliott wave counts.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. A new all time high from the AD line this week means that any bear market may now be an absolute minimum of 4 months away.

All of small, mid and large caps have made at least slight new lows below their prior swing lows of the 13th of April. This pullback has support from falling market breadth.

Breadth should be read as a leading indicator.

The new all time high from the AD line remains very strongly bullish and supports the main Elliott wave count.This new all time high from the AD line will be given much weight in this analysis. This is the piece of technical evidence on which I am relying most heavily in expecting a low may be in place here or very soon.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

Price made a lower low and lower high today, the definition of downwards movement. The AD line today has increased; downwards movement does not have support from falling market breadth. A rise in breadth today is bullish and supports the Elliott wave counts.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:10 p.m. EST.

Hiya Verne!

On a day when UVXY is down 1%, and VIX is up 3%, does that give you any hints about market action? Or it has no implication?

Thanks in advance. I know you have lots of trading experience with both vehicles…

That’s 3 post-fed headfakes in a row now. Like clockwork.

All I can say is the narrowing of the market’s range during this correction sure is something. Extremely steady. I keep expecting a break to one side or the other and yet the market continues to move in a contracting sinusoid.

I would consider the rise in on-balance volume to be a good indicator that during this triangle, accumulation has out paced distribution. I think that is a strong clue as to which way the breakout will go. Just my thought. But it does support the main count of Lara.

All that being said, we are not out of the woods yet in that the triangle is not complete. It is still able to morph into something different as happens frequently with triangles. That is why Lara constantly reminds her readers about money management.

It’s a general technical analysis principle that the longer price coils sideways, usually the more violent the move out of the trading range will be.

SPX 5 min in a squeeze and sitting on lower bollinger bands now. I expect a turn back up very shortly….2645 is as low as I would guess it might go (78% retrace). But it looks like the pullback low may be in a bit above that.

daily chart, showing price getting “penned in” by the descending trend line, and the bottom of the rising channel. I think that the main pretty much expects/requires the rising channel to hold. Note the impending squeeze (orange bb coming iinside the blue keltners) here on the daily. From a trend perspective, my weekly and daily both show SPX in (mild) downtrends. Hourly action is neutral. Well…the cusp approacheth!!!

I think both sides expect a big break to one side or the other, so I can’t help but think that we’re just going to get more sideways action for the foreseeable future…

It’s true that a break from the triangle is imminent, but that just means it can’t be used to predict future movements. Doesn’t necessarily mean all of the sudden the market is going to accelerate once it’s no longer “constrained”.

You could not be more mistaken….I will attribute that statement to your inexperience

We’ll see Verne. For 3 months, both bulls and bears have been declaring an imminent swing one way or the other. Neither side has been correct. When a new trend develops, I don’t see why it has to be an immediate, gargantuan impulse up or down. Otherwise buying straddles would be guaranteed money here. Perhaps you think it is. But over the last 3 months that’s generally been a losing trade (although I expect now you’re going to tell me how much money you’ve made on straddles over the last 3 months, in which case I’d like more of an explanation about how you enter/exit such trades). All I am saying is any number of things can happen. I’d appreciate in the future if instead of just insulting me, you’d explain yourself a bit more. Yes I do not have nearly as much experience as you, but I would like to learn. Kevin does a great job explaining the reasoning behind all his positions and trades without being demeaning or speaking as if everything he says is gospel. What exactly do you think is going to happen going forward?

The structure seems to be a triangle. It is certainly extended coiling action. I have made hundreds of trades on movement out of triangles or coils of one sort or another. I do not mean to be insulting. I am just saying that there is not a single trader with even minimal experience that does not see what is eventually going to happen when this coiling action completes. I will admit I do get a bit annoyed when I hear people making statements that make no sense. I am not saying I am always right, but too many folk throw out assertions that are baseless, and for the record, no one on this site has posted more live trades than I have.

Please don’t take offense at this Bo, but if you are not making money in this market which has been so predictably trading up to its 50 day and back down to around its lower BB for many weeks now, you may want to seek out someone to help you with your approach to your trading rather than bellyaching about your results. I gave some advice about trading spreads in a sideways market and I have no doubt that some folk paying attention are going to take very profitable advantage even if you won’t or cannot. I do wish you all the best.

Moderation note:

I don’t see a comment about inexperience as insulting. Which is why I didn’t delete or edit it.

I do acknowledge that Verne’s choice of words can come across as unkind sometimes, something I know you’re aware of Verne.

Be kind people. Always.

If Verne makes a comment which alludes to something not clearly outlined, and anyone here reading it is unsure of what he’s saying, then just ask him to illuminate.

Stick to the TA people. And again, be kind! The world needs more kindness.

Looks normal to me too Peter.

Third waves are often extended. When they extend in price they usually also do so in time. When that happens their subdivisions also last longer and show up at higher time frames.

Today may be minuette (ii) as another expanded flat.

As long as yesterday’s low isn’t taken out, this wave count looks good.

Thank you Lara. This looks about right. I began scaling in this AM, with stops just below yesterday’s swing low.

Will add more if the count proves to be correct. Will lick my tolerable wounds if not.

As did I Curtis. However, since I have a number of longer term long plays using options, I viewed today’s entries (upro) as short term, and I managed to sell right at the top. Sadly, I bought back (though at 1/3 size) in a tad early, but overall I guess I can’t complain. Waiting for a clear uptrend to reassert itself so I can fully buy back in for the next short term run.

Quiet here today. What’s up?

Just staring at this wave up …. and wondering why it looks so funky.

It’s the pause before the 2pm storm….

Does this look at odd start to a third wave to anyone else?

Not to me. It won’t instantly go ballistic. If it is a 3rd wave, it has to “wind up”. There’s been a 1-2, and now this 3 is doing it’s own initial 1-2. Normal. If the current little pullback keeps going and undercuts yesterday’s low, stop the presses…

Well, I must say, Lara, you have nailed this Intermediate 4 triangle throughout its duration. And now, it is nice when the main count and all alternates are pointing in the same direction.

I have noted before that back in the 70’s (that’s 1970’s folks), I followed Joseph Granville the originator of on-balance volume analysis. If we make a new ATH in on-balance volume, Joe would declare a new price ATH is on the way no bones about it. He was quite a flamboyant and gregarious fellow. Not always right, but quite a character.

“Ole’!”

Thank you Rodney.

I’ve had a few mornings when I’ve complained to Cesar that this market analysis is really hard… but I think it’s worth the time and effort expended. It’s very satisfying when it works out as expected. But conversely, upsetting when it doesn’t.

Looks like we may close a red candlestick today and OBV may move lower, and not make a new ATH today. But if the count is correct, then it will soon.