Downwards movement has unfolded exactly as expected so far for Monday’s session. The target for the main Elliott wave count remains the same.

Summary: One more day of downwards movement to 2,137 is expected. Thereafter, price should turn up to make a new high above 2,179.58.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

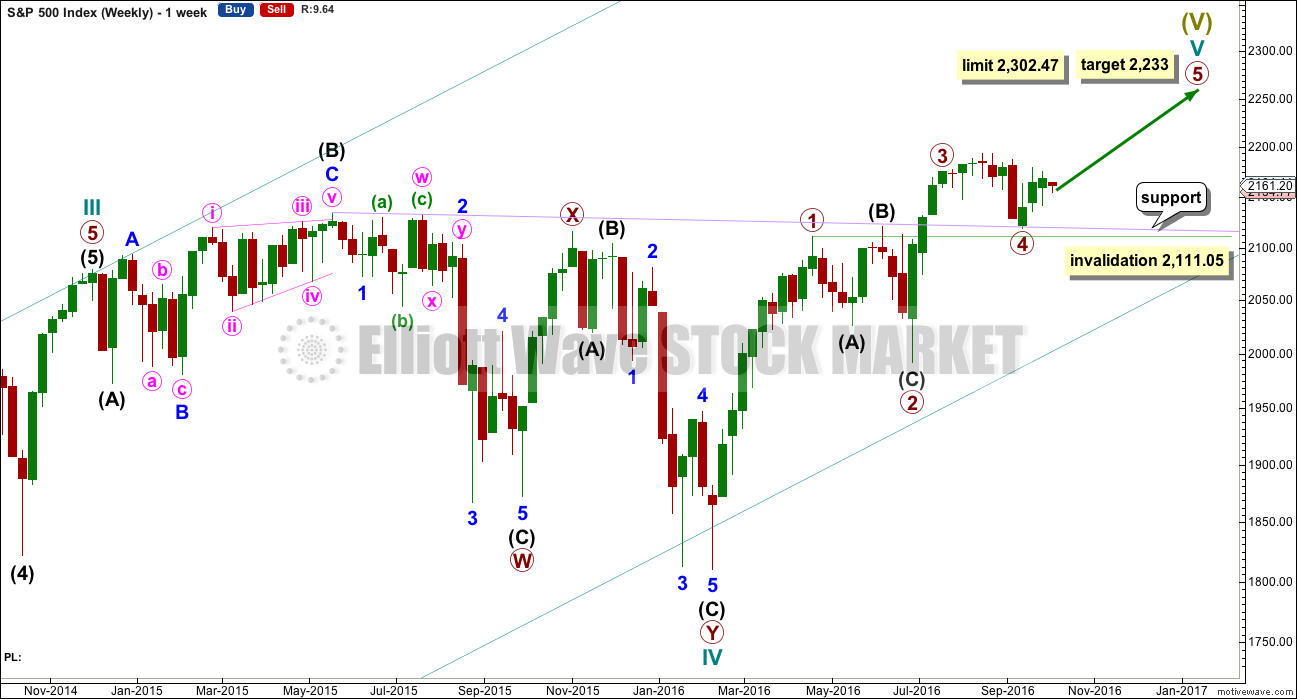

MAIN WAVE COUNT

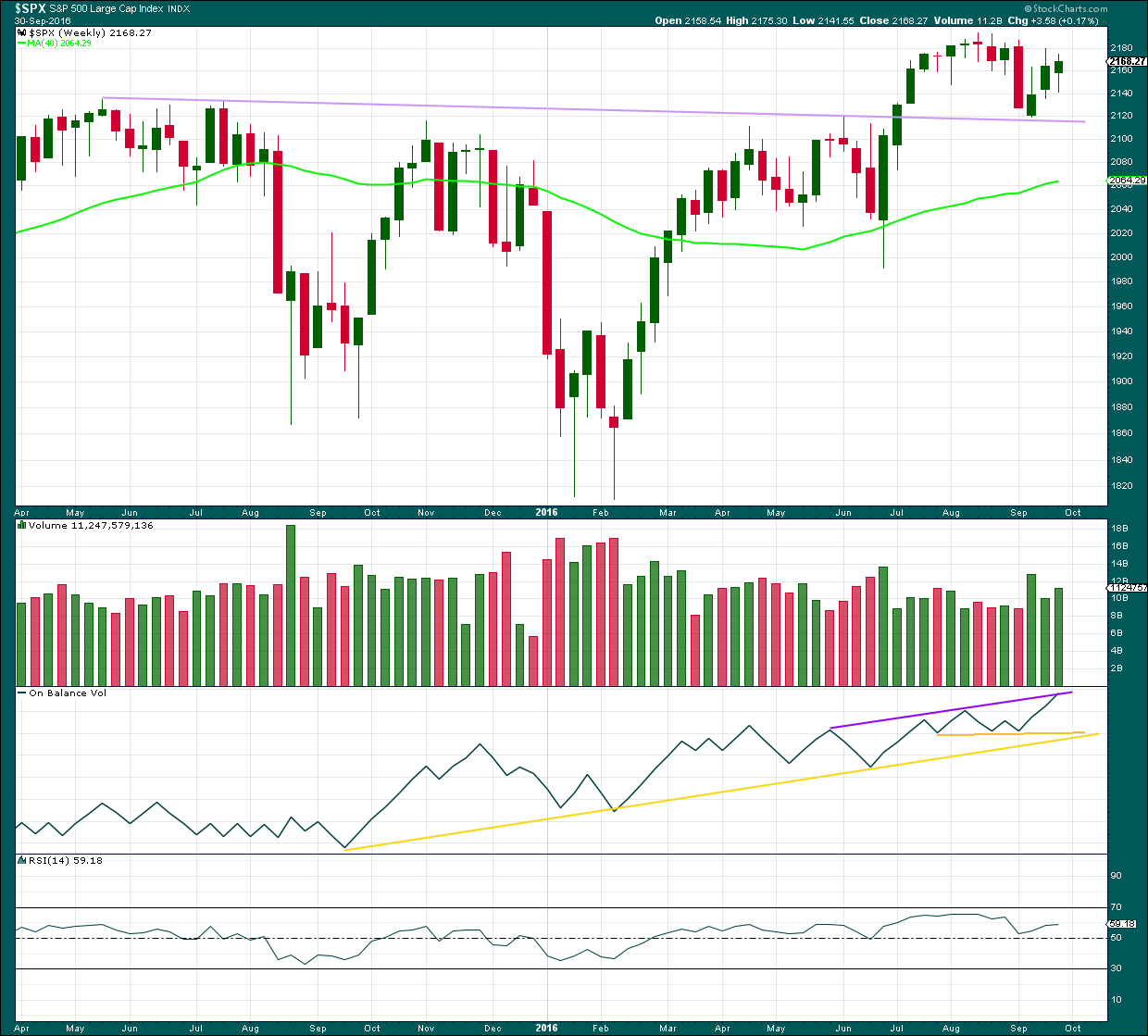

WEEKLY CHART

Cycle wave V must subdivide as a five wave structure. I have two wave counts for upwards movement of cycle wave V. This main wave count is presented first only because we should assume the trend remains the same until proven otherwise. Assume that downwards movement is a correction within the upwards trend, until proven it is not.

Primary wave 3 is shorter than primary wave 1, but shows stronger momentum and volume as a third wave normally does. Because primary wave 3 is shorter than primary wave 1 this will limit primary wave 5 to no longer than equality in length with primary wave 3, so that the core Elliott wave rule stating a third wave may not be the shortest is met. Primary wave 5 has a limit at 2,302.47.

Primary wave 2 was a shallow 0.40 expanded flat correction. Primary wave 4 may be exhibiting alternation as a more shallow combination.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

It is also possible to move the degree of labelling within cycle wave V all down one degree. It may be only primary wave 1 unfolding. The invalidation point for this idea is at 1,810.10. That chart will not be published at this time in order to keep the number of charts manageable. The probability that this upwards impulse is only primary wave 1 is even with the probability that it is cycle wave V in its entirety.

When the five wave structure upwards labelled primary wave 5 is complete, then my main wave count will move the labelling within cycle wave V all down one degree and expect that only primary wave 1 may be complete. The labelling as it is here will become an alternate wave count. This is because we should always assume the trend remains the same until proven otherwise. We should always assume that a counter trend movement is a correction, until price tells us it’s not.

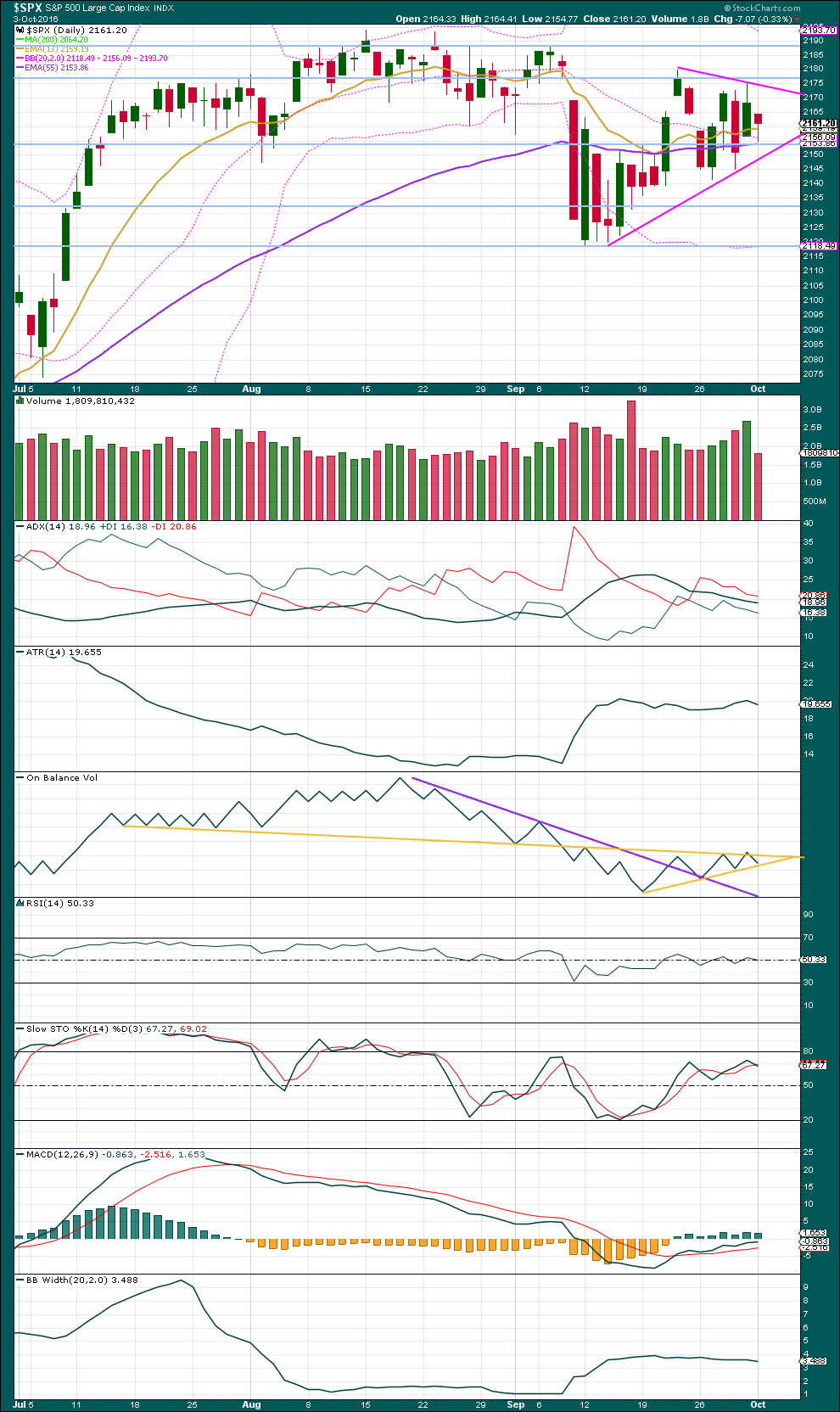

DAILY CHART

Primary wave 4 may be now complete as a double combination.

It is possible now that primary wave 4 could continue further as a triple, but because triples are very rare the probability of this is very low. If it is over here, then the proportion with primary wave 2 looks right. Within primary wave 5, no second wave correction may move beyond the start of its first wave below 2,119.12.

Primary wave 1 lasted 47 days, primary wave 2 was even in duration at 47 days, primary wave 3 lasted 16 days, and primary wave 4 has lasted 37 days. The proportions between these waves are acceptable.

If primary wave 5 has begun here, then at 2,233 it would reach 0.618 the length of primary wave 1.

At this stage, an impulse for primary wave 5 looks unlikely with invalidation of that idea at the hourly chart level. An ending diagonal now looks more likely for primary wave 5. Ending diagonals are choppy overlapping structures. The classic technical analysis equivalent is a rising wedge. They are terminal structures, doomed to full retracement at their end.

If primary wave 5 comes up to touch the upper edge of the maroon channel, it may end there.

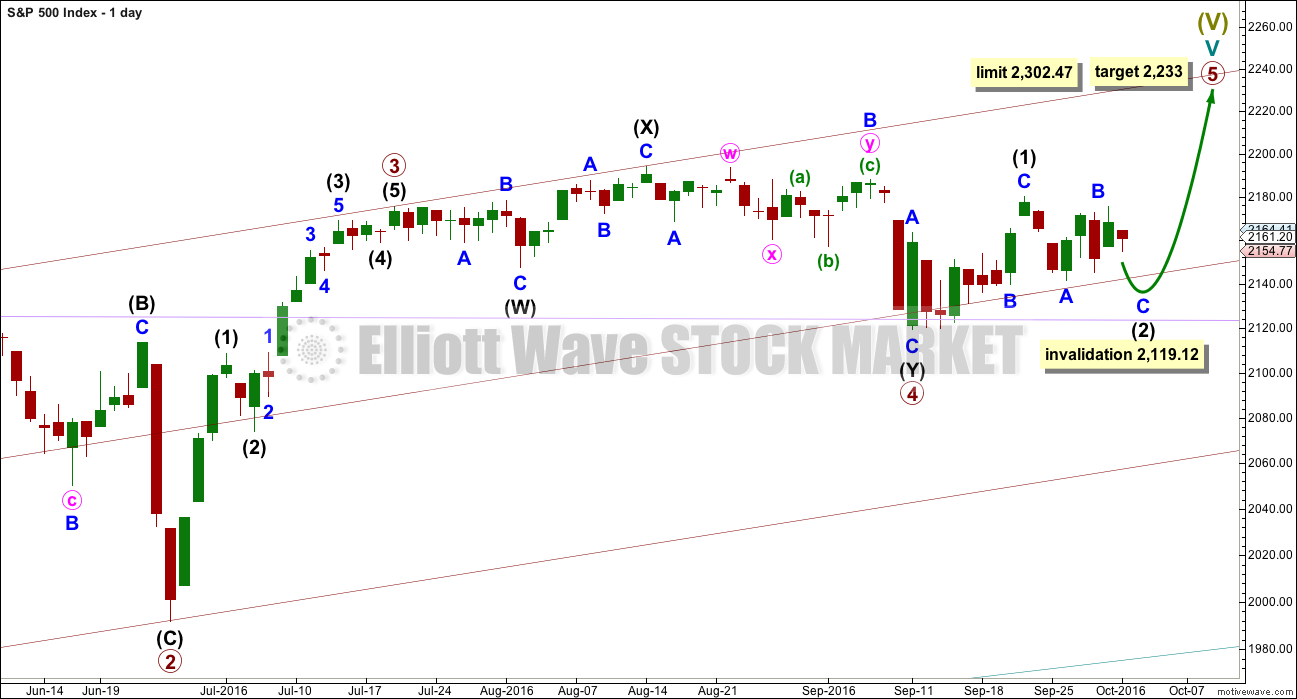

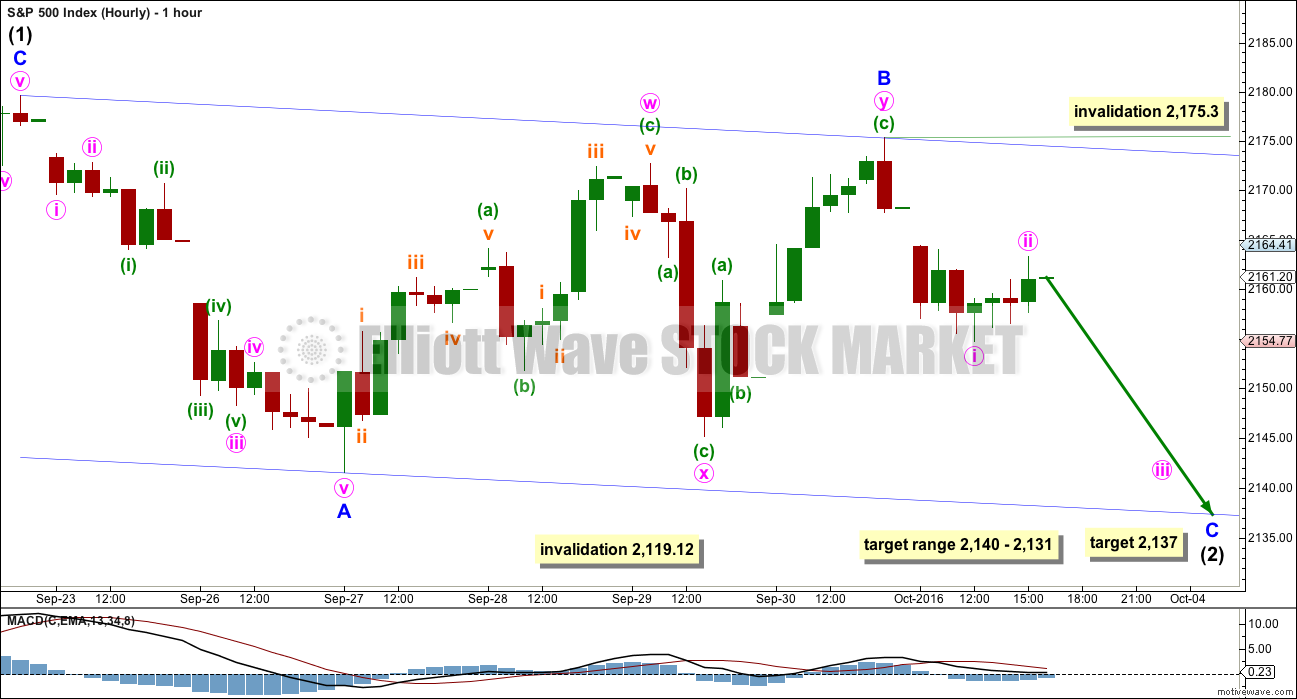

HOURLY CHART

If primary wave 5 is subdividing as an ending diagonal, then all sub-waves must subdivide as zigzags. Intermediate wave (1) may be a completed zigzag.

Second and fourth waves within diagonals have a normal depth of from 0.66 to 0.81 the prior wave. This gives a target range for intermediate wave (2) from 2,140 to 2,131.

Intermediate wave (2) must subdivide as a zigzag. It may not move beyond the start of intermediate wave (1) below 2,119.12.

Intermediate wave (1) lasted a Fibonacci eight days.

If intermediate wave (2) ends in one more day, it too would last a Fibonacci eight days. At 2,137 minor wave C would reach equality in length with minor wave A. Price may find support about the lower edge of the blue channel drawn here about the zigzag of intermediate wave (2).

Minor wave C must subdivide as a five wave structure. So far, within minor wave C, minute wave i is most likely complete and minute wave ii may be a brief shallow zigzag. Minute wave ii may move higher tomorrow, but it may not move beyond the start of minute wave i above 2,175.30.

If intermediate wave (2) is to end in only one more day, then minute wave ii should be over here.

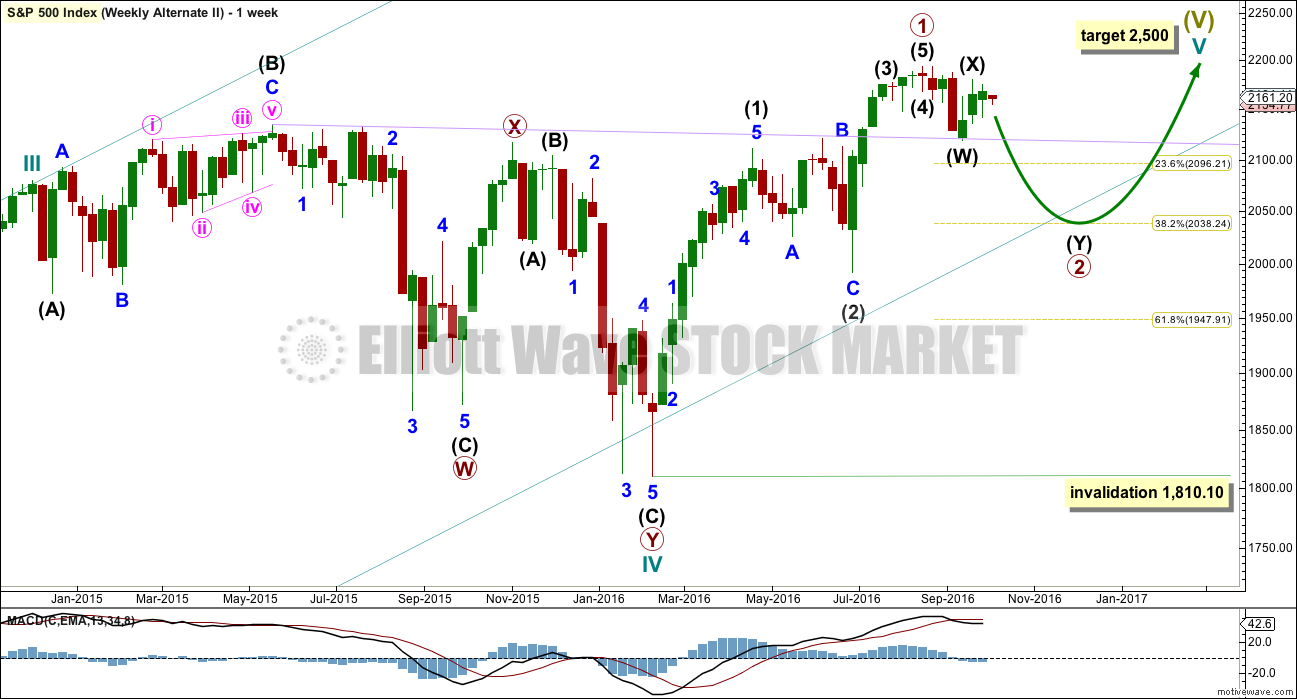

ALTERNATE WAVE COUNT

WEEKLY CHART

What if an impulse upwards is complete? The implications are important. If this is possible, then primary wave 1 within cycle wave V may be complete.

With downwards movement from the high of primary wave 1 now clearly a three and not a five, the possibility that cycle wave V and Super Cycle wave (V) are over has substantially reduced. This possibility would be eliminated if price can make a new all time high above 2,193.81.

If an impulse upwards is complete, then a second wave correction may be unfolding for primary wave 2. Expectations on how deep primary wave 2 is likely to be are now adjusted. It may be expected now to more likely only reach the 0.382 Fibonacci ratio about 2,038.

At this stage, it looks like price has found strong support at the lilac trend line.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10.

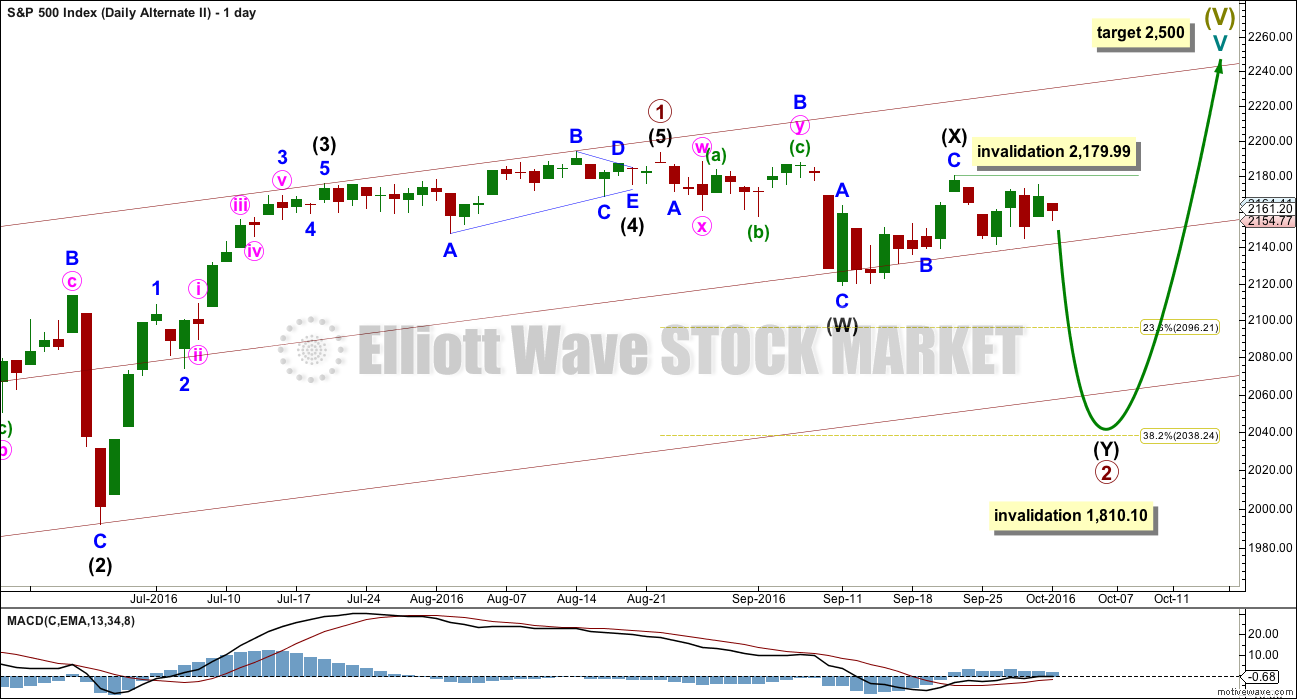

DAILY CHART

If an impulse upwards is complete, then how may it subdivide and are proportions good?

Intermediate wave (1) was an impulse lasting 47 days. Intermediate wave (2) was an expanded flat lasting 47 days. Intermediate wave (3) fits as an impulse lasting 16 days, and it is 2.04 points short of 0.618 the length of intermediate wave (1). So far this alternate wave count is identical to the main wave count (with the exception of the degree of labelling, but here it may also be moved up one degree).

Intermediate wave (4) may have been a running contracting triangle lasting 22 days and very shallow at only 0.0027 the depth of intermediate wave (3). At its end it effected only a 0.5 point retracement. There is perfect alternation between the deeper expanded flat of intermediate wave (2) and the very shallow triangle of intermediate wave (4). All subdivisions fit and the proportion is good.

Intermediate wave (5) would be very brief at only 18.29 points. Intermediate wave (5) is 1.43 points longer than 0.056 the length of intermediate wave (1).

At this stage, primary wave 2 now has a completed zigzag downwards that did not reach the 0.236 Fibonacci ratio. It is very unlikely for this wave count that primary wave 2 is over there; the correction is too brief and shallow. Upwards movement labelled intermediate wave (X) is so far less than 0.9 the length of the prior wave down labelled intermediate wave (W). The minimum for a flat correction has not been met. Primary wave 2 may continue lower as a double zigzag. A second zigzag in the double may be required to deepen the correction closer to the 0.382 Fibonacci ratio.

Intermediate wave (W) lasted a Fibonacci 13 sessions. Intermediate wave (X) has now lasted a Fibonacci eight sessions. If intermediate wave (Y) is equal in duration with intermediate wave (W), that would give the wave count a satisfying look.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10. A new low below this point would see the degree of labelling within cycle wave V moved up one degree. At that stage, a trend change at Super Cycle degree would be expected and a new bear market to span several years would be confirmed.

I will not publish an hourly chart for this alternate. The double zigzag of primary wave 2 is not looking right, so I do not have reasonable confidence in this wave count. Publication of an hourly chart for it would give it too much weight.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The lilac trend line has strong technical significance. Price has broken through resistance, turned down to test support, and is now moving up and away from this line. It is reasonable to conclude that a new all time high is a likely consequence of this typical behaviour.

Last week closed green and has some support from volume. A further rise in price overall would be expected to follow.

On Balance Volume last week came up to touch the purple trend line. It may find some resistance there. A break above this line would be a weak bullish signal. There is divergence with the high last week and the prior high seven weeks ago: OBV has made a higher high but price has made a lower high. This divergence is bearish and indicates weakness in price. This old bull market continues to show internal weakness.

RSI is not extreme and exhibits no divergence at the weekly chart level to indicate weakness in price. There is room for price to rise further.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small red daily candlestick with volume lighter than all days back to 2nd of September indicates weakness for bears today. The fall in price was definitely not supported by volume. This strongly suggests an upwards day should unfold tomorrow and does not support the Elliott wave count.

A triangle pattern is forming on the daily chart (pink trend lines). A break above or below would indicate the next trend. Triangles normally unfold with declining volume though; until today, volume was increasing not declining. This adds some doubt to the pattern.

ADX is declining, indicating the market is not trending. ATR is overall flat, in agreement with ADX. Bollinger Bands are now very slightly contracting. This market is not trending. This market is consolidating.

Within this long consolidation, which began back on about 11th of July, it is three downwards days that have strongest volume. This suggests a downwards breakout is more likely than upwards. This trick may or may not work for the S&P at this time. It is one piece of evidence to weigh up. This consolidation is bounded by resistance at 2,190 and support at 2,120.

On Balance Volume has moved down from the upper yellow line and is now sitting on the lower yellow line. These lines are about to cross, so OBV will break out of this small range within one or two more sessions. The direction of breakout by OBV may precede a direction for price to break out of its triangle.

RSI is still close to neutral. There is plenty of room for price to rise or fall.

Stochastics has not yet reached overbought. Overall, a continuation of an upwards swing within this consolidation may be expected until price finds resistance and Stochastics reaches overbought at the same time.

There are three moving averages on this chart: a short term Fibonacci 13 days (gold), a mid term Fibonacci 55 days (purple), and a long term 200 days (lime). Both the mid and long term averages are still pointing up, and the mid term average is above the long term average. The longer term trend should be assumed to be up, until these averages prove it is not. The short term average has come down to kiss the mid term average and today it remains above the mid term average. The short term trend is fluctuating, exactly as expected within a consolidating market.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is again working to indicate short term movements spanning one or two days.

One day of downwards movement may be enough to resolve the short term bearish divergence noted in last analysis for price and VIX (most recent blue lines).

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is support from market breadth as price is rising.

Short term bullish and bearish divergence is again working between price and the AD line to show the direction for the following one or two days.

One day of downwards movement may be enough to resolve the short term bearish divergence noted in last analysis for price and the AD line (most recent blue lines).

DOW THEORY

Major lows within the old bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the bear market from November 2014:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd November, 2015) – closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – closed above this point on 1st August, 2016.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 10:21 p.m. EST.

The Euro area banksters are starting to become beyond funny and a mite too predictable for my taste. Every time they jack up futures in unison the way they are doing presently means blood-red market days are on the horizon…

SPX 2119.12 is now key to establishing whether we are in an intermediate, or a primary second wave correction according to Lara’s count. We should know by day’s end I wager…if it is just intermediate, it really should end today with a red VIX candle confirming…

The stupendous mendacity from the talking heads on the tube continues un-abated. DB is a separate entity, all the EC banks are different, DB is the only one facing the fine, no possibility of contagion…. Yada, Yada, Yada ad nauseam…just how imbecilic do these arrogant stiffs think the rest of folk are exactly…?!

I think they think we really are very stupid indeed.

I’ve been thinking about the DB crash and EW theory vs fundamental analysis approach. In that is it the news that moves markets, or vice versa.

If the fundamental analysts are right, then DB crashing really should be affecting DAX at the very least, but it’s been sideways with an upwards bias since February.

DB should be affecting EURUSD, but it too has been essentially sideways.

It’s almost as if…. DB has it’s own separate Elliott wave count.

Great observations. No doubt the banksters are furiously pumping to try and maintain the narrative : “Nothing to see here…move along!”

Think Wile- E-Coyote, legs churning, still elevated several feet off the edge of the cliff… 🙂

LOL Yeah, I love the old Road Runner cartoons 🙂

Eventually gravity will prevail.

Gravity gets us all in the end. It’s why we end up 6 feet under LOL

????

Possible, but only if cycle IV moves substantially out of the EW channel and if it is grossly disproportionate to cycle II, it’s counterpart.

The teal channel is drawn using Elliott’s technique. If cycle IV is over it lasted 15 months, compared to cycle II only 3 months.

So for this idea, if cycle IV is only just over halfway through, it would be absolutely massive in proportion to cycle II. That’s not an invalid idea, it just has a horribly low probability.

GAME OVER!!!!!!!!!!!!!!!!!!!!!!!!

EUR Surges On Report ECB Near Consensus To Taper QE Before Its End

It has been a rollercoaster ride for stocks so far, and just as ES was ramping back to intraday highs, moments ago Bloomberg blasted a headline which surprised market watchers, according to which none other than the ECB may follow the BOJ in tapering its QE next.

ECB SAID TO NEAR CONSENSUS ON NEED TO TAPER QE BEFORE IT ENDS

?ECB QE TAPERING SCENARIOS SAID TO INCLUDE SLOWING BY EU10B/MTH

?ECB TIMING ON TAPERING SAID TO DEPEND ON ECONOMIC OUTLOOK

http://www.zerohedge.com/news/2016-10-04/eur-surges-report-ecb-near-consensus-taper-qe-its-end

That ECB stupidity was like dumping a big load of Euros in a corner for people to scoop up. I hope y’all shorted that idiocy…I certainly did! Fastest double in quite some time! (was already short but that spike was a real gift!) 🙂

Joseph, would you explain your meaning of GAME OVER?

The month of October during presidential election years has a unique statistical feature when it comes to volatility – the last six presidential cycles have seen volatility gains 100% of the time! Trade accordingly… 🙂

I’m wondering if the ending diagonal will be contracting, finish more quickly than it started, make a slight new ATH then BOOM!

Down it goes!

Possible. Just.. possible.

But we’ve been there too many times before. I need to be patient, and figure out exactly what price points need to be passed to tell us this may be happening.

There is very broad consensus among Elliotticians that we are in a final fifth wave up, but there are varying opinions as to what degree of which wave we are currently in. The guys at EW see us in a possible minor wave correction and expect to see the area DJI 17,000.00 revisited if that is the case before the uptrend resumes. This would of course result in a concomitant break of SPX 2000.00 While I am not sure about the current wave count or degree, I am quite sure about the importance of the round number pivots. Any immediate bearish case necessitates their decisive violation to the downside imo. October is infamously brutal for markets so things could get exciting….

Yes, finally. I expect October to be better for trading.

Hellooo!

Hi Doc! Nice to see you back 🙂