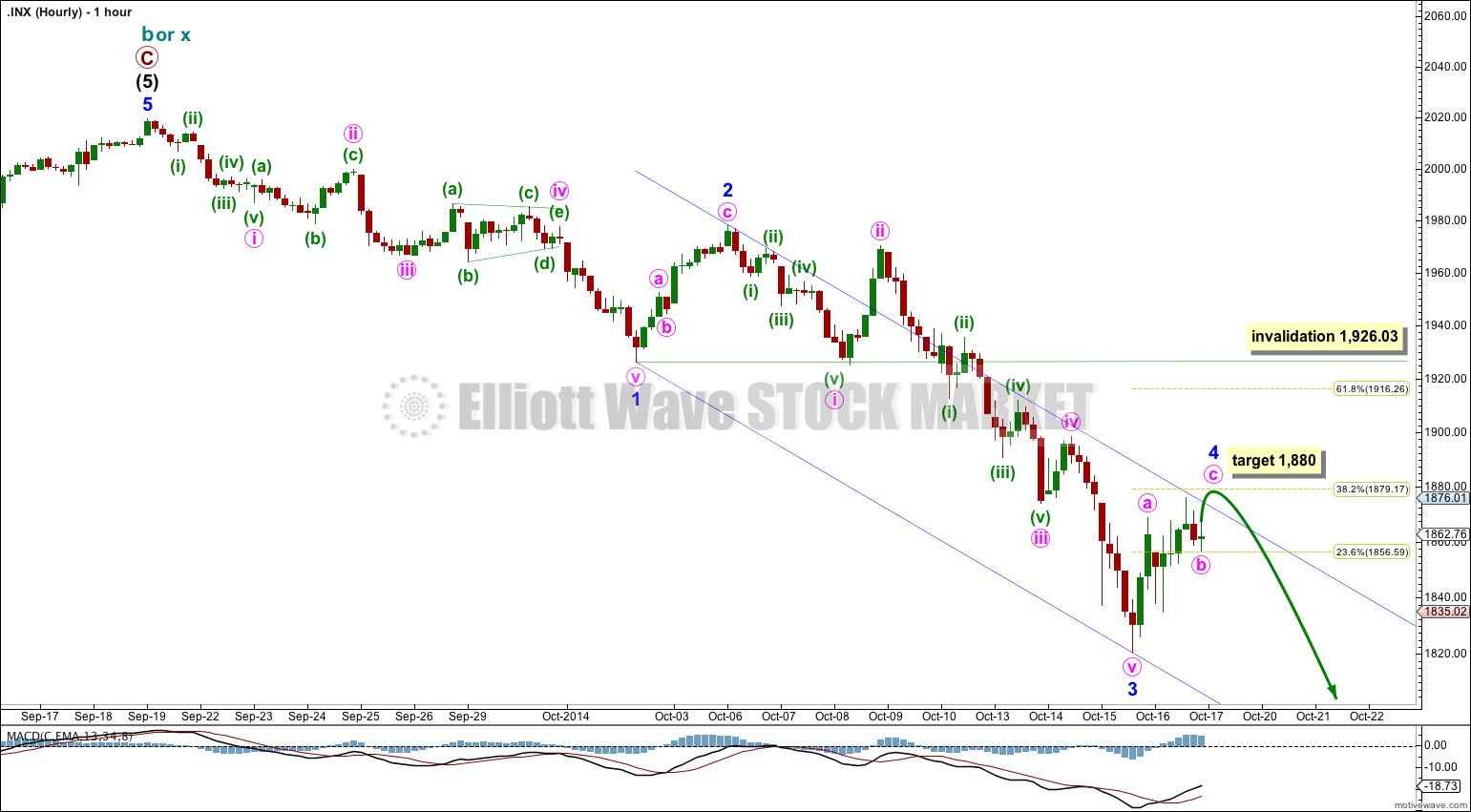

Upwards movement was expected for Thursday’s session to a target at 1,879.17. Price did move higher, reaching up to 1,876.01. I am changing my bullish Elliott wave count today.

Summary: I expect tomorrow to begin with a little more upwards movement to 1,880. Thereafter, a fifth wave down should unfold.

Click on charts to enlarge.

Bearish Wave Count

All monthly, weekly and daily charts are on a semi-log scale.

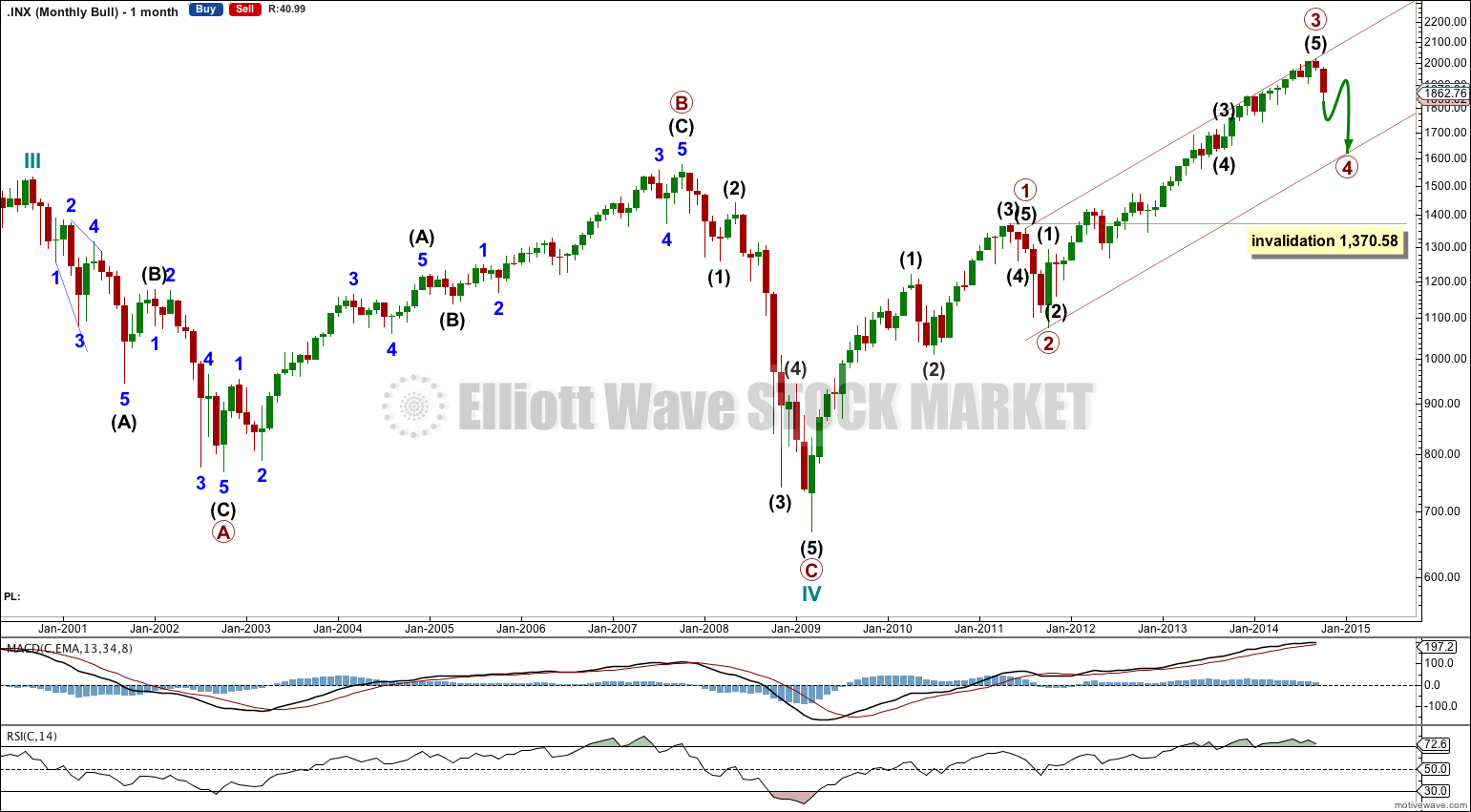

For the first time in three years the lower edge of the maroon – – – channel about cycle wave b (or x) was breached. This is significant.

The bear wave count sees a huge super cycle wave (II) incomplete as either an expanded flat correction, a combination, or a double flat.

There is double divergence between RSI and price at the end of this upwards wave. Also, when we see the first correction (a second wave) along the way down then we may see a failure swing for RSI: it may try again to break above 70 but fall short or just break the 70 level and then fall, which would repeat a pattern seen for the last two major market turns in 2000 (September) and 2007 (October).

The aqua blue trend lines are critical. Draw the first trend line from the low of 1,158.66 on 25th November, 2011, to the next swing low at 1,266.74 on 4th June, 2012. Create a parallel copy and place it on the low at 1,560.33 on 24th June, 2013. This lower trend line is now breached by about 4% of market value. As this is more than 3% it may now be used to indicate a major trend change.

There is technical divergence at the weekly chart level with price and MACD.

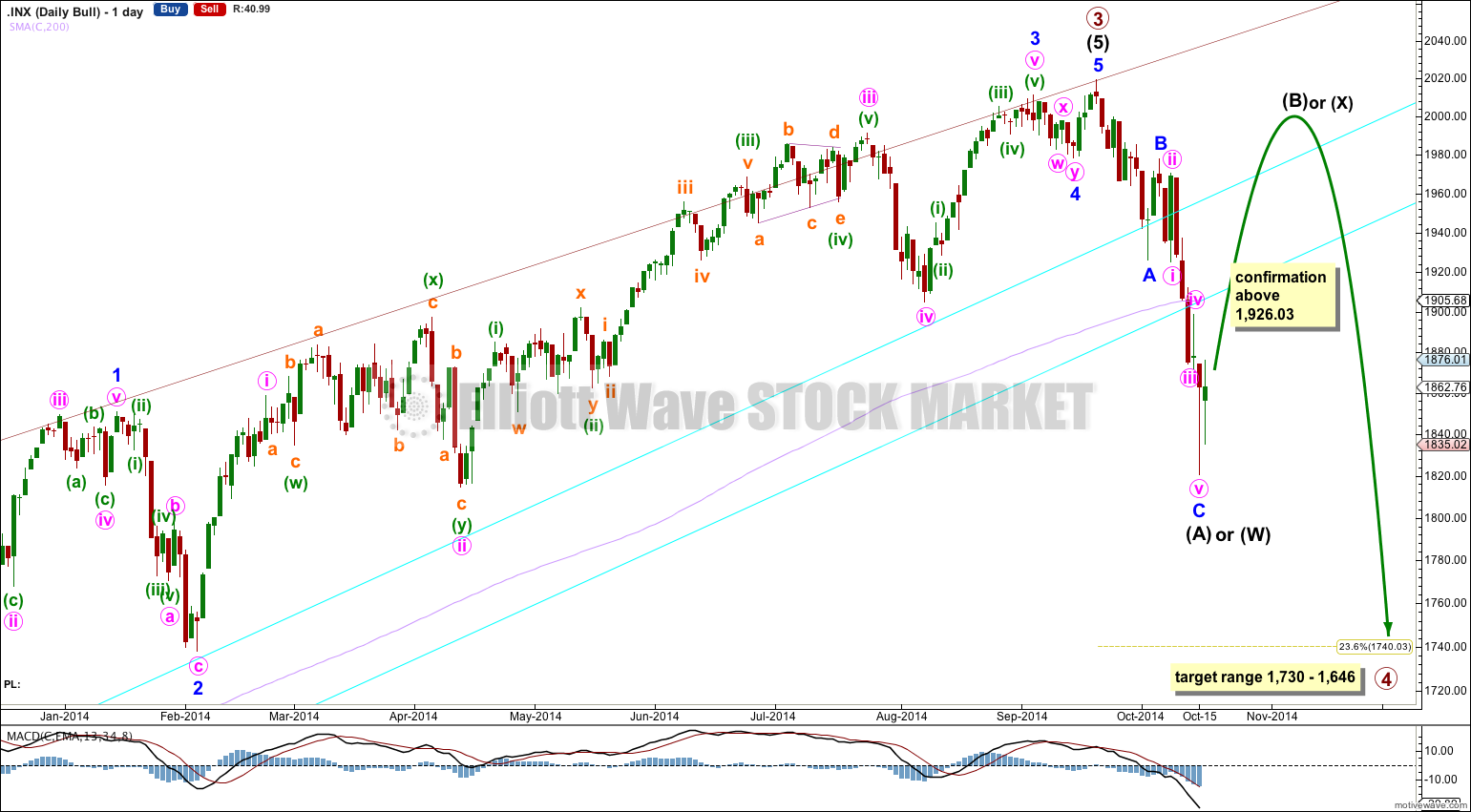

Draw channels and trend lines on the weekly chart and copy over carefully to the daily chart.

There are a couple of things about this wave count of which I am confident. I see intermediate wave (3) within primary wave C as over at 1,729.86 (19th September, 2013). It has the strongest upwards momentum and is just 0.76 longer than 2.618 the length of intermediate wave (1). At 455 days duration this is a remarkably close Fibonacci ratio. The subdivisions within it are perfect.

The large maroon – – – channel is copied over from the weekly chart. There is now a full daily candlestick below this channel and not touching the trend line. This is an indication of a trend change: cycle wave b (or x) zigzag should now be over and cycle wave c (or y) should be underway.

Minor wave 4 may not move into minor wave 1 price territory above 1,926.03.

To have full confidence in this bearish wave count, and to discard the bullish wave count, I want now to see three things happen:

1. A clear five down on the daily chart, with completion of intermediate wave (1).

2. Confirmation from NASDAQ with a new swing low for that market below 3,414,11.

3. A new low below 1,370.58.

When we have those three things I will have confidence in this wave count.

Minor wave 3 is 6.33 points longer than 1.618 the length of minor wave 1. This is a 4% variation and so an acceptable ratio. I would not expect minor wave 5 to exhibit a ratio to either of 1 or 3, but I will expect minor wave 5 to be short as both minor waves 1 and 3 look extended.

Draw a channel about this downwards impulse using Elliott’s first technique: draw the first trend line from the lows of minor waves 1 to 3, then place a parallel copy on the high of minor wave 2. At this stage it looks like minor wave 4 may slightly overshoot the channel. If it does then the channel should be redrawn using Elliott’s second technique.

Minor wave 4 should end within the price territory of the fourth wave of one lesser degree, which is between 1,874.14 to 1,898.71 of minute wave iv. At 1,880 minute wave c would reach 0.382 the length of minute wave a and minor wave 4 would end close to the 0.382 Fibonacci ratio of minor wave 3.

Minor wave 4 should show clearly on the daily chart as at least one or two green candlesticks. So far it is showing as one green candlestick, it may continue for another one or two days. I expect now it is most likely to be over tomorrow.

Minor wave 4 may not move into minor wave 1 price territory above 1,926.03.

Bullish Wave Count

I am today moving the degree of labeling within primary wave 3 all up one degree.

I have taken some time to go back over Dow and S&P 500 charts back to 1974. I have looked at prior impulses from the low of 60.96 in October 1974 to the high of 1,5552.87 in March, 2000 (at the left of this chart). Within that long bull market I have noticed that third waves do not always break above base channels, and second waves are not always contained within base channels. This happened within a cycle degree first wave.

Within the cycle degree third wave the base channel performed as usual, with the middle of the third wave breaking above it.

Considering the larger picture for this wave count expects upwards movement is a cycle degree fifth wave, it may behave in a similar manner to a cycle degree first wave and we may not see primary wave 3 break above a base channel drawn about primary waves 1 and 2. And so I am prepared to consider this possibility that primary wave 3 is actually over.

Primary wave 3 does show an increased momentum beyond that seen for primary wave 1.

This idea now expects to see a primary degree fourth wave correction. It may find support at the lower edge of the channel drawn about cycle wave V using Elliott’s first technique: draw the channel first with a trend line from the highs of primary waves 1 to 3, then place a parallel copy on the low of primary wave 2.

Primary wave 4 may not move into primary wave 1 price territory below 1,370.58.

Primary wave 4 is likely to end within the price territory of the fourth wave of one lesser degree, between 1,730 – 1,646.

There is no Fibonacci ratio between primary waves 3 and 1. Primary wave 3 is less than 1.618 the length of primary wave 1.

The price labels here show how to draw the double aqua blue trend lines.

Primary wave 2 was a 41% zigzag correction. I would expect primary wave 4 to most likely be a flat, triangle or combination. It may not be as deep as 0.618 the length of primary wave 4. If it finds support at the lower edge of the channel it may be a very shallow correction, maybe only 0.236 the length of primary wave 3.

I am expecting a flat, triangle or combination for primary wave 4 and so the first downwards movement is most likely to be a three, and least likely to be a five.

Alternately, the degree of labeling within primary wave 4 may be moved down one degree, and minor A may be an incomplete five wave structure.

At this stage if we see movement above 1,926.03 it would be confirmed that intermediate wave (A) is a completed three wave zigzag.

If we see a new low below 1,820.66 shortly then I will move the degree of labeling within primary wave 4 all down one degree and expect minor wave A is a completed five wave structure. That idea would see no divergence in the short term expectation with the bearish wave count.

If primary wave 4 is an expanded flat, running triangle or combination then it may include a new price extreme beyond its start above 2,019.26. If we do see a new all time high the bearish wave count would be invalidated and a bullish wave count would be my main wave count.

At this time with this reworked bullish wave count, despite its problems, I have much more confidence in it. While price remains above 1,370.58 both bull and bear wave counts will be equally valid, both have problems and both have points which favour them. They expect quite different structures to unfold downwards though: the bear wave count expects a big five down should unfold, and the bull wave count expects a fourth wave correction. Over the next few weeks it should be clearer which of these two possibilities is unfolding. Careful attention to structure should illuminate which scenario is correct.

This analysis is published about 08:32 p.m. EST.