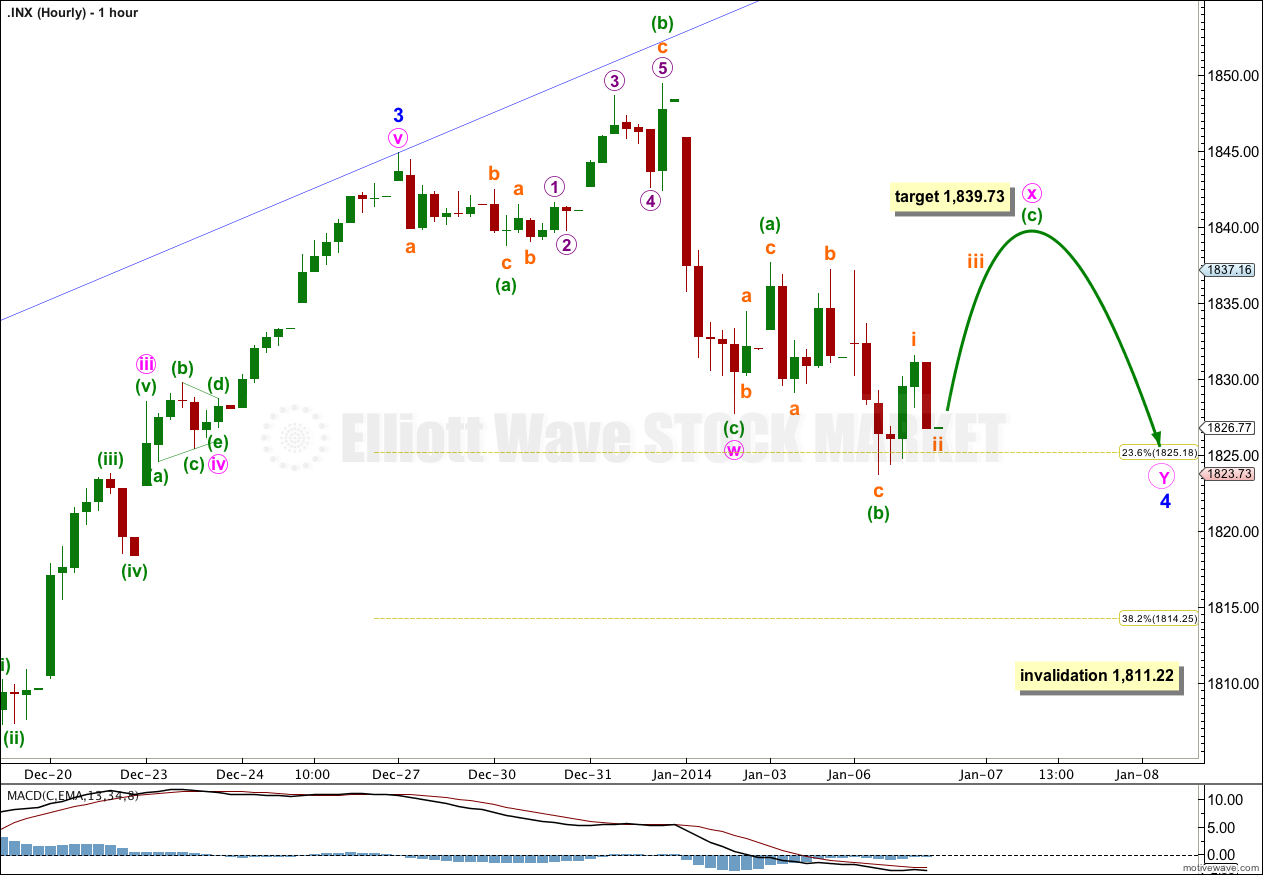

Last analysis expected a little downwards movement to begin the new week, followed by upwards movement. This is mostly what has happened. On the hourly chart this movement fits perfectly with the main wave count. The alternate hourly wave count was invalidated.

Click on the charts below to enlarge.

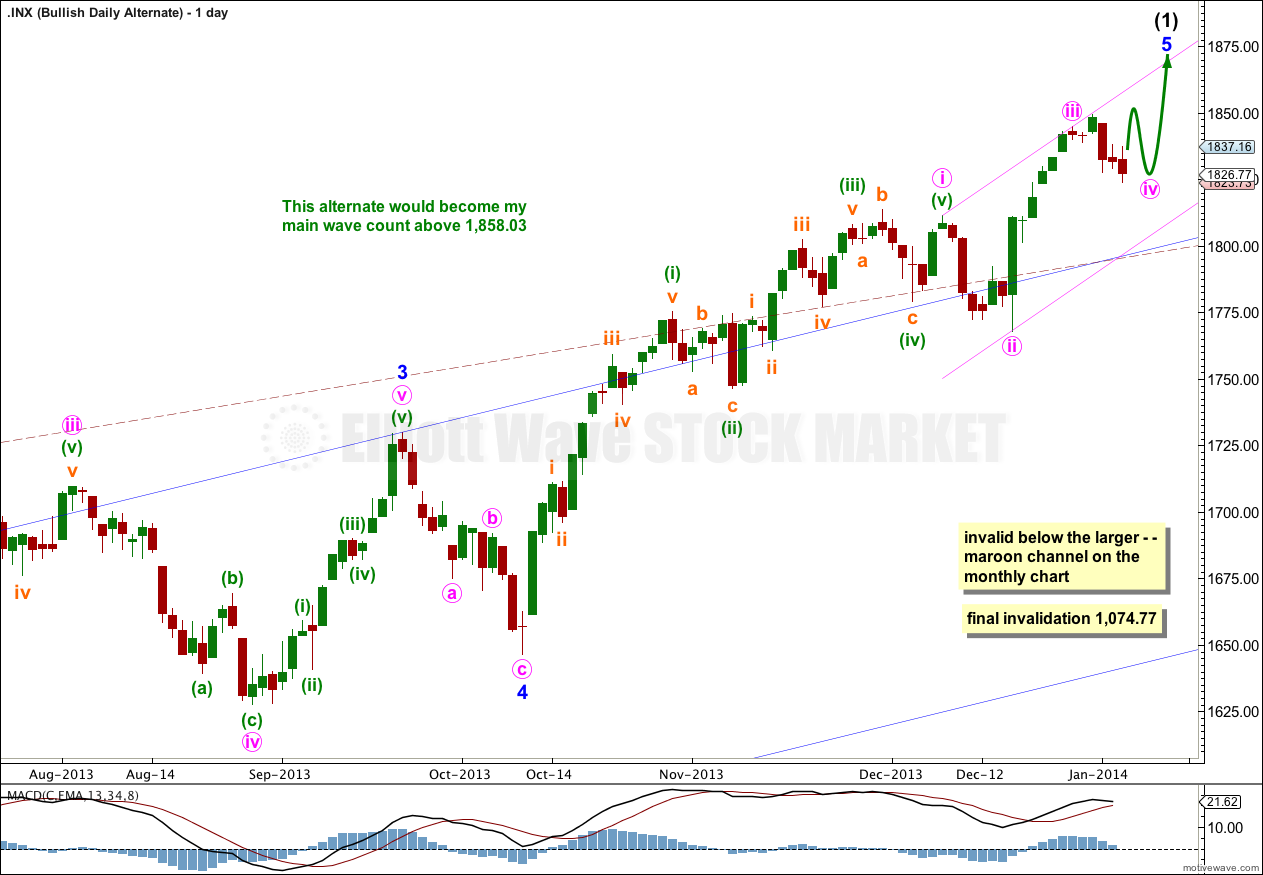

This wave count has a higher probability than the bullish alternate. Upwards movement over the last 4 1/2 years subdivides best as a zigzag. If something is “off” about the supposed recovery then it must be a B wave because there is plenty that is off in this scenario in terms of social mood.

Minor waves 1, 2 and 3 are complete. Minor wave 4 is most likely incomplete. If it ends on 9th January, 2014 it would have lasted a Fibonacci 8 days.

We may be about to see a larger fractal at minor wave degree of the structure within minor wave 1 at minute wave degree; there the first wave was extended, the third wave was shorter, and the fifth wave was shorter still.

Intermediate wave (3) is just 0.76 points short of 2.618 the length of intermediate wave (1). We may not see a Fibonacci ratio between intermediate wave (5) and either of (3) or (1).

Intermediate wave (1) lasted 18 days. Intermediate wave (5) may last a total of a Fibonacci 89 days which would see it end on 10th February, 2014. However, Fibonacci time relationships are not very reliable for the S&P. This is a rough guideline only,

At super cycle degree the structure is an expanded flat correction. Within the flat the maximum common length of cycle wave b is 138% the length of cycle wave a, and this is achieved at 1,858.03. When cycle wave b is longer than the common length of cycle wave a then the probability that an expanded flat is unfolding would reduce and it would be more likely that a long term bull market is underway. Above 1,858.03 I will swap this main wave count over with the bullish alternate.

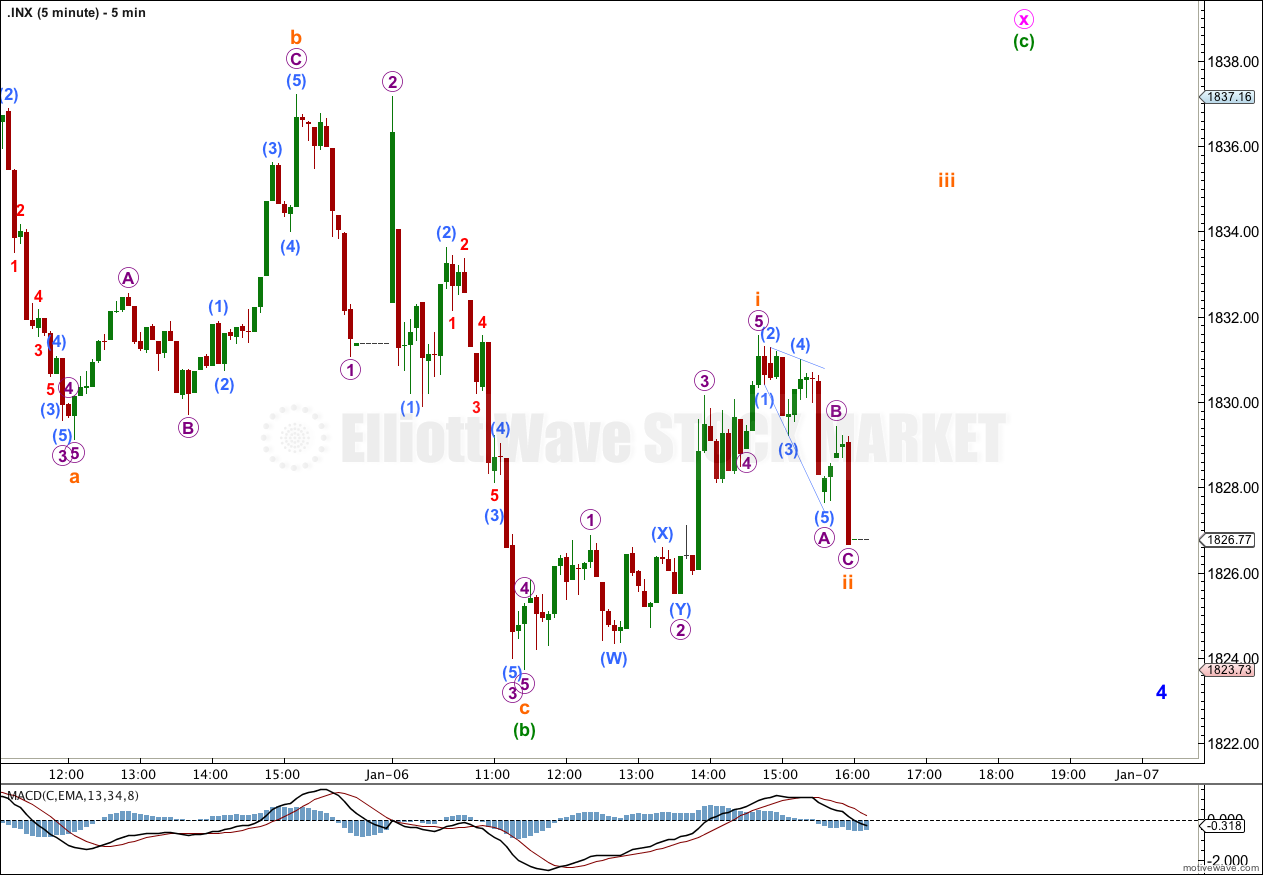

Minor wave 4 is still incomplete. It may be unfolding as either a double flat or double combination. Within the double minute wave x is an incomplete expanded flat correction.

Within minute wave x minuette wave (b) is a 140% correction of minuette wave (a). At 1,839.73 minuette wave (c) would reach 1.618 the length of minuette wave (a). I would expect this target to be reached tomorrow.

Thereafter, we may see either another flat, a zigzag, or a triangle unfold for minute wave y.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 1,811.22.

Bullish Alternate Wave Count.

It is possible that a new cycle degree bull market began at 666.79. So far it is not yet halfway through, and I would expect it to last for a few years (at least five more years and probably longer).

The current upwards impulse, labeled intermediate wave (5) for the main wave count and minor wave 5 for this alternate is incomplete. The structure within the final fifth wave is the same, and the structure on the hourly chart is the same. Targets would be the same for this bullish wave count. This wave count does not diverge with the main wave count, and it will not for several weeks or a couple of months or so yet.

The maroon – – – channel is an acceleration channel drawn about primary waves 1 and 2 on the monthly chart (it is drawn in exactly the same way on the main wave count, but there it is termed a corrective channel). I would not expect intermediate wave (2) to breach this channel because a lower degree (intermediate) wave should not breach an acceleration channel of a higher degree (primary) first and second wave.