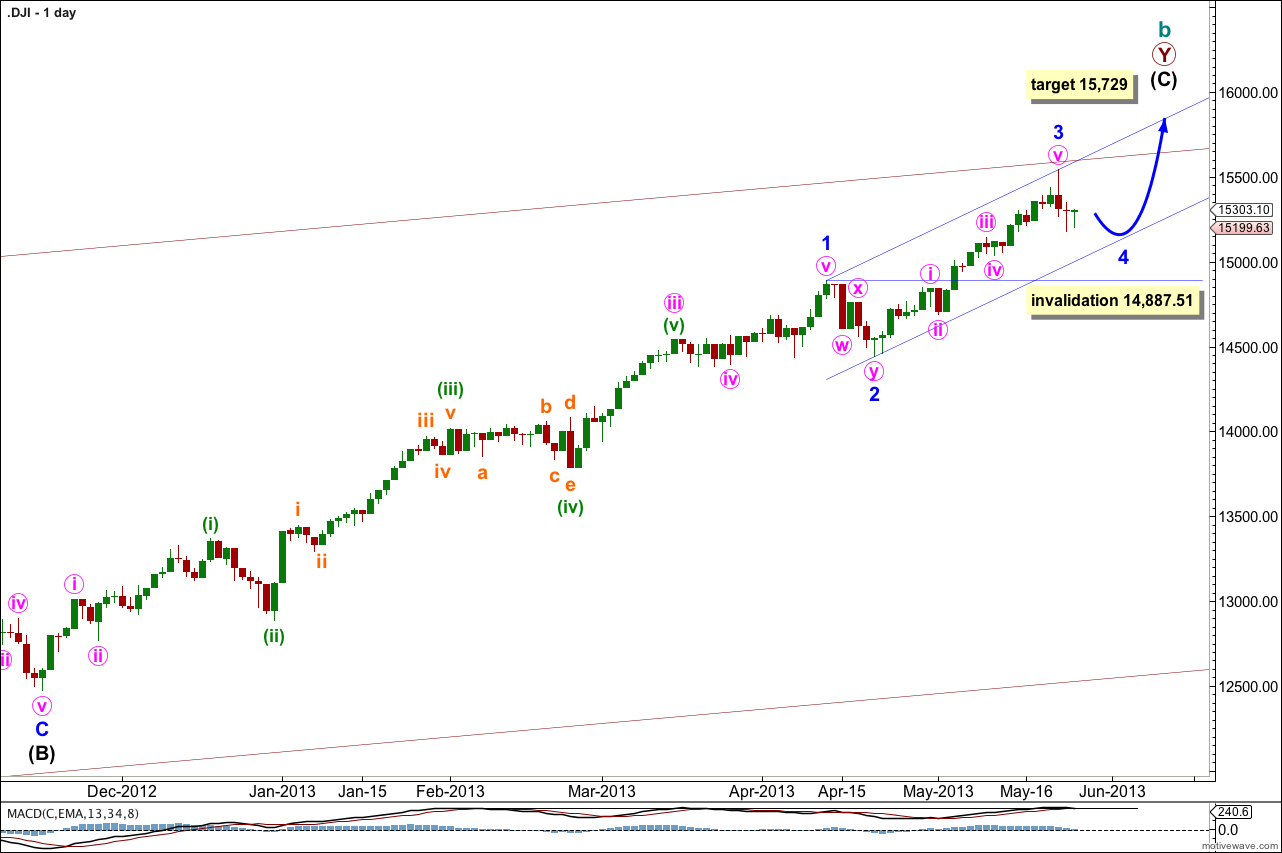

Last week’s analysis expected further upwards movement from the Dow which is what happened. Price has found resistance at the upper edge of a long held parallel channel on the monthly chart.

The wave count is slightly changed at minor wave degree. The target is mostly the same.

Click on the charts below to enlarge.

There are several possible ways to label this long upwards movement of intermediate wave (C). This wave count sees minor waves 1, 2 and 3 complete with the first wave extended. I have changed the labeling within intermediate wave (C) this week to this interpretation because it fits with last week’s strong upwards momentum. This wave count sees the strongest momentum as within the third wave.

There is no Fibonacci ratio between minor waves 1 and 3. This makes it more likely there will be a Fibonacci ratio between minor wave 5 and either of 1 or 3. Because minor wave 3 is shorter than minor wave 1 the upcoming minor wave 5 will be limited to no longer than equality with minor wave 3, as a third wave may never be the shortest wave.

At 15,729 intermediate wave (C) would reach equality with intermediate wave (A).

I have redrawn the channel using Elliott’s first technique. Draw the first trend line from the ends of minor waves 1 to 3, then place a parallel copy upon the low of minor wave 2. Expect minor wave 4 to find support about the lower edge of the channel.

The wide maroon channel is drawn about cycle wave b at the monthly chart level and copied over here to the daily chart. Upwards movement for last week found resistance at the upper maroon trend line and should continue to do so.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 14,887.51.

Minor wave 2 was a shallow (18%) double zigzag. Minor wave 4 should show some alternation with minor wave 2. So far minor wave 4 looks like it may be unfolding as a zigzag, but it may continue further as a double combination or possibly a triangle. It may end about the 0.382 Fibonacci ratio of minor wave 3 at 15,122.82.

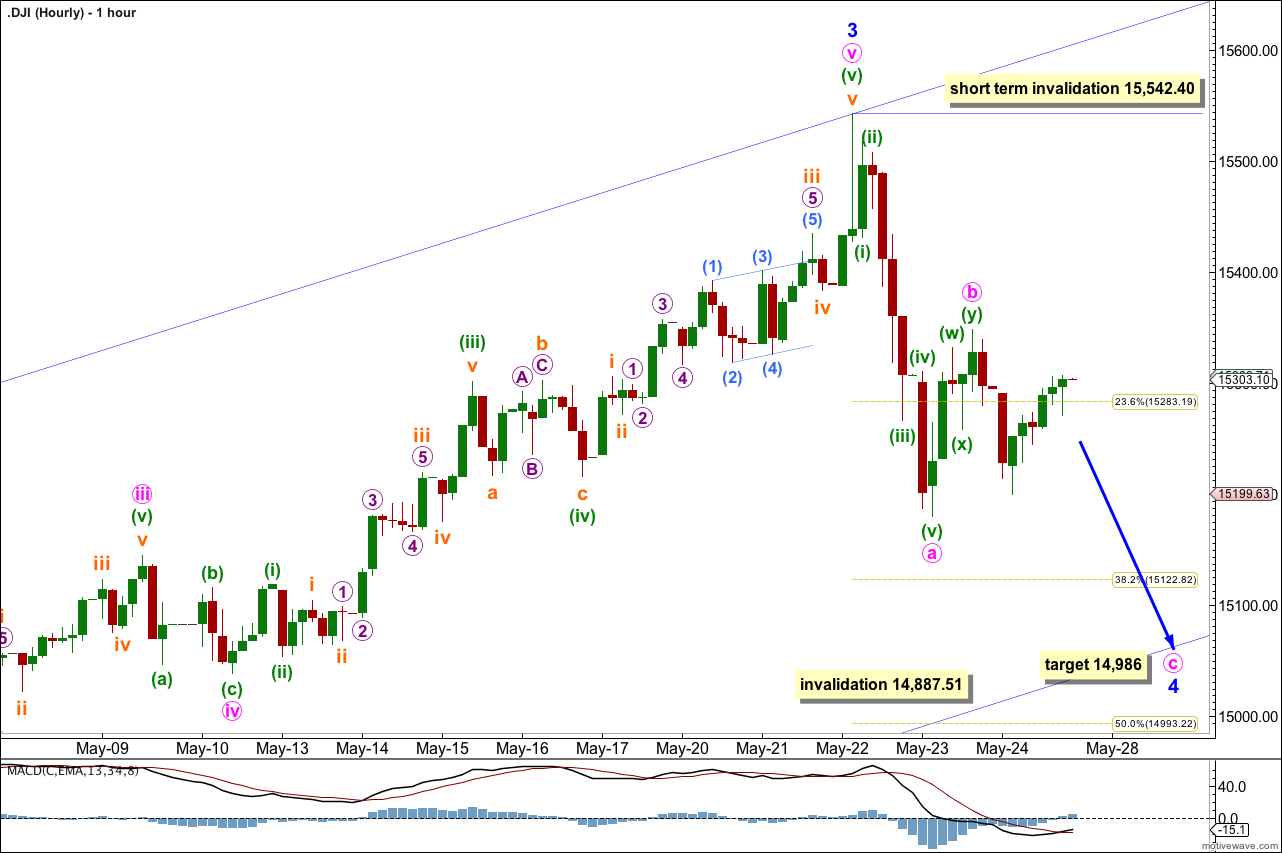

Within minor wave 4 minute wave a subdivides into a five wave impulse. Minute wave b may be complete as a double zigzag, or this may only be minuette wave (a) within minute wave b.

If minute wave b moves higher at the beginning of next week then it may not move beyond the start of minute wave a. This wave count is invalidated in the short term with movement above 15,542.40.

If minute wave b is over and does not move higher then at 14,986 minute wave c would reach equality in length with minute wave a.

Look for price to find support at the lower edge of this channel.

Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 14,887.51.