Last week’s analysis had a short term target on the hourly chart at 1,357 for micro wave 3. Price fell short of this target by 12.78 before a small fourth wave correction, then continued lower to complete a fifth wave. The following fourth wave correction has remained below the invalidation point at 1,441.48.

The wave count remains the same and is nicely explaining recent movement.

Click on the charts below to enlarge.

This daily chart focuses on the new downwards trend of primary wave C.

Within primary wave C intermediate waves (1) and (2) are complete. Intermediate wave (3) is underway and may have just passed the middle of it.

Within intermediate wave (3) minor waves 1 and 2 are complete and minor wave 3 may have just passed its middle.

Within minor wave 3 minute waves i, ii, iii and iv are complete. Minute wave v has just begun.

At 1,276 minute wave v would reach 1.618 the orthodox length of minute wave i. Because there is no Fibonacci ratio between minute waves i and iii I expect we shall see a Fibonacci ratio between minute wave v and either of iii or i.

Draw a channel about minor wave 3 using Elliott’s second technique. Draw the first trend line from the highs of minute waves ii and iv, then place a parallel copy upon the low of minute wave iii. Expect minute wave v to end midway within this channel most likely, or to find support at the lower edge if it gets down there. When this channel is breached by subsequent upwards movement then minor wave 3 should be over and minor wave 4 should be underway.

At 1,232 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

At 1,151 primary wave C would reach 1.618 the length of primary wave A.

Within minute wave v no second wave correction may move beyond the start of its first wave. This wave count is invalidated at minor degree with movement above 1,488.13.

Subminuette waves iii and iv within minuette wave (iii) are now complete. The final fifth wave downwards needs to complete minuette wave (iii). When that is done we should expect a relatively shallow fourth wave correction for minuette wave (iv) which should begin sometime over the next week.

Ratios within subminuette wave iii are: micro wave 3 has no Fibonacci ratio to micro wave 1, and micro wave 5 is just 2.23 short of equality with micro wave 1.

Ratios within micro wave 3 of subminuette wave iii are: submicro wave (3) is 4.3 short of 2.618 the length of submicro wave (1), and submicro wave (5) has no Fibonacci ratio to submicro wave (1).

Ratios within micro wave 5 of subminuette wave iii are: submicro wave (3) has no Fibonacci ratio to submicro wave (1), and submicro wave (5) is just 0.36 short of 0.236 the length of submicro wave (3).

Within subminuette wave iv there is no Fibonacci ratio between micro waves A and C.

Ratios within micro wave A of subminuette wave iv are: submicro wave (3) is just 0.24 longer than 4.236 the length of submicro wave (1), and submicro wave (5) has no Fibonacci ratio to either of submicro waves (1) or (3).

Within micro wave C of subminuette wave iv there are no adequate Fibonacci ratios between submicro waves (1), (3) and (5).

A parallel channel drawn about the zigzag of subminuette wave iv is clearly breached by downwards movement indicating the correction is over.

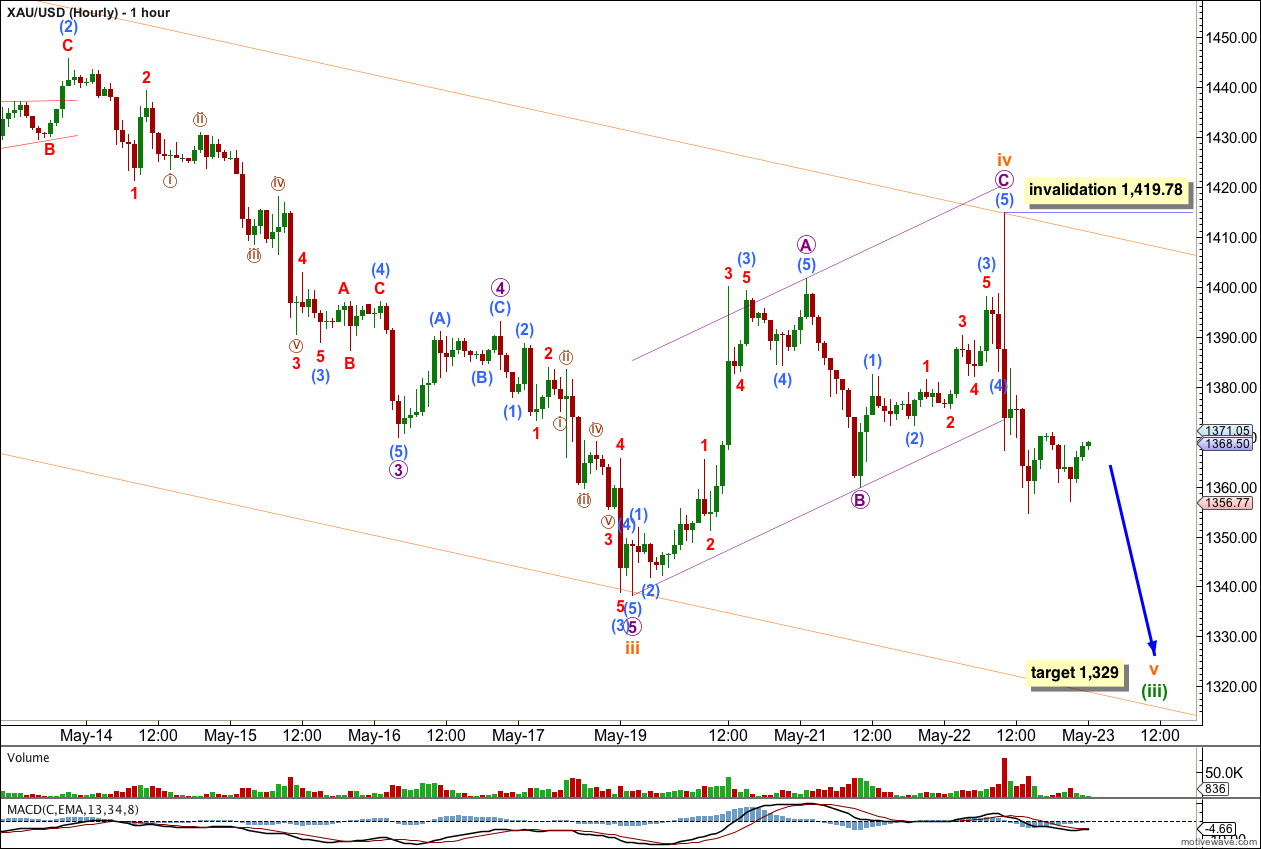

Within minuette wave (iii) there is no Fibonacci ratio between subminuette waves i and iii. At 1,329 subminuette wave v would reach 0.618 the length of subminuette wave iii.

Draw a parallel channel about minuette wave (iii). Draw the first trend line from the highs of subminuette waves ii to iv (you can see subminuette wave ii on the daily chart) then place a parallel copy upon the low of subminuette wave iii. If price moves below the target expect it to find support at the lower edge of the channel.

Within subminuette wave v no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement above 1,419.78.

When minuette wave (iii) is complete then the invalidation point must move up to the low of minuette wave (i) at 1,456.39. The following fourth wave correction may not move back into minuette wave (i) price territory.