Last analysis expected more upwards movement from the Dow for the week which is what has happened.

The wave count remains the same.

Click on the charts below to enlarge.

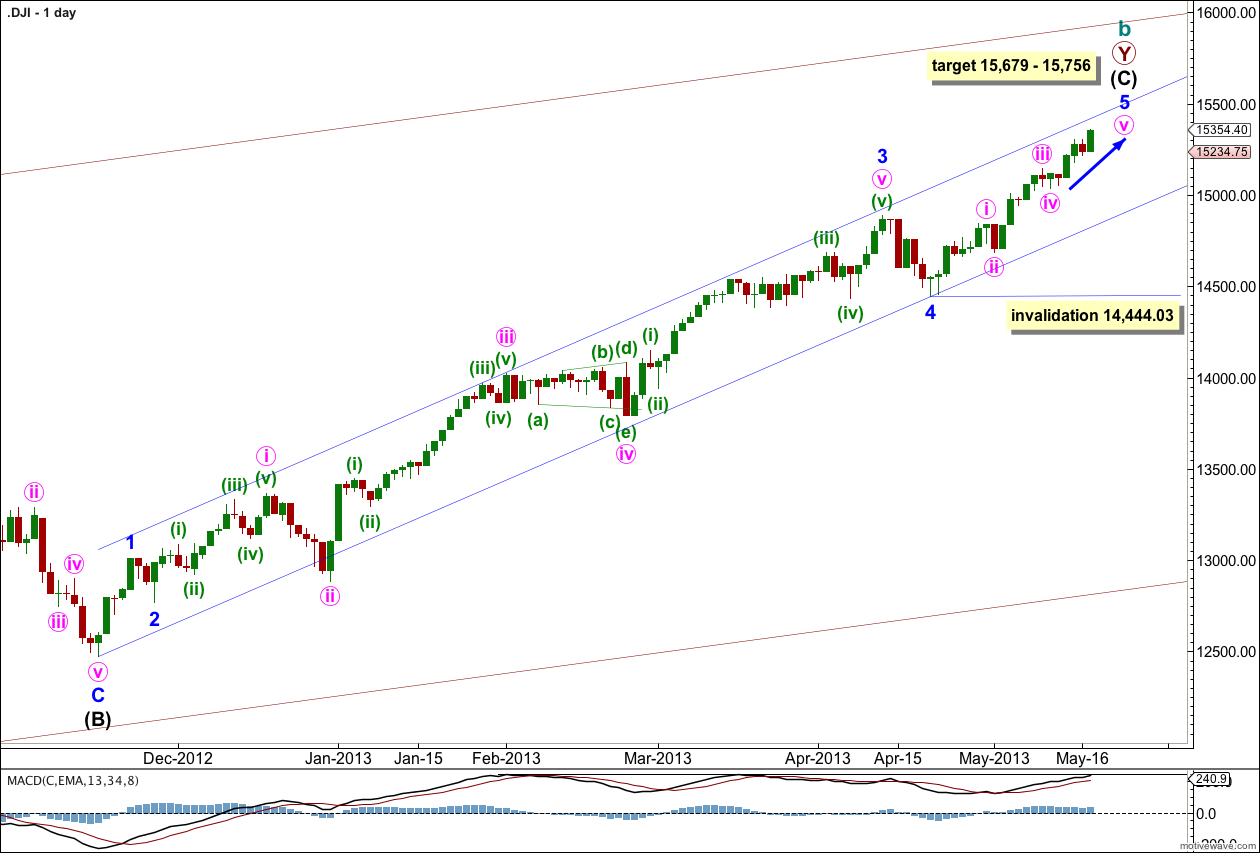

There are several possible ways to label this long upwards movement of intermediate wave (C). This wave count sees minor waves 3 and 4 complete.

There is no Fibonacci ratio between minor waves 1 and 3. This makes it more likely there will be a Fibonacci ratio between minor wave 5 and either of 1 or 3. There are several possible Fibonacci ratios. At 15,756 minor wave 5 would reach 0.618 the length of minor wave 3. At 15,679 minute wave v would reach 1.618 the length of minute wave i.

Within the target at 15,729 intermediate wave (C) would reach equality with intermediate wave (A).

The channel drawn here is a best fit. Draw the first trend line from the start of intermediate wave (C) to the low of minor wave 4, then place a parallel copy upon the high of minute wave (iii) within minor wave 3. Minor wave 5 may end midway within the channel, or should find resistance at the upper edge. When the channel is clearly breached by downwards movement we shall have an indication of a possible trend change.

At this stage we have some divergence with price trending higher and MACD trending lower. If this divergence continues on the daily chart this wave count will expect a trend change in coming weeks, maybe about two to four weeks away.

Within minor wave 5 no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 14,444.03.

The wide maroon channel is drawn about cycle wave b at the monthly chart level and copied over here to the daily chart. If price breaches the upper edge of the smaller blue channel then it may find resistance at the upper maroon trend line.

Within minute wave v minuette waves (i) and (ii) are complete. Minuette wave (iii) looks incomplete. At 15,642 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

Minute wave iii is longer than minute wave i so minute wave v is not limited. I would expect to see a ratio between minute wave v and either of iii or i. For this reason I would favour the lower end of the target zone.

If we move the degree of labeling down one degree within minute wave v and are yet to see a second wave correction for minuette wave (ii) within it then minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement below 15,038.18.

The channel drawn here is a best fit. Draw the first trend line from the low of minute wave ii to the low of micro wave 2 within subminuette wave iii of minuette wave (i) within minute wave v. Place a parallel copy upon the high of minuette wave (iii) within minute wave iii. Expect price to continue to find support and resistance about this channel.