Last analysis diverged: the main wave count expected upwards movement while the alternate expected downwards movement. Price has moved higher but still remains within the range in which both wave counts remain valid. We need to see price break out of this range to have clarity.

Click on the charts below to enlarge.

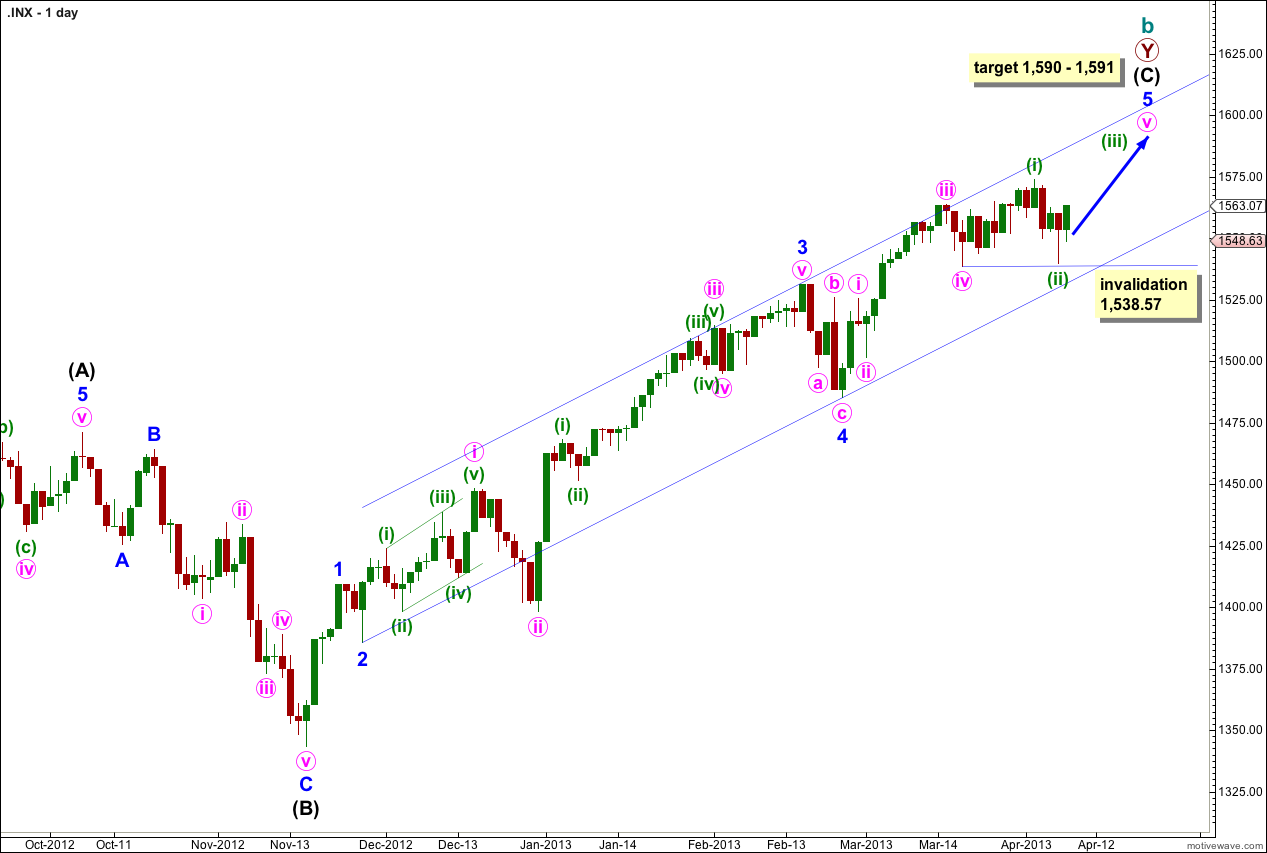

Main Wave Count.

We should always assume the trend remains the same, until proven otherwise. “The trend is your friend”. With price remaining just above 1,538.57 this wave count remains valid. Price remains firmly with the parallel channel.

This structure is nearing completion. Cycle wave b is a double zigzag and the end of the second zigzag is nearly over. Intermediate wave (C) is unfolding as a simple impulse and remains recently contained within its trend channel. Price may find resistance at the upper end of this channel. Draw it first with a trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the high of minor wave 3.

Cycle wave b is now 105% the length of cycle wave a and so this structure at super cycle degree is an expanded flat correction, the most common type of flat.

At 1,590 intermediate wave (C) would reach 0.618 the length of intermediate wave (A). At 1,591 minor wave 5 would reach 1.618 the length of minor wave 1.

When price reaches this target zone we will use an alternate wave count to see if the structure could be complete and a trend change could occur.

Movement below the channel containing intermediate wave (C) would be initial confirmation of a trend change. While price remains within this channel we shall expect more upwards movement.

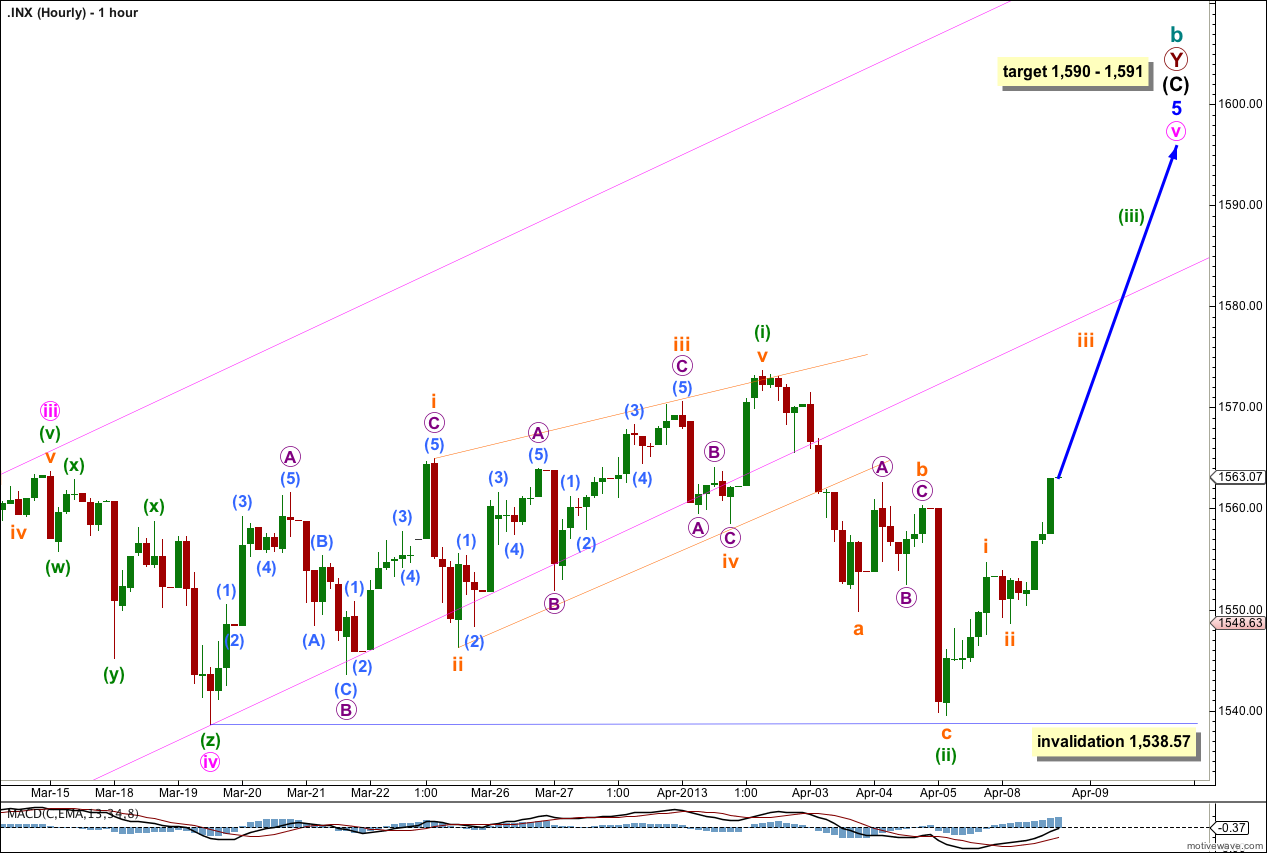

Within minute wave v no second wave correction may move beyond the start of its first wave. This wave count is invalidated with movement below 1,538.57.

Upwards movement has started to increase in momentum. A third wave at subminuette degree may have begun during Monday’s session.

If this wave count is correct we should see a further increase in upwards momentum tomorrow. The target remains the same.

Minuette wave (iii) must unfold as a simple impulse, the only possible structure for a third wave.

Any further movement below 1,538.57 would invalidate this wave count at both the hourly and daily chart level. If that were to happen I would struggle to see a viable wave count which could see new highs in the short term.

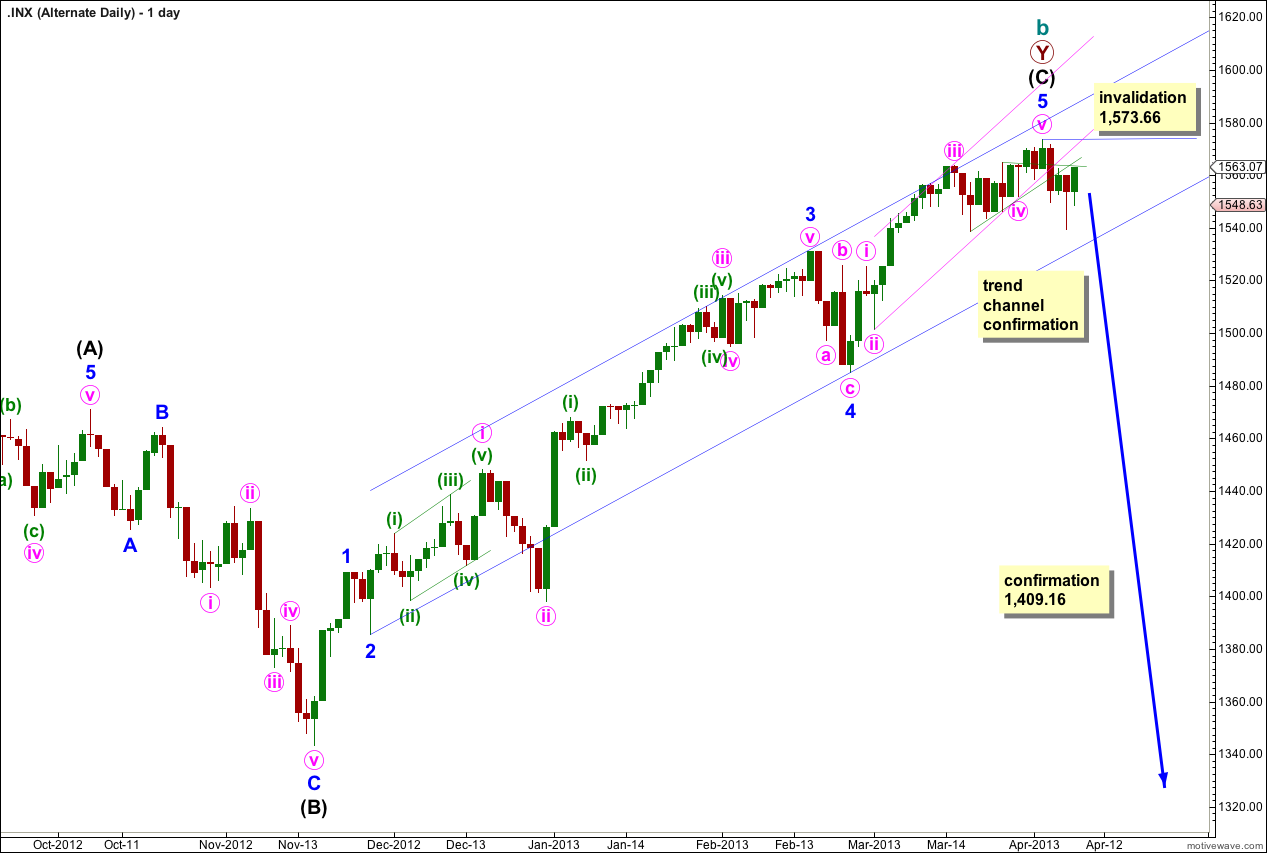

Alternate Wave Count.

It is possible that we have seen a trend change from the first target zone which was 1,573 to 1,575. Because we have no confirmation of this trend change this will be an alternate wave count.

There is a bearish engulfing candlestick pattern.

Cycle wave c would be extremely likely to take price to new lows below the end of cycle wave a at 666.79, and to last one to several years. Because this is an extremely big trend change it is wise to wait for some confirmation before having any confidence in this wave count.

Initially we need to see the main wave count invalidated with movement below 1,538.57 to have any confidence at all in this wave count. Movement below the channel drawn about intermediate wave (C) would give some more confidence in this wave count.

Final full confirmation would come with price movement below 1,409.16 as at that stage downwards movement could not be just a fourth wave correction within intermediate wave (C) and so it would have to be over.

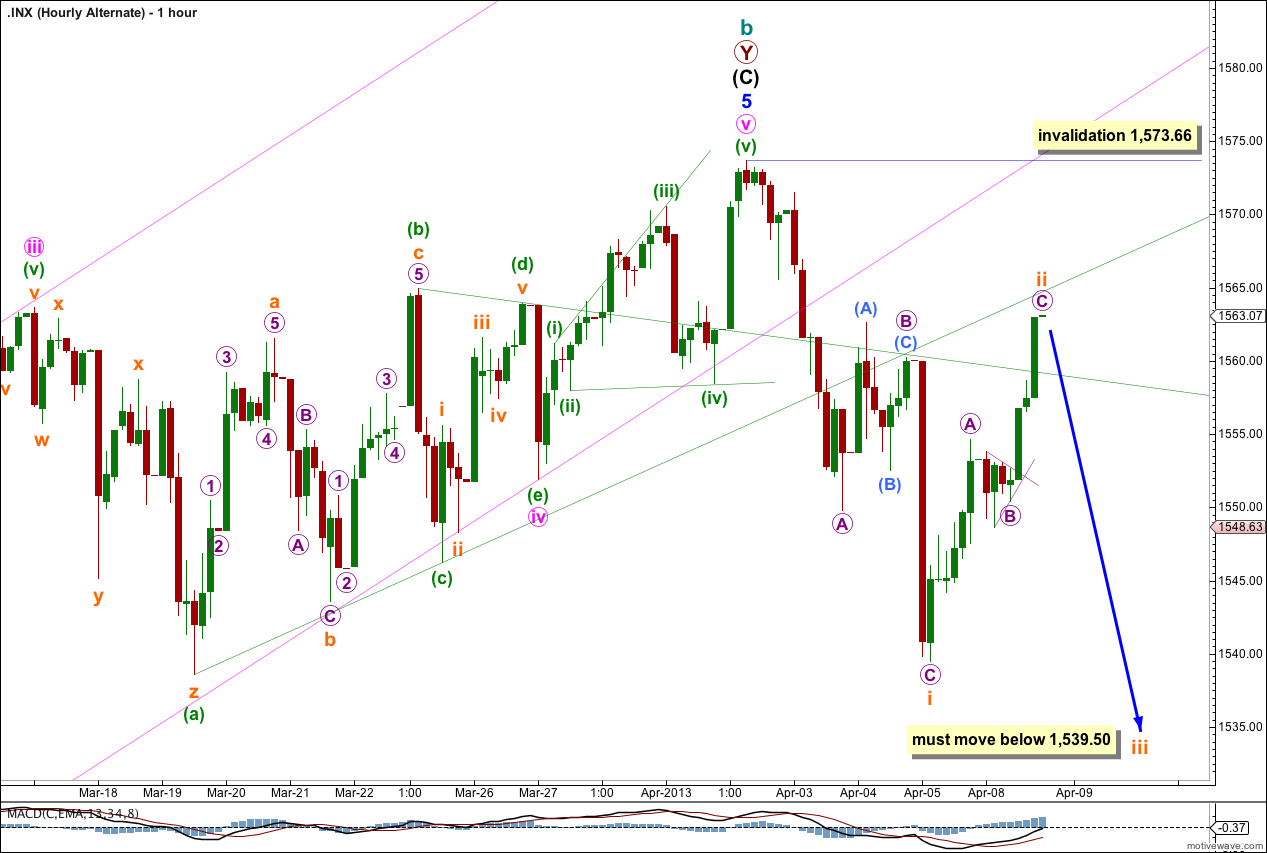

There are two possible structures for a first wave. Upwards movement has invalidated the last analysis which saw an impulse unfolding downwards. The only possibility left for this alternate is a leading diagonal for minuette wave (i).

Within the leading diagonal subminuette waves ii and iv must subdivide into zigzags. Subminuette waves i, iii and v are most likely to subdivide into zigzags but may also be impulses. Subminuette wave iv must overlap subminuette wave i price territory, and the final fifth wave may not be truncated.

Subminuette wave iii must make a new low below the end of subminuette wave i at 1,539.50.

Subminuette wave ii may not move beyond the start of subminuette wave i. This wave count is firmly invalidated with any movement above 1,573.66.