Downwards movement during the last week breached our invalidation point on the main wave count, but it was expected for our alternate.

I have a new main wave count for you to end the week. The alternate is little changed and remains valid.

When the channel on the daily chart for the alternate has a clear and strong breach then we may discard it and have only one main wave count. At that stage we may have more confidence in the main wave count. A channel breach should occur within the next one or two sessions, if our main wave count is correct.

Click on the charts below to enlarge.

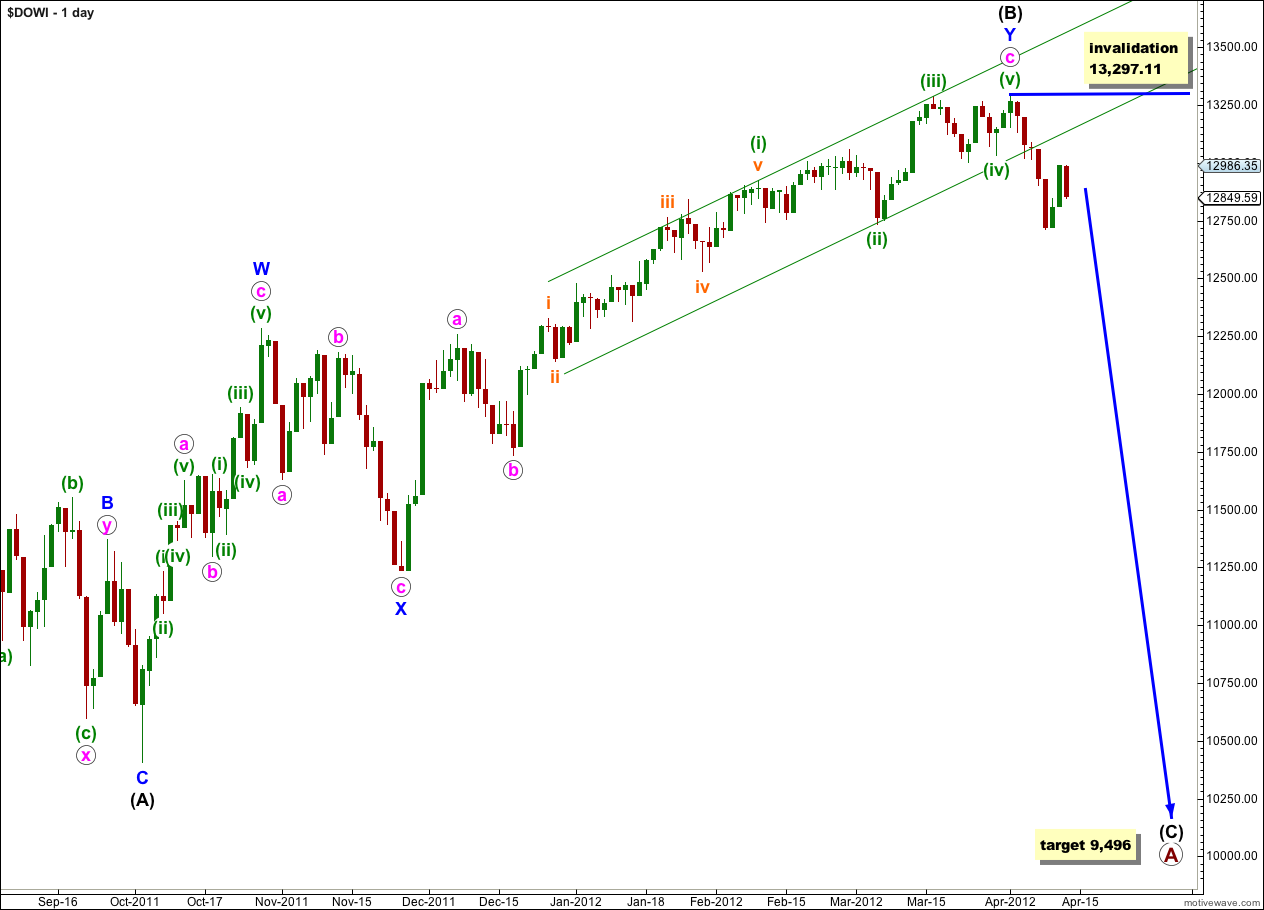

Main Wave Count.

If wave (B) black was a double zigzag structure (which most easily subdivides as) then it is very likely that it was over recently. Wave (B) black is a 123% correction of wave (A) black. Primary wave A is subdividing as an expanded flat which expects a C wave to move substantially beyond the end of wave (A) black. At 9,496 wave (C) black would reach 1.618 the length of wave (A) black.

We may use Elliott’s channeling technique to draw a parallel channel about wave c pink of wave Y blue. This channel is drawn first from the highs of (i) to (iii) green, then a parallel copy is placed upon the low of (ii) green. This channel is clearly breached by downwards movement indicating that we may have seen a trend change.

Within wave (C) black no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 13,297.11.

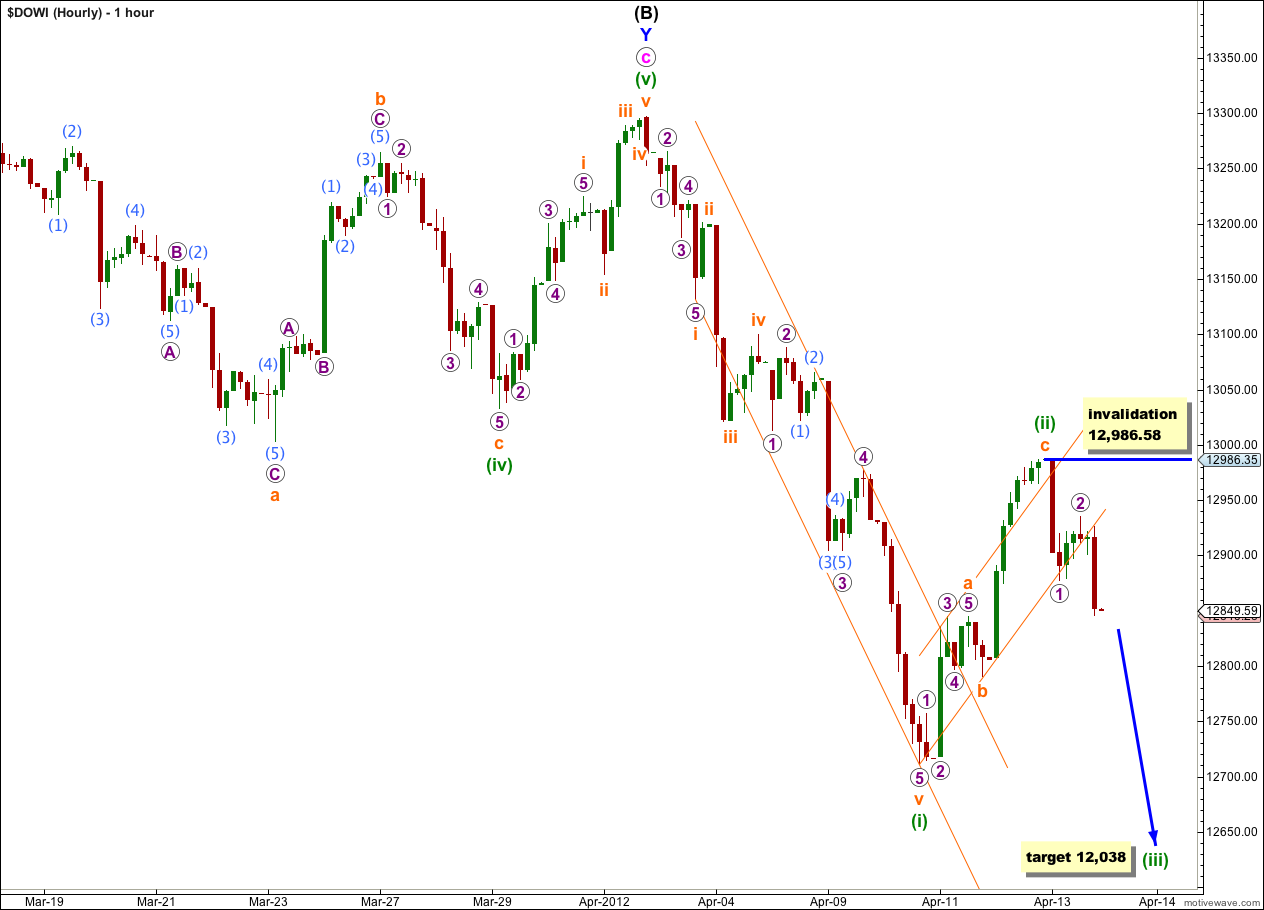

Last week’s downwards movement is in a clear impulsive structure. It fits most easily as an impulse with a fifth wave extension.

Ratios within wave (i) green are: wave iii orange is 12.87 points longer than equality with wave i orange, and wave v orange has no Fibonacci ratio to either i or iii orange.

Ratios within wave v orange are: there are no Fibonacci ratios between waves 1, 3 and 5 purple.

Ratios within wave i orange are: there are no Fibonacci ratios between waves 1, 3 and 5 purple.

Within wave (ii) green there is no Fibonacci ratio between waves a and c orange.

The channel drawn about wave (i) green is a best fit. This channel was clearly breached by upwards movement for (ii) green.

The channel drawn about wave (ii) green is Elliot’s technique. This channel was clearly breached at the end of Friday’s session indicating that wave (ii) green is complete and wave (iii) green may be underway.

At 12,038 wave (iii) green would reach 1.618 the length of wave (i) green. If this wave count is correct then this target may be met towards the end of next week.

Within wave (iii) green wave ii orange may not move beyond the start of wave i orange. This wave count is invalidated with movement above 12,986.58.

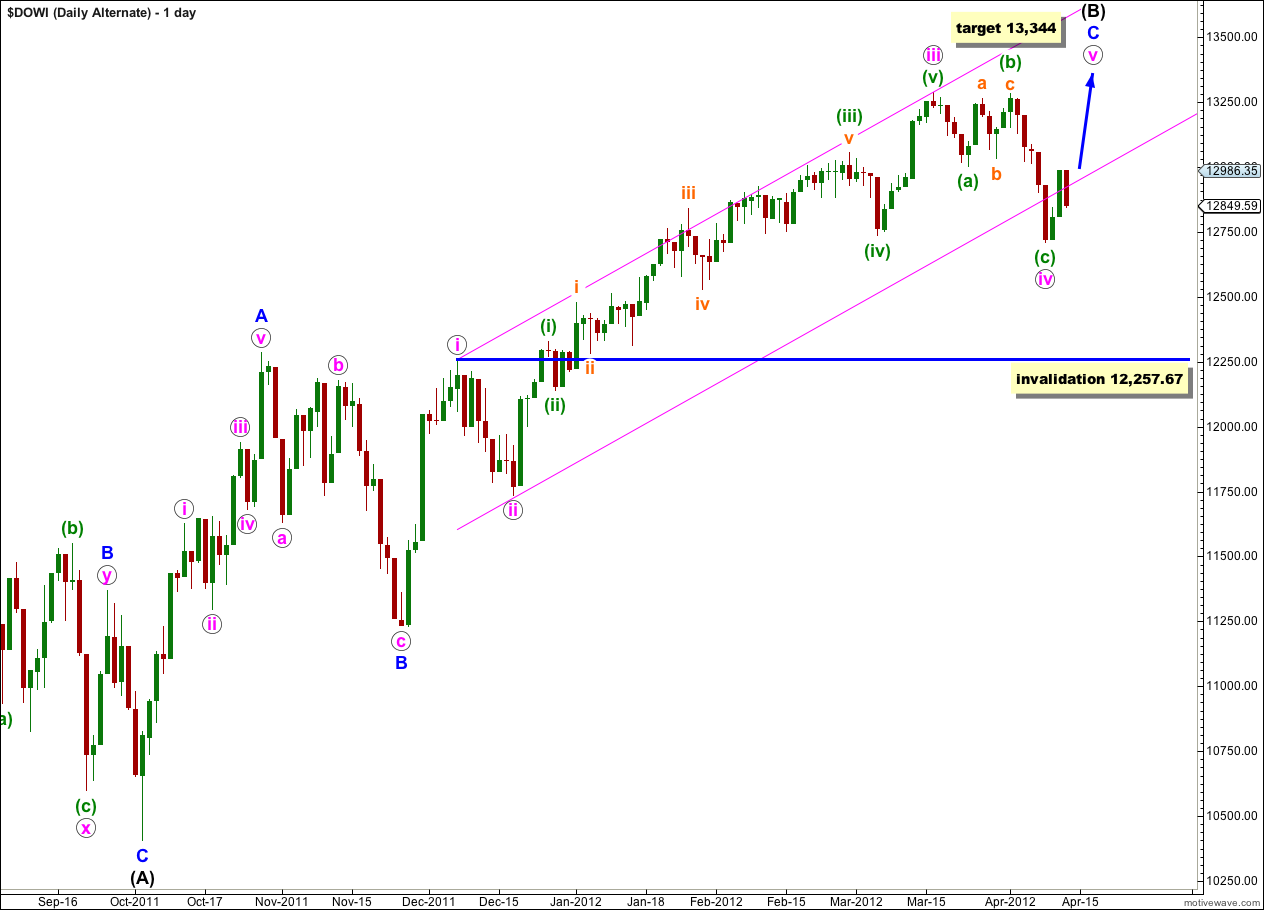

Alternate Wave Count.

If wave (B) black is a single zigzag structure then wave C blue within it is probably incomplete.

This wave count has a lower probability than the main wave count though because it sees the upwards wave labeled A blue as a five wave impulse. This is possible, but it does have an odd looking third wave within it. It is more satisfactory to see this as a three than a five.

At 13,344 wave v pink would reach 0.618 the length of wave iii pink, and wave (B) black would be less than 138% the length of wave (A) black.

The maximum common length for wave (B) black in relation to wave (A) black is up to 138% at 13,647. If this wave count is correct then we would expect to see a major trend change before price reaches this point.

When we use Elliott’s channeling technique about the upwards wave of C blue it shows quite nicely how upwards movement has been contained, with a fourth wave overshoot of the lower edge of the channel.

If on Monday and Tuesday price substantially moves outside and below this channel then the probability of this wave count would significantly decrease.

However, if price moves back upwards into the channel then this wave count shall remain valid and we must accept the risk that we may yet see new highs.

Wave iv pink may not move into wave i pink price territory. This wave count would be finally technically invalidated with movement below 12,257.67.