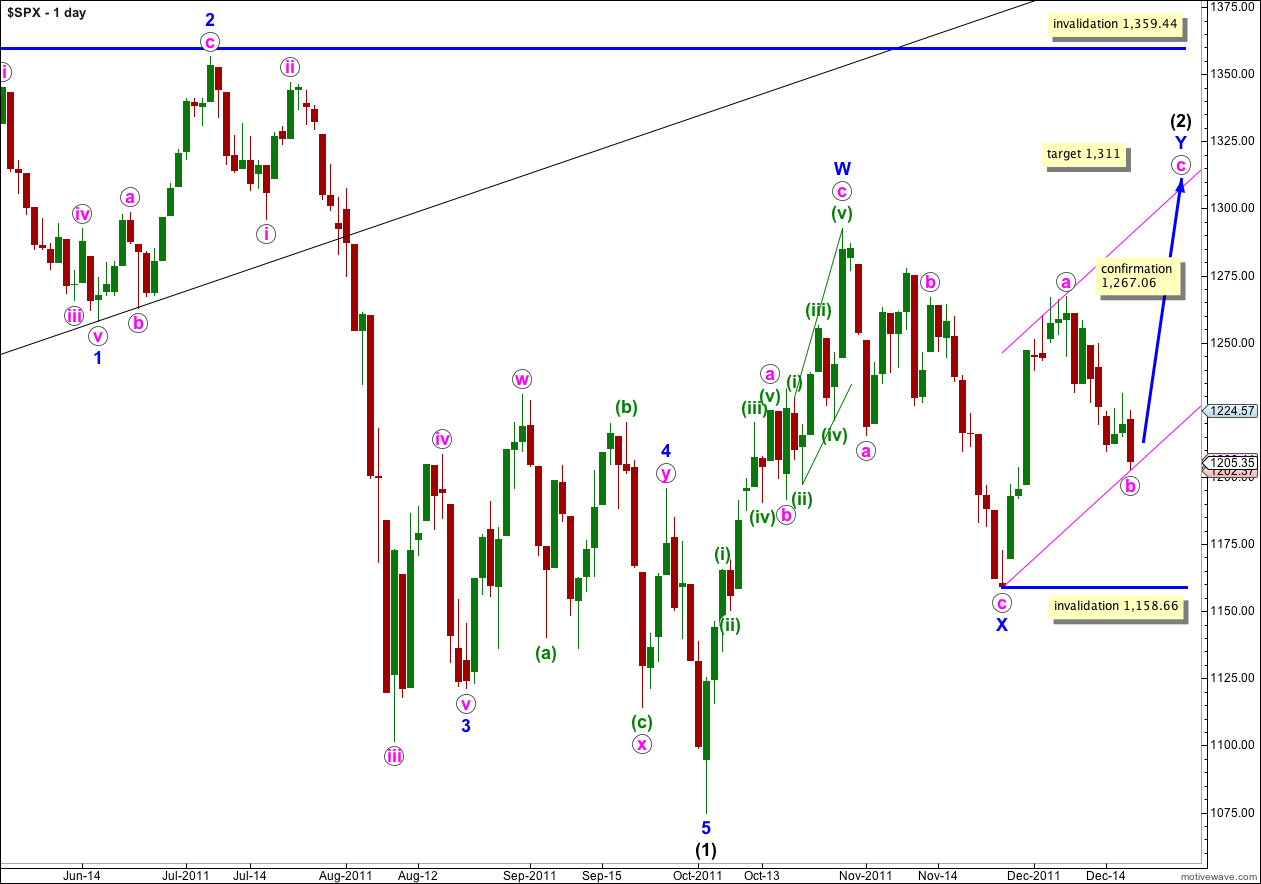

Elliott Wave chart analysis for the S&P 500 for 19th December, 2011. Please click on the charts below to enlarge.

As expected from last analysis the S&P 500 has moved lower, falling short of the downwards target on the hourly chart by 11.37 points.

Wave c pink is highly likely to take price to a new high above the end of wave a pink at 1,267.06 to avoid a truncation. Wave Y blue is highly likely to take price to a new high above the end of wave W blue at 1,292.66 to achieve the purpose of a double zigzag, which is to deepen a correction.

At 1,311 wave c pink would reach equality in length with wave a pink. This is the most likely target for upwards movement to end.

We may draw a parallel channel about the zigzag for wave Y blue. Wave c pink may end about the upper edge of the channel, or with a small overshoot.

Wave b pink may not move beyond the start of wave a pink. This wave count is invalidated with movement below 1,158.66.

Wave b pink is now a complete double zigzag structure. It is most likely that downwards movement is over here. There does exist a very small possibility that wave b pink could continue yet further as a triple zigzag structure, but the rarity of triples means that this has a very low probability.

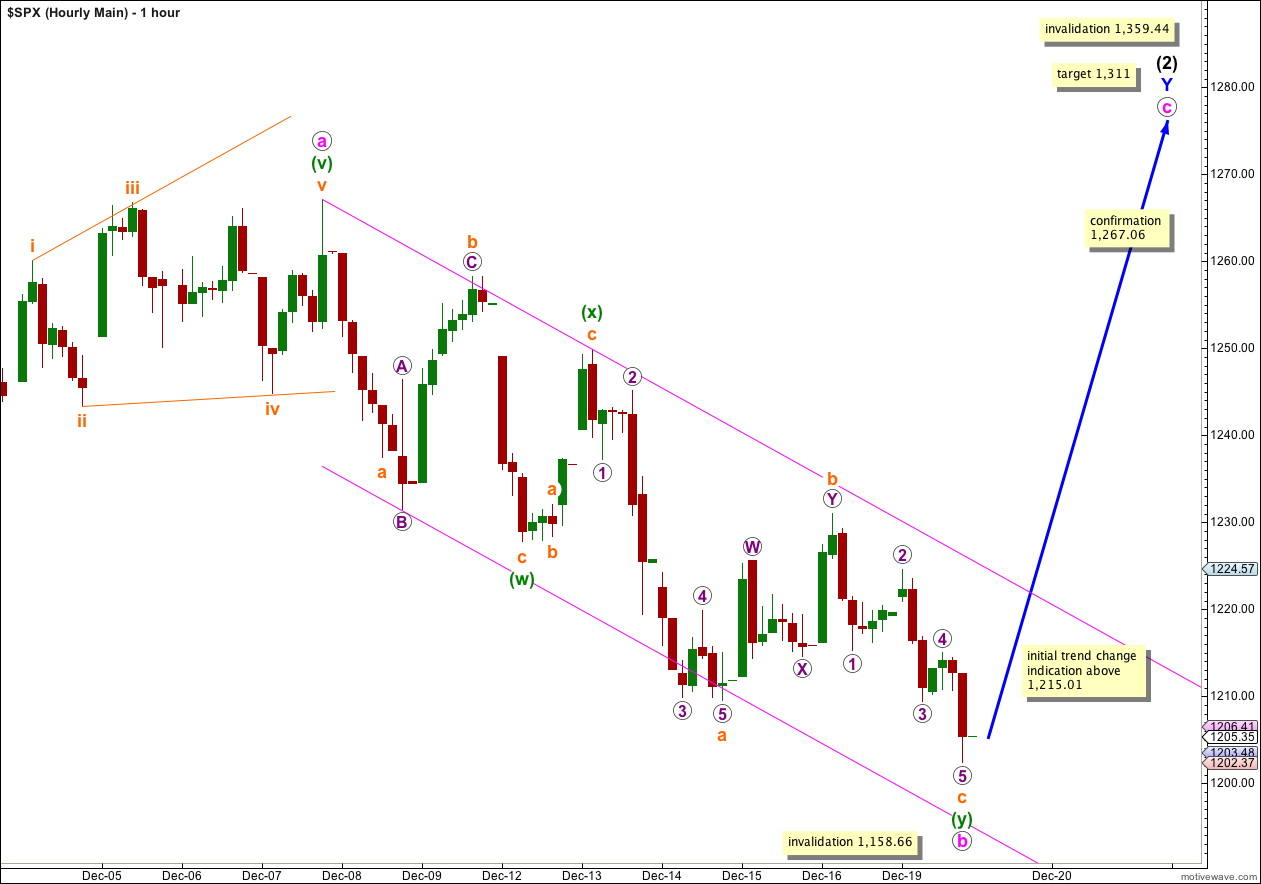

Within the zigzag for wave (y) green there is no Fibonacci ratio between waves a and c orange.

Ratios within wave c orange are: wave 3 purple is just 0.68 points short of equality with wave 1 purple, and wave 5 purple has no Fibonacci ratio to either of 1 or 3 purple.

Movement above 1,215.01 would indicate that wave c orange is a complete structure. This would be our first indication that wave b pink is over and wave c pink upwards is underway. However, this does not eliminate the possibility of a rare triple zigzag.

Movement above the parallel channel here on the hourly chart would be stronger indication of a trend change to the upside.

Until we have confirmation of a trend change we must allow for the small possibility of further downwards movement. The invalidation point must remain at 1,158.66; any further downwards movement of wave b pink may not move beyond the start of wave a pink.

There is some divergence on the hourly and 90 minute charts with price making a new low for Monday’s session, and MACD trending upwards. This is further indication that downwards movement has likely ended for the short to mid term.

Waves a and b pink both lasted a Fibonacci 8 days. If wave c pink also lasts a Fibonacci 8 days it would end on Friday 30th December, the last trading day of this year.

Movement above 1,267.06 would be final confirmation that this wave count is correct. At that stage our first alternate daily wave count would be invalidated.

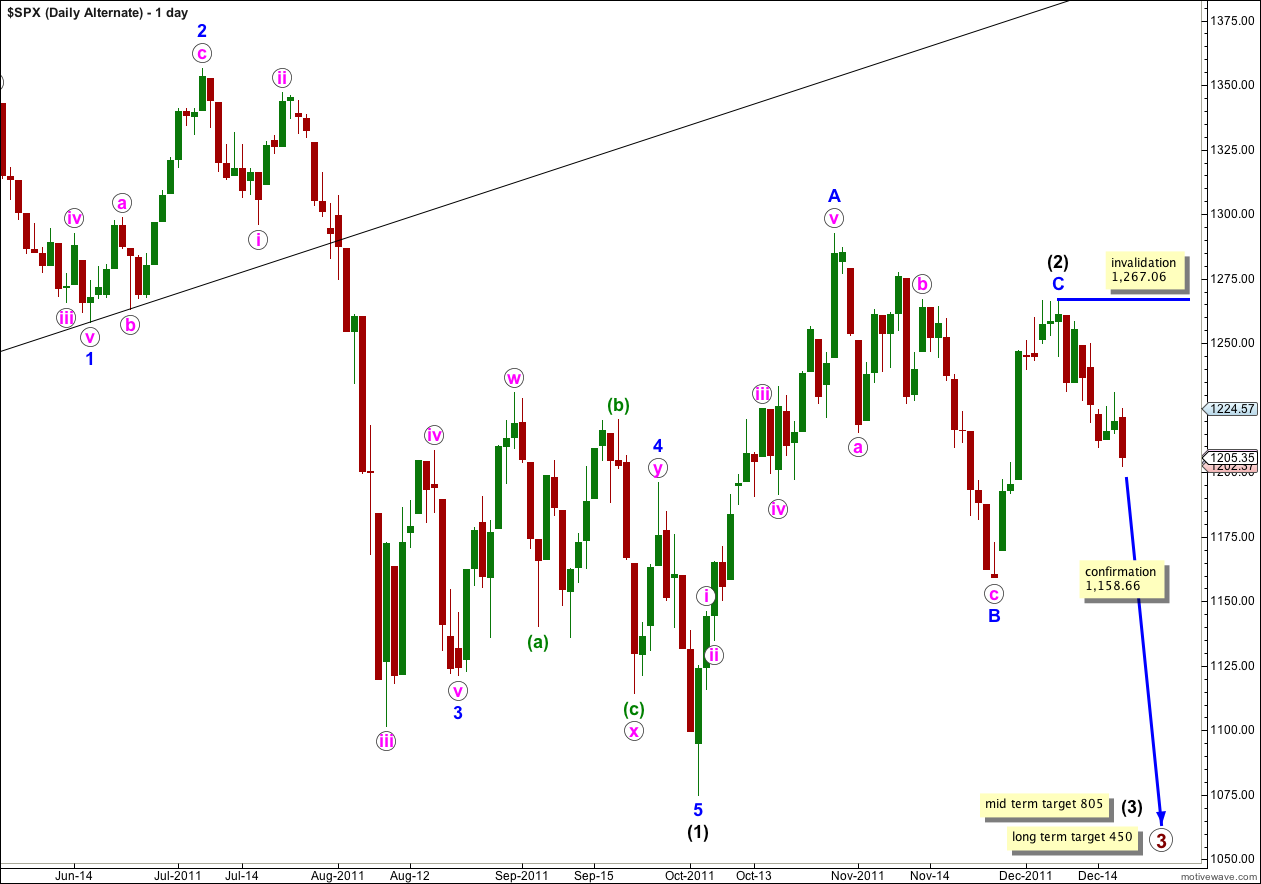

Alternate Wave Count.

This wave count has a low probability because wave C blue within the zigzag for wave (2) black is severely truncated. However, the subdivisions fit.

Only if we saw very strong downwards movement from this point below 1,158.66 would we need to use this wave count. At that stage it would provide a valid explanation.

Within wave (3) black no second wave correction may move beyond the start of the first wave. This wave count is invalidated with movement above 1,267.06. If this wave count is invalidated by upwards movement then our main wave count could be considered confirmed.

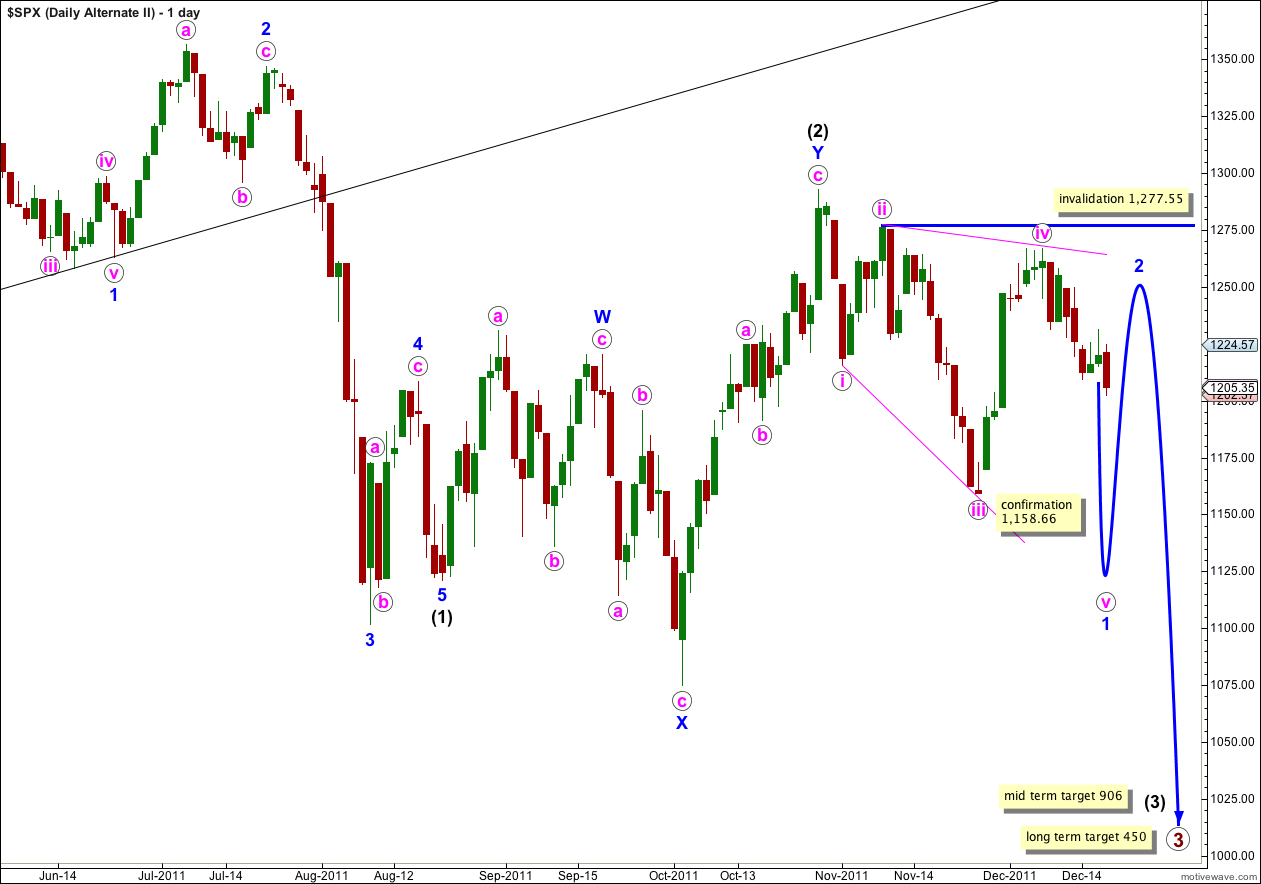

Second Alternate Wave Count.

There are four reasons why I consider this wave count to have the lowest probability:

1. Wave iv pink is not an obvious zigzag and it should be.

2. Wave iv pink is already deeper than 0.81 of wave iii pink; this is the maximum common length for wave 4 within a diagonal in relation to wave 3.

3. While leading diagonals are not uncommon, leading expanding diagonals are supposedly less common structures.

4. A similar wave count on the Dow is invalidated; the Dow and S&P 500 have been moving together nicely for some time and it would be highly unusual for them to now diverge.

Within the leading diagonal for wave 1 blue wave iv pink may not move beyond the end of wave ii pink. This wave count is invalidated with movement above 1,277.55.

A leading diagonal may not have a truncated fifth wave. This wave count requires movement below 1,158.66 to remain valid.

Well called Lara,you sounded quite sure of the end of wave b and that gave me more confidence in trading my country,s index as we follow the US quite closely,thanks.

Yes, that was a good call. It’s the duration which sometimes just has a nice Fibonacci number, and when it coincides with a complete structure and a nice fit within a trend channel we may be more confident that the count is right. It doesn’t always work out that way though!

I’ve noticed the Dow, euro, pound, and oil which I looked at closely a couple of days ago, all seem to be nicely aligned at the moment. This may be happening right before something big; the next move down for the S&P in the new year should be pretty dramatic, if I’m right.

I wish I was wrong about that actually! The social implications of this wave count aren’t pretty 🙁