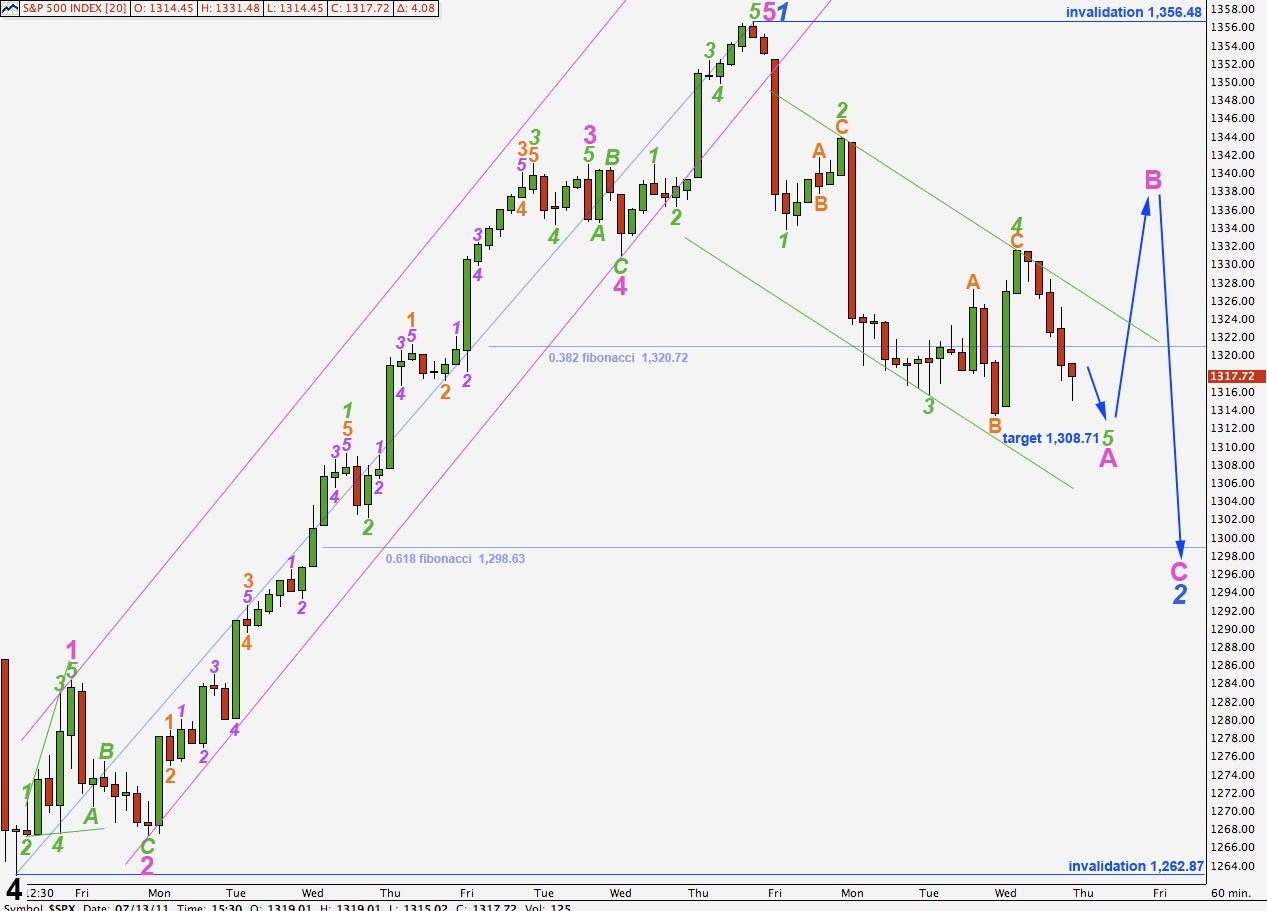

Elliott Wave chart analysis for the S&P 500 for 13th July, 2011. Please click on the charts below to enlarge.

Main Wave Count.

The S&P did not behave as expected yesterday, moving initially higher instead of lower and then turning downwards again.

What is likely to have happened was an extension of a fourth wave correction.

So far wave behaviour may be consistent with the start of a third wave. I have compared recent movement to the start of cycle wave A and wave behaviour is similar.

Positives for this wave count:

– it has a good fit in its trend channel.

– within primary wave C the proportions of black and blue waves look good.

– it explains the strong trend channel breach with recent downwards movement.

Negatives for this wave count:

– within the ending diagonal of wave 5 black it must see waves 1 and 3 blue as zigzags and this is stretching credulity a bit.

– wave 2 blue does not have a very clear three wave look on the daily chart and on the hourly chart this movement looks wrong as a zigzag.

– I would have expected cycle B to reach 90% of cycle A at 1,494.15 because cycle A is most easily seen as a three wave structure, so this would be a super cycle flat correction.

Wave 2 blue may not move beyond the start of wave 1 blue. This wave count is invalidated with movement above 1,359.44.

What was yesterday labeled wave 4 orange in its entirety was only wave A of wave 4 orange. Wave 4 orange continued further as an expanded flat correction.

Within wave 4 orange wave B purple is a 120% correction of wave A purple and wave C purple is just 0.54 points short of 1.618 the length of wave A purple. This is a perfect expanded flat correction.

Wave B purple downwards has a corrective count of 19 on the 1 minute chart and so this structure fits perfectly for a B wave and would not fit as a fifth wave.

Wave 3 orange has no fibonacci ratio to wave 1 orange. It is more likely then that wave 5 orange will exhibit a ratio to either of 3 or 1. At 1,308.71 wave 5 orange will reach equality with wave 1 orange. This is our target for tomorrow.

Wave 5 orange is likely to end mid way in the parallel channel.

Within wave 5 orange on the 15 minute chart we can see an almost complete impulse. It may have closed the session in the fourth wave after a third wave extension. Therefore, we should expect at least a little downwards movement when markets open tomorrow to complete the final fifth wave.

Thereafter, expect a short term trend change. Wave 2 green is most likely to be a zigzag and may be a deep correction. We may use a fibonacci retracement drawn over the length of wave 1 green down to provide initial targets for wave 2 green.

Wave 2 green may last a couple of days or so and may be choppy and overlapping. When price breaches this orange parallel channel about wave 1 green then wave 1 may be confirmed over and wave 2 would then be underway.

Wave 2 green may not move beyond the start of wave 1 green. This wave count is invalidated with movement above 1,356.48

Alternate Wave Count.

Positives for this wave count:

– recent upwards movement labeled 1 blue fits very well and has the right look on the hourly chart.

– we can see cycle wave A as a three wave structure and expect upwards movement for cycle wave B to reach at least to 1,494.15 where it will be 90% the length of cycle wave A.

– the problem of how to see the last piece of upwards movement to end black wave 3 is completely resolved.

Negatives for this wave count:

– wave 4 pink within wave 3 blue within wave 3 black is out of proportion to other corrections of a higher wave degree; it is too large.

– it does not have as good a fit within its trend channel as the main wave count does.

For exactly the same reasons the target for tomorrow when markets open is 1,308.71.

Thereafter, we should expect a trend change.

Wave B pink may not move beyond the start of wave A pink. This wave count is invalidated with movement above 1,356.48.

Wave 2 blue may not move beyond the start of wave 1 blue. This wave count is invalidated with movement below 1,262.87.

Lara,

Count seems to be getting a bit tricky here. Do you think we have completed Green 1/Pink A yet?

Peter

Hi Peter,

I think we have and I think the wave count I should have had on the hourly is the same as the one I had for the Dow yesterday.

I think we have seen a brief shallow second wave correction and it is just completing a first wave down to start 3.

Look at it on a 15 minute chart and that last downwards wave starting at 1,326.88 so far has a count of 8. It looks like an impulse and its in the fifth wave to end it.