S&P 500: Elliott Wave and Technical Analysis | Charts – May 11, 2021

Yesterday’s technical analysis concluded with an expectation for more downwards movement today.

The alternate Elliott wave count looks more likely now. The main Elliott wave count is invalidated at the hourly chart level.

Summary: The new main Elliott wave count expects a small fourth wave to end tomorrow either at support at the lower edge of a channel, or if the channel is overshot to end about 4,092 or 4,079.24. The next target for the next wave up is at 4,900.

A new alternate Elliott wave count expects essentially the same movement, it just labels the correction one degree higher. It has a low probability.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts are last updated here with video here.

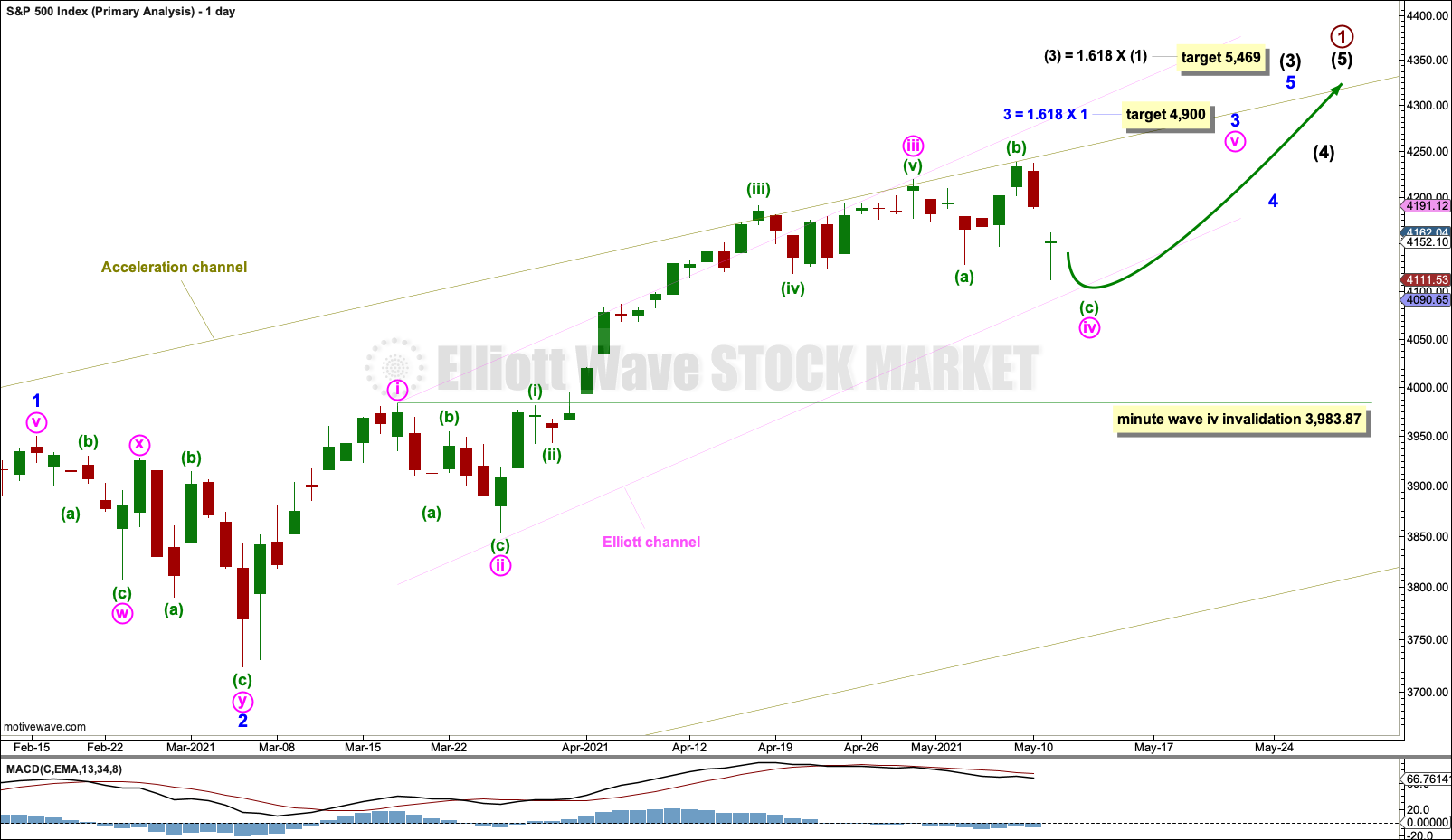

MAIN WAVE COUNT

WEEKLY CHART

Today the prior main Elliott wave count is discarded based upon a lower probability. I will still chart it and it may be useful in the future, but for now it no longer has the right look.

Cycle wave V may last from one to several years. So far it is in its fourteenth month.

This wave count may allow time for the AD line to diverge from price as price makes final highs before the end of the bull market. The AD line most commonly diverges a minimum of 4 months prior to the end of a bull market. A longer divergence is positively correlated with a deeper bear market. A shorter divergence is positively correlated with a more shallow bear market. With zero divergence at this stage, if a surprise bear market does develop here, then it would likely be shallow.

A longer divergence between price and the AD line would be expected towards the end of Grand Super Cycle wave I.

It is possible that cycle wave V may continue until 2029, if the 2020s mirror the 1920s. Either March or October 2029 may be likely months for the bull market to end.

Cycle wave V would most likely subdivide as an impulse. But if overlapping develops, then an ending diagonal should be considered. This chart considers the more common impulse.

There is already a Fibonacci ratio between cycle waves I and III within Super Cycle wave (V). The S&P500 often exhibits a Fibonacci ratio between two of its actionary waves but rarely between all three; it is less likely that cycle wave V would exhibit a Fibonacci ratio. The target for Super Cycle wave (V) to end would best be calculated at primary degree, but that cannot be done until all of primary waves 1, 2, 3 and 4 are complete.

Primary wave 1 within cycle wave V may be incomplete. This gives a very bullish wave count, expecting a long duration for cycle wave V which has not yet passed its middle strongest portion.

Within primary wave 1: Intermediate waves (1) and (2) may be complete, and intermediate wave (3) may now be nearing an end.

Within intermediate wave (3): Minor waves 1 and 2 may be complete, and minor wave 3 may be nearing an end.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 3,588.11.

An acceleration channel is drawn about cycle wave V. Draw the first trend line from the end of intermediate wave (1) to the last high, then place a parallel copy on the end of intermediate wave (2). Keep redrawing the channel as price continues higher. When primary wave 1 is complete, then this channel would be drawn using Elliott’s first technique. The channel may then be used to provide confidence that primary wave 1 may be over and primary wave 2 may have arrived; when the channel is breached by downwards movement it would indicate a trend change.

When primary wave 1 may be complete, then a multi-month pullback or consolidation may unfold for primary wave 2. It is possible that primary wave 2 may meet the technical definition of a bear market; it may correct to 20% or more of market value.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,191.86.

DAILY CHART

The daily chart focusses on minor wave 3 within intermediate wave (3).

Intermediate wave (3) may be extending. Third waves are most commonly extended for the S&P500, so this wave count follows a common tendency. A target is calculated for minor wave 3, which is also expected to be extending.

Minute wave iv within minor wave 3 may not move into minute wave i price territory below 3,983.87. Minute wave iv may continue lower tomorrow to end as an expanded flat.

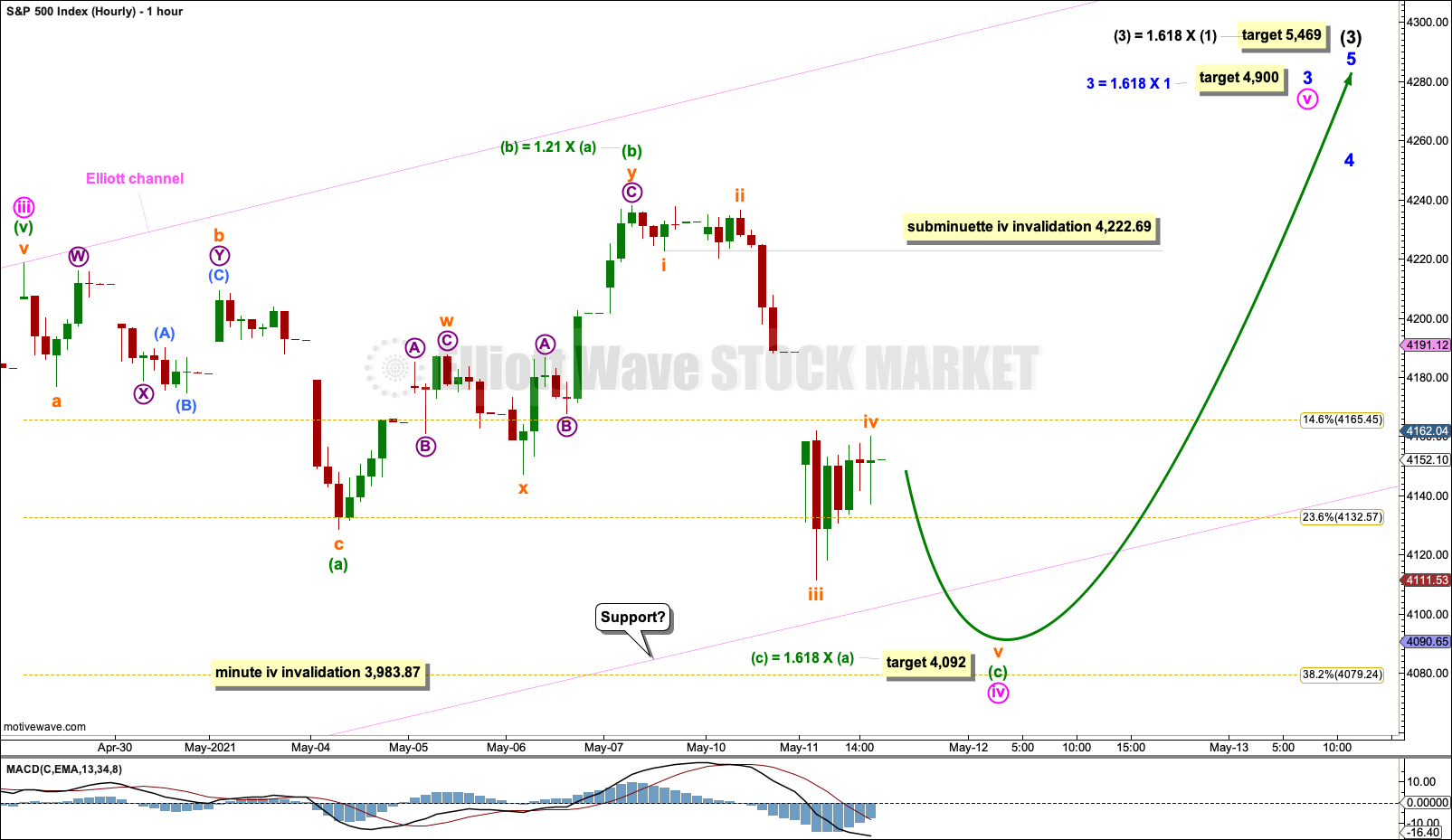

HOURLY CHART

Minute wave iv may be continuing lower as an expanded flat. Minuette wave (b) within the expanded flat is a 1.21 length of minuette wave (a), which is within the most common range of 1 to 1.38.

A target is calculated for minuette wave (c) to reach a common Fibonacci ratio to minuette wave (a). This target expects minute wave iv to slightly overshoot the lower edge of the pink Elliott channel; in the first instance, look for the strong possibility that price may find support there and the target may not be reached.

Minuette wave (c) is subdividing as an impulse. Subminuette wave iv within the impulse may not move into subminuette wave i price territory above 4,222.69. If price breaks above this short-term invalidation point without first making a new low tomorrow, then the pullback for minute wave iv may be expected to be complete.

If price continues lower below the channel and through the first target at 4,092, then the next target for minute wave iv may be the 0.382 Fibonacci ratio at 4,079.24.

ALTERNATE WAVE COUNT

WEEKLY CHART

If the current pullback is moved up one degree from minute wave iv to minor wave 4, then this alternate wave count considers minor wave 3 within intermediate wave (1) may be complete.

Intermediate wave (3) must subdivide as an impulse. Minor waves 1 to 3 within intermediate wave (3) may be complete. Minor wave 3 is considerably shorter than minor wave 1. The S&P has a very strong tendency to exhibit extended third waves; it is unusual for a third wave to be shorter than its counterpart first wave. This reduces the probability of this wave count.

Minor wave 4 may not move into minor wave 1 price territory below 3,950.53.

DAILY CHART

Minor wave 4 may be subdividing as an expanded flat, in exactly the same way as minute wave iv is seen for the main Elliott wave count.

Minor wave 4 may end tomorrow with a little more downwards movement to either find support at the lower edge of the pink Elliott channel or to end about 4,092.

The hourly chart would be the same as the main hourly chart except the degree of labelling would be one degree higher.

TECHNICAL ANALYSIS

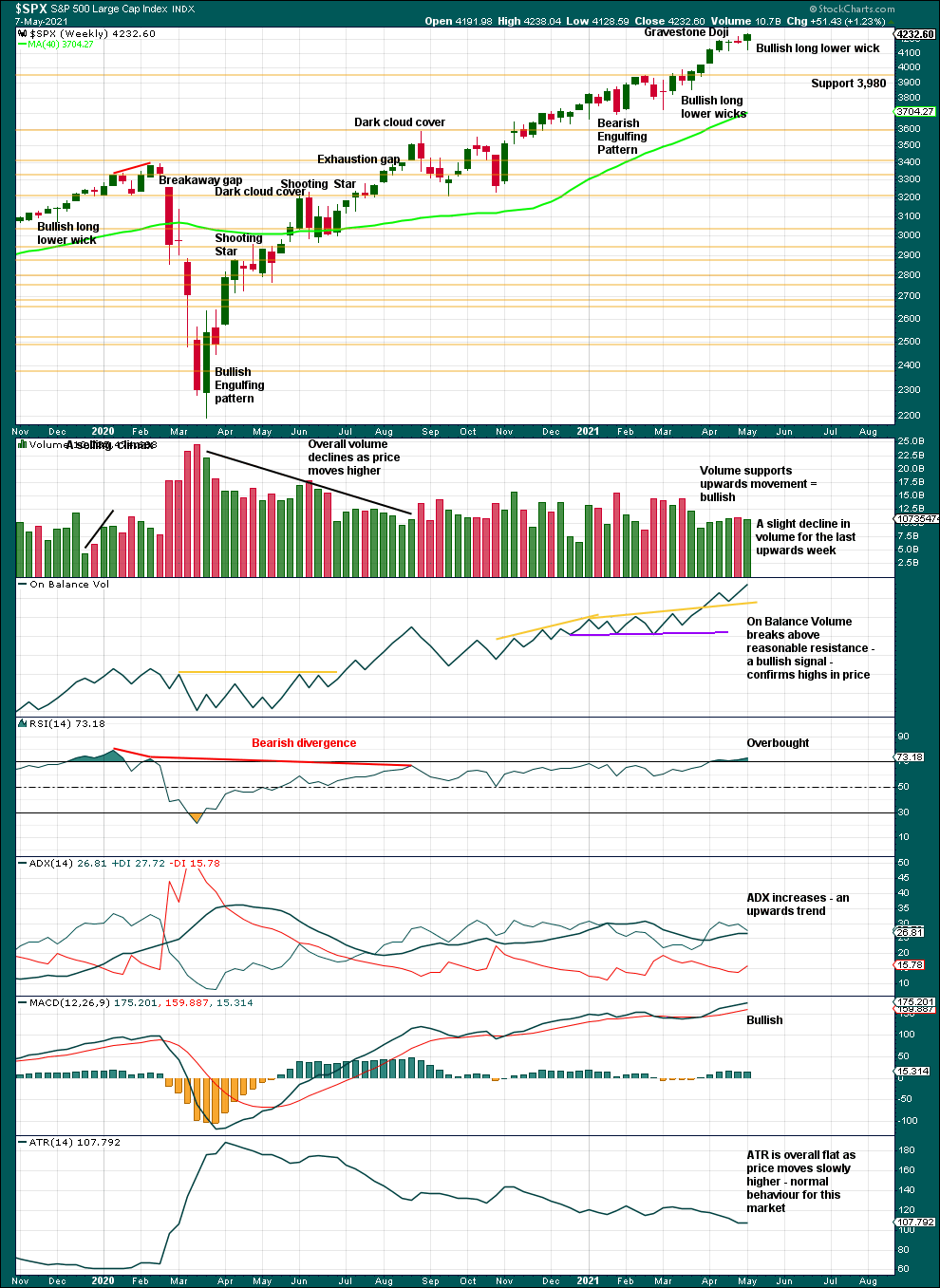

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A series of higher highs and higher lows off the low of March 2020 continues. The last short-term swing low is now at 3,723.34. While this remains intact, the dominant view should be of an upwards trend. There is a long way for this trend to run before conditions may become extreme.

This chart has the look of a sustainable bull market in a relatively early stage; there is as yet no evidence that a larger correction should begin here. Although RSI has now reached overbought, this market has a strong bullish bias and RSI can move deeply overbought and remain there for years prior to the bull market ending.

Last week price closes to new all time highs. This is bullish and supports both Elliott wave counts. The lower wick on this weekly candlestick suggests more upwards movement this week.

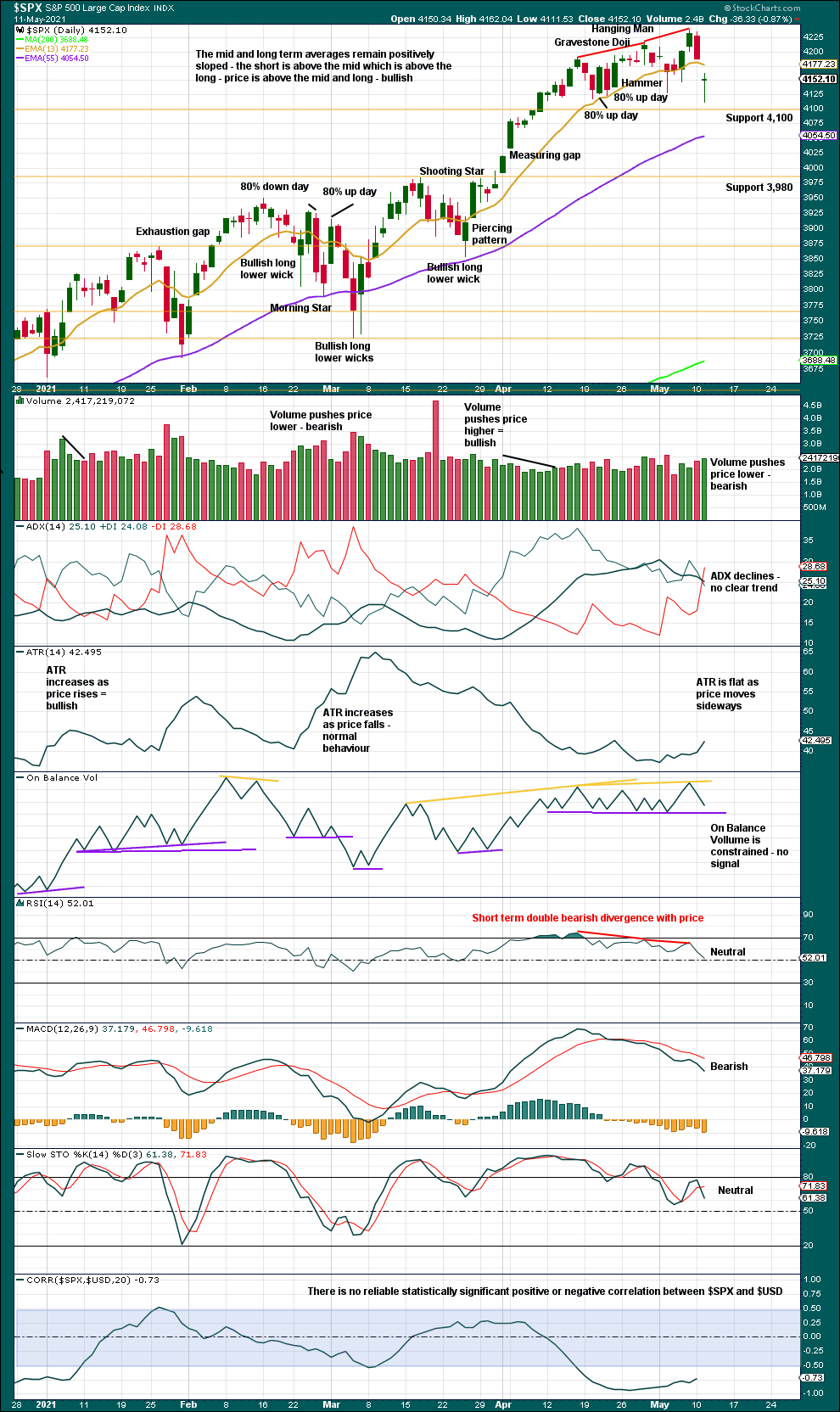

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The series of higher highs and higher lows from the low of the 30th of October continues.

Pullbacks are a normal and to be expected part of a bullish trend.

Another downwards session ends as a doji. Doji are normal within downwards trends, but on its own this doji does not mean price may not fall further. There is support below about 4,100 and On Balance Volume is very close to support, which may halt price falling much further. If support at 4,100 is breached though, next support is strong about 3,980.

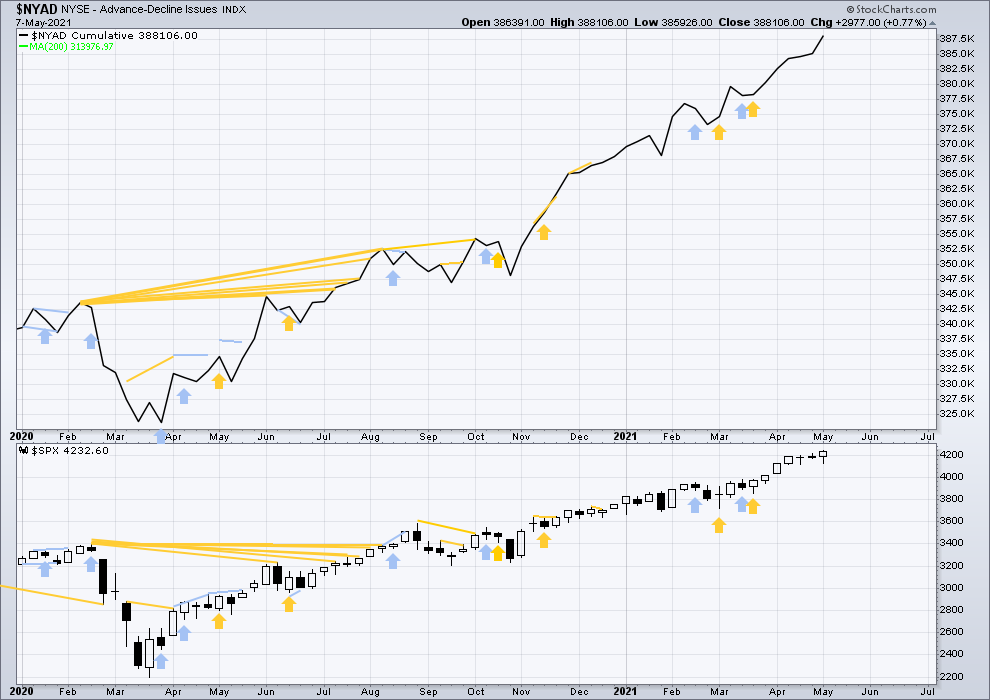

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Lowry’s Operating Companies Only AD line has made a new all time high on the 6th of May (data for the 7th of May is not yet available; it may too show a new all time high). This supports the Elliott wave counts.

Large caps all time high: 4,238.04 on May 7, 2021.

Mid caps all time high: 2,778.84 on April 29, 2021.

Small caps all time high: 1,399.31 on March 12, 2021.

The last new high is found in large caps only. Small caps have been lagging since the 15th of March. Mid caps have been lagging since the 29th of April. This lag from small and mid caps is not precise in terms of timing when a pullback may begin, but it is an early warning sign of some developing weakness. It would be expected that as third waves come to an end some weakness should begin to develop; this situation may fit for either Elliott wave counts.

Last week again price and the AD line both make new all time highs. Upwards movement has support from rising market breadth. This is bullish and supports both Elliott wave counts.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Both price and the AD line have moved lower today. Price has made a new low below the prior swing low of the 30th of April, but the AD line has not. Price is falling faster than breadth. This divergence is bullish for price and supports the Elliott wave counts that expect this pullback to be short term in nature.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Inverted VIX remains well below all time highs. The all time high for inverted VIX was in the week beginning October 30, 2017. There is over 3 years of bearish divergence between price and inverted VIX. This bearish divergence may develop further before the bull market ends. It may be a very early indicator of an upcoming bear market, but it is not proving to be useful in timing.

Following two weeks of short-term bearish divergence, last week price has moved higher. This bearish divergence is considered to have failed for the short term.

Last week both price and inverted VIX have moved higher. Price has made new all time highs, but inverted VIX has failed to make new short, mid or long-term highs. There is again all of short, mid and long-term bearish divergence.

Comparing VIX and VVIX at the weekly chart level:

Last week both VIX and VVIX have moved lower. There is no new divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Both price and inverted VIX have moved lower today. Inverted VIX has made a new low below the prior swing low of the 24th / 25th of March, but price has not. This divergence is bearish for price. Because this disagrees with divergence today from the AD line, divergence from inverted VIX will be given no weight in this analysis.

Comparing VIX and VVIX at the daily chart level:

Both VIX and VVIX have moved higher. There is no new short or mid-term divergence.

DOW THEORY

Dow Theory confirms a new bull market with new highs made on a closing basis:

DJIA: 29,568.57 – closed above on 16th November 2020.

DJT: 11,623.58 – closed above on 7th October 2020.

Most recently, on 7th May 2021 both DJIA and DJT have made new all time highs. An ongoing bull market is again confirmed by Dow Theory.

Adding in the S&P and Nasdaq for an extended Dow Theory, confirmation of a bull market would require new highs made on a closing basis:

S&P500: 3,393.52 – closed above on 21st August 2020.

Nasdaq: 9,838.37 – closed above on June 8, 2020.

The following major swing lows would need to be seen on a closing basis for Dow Theory to confirm a change from bull to a bear market:

DJIA: 18,213.65

DJT: 6,481.20

Adding in the S&P and Nasdaq for an extended Dow Theory, confirmation of a new bear market would require new lows on a closing basis:

S&P500: 2,191.86

Nasdaq: 6,631.42

Published @ 06:16 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.