S&P 500: Elliott Wave and Technical Analysis | Charts – December 23, 2020

Summary: The wave count expects the low of the 30th of October to not be breached for many months or years. A new mid-term target is at 3,785. The next target is at 4,606. The invalidation point is at 3,645.84.

An alternate is considered at the daily chart level. It is judged to have a very low probability. For confidence it requires a new low below 3,645.84 and then below 3,549.85.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts are last updated here with video here.

ELLIOTT WAVE COUNT

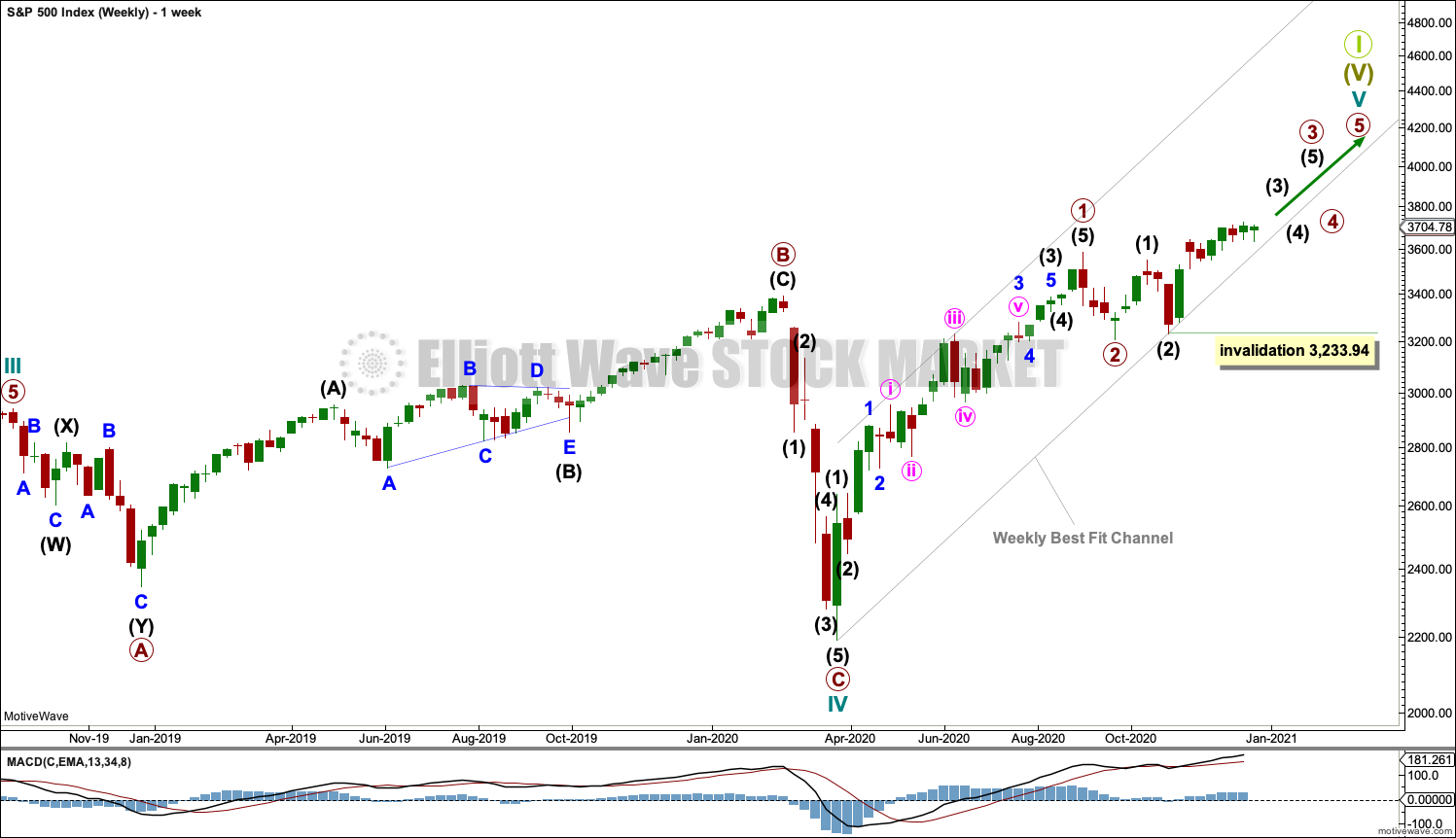

WEEKLY CHART

Cycle wave V may last from one to several years. So far it is in its ninth month.

This wave count may allow time for the AD line to diverge from price as price makes final highs before the end of the bull market. The AD line most commonly diverges a minimum of 4 months prior to the end of a bull market.

Cycle wave V would most likely subdivide as an impulse. But if overlapping develops, then an ending diagonal should be considered. This chart considers the more common impulse.

Primary waves 1 and 2 may be complete.

Primary wave 3 may only subdivide as an impulse.

There is already a Fibonacci ratio between cycle waves I and III within Super Cycle wave (V). The S&P500 often exhibits a Fibonacci ratio between two of its actionary waves but rarely between all three; it is less likely that cycle wave V would exhibit a Fibonacci ratio. The target for Super Cycle wave (V) to end would best be calculated at primary degree, but that cannot be done until all of primary waves 1, 2, 3 and 4 are complete.

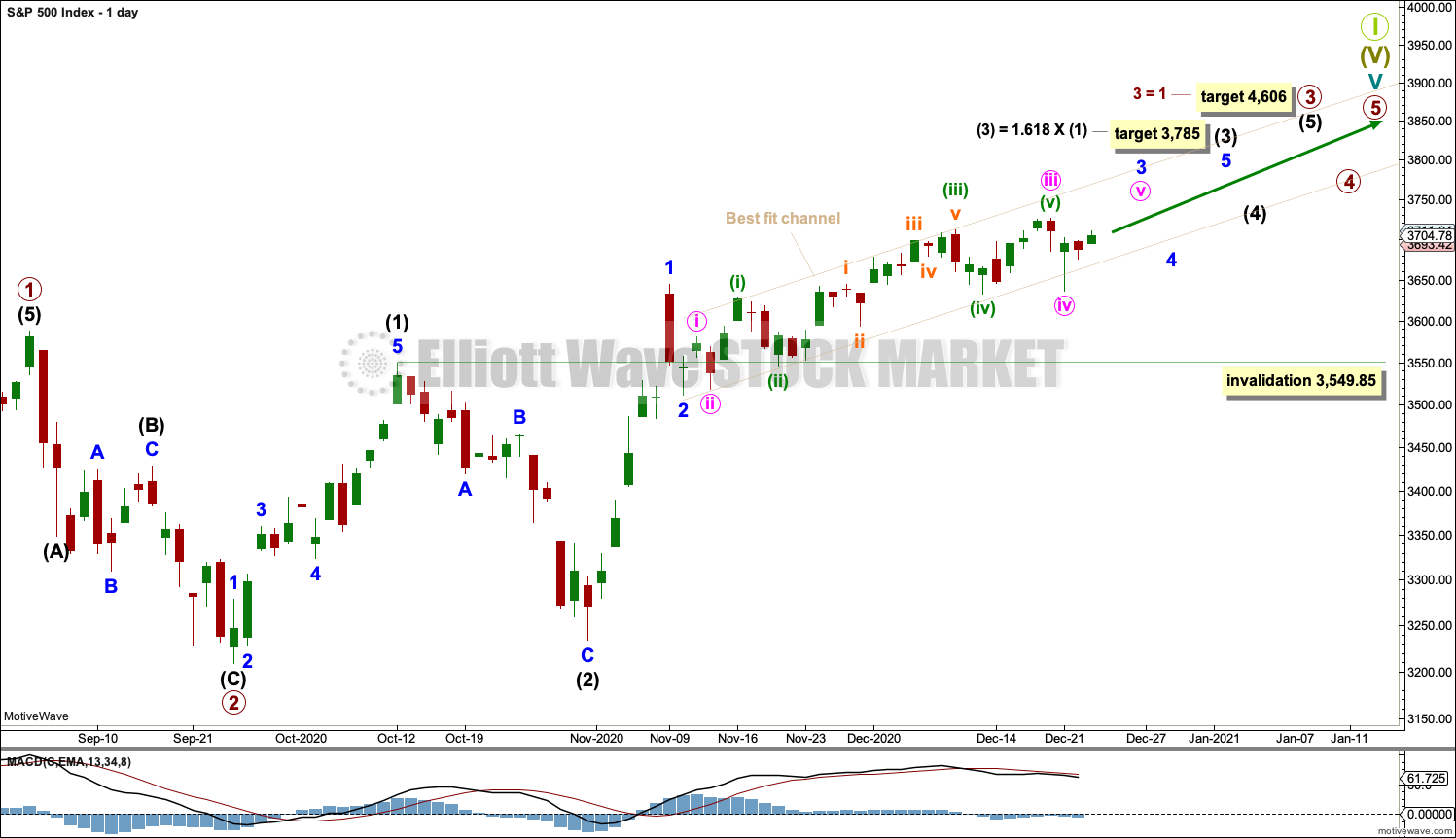

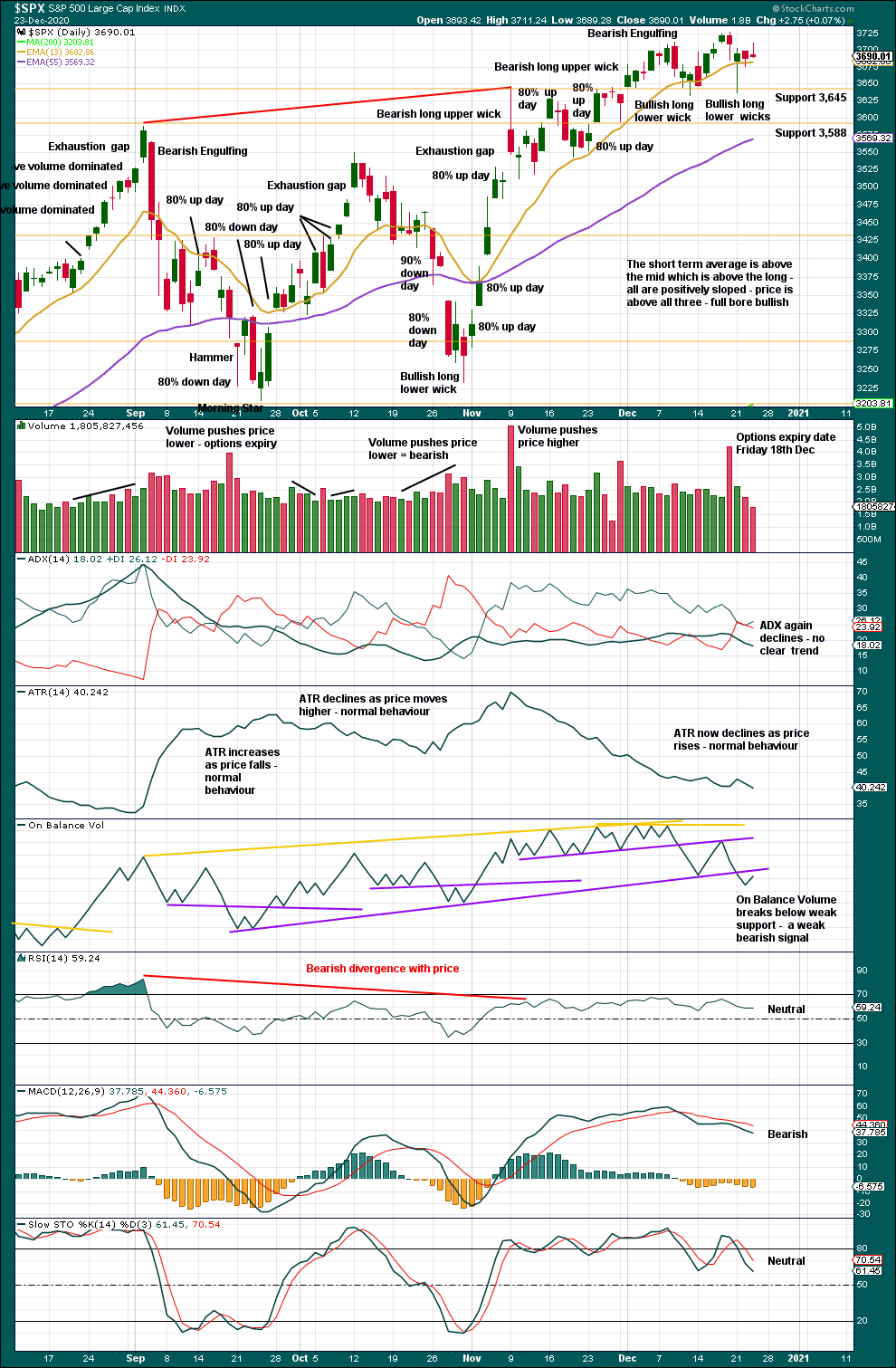

DAILY CHART

Primary waves 1 and 2 may both be complete. Primary wave 3 may be underway.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3: Intermediate waves (1) and (2) may both be complete, and intermediate wave (3) may be underway and may only subdivide as an impulse. A target is calculated for intermediate wave (3).

Intermediate wave (4) may not move into intermediate wave (1) price territory below 3,549.85.

Primary wave 1 looks extended. The target for primary wave 3 expects it to also be extended.

This wave count now expects that a third wave at three large degrees (minor, intermediate and primary) may have passed through its middle portion. Each successive fourth wave correction must remain above its corresponding first wave price territory.

When third waves extend they do so in price as well as time. Extended waves usually exhibit corrections within them that are more time consuming than those within waves that are not extended.

The best fit channel has provided support for downwards movement. It may now provide resistance to upwards movement, so it may be useful to show where the next pullback may arrive.

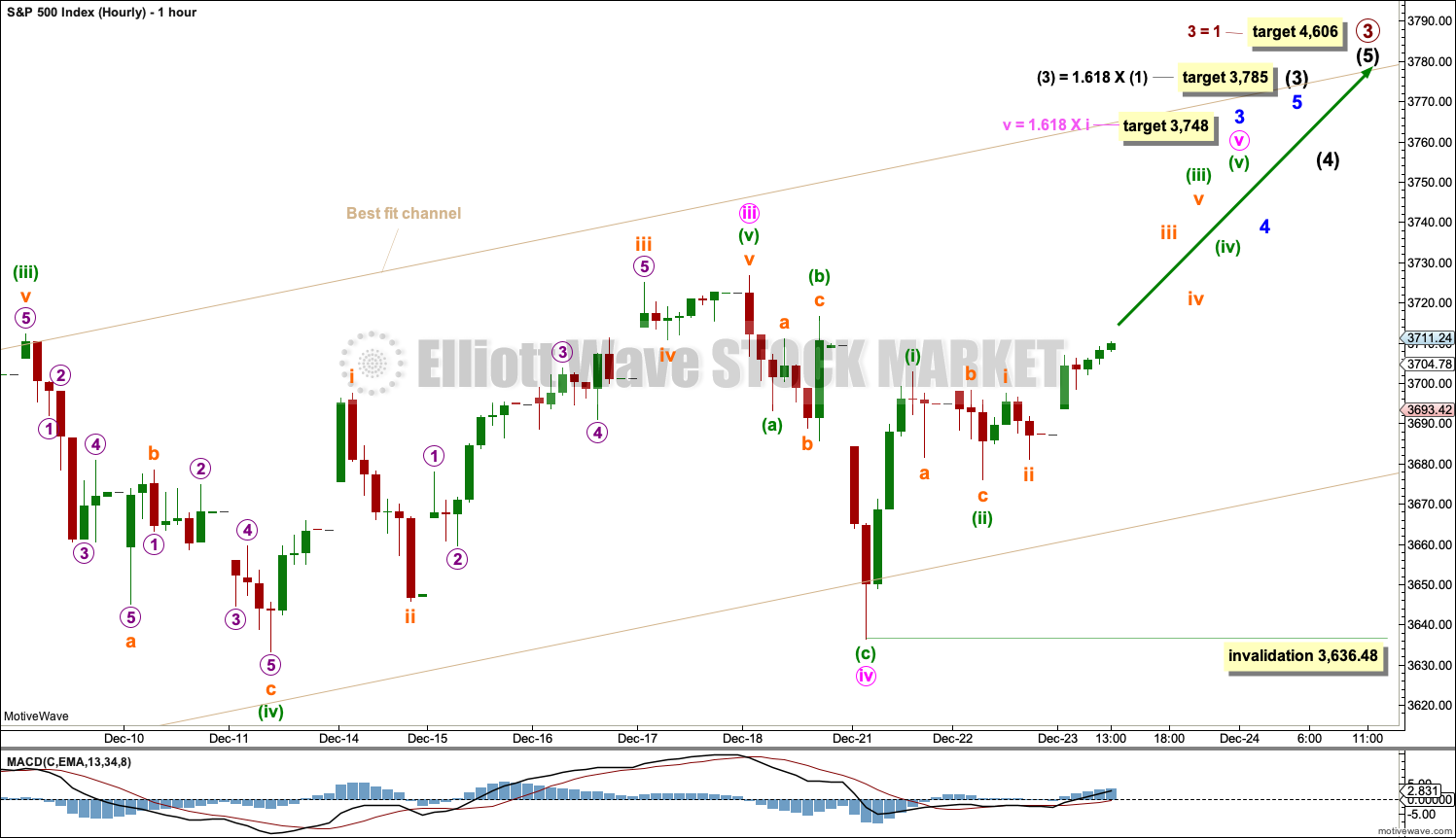

HOURLY CHART

Minute wave iii may have been over at the last high and minute wave iv over at the last low. All subdivisions fit on the hourly chart, and this has a good look on the daily chart.

If minute wave iii is over at the last high, then it exhibits no Fibonacci ratio to minute wave i. This makes it more likely that minute wave v may exhibit a Fibonacci ratio to minute waves i or iii. If minute wave v were to exhibit the most common Fibonacci ratio of equality in length to minute wave i, then it would be truncated. The next Fibonacci ratio in the sequence is used to calculate a ratio for minute wave v.

If minute wave iv continues lower as a double zigzag, then it may not move beyond the start of minute wave i below 3,581.16.

Within minute wave v: Minuette waves (i) and (ii) may be complete, and minuette wave (iii) may exhibit some increase in upwards momentum.

If the degree of labelling within minute wave v is moved down one degree, and minuette wave (ii) is yet to unfold, then minuette wave (ii) may not move beyond the start of minuette wave (i) below 3,636.48.

ALTERNATE DAILY CHART

In the interest of always trying to consider all possibilities (so as to not be left without a potential pathway should the main wave count become invalidated) this alternate is considered.

This alternate wave count does not have support from classic technical analysis at this time, so it is judged to have a low probability. However, low probability does not mean no probability. Confidence / invalidation points may be used to judge any change in probability between the two wave counts.

It is possible that primary wave 2 may be an incomplete expanded flat correction.

Intermediate wave (B) may have continued higher as a double zigzag. Intermediate wave (B) is now 1.39 times the length of intermediate wave (A), which is just beyond the common range of up to 1.38.

There is no rule for flat corrections that state a limit for B waves, so it is possible that intermediate wave (B) may extend higher. If intermediate wave (B) were to reach twice the length of intermediate wave (A) at 3,942.28, then the idea of a flat correction should be discarded based upon a very low probability.

TECHNICAL ANALYSIS

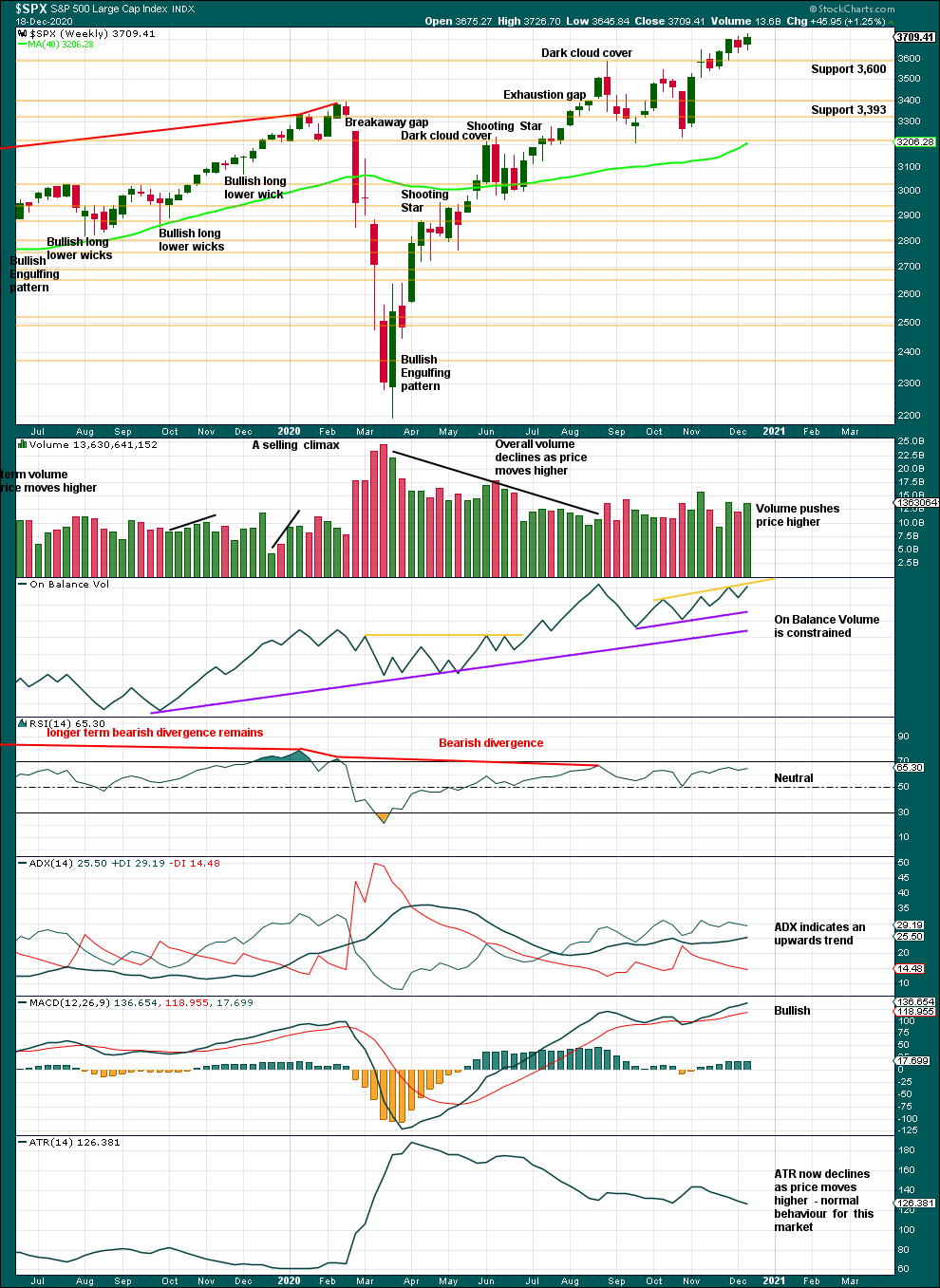

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart is bullish and still supports the main Elliott wave count. All of volume, ADX and MACD are bullish. There is no bearish candlestick reversal pattern. Conditions are not extreme. There is room for this upwards trend to continue.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Overall, this chart is bullish and still supports the Elliott wave count. There is a series of higher highs and lower lows from the low on the 24th of September.

Neither ADX nor RSI are yet extreme. There is room for an upwards trend to continue.

The short-term volume profile remains bearish. On Balance Volume gives a bearish signal, but this signal is weak. This supports the alternate Elliott wave count.

The Dragonfly doji today comes within the context of a small consolidation, not at the end of an upwards trend, so it should not be read as a bearish reversal pattern.

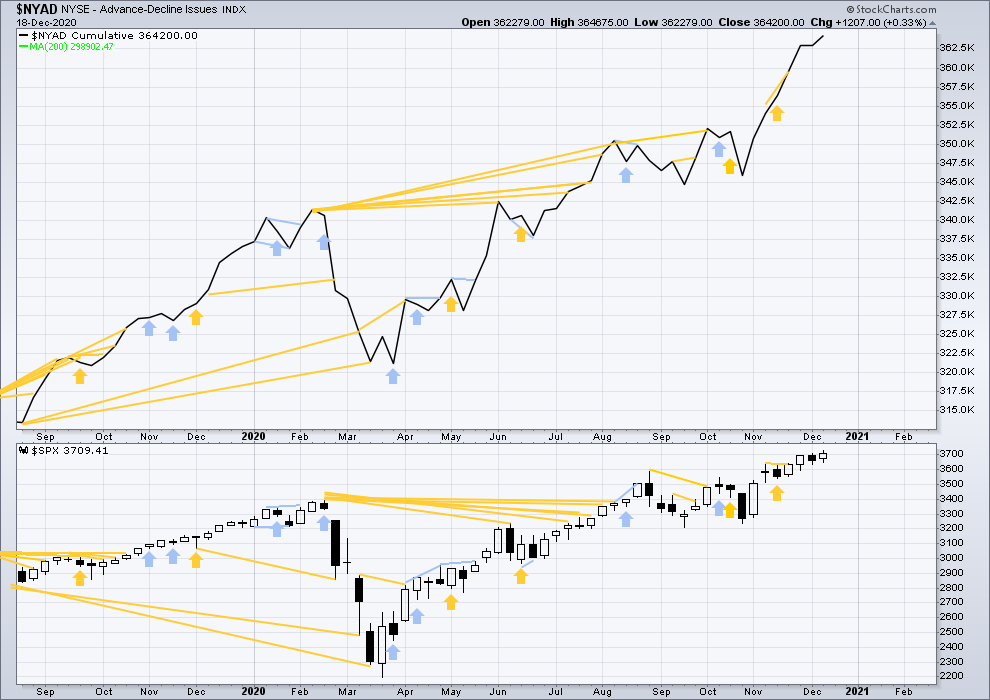

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Lowry’s Operating Companies Only AD line has made a new all time high on the 17th of December. This is a strong bullish signal and supports the main Elliott wave count.

Large caps all time high: 3,726.70 on December 18, 2020.

Mid caps all time high: 2,318.43 on December 23, 2020.

Small caps all time high: 1,124.52 on December 23, 2020.

Last week both price and the AD line have made new all time highs. Upwards movement has support from rising market breadth. This is bullish and supports the main daily Elliott wave count.

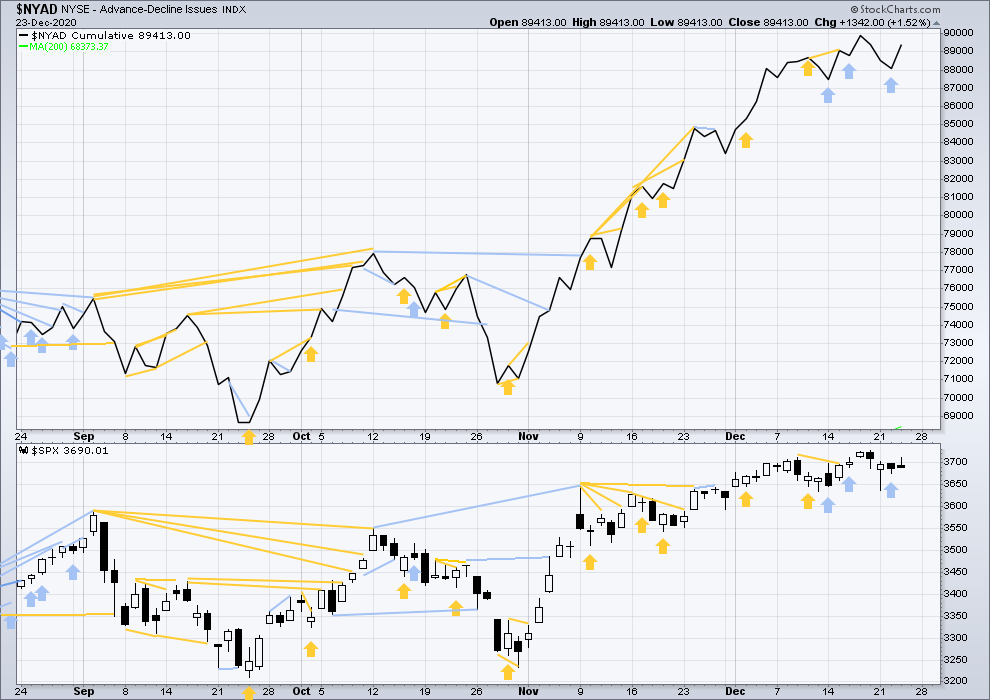

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Today both price and the AD line have moved higher. Neither have made new all time highs. There is no new short-term divergence.

Today both small and mid caps recorded new all time highs. The rise in price is led by small and mid caps, which is a feature of a healthy bull market and supports a bullish Elliott wave count.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Inverted VIX remains well below all time highs. The all time high for inverted VIX was in the week beginning October 30, 2017. There is over 3 years of bearish divergence between price and inverted VIX. There is all of long, mid and short-term bearish divergence. This bearish divergence may develop further before the bull market ends. It may be a very early indicator of an upcoming bear market, but it is not proving to be useful in timing.

Short-term bearish divergence noted last week has been followed by an upwards week, so it is considered to have failed.

Last week price has made another new all time high, but inverted VIX has failed to make a new short-term swing high. This is new short-term bearish divergence.

Comparing VIX and VVIX: VVIX has made a new short-term swing high above the prior high of the week beginning 16th November, but VIX has not. VVIX is increasing faster than VIX. This divergence is bearish for price and supports the alternate daily Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Today both price and inverted VIX have moved higher. There is no new short-term divergence.

Comparing VIX and VVIX at the daily chart level: VIX has made a slight new high above the prior swing high of the 14th of December, but VVIX has not. With volatility of VIX less, this divergence is bullish for price. Today both VIX and VVIX have moved lower. There is no new short-term divergence.

DOW THEORY

Dow Theory confirms a new bull market with new highs made on a closing basis:

DJIA: 29,568.57 – closed above on 16th November 2020.

DJT: 11,623.58 – closed above on 7th October 2020.

Adding in the S&P and Nasdaq for an extended Dow Theory, confirmation of a bull market would require new highs made on a closing basis:

S&P500: 3,393.52 – closed above on 21st August 2020.

Nasdaq: 9,838.37 – closed above on June 8, 2020.

Published @ 07:43 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.